Pharma stocks are making a comeback after months of underperformance. Recently Piramal pharma share price jumped after correcting heavily to 52-week low. Is the outperformance here to stay or it is just a short lived rally? PPL share price rose almost 10% to close at 101. Will the outperformance sustain, let’s discuss.

Piramal pharma share price: A dark horse in pharma pack?

About Piramal pharma

Piramal pharma limited is a company under Piramal group. Piramal Pharma Limited (PPL) offers a portfolio of differentiated products and services through end-to-end manufacturing capabilities across 15 global facilities and a global distribution network in over 100 countries. PPL includes Piramal Pharma Solutions (PPS), an integrated Contract Development and Manufacturing Organization; Piramal Critical Care (PCC), a Complex Hospital Generics business, and the India Consumer Healthcare business selling over-the-counter products.

PPS offers end-to-end development and manufacturing solutions through a globally integrated network of facilities across the drug life cycle to innovators and generic companies. PCC’s complex hospital product portfolio includes inhalation anaesthetics, intrathecal therapies for spasticity and pain management, injectable pain and anaesthetics, injectable anti-infectives, and other therapies.

The Indian Consumer Healthcare business PPL is among the leading players in India in the self-care space, with established brands in the Indian consumer healthcare market. In addition, PPL has a joint venture with Allergan, a leader in ophthalmology in the Indian formulations market. In October 2020, the company received a growth equity investment from the Carlyle Group.

Financial Performance

After demerging from Piramal enterprise Piramal pharma is working hard to concrete it’s footing in pharma space. Piramal pharma primarily work in three business segments, contract development and manufacturing organization(CDMO), complex hospital generics(CHG), India consumer healthcare(ICH) with significant presence in all segments.

Piramal has 13 CDMO sites across North America, Europe and India, with capacities across drug substance and drug products, In CDMO company claims to have 3rd position in India and 13th globally. In CHG category company provides inhalation anesthesia, anesthesia and pain management, intrathecal therapy and other injectables. Piramal pharma solutions claims to be 4th largest inhaled anesthesia player globally. In India Healthcare segment Co claims 10th position in OTC(over the counter) brand in India.

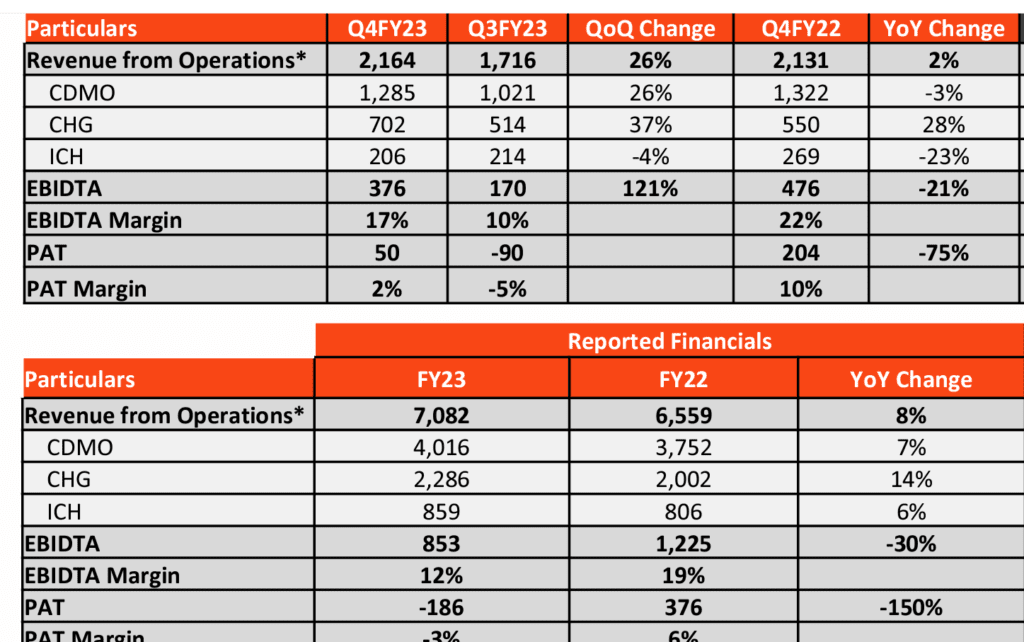

While company had challenging FY2022-23 like other pharma companies mainly due to macro challenges but it made a strong comeback in March 2023 quarter posting revenue of 2164 crore, operating profit of 351 crore with 16% operating profit margin. Piramal pharma posted profit of 42 crore in Mar-23 quarter after making loss in previous 3 quarters. Before March 2023 quarter Piramal pharma posted a profit of 185 crore in March 2022 quarter.

For full year FY-23 company registered a revenue of 7082 crore growing 8% yoy from 6559 crore in FY22. Revenue wise maximum chunk of revenue came from CDMO segment(57%), CHG(32%) and ICH(12%). Geography wise North America contributed 45% of revenue followed by Europe 20%, India 20%, Japan 4% and 11% from rest of the world. EBITDA margin was 12%in FY23 against 19% in FY22. Decline in EBITDA margin in FY23 was primarily due to higher raw material cost and pricing pressure in developed markets.

More about Pharma stocks, click here

Future outlook for Piramal pharma

Piramal pharma share price is rising after falling from ₹165 in Nov 2022 to ₹63 in Mar 2023, currently it is trading at ₹92.45, after demerging from Piramal enterprise it was listed at ₹200 at exchanges.

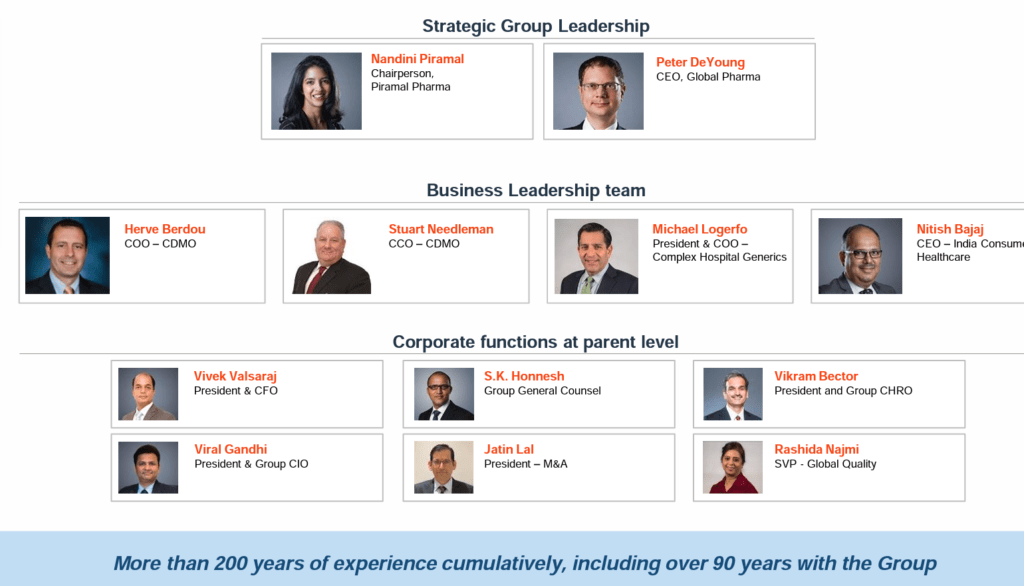

Management of Piramal pharma

Nandini Piramal(41), daughter of industrialist Ajay Piramal is heading the pharma business after demerger, earlier she was head of OTC (over-the-counter) business of PEL, and provided assistance in areas such as setting the strategy and driving results at the group’s pharma business. She also headed the HR, IT and quality functions as Executive Director of PEL. Even before the demerger of experts from different pharma domain Peter Stevenson, Nathalie Leitch and Sridhar Gorthi were inducted in the board in July 2022.

The objective was to maintain high governance standards for the newly listed entity, bolster business insights, and augment its organic growth and acquisition strategies, says Nandini. “Peter Stevenson is an expert in pharma manufacturing, Natalie is an expert in generic hospital products, and Rishi is a consumer goods and ESG expert. Having such a board will provide us focus,” she adds.

Growth drivers in Piramal Pharma

👍 Piramal pharma is one of the largest player of CDMO’s in India and globally. CDMO market is projected to grow at a healthy pace, from $115 billion in 2020 to $169bn in 2026(estimated, source industry report), at a robust CAGR of 7% with strong growth in small molecule CDMO’s from $61bn in 2020 to $113bn in 2026E, at a healthy CAGR of 11%.

👍 PPL’s primary market America and Asia Pacific are growing at 7.7-8.5% in 2021-26, faster than other markets because of Pharma companies outsourcing to “integrated service providers” of which PPL will be a big beneficiary.

👍 Piramal pharma is one of few notable player in complex hospital generics(CHG) segment, CHG is an addressable market of $54bn with high entry barrier and better pricing due to supply issues. (30-35% of revenue comes from CHG segment for PPL and CHG is growing at a healthy 14%CAGR.

👍 Inhalation anesthesia(IA) sales is showing strong momentum in US(64% of sales in CHG segment is from IA).

👍 Indian consumer Healthcare brings 10-15% of company’s revenue though small but a possibility of huge growth at fast pace. ICH with a addressable market size of more than $7bn and revenue is growing at a robust 15-16% yoy.

Risks

Piramal pharma was suffering due to inflation in western economies as attrition was very high on overseas plant. Raw material price were impacting it’s margin badly but now things are seems to be improving, any new trouble in macron front will ruin the set-up for PPL.

Any pressure on pricing front whether in India or overseas will impact the margins badly of PPL.

Conclusion

Piramal Pharma’s contract development and manufacturing(CDMO) business is on cusp of a turnaround as headwinds faced over last 12-18 months are getting over. All segments of company CDMO, CHG, ICH are ready to show strong show as scaleup, capital expenditure would prove beneficial going forward. Complex hospital generics(CHG) business is fastest growing, profitable sector for company and this will continue as stable growth in US inhalation anesthesia market where PPL has leadership position. Company also launching new products rapidly and exploring new markets.

Piramal pharma can be a consistent compounder going forward if things go smooth from here and should be bought on dips for long terms suggests analysts.