Wipro CEO Thierry Delaporte resigned from his post and will be relieved from the duty on May,31, 2024. Delaporte had another one year of service left of his 5 year tenure as top most executive of the company but he decided to vacate his post early to seek the passion out of workplace. Though the timing of his exit may seem surprising but many have seen it coming since long as Wipro was lagging behind its competition in many ways and Thierry was not able to change it in last 4 years.

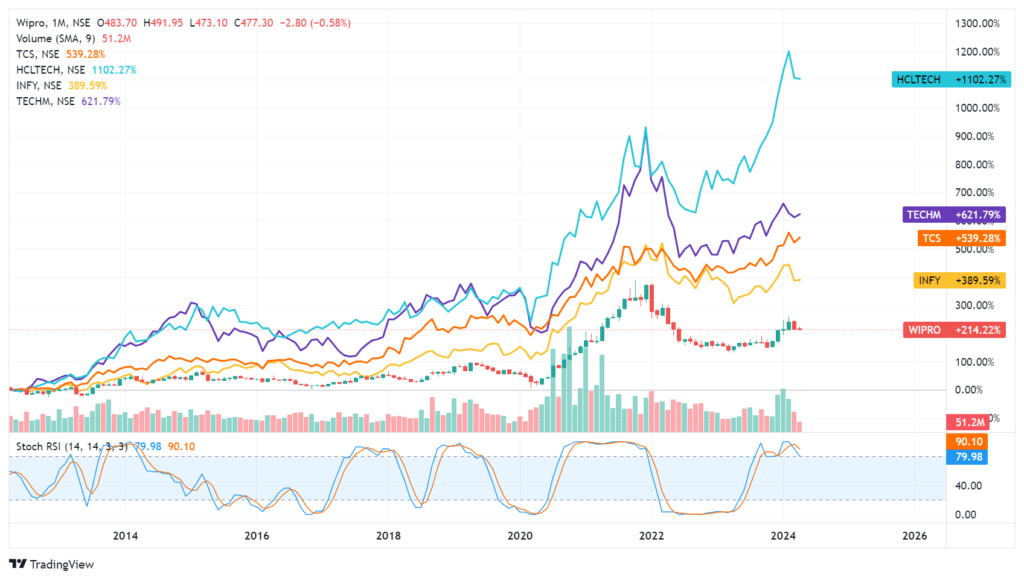

Wipro was India’s 3rd largest IT company in India only behind Tata consultancy services and Infosys when Delaporte joined the company but now it slipped to 4th spot as HCL tech took over 3rd rank. Wipro trades at a discount when relatively valuated to other large cap IT companies in India, reason, it lags the growth they produce and top level exodus that company is facing from last few years. So, why his exit can be a blessing in disguise for the company, let’s analyze.

A brief profile Of Thierry and his tenure at Wipro

Thierry Delaporte was appointed in May 2020 for 5 years to lead the company but he chose to call it a day one year prior to his term getting completed. Usually exit of top executive is considered negative (specially for IT companies where manpower and able management work as a backbone) but why this exit can be a blessing in disguise for Wipro. 56 year old Delaporte was born in France and had a finance degree among others. Before joining Wipro he worked at Capgemini for a total of 25 years starting 1995 till 2020 in different capacities.

Delaporte was highest paid CEO in India and in Indian IT sector, According to the company filings, he had a salary package of over ₹82 crore per annum. For context, other top IT companies paid salary ranging from 56cr to 29cr to their CEO’s. Salil Parekh, CEO of Infosys, received a salary package of ₹56.45 crore. Tech Mahindra CEO CP Gurnani had a total compensation of ₹30 crore, while former TCS CEO Rajesh Gopinath earned over ₹29 crore in FY23.

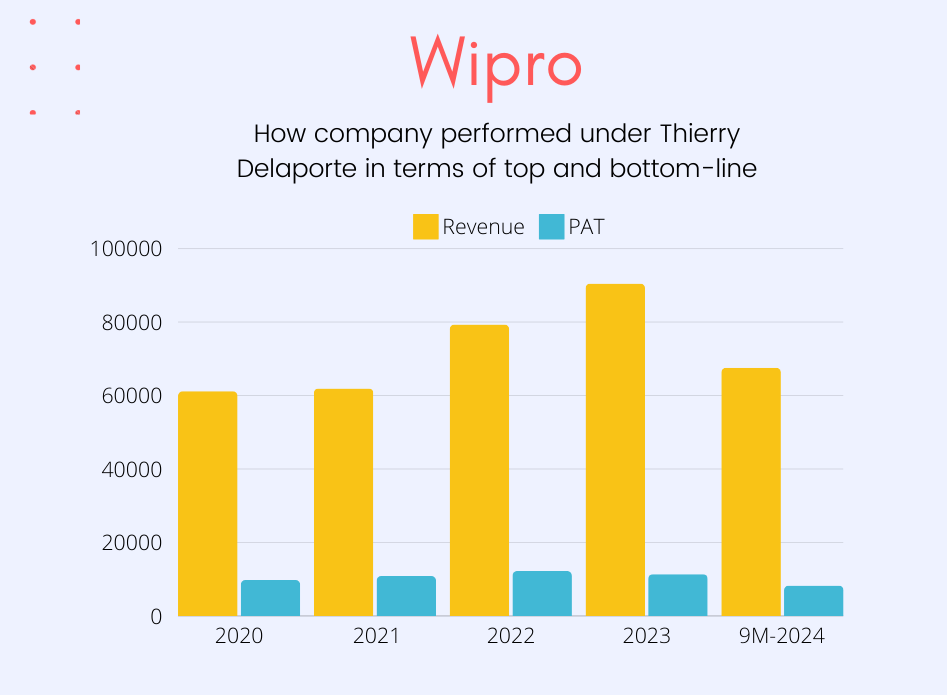

At the time of his joining Wipro’s market cap was approx ₹90,000cr which soared to 3,50,000cr within 1.5 years of his joining, but that was largely due to broad base rally in IT stocks post Covid restrictions came in to place as more and more companies shifted toward online working and they spent big to strengthen their online related infra including AI-ML. Due to huge order inflows coming to large IT companies they saw a sudden spurt in the order book and that translated into good growth in top and bottom line.

To reduce the pandemic effect central banks around the globe eased monetary policy by reducing the interest rates and provided ample liquidity to the system so that things can work smoothly, due to this corporate world spent big on discretionary products but then when world became normal, inflation started to trouble the central banks and governments, to cool off inflation they raised rates swiftly and removed liquidity out of system. So a tough macro situation.

A good leader is always who stand tall in tough times, Wipro did well when macro picture was rosy but lagged when it became tough. Wipro’s CEO Thierry Delaporte tried many strategies but none of them worked in the favor of the company and company lost it’s 3rd largest Indian IT company to HCL Tech. Experts noted that mass exodus of top management, swift policy changes and less communication between employees and top management were the primary odds that company was facing and as result was trading at a discount compared to other listed Peers.

While under Delaporte’s leadership Wipro did some very large billion dollar acquisitions e.g. Capco and Rizing but the company continued to underperform compared to peers. More importantly, Wipro’s founder & chairman Azim Premji, who holds 73% stake in the company, privately expressed his dissatisfaction over Delaporte’s performance, according to sources familiar with the matter. A high cost structure combined with some very expensive expat hires were something source of concern for the Sr. Premji.

Srinivas Pallia ‘the new CEO’ of Wipro

A brief introduction-

Srini joined Wipro in 1992, with a career spanning over three decades and a deep and broad background across Wipro’s various geographies, functions, service lines, and business units, Srini brings a wealth of knowledge and insight to his role. His unwavering commitment to client satisfaction, his relentless focus on delivering results, and his extensive first-hand experience of significant technological changes and industry transformations further enhance Wipro’s position.

Srini holds a bachelor’s degree in engineering, and a master’s in management studies from Indian Institute of Science, Bangalore. He graduated from Harvard Business School’s Leading Global Businesses executive program, and the Advanced Leadership Program at McGill

Executive Institute.

Srini has held numerous leadership roles, including President of Wipro’s Consumer Business Unit and Global Head of Business Application Services. Most recently, he served as the CEO for Americas 1, Wipro’s largest and fastest-growing market. In this role, Srini led a wide range of industry sectors and was responsible for establishing their vision, as well as shaping and implementing growth strategies.

An uphill task in hand for Srini

| Company | C. Sales Gr. | C. Profit Gr. | Stock pr. CAGR | ROE |

| TCS | 14% | 12% | 14% | 39% |

| Infosys | 14% | 10% | 14% | 26% |

| HCL Tech | 17% | 20% | 16% | 24% |

| Wipro | 9% | 7% | 8% | 19% |

| Tech Mahindra | 23% | 14% | 11% | 21% |

Among Peers Wipro had the slowest sales growth of just 9% in last 10 years, in fact it is the only major IT company to have single digit sales growth in India, what is more worrisome is it’s profit growth of just 7%, reason it’s growing cost structure. Wipro acquired some companies which market considered expensive, furthermore the compensation structures for many recent hires were out of whack. “A lot of VPs and GMs operate out of Paris. One of Srini’s first tasks would be to look at costs closely.”

In 2019, Expenses were 80% of company’s total revenue, in 2020 this figure became 79.8%, in 2021 expenses were 76.1% of total revenue, in 2022 it came to 79% and in 2023 expenses rose to 81.3% of total revenue. Expenses are 73% of total revenue for TCS, 75-76% for Infosys and 76-77% for HCL Tech. Though expenses are highest for Wipro compared to others, what’s more troubling is growing employee cost, to total expenses employee cost was 50% in 2018, 53% in 2020 which now rose to 59% in 2023.

As I mentioned controlling cost without compromising on quality of work should be the first priority for new CEO Srini Pallia. Insiders believe, ‘Srini is an extremely bright leader with very high potential and most are very confident that he will turn around Wipro within reasonable time because he commands very high respect of the Wipro team and is very strong in strategy including execution excellence.

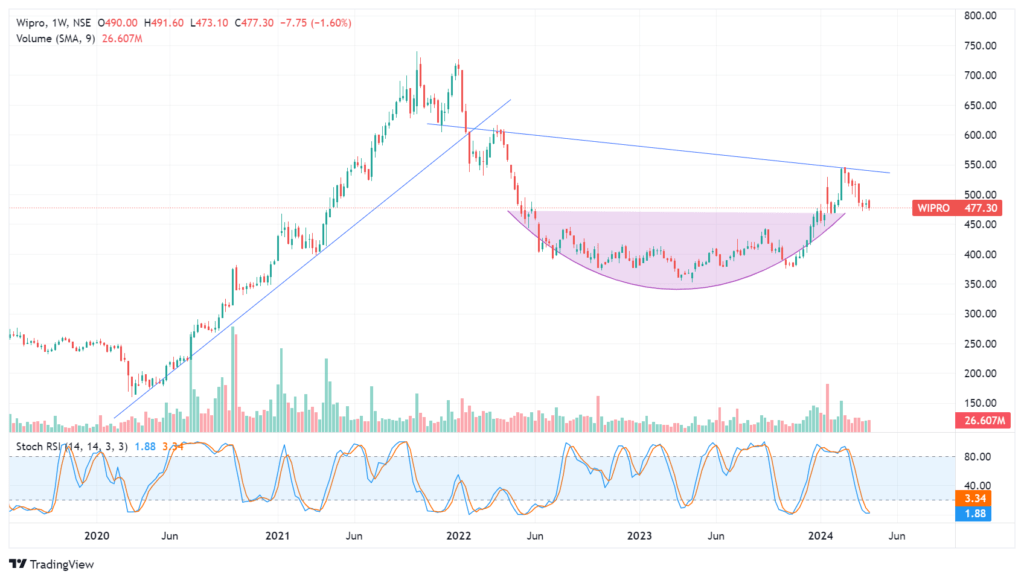

Timing of this change and Q4 updates

There are multiple thoughts on timing of Delaporte’s exit, it can be due to company doing a fresh start of new financial year. As macro picture is starting to get more clear, company must be planning to catch up with other Peers. Other thoughts are he left just a few days ago of q4 earnings release so Q4 must be bad and FY-25 outlook must be discouraging for the company that’s why he was to leave without completing his tenure.

Wipro’s revenue growth in constant currency on a year-on-year basis has fallen steeply since Q4Fy22. It revised its revenue growth guidance for Q4 to -1.5 percent to 0.5 percent. Margins too have been a pain point for Wipro, which at 16%, is among the lowest when compared to its peers. Wipro is going to release its Q4 earnings on April 19, 2024, so all eyes will be on company’s future outlook and on new CEO’s vision of how he want to re-shape the things for company.

Eye on re-rating

Rerating will depend upon how new management move things forward specially on margin and large deal wins front as Wipro is lagging in both when compared to Peers. Wipro’s valuation is attractive as it trades at a P/E of 21(FY-25 forward) but keeping an eye on how different verticals of the company are performing and how swiftly and efficiently changes are translating into results will be key. Srinivas Pallia, company veteran knows a lot about his team, being an insider he giving top positions to those who helped building this organization will surely boost the moral of the employees.

We will keep an eye on it’s Q4 performance and will give a detailed analysis here post announcement.

Technically, the stock is weak as long as it trades below ₹535 and this level should be crossed for any further up move.

Know more about 2024 listings and their performance, click here

Track the corporate developments in Wipro, click here