Wipro’s ADR (American depository receipt) was down 12% on Friday after Wipro announced its Q1 number on after market hours. Will Wipro share price movement will follow the ADR on Monday when our market opens is the question many investors are asking. Let us begin answering by finding the reasons of why street is disappointed on Wipro’s Q1 numbers, Is it weak numbers or weak guidance that is troubling the street and will it ruin the party going on in other IT stocks too?

What is an ADR and why Indian investors track it?

American Depositary Receipts (ADRs) are negotiable securities issued by a bank that represent shares in a non-U.S. company. ADRs can trade in the U.S. both on national exchanges and in the Over-The-Counter (OTC) market, are listed in U.S. dollars, and generally represent a number of foreign shares to one ADR. This gives U.S. investors exposure to foreign equities without having to trade on a local exchange in the local currency. Investors can trade ADRs during the U.S. market sessions.

As the underlying asset is same against which they’re issued and listed on NYSE the moment of ADRs and that of Indian listed equities mimic each other in most cases. That is the reason behind Indian investor’s tracking the movement of ADR to take a clue of price movement of those companies on our exchanges.

Wipro Q1 highlights

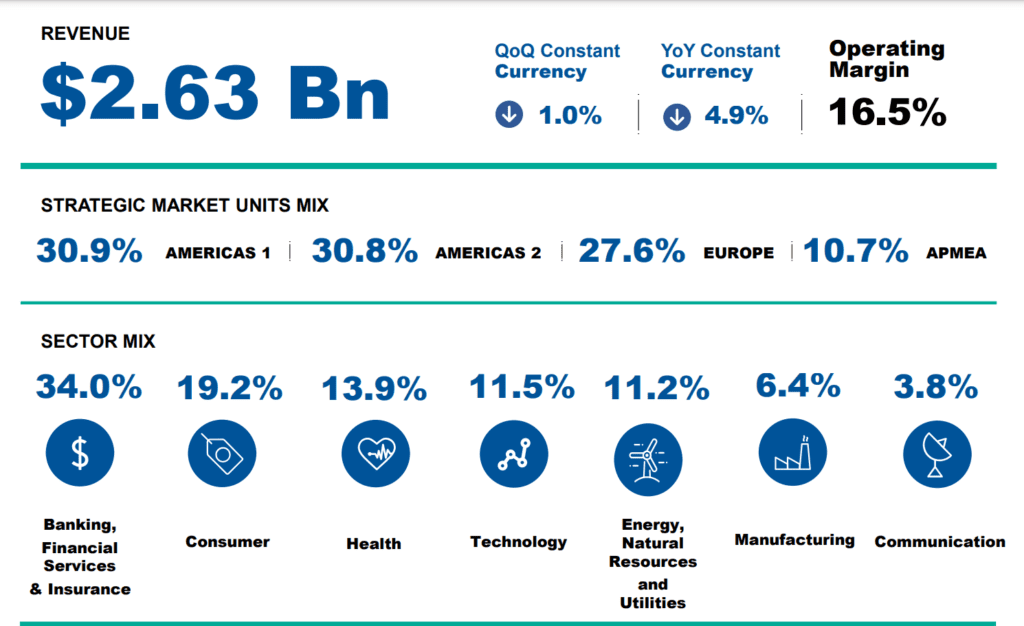

- Gross revenue was at ₹21,963cr ($2,635.8 mn), a decrease of 1.1% QoQ and 3.8% YoY.

- IT services segment revenue was at $2,625.9mn, a decrease of 1.2% QoQ and decrease of 5.5% YoY.

- Constant currency IT Services segment revenue decreased 1.0% QoQ, and 4.9% YoY.

- Total bookings was at $3,284 mn. Large deal bookings was at $1,154 mn, down 3.1% QoQ and 3.6% YoY.

- IT services operating margin for the quarter was at 16.5%, an increase of 0.1% QoQ and 0.4% YoY.

- Net income for the quarter was at ₹30.0bn ($360.4 mn), an increase of 5.9% QoQ and 4.6% YoY.

- Earnings per share for the quarter was at ₹5.75 ($0.071), an increase of 5.9% QoQ and 9.9% YoY.

- Operating cash flows of ₹40.0bn ($479.0 mn), an increase of 6.5% YoY and at 131.6% of Net Income for the quarter.

- Voluntary attrition was at 14.1% on a trailing 12-month basis.

Management commentary

Commenting on the company’s performance new appointed MD and CEO Mr. Srini Pallia said “We recorded another quarter of total large deal bookings over $1 bn, with our largest win in the recent years. Our top accounts continued to grow, accompanied by a growth in Americas1 SMU, BFSI and Consumer sectors. We are pleased with the momentum we have built in Q1 across industries and sectors and confident in our ability to execute better on bookings and profitable growth as we transition to Q2. While we continue to

build on our ai360 strategy and preparing our workforce for an AI-first future.”

Guidance for upcoming quarter

Wipro expects revenue from our IT Services business segment to be in the range of $2,600mn

to $2,652mn. This translates to sequential guidance of growth of (-)1.0% to +1.0% in constant currency

terms. Wipro raised the guidance for Q2 as earlier the guidance was of (-)1.5% to (-)0.5% growth. Wipro net added 337 employees during the quarter, reversing the trend of declining headcount after six quarters. This addition takes the total to 2,34,391 employees (net addition in employees is QoQ, YoY there is a dip in number of employees). Attrition rate at 14.2%, down both YoY and QoQ and it is at lowest levels in last 6 quarters.

Possible reason behind big fall in Wipro ADR

• Though Wipro have raised the guidance by 0.5% but still it is more or less at same levels as the guidance given few quarters ago. From last 6 quarters Wipro downgraded its growth guidance and street will not be happy with marginal uptick. Wipro, unlike other large IT companies is not giving the guidance for full FY, it only provided the guidance for September quarter, which street will see as a sign of uncertainty and weakness.

• Though Wipro’s bottom line growth was in-line with street expectations but topline growth missed the estimates, in terms of company’s large deal wins and TCV though company recorded over $1bn large deal wins and $3.3bn TCV but both were at lowest levels in last few quarters.

• Geography wise Wipro’s approx. 27% revenue comes from Europe market and 60% revenue comes from Americas. Both market is still showing weakness, in terms of revenue BFSI segment accounts for approx 34% of the revenue followed by consumer and health at 19.2% and 13.9% respectively. Macro situation in Europe is still uncertain and revenue from Europe is still falling and from Americas it is yet to show concrete signs of stabilization. Same is the case foe segment revenues.

Positives in the Q1 number

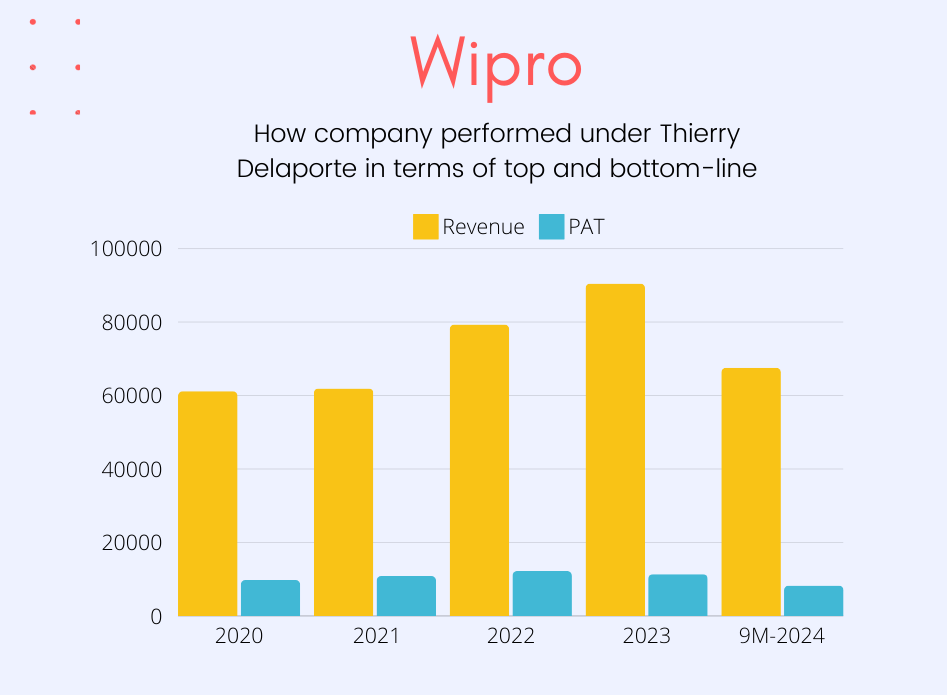

When Wipro’s CEO Thierry Delaporte resigned from his post few months back and Srini Pallia joined, we pointed in our article that he has a uphill task in hand to turnaround the company as it was lagging Peers in terms of compounded sales and profit growth. Primary reason behind the underperformance was a high cost structure combined with some very expensive expat hires, expensive acquisitions like Capco and Rizing and very frequent changes in top management.

Srini in his initial conversation with company employees pointed out that his first task is to lower the cost structure and change the top management’s recruitment/ remuneration process and it is pleasant to to see that in Q1 company improved its operating margin to 16.5% (opr margin is at highest in last few quarters). This uptick in margin is due to reduction in operating cost. It is too early to say that Srini’s initiatives are showing results but it is a positive development and investors should take a note if it and keep an eye on future progress in this regard.

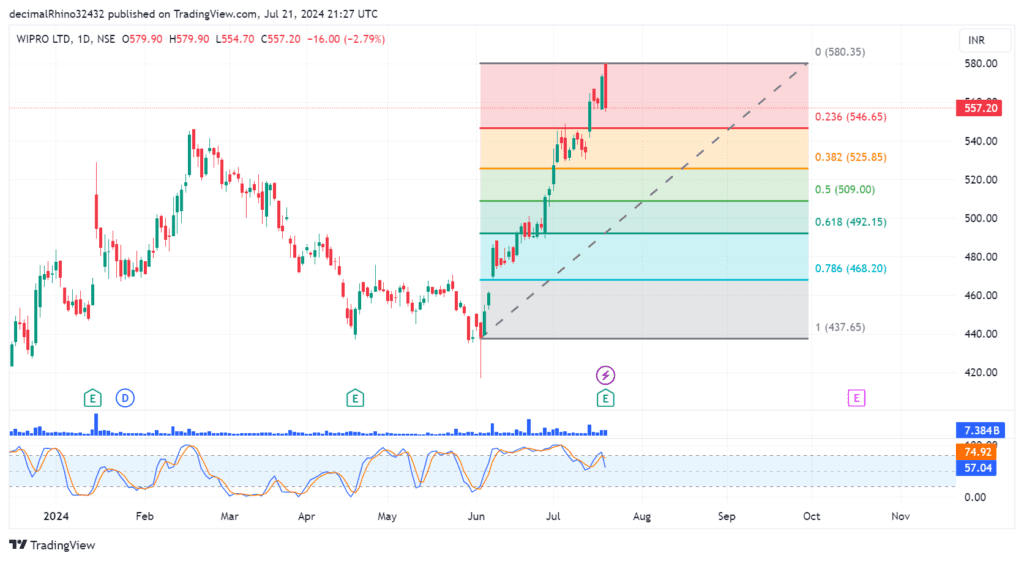

Valuation and our take on Wipro share price movement going ahead

The stock of Wipro is currently trading at a P/E of 26.3 against a 5 year average of 14-42. Our forecast is Wipro will do an EPS of 23-24 in FY25 and giving it a P/E of 25 (estimate) the target price should be between ₹575-600 (forecast based on the guidance provided by the company, we are making an optimistic case while forecasting the EPS). Wipro’s CMP is ₹557 and the stock is up more than 15% in last one month. Chart of the stock looks exhausted and may correct so investors are advised to approach the stock cautiously.

Levels to watch for once stock reverses from current top (levels drawn from Fibonacci retracement tool). Note: Please do your own research and approach registers investment advisor before making any investment decision.