Mutual fund with other big investors like Foreign institutional investors (FIIs) are big market movers so it is best for retail investors to track their purchases to get a cue for stock specific movement. In fact tracking the smart money flow is considered one of the best way to make money in market. Here are the top mutual fund picks from July 2024 and their technical and fundamental analysis with an expert opinion.

Top mutual fund picks from July 2024

JNK India

The recent debutant on d-street was one of the top mutual funds pick this month, JNK India is one of the leading Heating Equipment manufacturer in India in terms of new order booking between Fiscal 2021 to Fiscal 2023 and have capabilities in thermal designing, engineering, manufacturing, supplying, installing and commissioning process fired heaters, reformers and cracking furnaces. The company is one of the well-recognized process fired heater companies in India, having a market share of approximately 27% in the Indian Heating Equipment market, in terms of new order bookings in Fiscal 2023-24.

The issue received decent response from investors as it was subscribed 28x, in which QIB quota was booked 75x, Retail quota was booked 23x and NII quota was booked 4x. The stock made a decent debut as it listed on ₹621 per share on the NSE, it marked a significant 49.63% increase from its issue price of ₹415. The bullish trend continued post listing, with the stock reaching a peak of ₹709.80 per share, a notable 14.30% surge from its listing price. Currently the stock trades at ₹767.

Stock currently trades at a p/e of 59 and presented a good set of numbers in Q4FY24 with 56.19% jump in net profit while sales rose 111.22% to Rs 226.85 crore in the quarter ended March 2024 as against Rs 107.40 crore during the previous quarter ended March 2023. The stock is a play for India’s growing energy needs and still available at a reasonable valuation compared to peers. With JNK venturing into green energy equipment, the orderbook is poised to grow and that may be reason behind mutual funds raising the stake in the company.

| Company | Mcap(cr) | EBITDA margin (%) | ROE(%) | Mcap/Sales (x) | P/E(x) | EV/EBITDA(x) | P/BV(x) | CMP |

| JNK India | 4,267 | 17 | 39.5 | 5.7 | 59 | 34 | 21.76 | 767 |

| THERMAX | 60,281 | 9.52 | 14.2 | 4 | 103 | 32 | 3.3 | 5,059 |

| BHEL India | 1,10,521 | 5 | 1.10 | 7.1 | 392 | 42.1 | 4.5 | 317 |

Though is very less trading history of this stock so nothing much on charts but 700-710 zone is a strong support for the stock and as long as it is trading above it the bias will remain positive.

Mphasis

Mphasis, a global Information Technology (IT) solutions provider specializing in providing cloud and cognitive services, applies next-generation technology to help enterprises transform businesses globally. With the focus of the market returning to IT stocks due to easing macro concerns in western economies and talk of a rate cut expectations are high that good growth will return from Q3 of FY25. Accordingly, many mutual funds are picking the stock from IT pack and definitely Mphasis is a top pick due to its industry beating growth.

Though company’s Q1 was mixed in terms of slower topline growth due to persisting weakness in BFSI space and with stock running more than 18% in last one month, our approach is cautious on the stock in near term, but signs of the recovery was visible in Q1 with company maintaining a robust deal pipeline and healthy margin outlook. So the stock is still a preferred pick for long term from Mid sized IT stocks.

Currently, stock is trading at a FY25(E*) p/e of 33 and seems perfectly priced so in near term stock should spent time in a range. As long as stock is above 2720-2740 our bias will remain positive on the stock but if it falls below the given level, the fall can continue till 2500.

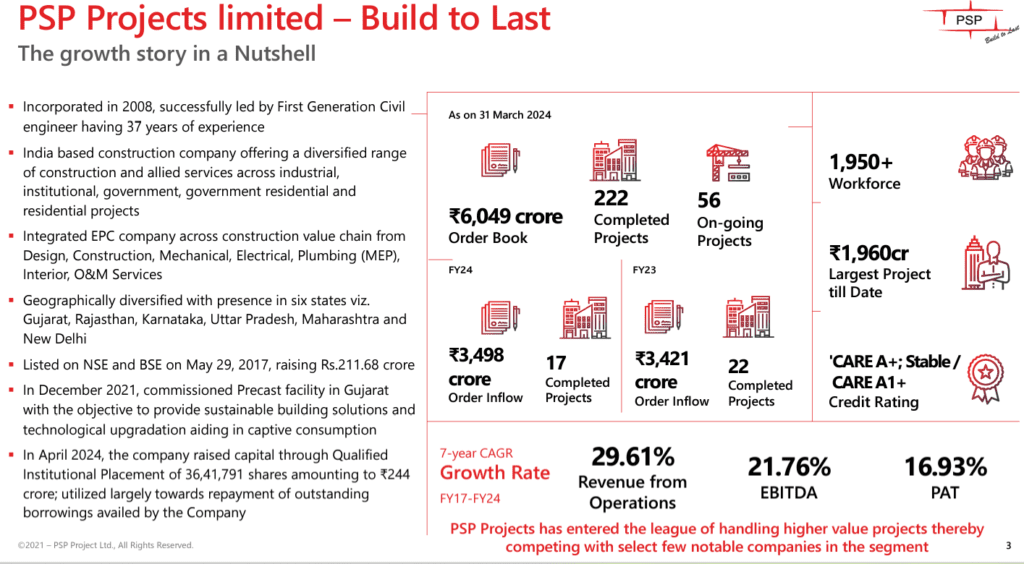

PSP Projects

PSP Projects is a multidisciplinary construction company offering a diversified range of construction and allied services across industrial, institutional, government, government residential and residential projects in India. It provides its services across the construction value chain, ranging from planning and design to construction and post-construction activities, including MEP work and other interior fit outs to private and public sector enterprises.

In its one of the most notable projects it has constructed world’s biggest office complex (Surat Diamond Bourse) having Contract Value of Rs. 1575 Cr and 66 Lakhs Sq. Ft Built-up area and Kashi Viswanath corridor in Uttar Pradesh, Prestige fintech in Gift city, Leela hotel in Gandhinagar and many more. Company is one of the fastest growing construction co in India. The company have a impressive revenue CAGR of 29% and PAT CAGR of 19.71% in last 7 year.

During FY24 the company recorded highest ever outstanding order book of Rs.6,049 crore, a YoY growth of 20%. During the year, the company received highest ever order inflow to the tune of Rs.3,498 crore. Co recently concluded its 244cr QIP in which marquee investors like Fidelity Funds – Asian Smaller Companies Pool and ICG Q ltd, ICICI prudential housing opportunities fund, UTI small cap fund, LIC mf multi cap fund and Bandhan elss tax save fund etc participated.

Now mutual funds holding in the company stands at 10.1% from 2.2% earlier, a change of 7.9%. Mutual funds broadly participated in co’s QIP showing their confidence in the company. Technically, stock is trading near lower band of regression trend with a negative bias, for the bulls to take control, it should cross and sustain above 720-730 zone.

Sharda motors industries

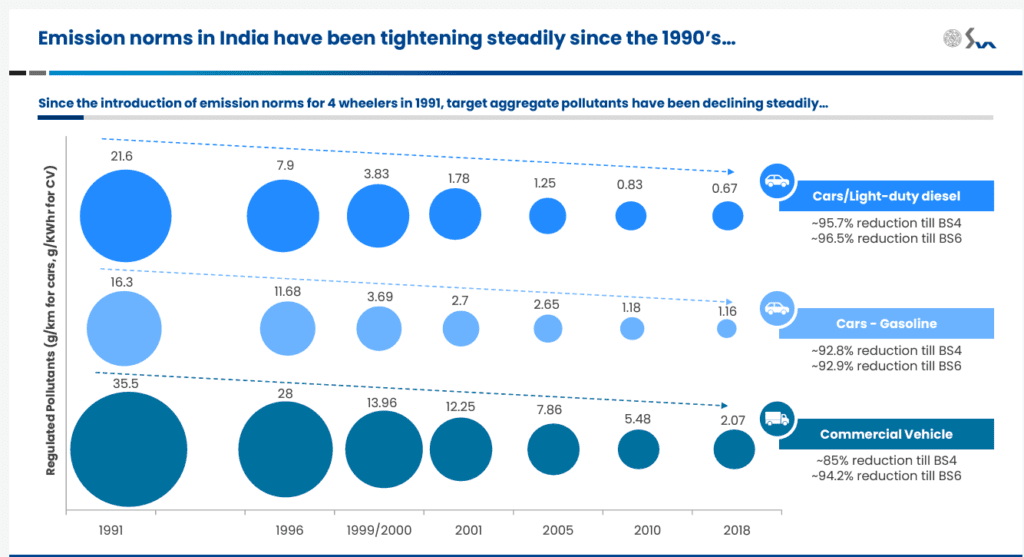

Sharda motor is another very promising company that mutual funds are buying into. The company is primarily engaged in the manufacturing and assembly of Auto Components and White Goods Components and it is India’s largest manufacturer of emission control systems. With Emission norms continue to tighten across vehicle segments – new norms such as TREM V to present a huge opportunity for Sharda Motor, e.g. RDE Norms have enabled Sharda Motor to increase content per vehicle between 10-15%.

- Co have market share of ~30% for emissions control systems in India for passenger vehicles and is one of the few players with technology for advanced emission systems in line with global standards and that has enabled co’s empanelment with marquee customers.

- Demonstrated strong revenue growth CAGR of >30% between FY20-FY2, steady state EBITDA margins >10%

- High return ratios and capital efficiency ratios, As of FY24, The co. is debt-free with a surplus fund of Rs. ~900 Cr, including investment in bonds and mutual funds.

Sharda motors is one of the best play for us in automotive segment as going ahead the emission norms will be tougher due to India moving toward zero emission goals and emissions from vehicles is primary source of pollutants. From above graph you can see how already we have moved in terms of regulated pollutants in last 25 years and it will keep changing in upcoming 25 years. Further the company is diversifying its business into making suspension systems which helps vehicles in light weighting thus saving fuel for ICEs and increasing range in the case EVs.

The stock of Sharda motors is already more than 2x in last 6 months but still cheapest among peers as it trades at a p/e of 24. Stock made a high around 3,000 and retraced from there and now trading near 38.2% Fib retracement level. If this is broken stock could fall further.

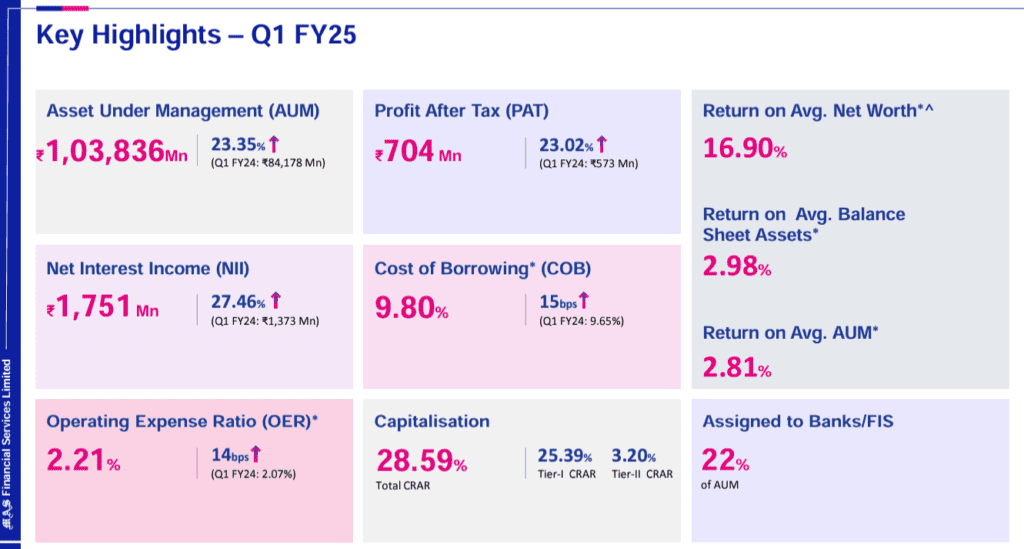

MAS financial services

MAS Financial Services Limited is a non-deposit taking NBFC registered with the RBI. It is engaged in offering retail financing products for MSMEs, home loans, two-wheeler loans, used car loans and commercial vehicle loans. Company’s most of the loan portfolio in terms of AUM mix is in Micro-enterprise and SME segment, and a small segment is in 2w loans, used vehicle loans and salaried personal loans.

MAS financial can be a play of rate cut, with cost of borrowing coming down (For MAS cost of borrowing is already one of the lowest among peers) and the co serving priority sectors like MEL and SME the efficiency will get better, already MAS fin’s asset quality is robust. Co is increasing its focus on low ticket housing loans in semi-urban and rural areas which will be a key growth driver in low interest regime, this may be the reason mutual funds raised their holding in the company.

Mutual funds with other marquee investors recently participated well in MAS fin’s 500cr QIP which was over subscribed which made the the stock one of the top mutual fund picks of the month.

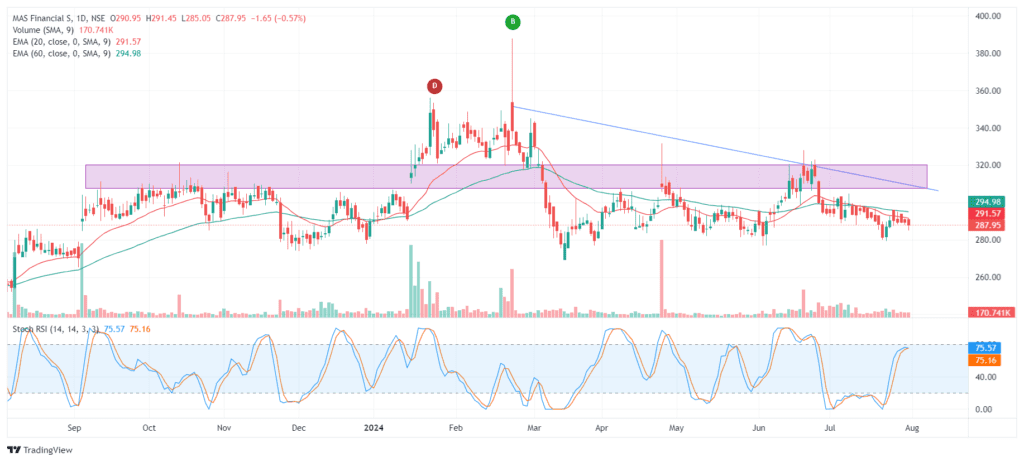

Despite mutual funds raising the stake in the company, the stock performed poor from last few months, Stock will continues to trade with negative bias as long as it is not crossing 320 and trading above it. But we have selected this stock from a long list due to it being a contra pick if one is interested to play the rate cut cycle and have plans to hold a stock for next 18-24 months.

Conclusion

Mutual funds picking stake in a company or participating in QIPs is a positive sign as they conduct thorough research before picking stake in a company. Many investors track these smart money flows (buy and sell of Mutual funds, other DIIs and FIIs) to benefit from it. Here we have prepared a list of 5 stocks from top mutual fund picks of this month’s stocks by applying more filters and shortlisting based on stringent finminutes research criteria.

Well explained with clear rationale. Such type of content is very low to see these days.