- The BPCL SBI Card OCTANE is primarily a Fuel Credit Card, a premium variant of the BPCL SBI Card launched in collaboration with Bharat Petroleum Corporation Limited.

- For travelers with a large portion of their monthly expenses on fuel, especially at BPCL fuel stations, this card can be an excellent choice with a joining fee of ₹ 1,499.

- Apart from fuel benefits to cardholders, other benefits like 6000 bonus reward points equivalent to ₹1500 on payment of annual fee as a welcome gift, 7.25% value back ~ 25X Reward Points on fuel purchases at BPCL outlets, and a maximum 2500 Reward Points per billing cycle.

- Cardholders will also earn 10 reward points on every ₹100 spent on dining and movie tickets, and get a voucher worth ₹2,000 from popular brands. The annual fee of ₹1,499 from the second year is reversible if the annual spending for the last year is greater than or equal to ₹ 2,00,000 and more.

- SBI Card offers several credit cards ranging from luxury to everyday use, and the BPCL SBI Card Octane is an everyday use card specially designed for travellers.

Key Highlights of BPCL SBI Card OCTANE

| Key Highlights | Joinig Fee | ₹ 1,499 + taxes |

| Annual Fee/Renewal Fee | ₹ 1,499 + taxes | |

| Welcome Benefit | Earn 6000 bonus reward points equivalent to ₹1500 on payment of annual fees | |

| Milestone Benefits | Get e Gift Vouchers worth ₹ 2,000 from Aditya Birla Fashion Or Yatra, or Bata/Hush Puppies on annual spends of ₹ 3 Lakhs | |

| Best Suited For | Travel, Rewards, Fuel | |

| Co-Branded With | Bharat Petroleum Corporation Limited (BPCL) | |

| Fuel Surcharge Waiver | 1% fuel surcharge waiver across all BPCL petrol pumps | |

| Rewards | Enjoy 7.25% Value back ~ 25X Reward Points on fuel purchases Enjoy 25 Reward Points on every ₹ 100 spent at BPCL Fuel, Lubricants & Bharat Gas (Website and app only). |

Features & Benefits

| Benefits | Details |

|---|---|

| Welcome Benefits | Cardholders will earn 6000 bonus reward points equivalent to ₹1500 on payment of an annual fee of just ₹1,499. Reward points will be credited to the cardholder’s account within 30 days of the annual fee payment. |

| Value Back Benefits | – Enjoy 7.25% value back equivalent to 25X Reward Points on fuel purchases at BPCL outlets. A maximum of 2500 Reward Points per billing cycle and 6.25% + 1% fuel surcharge waiver on every BPCL transaction up to ₹ 4000 (excluding GST and other charges) – 25 Reward Points per ₹100 spent on BPCL purchases & Fuel Surcharge waiver on BPCL Pumps will be credited on the date of the BPCL fuel transaction |

| Reward Benefits | – Enjoy 25 Reward Points on every ₹ 100 spent at BPCL Fuel, Lubricants & Bharat Gas (Website and app only) spending – Earn 10 Reward Points on every Rs. 100 spent on Groceries, Movies, Dining, and Departmental Stores (up to 7500 Reward Points per month) – Earn 1 Reward Point per Rs 100 spent on other retail purchases (excluding mobile wallet uploads and non-BPCL fuel spends) – 4 reward points = ₹ 1 |

| Lounge Access Benefits | Get 4 complimentary airport lounge access per calendar year to Domestic VISA lounges in India (Maximum 1 visit per quarter) |

| Insurance Benefits | Get complimentary Fraud Liability cover of ₹1 Lakh |

| Movie & Dining | Earn 10 reward points on every ₹100 spent on dining & movie tickets |

| Milestone Benefits | Get a voucher worth ₹2,000 from popular brands like Bata, Yatra, Hush Puppies, & Aditya Fashion on annual spends of ₹3 lakh (Aditya Birla Fashion vouchers can be redeemed only at these brand stores – Louis Philippe, Van Heusen, Allen Solly, Peter England, Planet Fashion, Simon Carter) |

| Fuel Surcharge Waiver | – 1% fuel surcharge waiver on every BPCL transaction up to ₹ 4000 across India (excluding GST & other charges) – Fuel surcharge waiver up to a maximum of ₹ 100 per statement cycle on a credit card account, equivalent to an annual saving of ₹ 1200. |

| Contactless Advantages | – Easy Payment: Make everyday purchases easier with BPCL SBI Card OCTANE. Wave your card over the secure reader to make payments – Fast & Convenient: No need to hand over your card for everyday purchases – Security: The card will never be away from you during contactless payments, eliminating the possibility of card loss and fraud due to skimming. – Visa Pay Wave’s unique Security Key feature ensures only one transaction is made, no matter how many times your card is waved over the reader, making the card’s security impossible to breach |

| Worldwide Acceptance | BPCL SBI Card OCTANE, being an international credit card, can be used for payments at over 24 million VISA or MasterCard-accepted outlets across the world, including 3,25,000 outlets in India |

| Add-on Cards | With this primary card, cardholders can empower their family further with the facility of additional cards for their parents, spouse, children, and siblings above 18 years of age |

| Utility Bill Payments | Pay utility bills easily with BPCL SBI Card OCTANE. |

| Balance Transfer on EMI | – Save money even while paying off credit card dues – Transfer your credit card dues from other banks’ credit cards to BPCL SBI Card OCTANE & repay in EMIs at a lower interest rate |

| FlexiPay | Conversion Into Easy Monthly Installments: Convert purchases of ₹ 2,500 or above with BPCL SBI CARD OCTANE to FlexiPay by logging in with your username & password at sbicard.com within 30 days of payments. |

| Other Benefits | Spend-Based Fee Reversal Benefit – Next year fee waiver for annual spends of ₹ 2 lakh |

BPCL SBI Card OCTANE Review

Reward Redemption Process:

The reward points earned can be redeemed in the following formats:

- To purchase gift vouchers, visit Shop & Smile through the SBI mobile app

- Against cash through an email or calling SBI’s customer care.

- Users can redeem their earned Reward Points instantly at BPCL Fuel Stations by swiping the credit card while paying with Points.

- 4 RPs = ₹ 1

- Reward Points earned become invalid after 2 years from the date of accumulation

- The Reward Redemption Fee of ₹ 99 is applicable

Fees & Charges of BPCL SBI Card OCTANE

| Types of Charges | Details |

|---|---|

| Joining Fee | ₹1,499 + taxes |

| Annual Fee/Renewal Fee | ₹1,499 + taxes from the second year onwards. Renewal Fee is reversible if annual spending for the last year is greater than or equal to ₹ 2,00,000 |

| Add-On Fee | Nil |

| Cash Advance Fee | 2.5% or ₹ 500, whichever is higher at domestic ATMs 2.5% or ₹ 500, whichever is higher at international ATMs |

| Finance Charges | 3.5% per month 42% per annum |

| Late Payment Fee | For outstanding balance- Charges Balance b/w Nil– Up to ₹ 0 – ₹ 500 ₹ 400– b/w ₹ 501 – ₹ 1,000 ₹ 750– b/w ₹ 1,001 – ₹ 10,000 ₹ 950– b/w ₹ 10,001 – ₹ 25,000 ₹ 1100– b/w ₹ 25,001 – ₹ 50,000 ₹ 1300– Above ₹ 50,000 ₹ 100 – An additional Late Payment Charge of ₹100 will be charged on missing payment of the Minimum Amount Due (MAD) by the due date for two consecutive cycles |

| Overlimit Fee | 2.5% of the over limit amount that exceeds the credit limit or ₹ 600 whichever is higher, will be levied |

| Reward Redemption Fee | ₹ 99 |

| Interest Free Credit Period | The interest-free loan period can vary b/w 20 – 50 days, depending on when the merchant submits the claim. |

| Cash Payment Fee | ₹ 250 + taxes |

| Card Replacement Fee | ₹ 100 – ₹ 250 |

| Fuel Surcharge Waiver | 1% fuel surcharge waiver on every BPCL transaction up to ₹ 4000 across India, applicable up to a maximum of ₹ 100 per statement cycle |

| Foreign Currency Mark-Up Fee | 3.5% of the transaction amount |

| Cheque Payment Fee | ₹ 100 |

| Payment Dishonor Fee | 2% of Payment Amount subject to minimum charges of ₹ 500 |

| Network Change Fee | ₹ 200 |

| Rent Payment Charges | ₹ 199 + GST |

Eligibility Criteria for BPCL SBI Card OCTANE Credit Card

| Eligibility criteria | Details |

|---|---|

| Age | Be at least 18 years old |

| Nationality | Indian |

| Income | Have a regular source of income |

| Occupation | Salaried or self-employed |

| Credit score | Have a good credit history with a decent credit score of at least 750 |

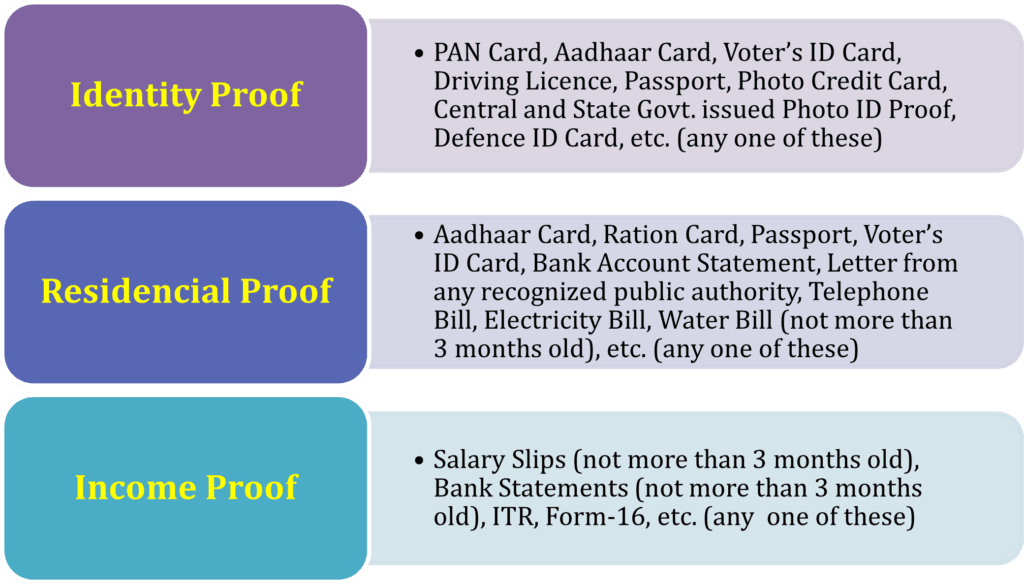

Documents Required for BPCL SBI Card OCTANE Credit Card

Applicants will be required to submit proof of identity, address, and income for the BPCL SBI Card OCTANE Credit Card given below:

How to Apply for the BPCL SBI Card OCTANE Credit Card

SBI Card allows its customers to apply for the BPCL SBI Card OCTANE Credit Card either online or offline.

Offline:

If the customer wants to apply for this credit card offline, they can visit the nearest SBI branch with all the required documents and fill up the physical application form.

Online:

If the customer wants to go for this card online, he has to follow the following simple steps:

Step 1) Visit the official website of SBI Card.

Step 2) Go to the travel and gasoline category & find the BPCL SBI Card OCTANE Credit Card

Step 3) Click on ‘Apply Now’.

Step 4) Fill in all the required information, complete all the formalities and then proceed further.

Step 5) Submit the application.

Customer Care Service

If you have any related queries or you need assistance, reach out to SBI Card’s customer care team via phone or email:

- Dial 1860 180 1290 or 39 02 02 02 (prefix local STD code)

- Email [email protected]

SBI offers one of the best Fixed Deposit rates to NRIs.

FAQs

Yes, BPCL SBI Card OCTANE, being an international credit card, can be used for payments at over 24 million VISA or MasterCard accepted outlets across the world, including 3,25,000 outlets across India.

The annual fee is ₹1,499 + taxes from the 2nd year onwards. Annual fee is reversible if annual spending for the last year is greater than or equal to ₹ 2,00,000.

Yes, with this primary card, empower your family further with the facility of additional cards for your parents, spouse, children, and siblings above 18 years of age as authorized users. Authorized users can use your card to make purchases & earn reward points on it. However, the primary cardholder will be responsible for paying the bill for all purchases made by authorized users.

Official website: You can view the recent transactions and statements by logging into the SBI Card official website with your user ID and password, and also download the same in PDF format.

Mobile application: You can log in using your user ID and password through the registered account on your downloaded mobile app. After this, you can view your recent transactions and statements. You can also download it in PDF format.

No, one can get RPs only at BPCL (Bharat Petroleum) fuel stations. However, the 1% fuel surcharge waiver applies to all fuel outlets all over India.

No, this facility is not available on your Basic Card even if it is linked with BPCL.

The reward points are valid for a period of 24 months (2 years) from the date of accumulation.