In Vedanta Ltd’s board meeting on December 16, 2024, the company approved the Fourth Interim Dividend of ₹8.5 per equity share on a face value of ₹1 per equity share for the Financial Year 2024-25, amounting to a cash outflow of ₹3,324 Crores.

Vedanta has already declared three interim dividends this year, totaling ₹11, ₹ 4, and ₹20. The record date for payment of the dividend is Tuesday, December 24, 2024, and the interim dividend will be paid within one month from the record date.

The Vedanta share price today is down more than 2% due to a broad market correction, but should investors buy Vedanta stock for its dividends? This is the question we are answering.

Vedanta Limited, a subsidiary of Vedanta Resources Limited, is one of the world’s leading critical minerals, energy and technology companies spanning across India, South Africa, Namibia, Liberia, UAE, Saudi Arabia, Korea, Taiwan, and Japan with significant operations in Oil & Gas, Zinc, Lead, Silver, Copper, Iron Ore, Steel, Nickel, Aluminium, Power & Glass Substrate and foraying into electronics and display glass manufacturing.

Vedanta Ltd’s stock price is up almost 100% in the last year due to various corporate announcements, foraying into the semiconductor industry, and debt reduction/ restructuring. Now the question is, can the new investors buy the stock after such a good run-up in the last year?

Are there enough triggers to push the stock further? To answer that, I will look into both the technical and fundamental setup of the stock and any possible triggers for the company going ahead to gauge the stock price movement.

Vedanta Ltd’s fundamentals

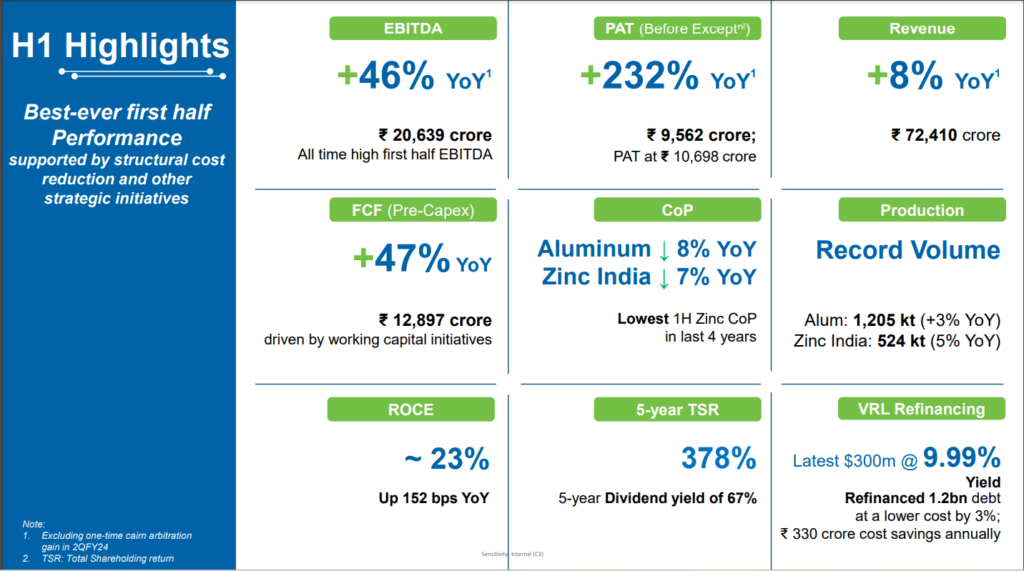

Q2 Number and key highlights

- Consolidated Revenue of ₹37,171 crore, up 5% QoQ and 10% YoY

- Vedanta Limited reported a strong Q2 FY ’25 performance with a 44% year-on-year increase in EBITDA to ₹10,364 crores.

- The company achieved an all-time high first-half EBITDA of ₹20,639 crores, up 46% year-on-year.

- EBITDA margin increased to 34%, up 9% from 25% in Q2 of the previous year, driven by cost reduction initiatives and operational efficiency.

- Profit after tax (PAT) before exceptional items increased by 230% year-on-year to ₹4,467 crores.

- Liquidity improved by 30% in both QoQ & YoY with Strong Cash and Cash Equivalent of ₹21,727 crore.

- Generated Free Cash Flow (pre capex) of ₹8,525 crore up 50% YoY.

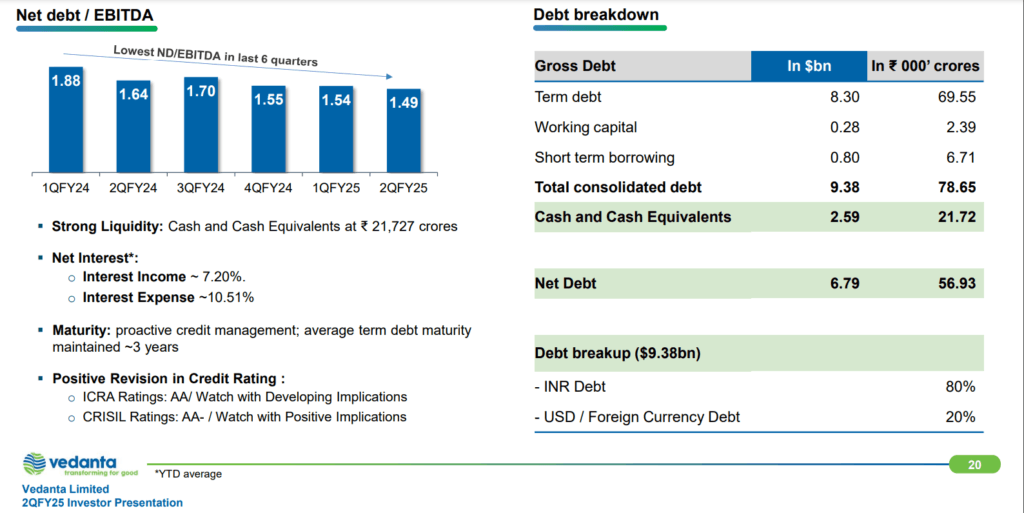

Debt and fund raising updates

- Net debt of ₹56,927 crore as on 30th September 2024, declined by ~₹4,400 crore vs June 2024.

- Net debt/ EBITDA at 1.49x in 2QFY25, marking the best position in last 6 quarters.

- Raised ₹8,500 crore through QIP and ₹3,133 crore through the Offer for Sale (OFS) of HZL.

- Parent company, VRL, successfully raised $1.2 billion through a bond issue and reduced the interest costs on this debt by over 3%.

- Net Debt at the parent entity was reduced by $1bn in the first half to reach its lowest level in a decade.

Vedanta News: H1 highlights

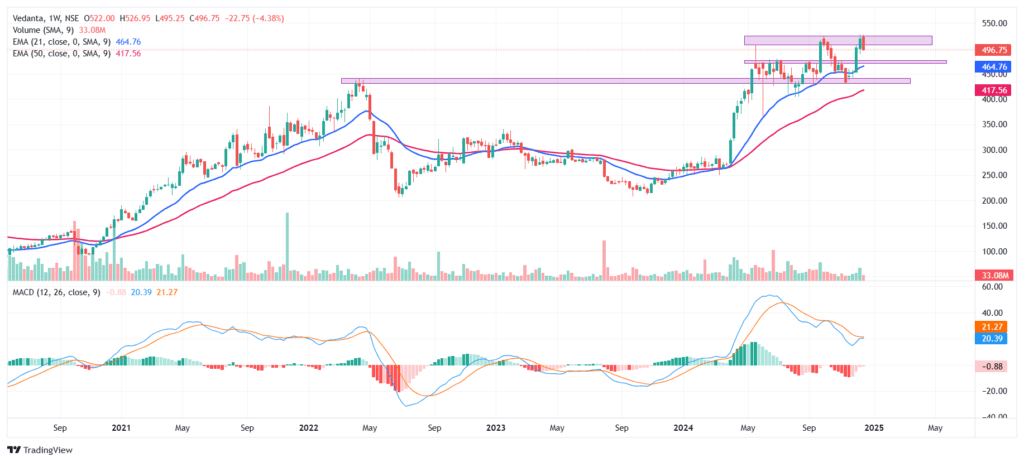

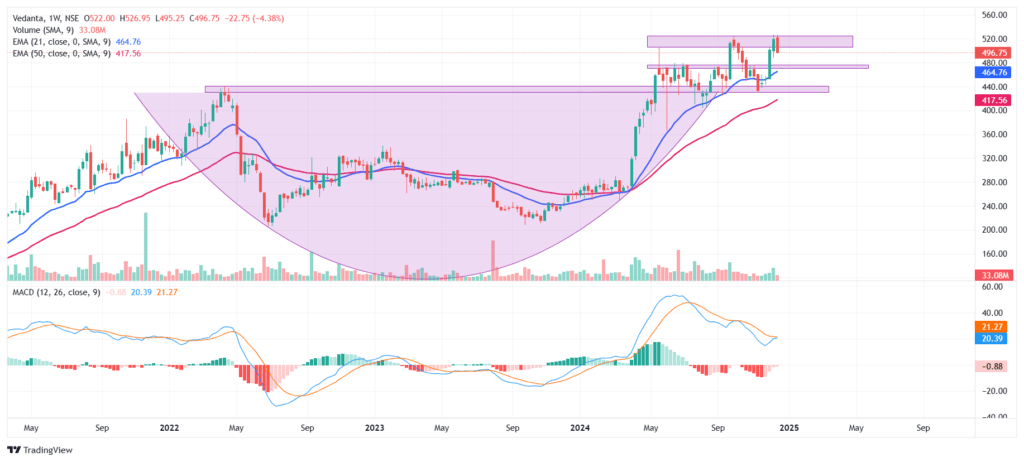

Technical Setup

With the tide turning in the favor of the metal sector due to global economic rebound and chances of improving geopolitical stability, I added Vedanta when it had a golden (EMA 21 and 50) crossover near Rs 275 in starting of April 2024.

Vedanta Ltd had a neckline resistance in the 430-440 zone, and that was the point where I planned to review the stock. Vedanta in May 2024 broke the neckline, giving a rounding bottom breakout, now the 430-440 zone is a very strong support for it. The stock of Vedanta is taking resistance in the 510-525 range.

So, as long as Vedanta does not cross 525 with conviction, I expect it to remain in the 475-525 zone (475 is minor support) if broken, the stock can fall to 440 (major support). The view will remain positive as long as stock is above 440. A good upside can happen once the stock crosses the upper range and trades above it.

Future Outlook

Vedanta Ltd’s majority of revenue is from the metal and mining sector, which is cyclical, while the sector was struggling due to poor economic growth, higher inflation, and supply chain issues from the last few years, but the upcoming few years are expected to see positive traction.

Two of the world’s largest economies, the US and China, are seeing early green shoots as inflation in the US is going down and growth is coming up. With Trump assuming office, the economy there is expected to do well.

In China, while the economy is still showing subdued growth, a big stimulus is expected from the Chinese government to boost the economy and help the struggling housing sector. Will the stimulus help the struggling Chinese economy is another story.

Still, it will be a positive development for the metal sector globally as the Chinese housing sector is the biggest metal consumer in the world. Vedanta is one of the largest producers of metals like zinc, silver, aluminum, and copper in India and globally, so it will be a big beneficiary of rising demand.

Another reason for us being positive on Vedanta is its dominance in silver and zinc production. Hindustan Zinc is the world’s third-largest silver producer, and operates the world’s second-largest silver mine, Sindesar Khurd, in Rajasthan also It is India’s largest silver producer, accounting for about 95% of the country’s primary silver.

Similarly, Hindustan Zinc is the world’s second-largest integrated zinc producer and has a market share of around 75% of India’s zinc market. Vedanta is the promoter of Hindustan Zinc and owns a 63.42% stake.

Our view on both metals is very positive due to their rising use in industries like renewable energy, EVs, electronics, medical science, etc. I see silver prices making new highs and any dip as a buying opportunity. Vedanta will be a primary beneficiary of the rising prices of these metals.

Apart from that, deleveraging on the parent level, and reducing and refinancing debts with a jump in free cash flow forecast for the company is a positive development that will pan out well for the company. Vedanta’s 80% debt is in INR, so it will not be much impacted by currency fluctuations.

On the company’s ongoing de-merger, it updated that the demerger process is progressing well, with expectations to unlock significant value and enhance leadership in critical minerals by March 31, 2025. In terms of valuation, Vedanta is currently trading at a P/E of 10 (On FY25 EPS estimates), and if it retains the current P/E of 18, its estimated target price is 900. (But, debt and demerger execution overhang will keep the prices subdued)

Conclusion

Vedanta’s prospects are good, and it can be a good addition to the investor’s watchlist, but buying the stock solely for the dividend is not advised. When buying, a strict stop-loss should be followed (refer to technical analysis above).

Vedanta is paying a consistent dividend, and its dividend yield could be sustained at 5-6% for the next 3 years. Investors should keep a close look at the following points to take cues on the Vedanta share price movement-

- Deleveraging at parent level, Vedanta is expected to reduce debt by $3-3.5bn in next three years.

- Progress on capex in Zn, Aluminium, and ferro metals and also on their prices in international market.

- Vedanta is investing big in Semiconductor chips and display glass, Vedanta through its subsidiary Vedanta Semiconductors Private Limited (VSPL) plans to set up a 40nm CMOS-based semiconductor fab with a capacity of 40,000 wafers starts per month of 300 mm wafer size.

- In phase 2, post reaching the mass production of 40nm, the company will transition to upgraded technology of manufacturing 28nm size chips. These semiconductor chips will cater to applications in mobiles, consumer electronics, automotive, and network equipment.

- Vedanta Displays Limited (VDL) is a wholly owned subsidiary of Vedanta Limited.

- VDL plans to set up an integrated display and module fab to cater to all major applications across small, medium, and large-sized display segments. Initially, the company will focus on Gen 8.6 A-Si IPS fabs including glass, panel, and module with a per month capacity of 60,000 sheets and 10mn modules to cater to key sizes of all major applications including televisions, IT, automotives and smartphones.

- In phase 2, the company intends to increase monthly production capacity to 240,000 sheets and 40mn modules. Investors need to track the progress of these happenings.

- Investors also need to closely track the ongoing demerger.