No sell in May and go away for US stocks, as the Dow is up for the 10th straight day. Among key US indices, the Dow Jones closed 0.32% or 126 points higher at 39,558.11 today. The S&P 500 was up another 25.26 points or 0.48% and closed at 5,246.68. The tech-heavy Nasdaq composite was up 0.75% or 122.94 points and closed the day at a new record high of 16,511.18.

The major indices also wrapped the previous week on the positive note. The Dow registered a 2.16% gain for the week, its best since December and its fourth positive week in a row. The S&P 500 and the Nasdaq Composite both posted a third consecutive winning week, rising 1.85% and 1.14%, respectively and winning run continues.

The inflation readings and US markets

The producer price index reading for April came in above estimates, dampening the expectations that the Federal Reserve would begin cutting rates later this year. The PPI gained 0.5% from the prior month, higher than the 0.3% that economists polled by Dow Jones had anticipated. The higher WPI reading of +0.5% ruined the mood of market as they started at day’s low but later moved to day’s high and stayed there till close. Why?

Producer Price Index, which measures prices producers receive for goods produced were revised for the March month offsetting the thoughts of stubborn inflation. March’s monthly price increase was revised lower to a decrease of 0.1% from an initial reading of a 0.2% increase. Also Fed chair Jerome Powell reiterated that he does not expect the central bank’s next move to be a rate hike. He also said that PPI was more “mixed” than “hot,” providing a further relief to the markets.

Powell also said, US inflation to resume declining through 2024 as it did last year, however, his confidence on lower inflation has lately dropped with the quick rise in prices during the first quarter. Powell says it will likely take more time than previously thought to attain confidence needed to lower the key interest rates.

During the event hosted by the Foreign Bankers’ Association in Amsterdam, Powell said, “I expect that inflation will move back down … on a monthly basis to levels that were more like the lower readings that we were having last year.” “I would say my confidence in that is not as high as it was,” added the Fed chief.

April job report earlier brought a ray of hope for markets

The April jobs report of US, however, did show some signs of moderation, with a slower pace of job growth and an unexpected tick up in unemployment. Powell described the labor market as very strong with signs of gradual cooling and re-balancing, in part driven by an increase in labor supply from immigration as well as an easing in demand.

Jobless claims totaled a seasonally adjusted 231,000 for the week ending on May 4, up 22,000 from the previous period and higher than the Dow Jones estimate for 214,000, the Labor Department reported Thursday. It was the highest claims number since Aug. 26, 2023. The increase in claims follows a string of mostly strong hiring reports, though hiring in April was light compared with expectations. Also, job openings have been declining amid expectations that the labor market is likely to slow through the year.

“Weekly jobless claims are one of the timeliest indicators of when the economy is starting to undergo serious deterioration, and the magnitude of new layoffs this week looks worrisome,” wrote Christopher Rupkey, chief economist at FWDBONDS. “One week does not a trend make, but we can no longer be sure that calm seas lie ahead for the US economy if today’s weekly jobless claims are any indication.”

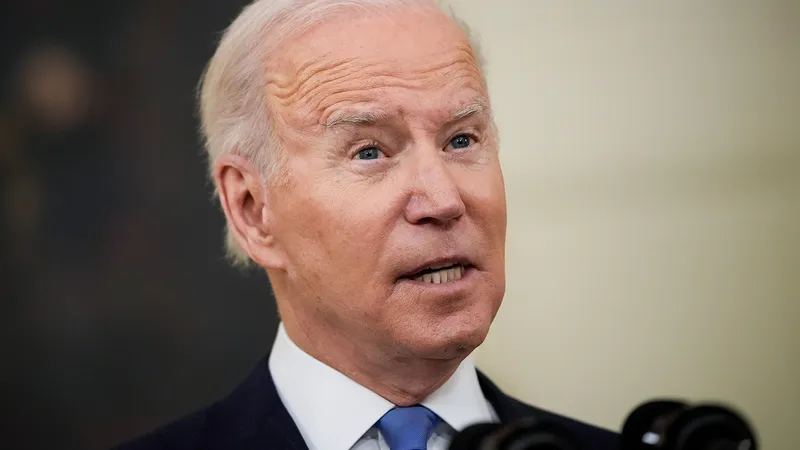

Biden’s Tariff hike on Chinese goods also cheered markets

President Biden spoke Tuesday afternoon about the administration’s decision to announce a new wave of tariffs across an array of Chinese goods. The White House plans to raise duties on $18 billion in Chinese imports, which include electric vehicles, steel, aluminum, semiconductors, medical devices, and more.

“American workers can outwork and outcompete anyone as long as the competition is fair. But for too long it hasn’t been fair,” the president said while speaking at the White House Lawn. He criticized the Chinese government of “cheating” due to heavy state subsidies and “unfairly low” global market prices.

Electric vehicles are a prime focus, with duties in that category set to quadruple this year from 25% to 100%. “Future of electric vehicles will be made in America by union workers. Period,” Biden said.

Other tariff targets include steel, aluminum, semiconductors, medical devices, and more. The administration plans to raise duties on $18 billion in Chinese imports. The announcement comes as President Biden gears up for a rematch against his predecessor, Donald Trump.

The indicators on inflation watch

US dollar index (DXY) eased significantly following today’s inflation numbers, it fell 0.23% or below 105 before recovering back and currently trading at 105.01. US 10y treasury fell 0.036 points to 4.445%, the yields are falling from almost a week now. Oil price also fell more than 1.3% following the Fed comments on rate cuts and higher for longer interests rates smelling further fall in demand due to tighter economic conditions.

More closely followed consumer price index (CPI) report is due to be released Wednesday and markets must be waiting to take more cues from there. The report will further concrete the view of US markets about rate cut expectations by seeing the pace at which inflation is falling through CPI.

Read our coverage about global markets, click here