Vedanta demerger is finally happening, in a bid to overhaul its corporate structure and make demerged entities more investable Vedanta has presented a plan to demerge its businesses into six different companies. Vedanta was trying different options from some time to revitalize the business, it announced delisting back in 2020 but offer was rejected by stakeholders due to inappropriate valuations, it then was mulling plan to restructure business strategically and came up with demerger plan.

While experts are positive about the development but also worried about high debt level and number of payments lined up in next few years. Lets analyze the pros and cons of Vedanta’s demerger plan, will it benefit its minority shareholders and what options Vedanta have to pay debts.

A little on terminology, what is demerger?

A demerger is a corporate restructuring in which a company splits into two or more separate companies. This can be done for a variety of reasons, such as to unlock value for shareholders, to focus on specific business segments, or to improve operational efficiency. Understand it with below image.

In this example, the parent company has demerged into two separate companies, Company A and Company B. The shareholders of the parent company now own shares in both Company A and Company B.

Demerger details and why Vedanta going for demerger?

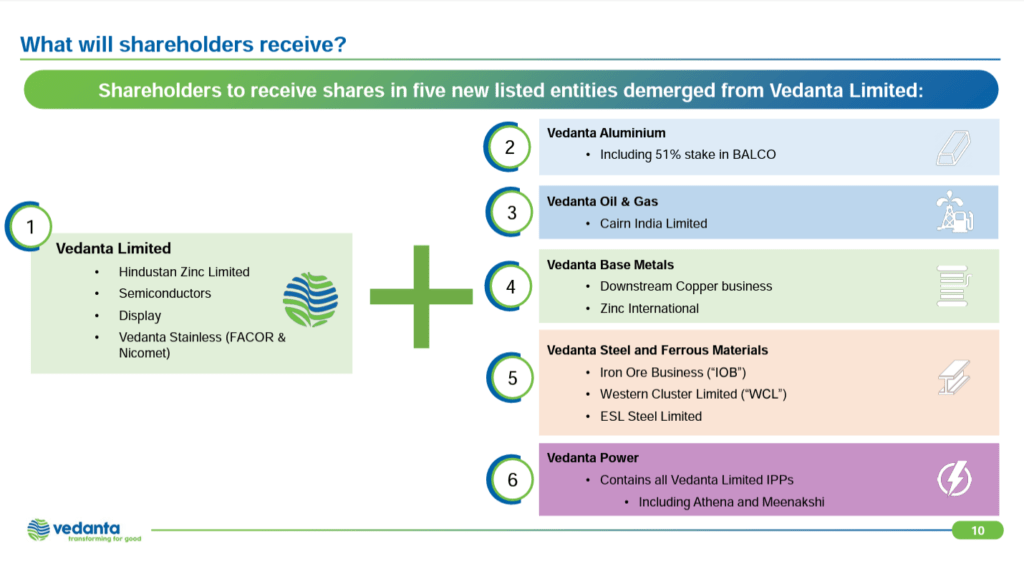

Vedanta Limited has announced its demerger plan to split into six separate companies, each with a focus on a specific business segment. The six companies are:

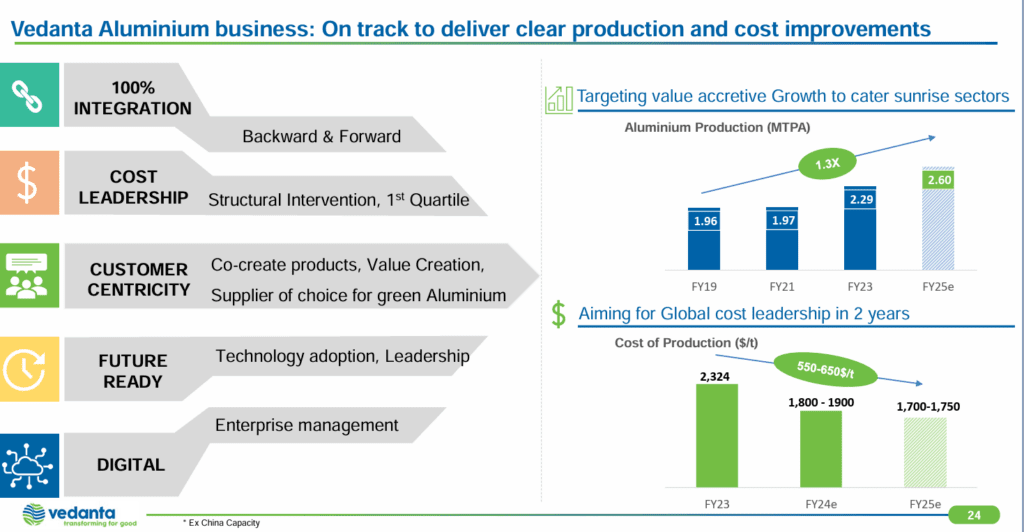

- Vedanta Aluminium

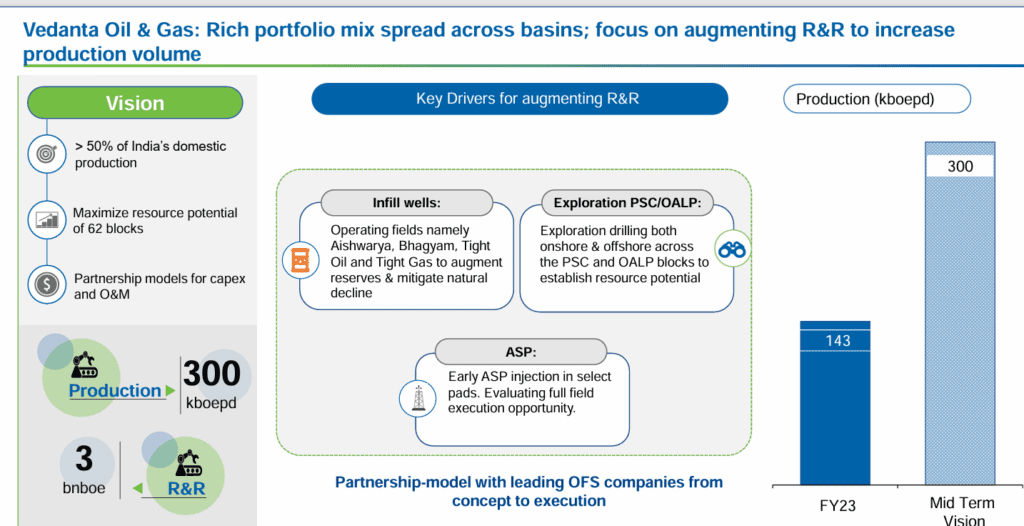

- Vedanta Oil & Gas

- Vedanta Power

- Vedanta Steel and Ferrous Materials

- Vedanta Base Metals

- Vedanta Ltd

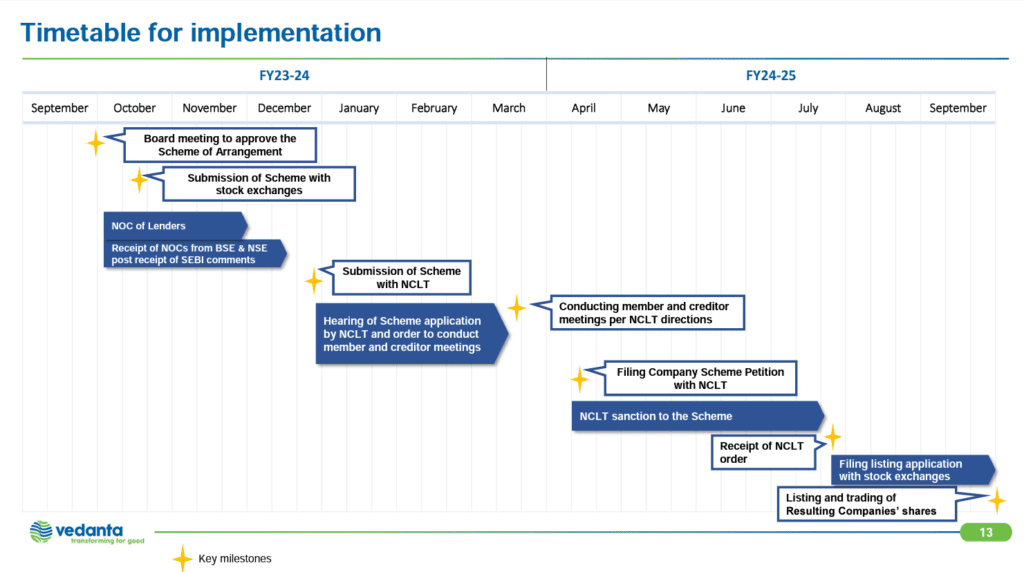

The demerger is expected to be completed by September 2025, and the six companies will be listed on the Indian stock exchanges.

Here is a summary of the Vedanta demerger plan:

- Number of new companies: 6

- Business segments: Aluminium, oil & gas, power, steel & ferrous materials, base metals, and corporate

- Expected completion date: September 2025

- Shareholder entitlement: One share of each new company for every share of Vedanta Ltd held

Why demerge into six separate companies

Vedanta’s demerger into six separate entities aims to achieve the following goals:

- Unlock value: Vedanta believes that the demerger will unlock the full value of its business segments, as each individual entity will be able to focus on its own unique strengths and opportunities.

- Simplify corporate structure: The demerger will simplify Vedanta’s corporate structure, making it easier for investors to understand and invest in the company.

- Enhance operational efficiency: The demerger will allow each individual entity to operate more efficiently, as they will be free from the constraints of the larger group.

- Attract new investment: Vedanta believes that the demerger will make it more attractive to new investors, as they will be able to invest in specific business segments that they are interested in.

- Accelerate growth: The demerger will allow each individual entity to focus on its own growth strategy, which could lead to accelerated growth for the overall group.

Vedanta demerger plan, how experts are reacting?

Experts are generally positive about Vedanta’s demerger plan. They believe that the demerger will unlock value for shareholders and make the company more attractive to investors. Analysts at Edelweiss Securities said that the demerger is a “positive move” and that it will “create a more focused and efficient business structure.” Analysts at Morgan Stanley said that the demerger is a “step in the right direction” and that it will “make Vedanta more attractive to global investors.”

Here are some specific comments from experts on Vedanta’s demerger plan:

- “The demerger is a positive move for Vedanta as it will allow each business segment to focus on its own strengths and opportunities.” – Edelweiss Securities

- “The demerger is a step in the right direction and will make Vedanta more attractive to global investors.” – Morgan Stanley

- “The demerger is complex and could be disruptive to Vedanta’s business.” – CLSA

- “The demerger is positive in the medium to long term, but there are some risks associated with the execution.” – Credit Suisse

Kotak institutional equities however published a detailed report on Vedanta demerger with a mixed review. The brokerage firm believes that the demerger will unlock value for shareholders, but it is also concerned about the company’s high debt levels and the potential for disruption to the business during the demerger process.

In a report released on September 30, 2023, Kotak Institutional Equities said that the demerger will “unlock value for shareholders as each business segment will be better positioned to focus on its own unique strengths and opportunities.” The brokerage firm also said that the demerger will make Vedanta “more transparent and accountable to investors.”

However, Kotak Institutional Equities also expressed concerns about Vedanta’s high debt levels. The brokerage firm said that the debt levels are “a key overhang” and that it is “unclear how Vedanta plans to address this issue.”

The brokerage firm also warned of the potential for disruption to the business during the demerger process. Kotak Institutional Equities said that the demerger is a “complex process” and that there is a risk of “execution challenges.”

Price target by analysts after Demerger announcement

The following are the price targets for Vedanta by analysts post the demerger announcement:

- Edelweiss Securities: ₹270 per share

- Morgan Stanley: ₹290 per share

- CLSA: ₹250 per share

- Credit Suisse: ₹260 per share

Vedanta’s current debt and is debt really a trouble for Vedanta?

As of September 30, 2023, Vedanta Limited had a total debt of ₹59,846 crore (US$7.2 billion). This is an increase from the ₹53,109 crore (US$6.4 billion) that the company owed at the end of March 2023.

The increase in debt is due to a number of factors, including:

- Increased investment in capital projects

- Rising interest rates

- A weaker Indian rupee

Vedanta’s debt payment schedule for next 5 years-

| Year | Amount due (US$ billion) |

|---|---|

| 2024 | 2.0 |

| 2025 | 3.6 |

| 2026 | 1.5 |

| 2027 | 1.2 |

| 2028 | 0.9 |

The company plans to repay its debt using a combination of cash flow from operations, asset sales, and refinancing. It is important to note that this is just a schedule, and the actual amount of debt that Vedanta repays in any given year may vary depending on a number of factors, including the company’s financial performance, market conditions, and its ability to refinance debt.

A look at Vedanta’s Financials

As of Sept 30, 2023 Vedanta had a cash balance of ₹32,130 crore (US$3.9 billion). Meanwhile Vedanta is generating good amount of cash from its operations. The average yearly EBITDA of Vedanta and Hindustan Zinc combined for the past 3 years is ₹41,695 crore (US$5.1 billion).

| Year | Vedanta EBITDA (₹ crore) | Hindustan Zinc EBITDA (₹ crore) | Combined EBITDA (₹ crore) |

|---|---|---|---|

| 2020-21 | 38,658 | 11,037 | 49,695 |

| 2021-22 | 34,048 | 15,142 | 49,190 |

| 2022-23 | 45,929 | 13,917 | 59,846 |

| Average | 39,545 | 13,365 | 52,910 |

It clearly indicate that Vedanta has sufficient cash to meet its debt obligations. The company plans to generate more cash flow from operations by increasing its production and sales volumes, and by reducing its costs. Vedanta is also considering selling some of its non-core assets to raise cash.

In addition, Vedanta is planning to refinance some of its debt. This means that the company will borrow new money at lower interest rates to repay its existing debt.

Vedanta’s debt to equity ratio

Though Vedanta’s debt-to-equity ratio has fluctuated over the past 5 years, but it has remained relatively stable overall. The company’s debt-to-equity ratio is currently at 0.71.

Vedanta’s debt-to-equity ratio over the past 5 years is as follows:

| Year | Debt-to-equity ratio | Debt(crore) |

|---|---|---|

| 2018-19 | 0.73 | 53,109 |

| 2019-20 | 0.77 | 59,695 |

| 2020-21 | 0.62 | 49,695 |

| 2021-22 | 0.61 | 49,190 |

| 2022-23 | 0.71 | 59,846 |

As Vedanta deals in sectors that require huge capital to run, so let’s look at debt to equity ratio of other similar companies from around the globe. This ratio for companies similar to Vedanta is 0.65. This is based on a sample of 10 companies that are similar to Vedanta in terms of size, industry, and geographic reach.

| Company | Debt-to-equity ratio |

|---|---|

| BHP Group | 0.28 |

| Rio Tinto | 0.32 |

| Vale | 0.51 |

| Glencore | 0.72 |

| Anglo American | 0.75 |

| Freeport-McMoRan | 0.83 |

| Newmont | 0.91 |

| Barrick Gold | 0.97 |

| Southern Copper | 1.04 |

| First Quantum Minerals | 1.16 |

| Teck Resources | 1.28 |

What Vedanta aims to achieve through demerged businesses

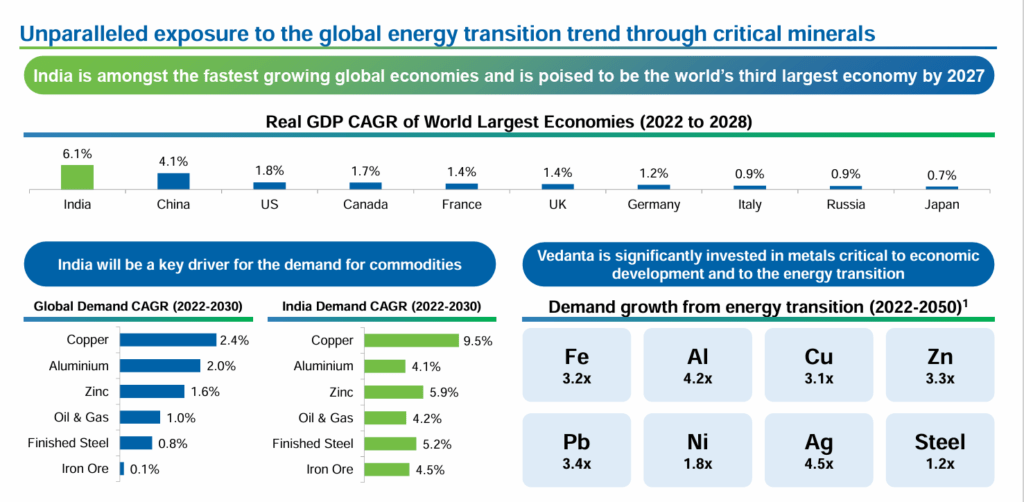

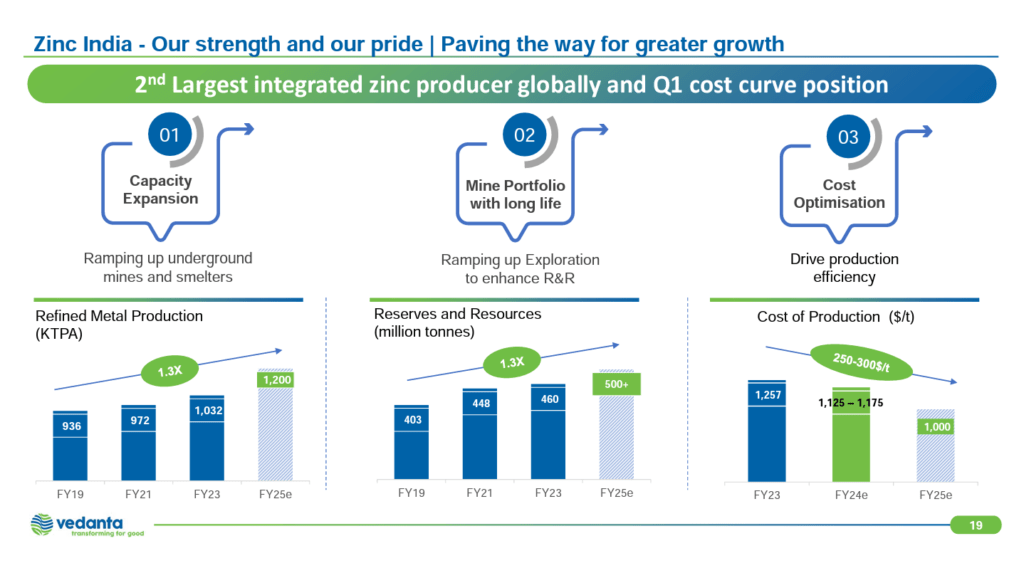

Vedanta is demerging its core business in to six different companies and aims to capture India’s growth story through them. India being one of the fastest growing economy brings fast infrastructure development, creating a huge demand for metals and other commodities(e.g. Oil and gas) in which Vedanta is a leader. Capitalizing its stronghold on these businesses Vedanta want to create a commodity powerhouse which could grow at 12-15% production CAGR.

Vedanta is looking to achieve operational excellence and cost leadership through expert management teams across broad portfolio to drive returns. With separate business Vedanta aims to focus more on appropriate investments in Capex as commodity cycle churns, this will also help in forging strategic alliances when and where required and to help in growing in organic and inorganic opportunities.

Vedanta Q2 FY-24 estimates-

Vedanta will release its Q2 earnings on Oct 27,2023. According to Bloomberg consensus estimates, Vedanta is expected to report revenue of Rs 38,394.8 crore and net profit of Rs 1,160.4 crore in Q2 FY24. But some factor could impact Vedanta’s Q2 earnings.

- Metal prices: Metal prices have declined in recent months, due to a slowdown in the global economy and concerns about a recession. This could have a negative impact on Vedanta’s earnings, as the company is a major producer of metals such as aluminum, copper, and zinc.

- Oil and gas prices: Oil and gas prices have also declined in recent months, due to concerns about a recession. This could have a negative impact on Vedanta’s earnings, as the company is a major producer of oil and gas.

- Rupee exchange rate: The rupee has depreciated against the US dollar in recent months. This could have a positive impact on Vedanta’s earnings, as the company exports a significant portion of its products.

Conclusion

We will keep tracking progress of Vedanta demerger as it happens and the kind of response it receives from lenders and shareholders to proceed with proposed demerger. Though I don’t see lenders causing any hindering in the process as demerger is beneficial for all. Here are some updates from Vedanta in fast few days: From Vedanta’s investor relation web page

- On October 17, 2023, Vedanta Limited announced that it has received the approval of the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) for the demerger scheme.

- On October 18, 2023, Vedanta Limited announced that it has fixed the record date for the demerger scheme as November 4, 2023.

- On October 20, 2023, Vedanta Limited announced that it has filed the necessary documents with the Registrar of Companies (ROC) for the demerger scheme.

The demerger is expected to be completed by September 2025. Shareholders of Vedanta Ltd will receive one share of each of the new companies for every share of Vedanta Ltd they hold on the record date.

Are you holding Vedanta shares in portfolio and not sure what to do, write your queries in comment box or reach out to us on our social media pages.

Read more about India’s inclusion into JP Morgan global bond index, click here