Tesla is struggling with plummeted sales from last few quarters but 55% drop in earnings in Q1 is something that took everyone by surprise. Tesla’s 3 key market US, Europe and China are throwing differs set of challenges to the company in which primary concerns are tepid sales of electric vehicles due to high prices and slowing demand in overall and increasing competition in China (Tesla’s second largest market after US). In Europe sales of Tesla’s flagship models are reaching a saturation point.

It was a general consensus among investors that Tesla will enter new markets specially of emerging economies like India (World’s third largest auto market) and will install manufacturing facilities there to lower the cost but in its earnings conference call CEO Elon Musk said that company will utilize its existing manufacturing plants to full capacity before moving ahead to new manufacturing plants. Significant drop in earnings and delayed plan to enter new market but what got investors excited, read to know the details –

Tesla’s Q1 earnings and road ahead

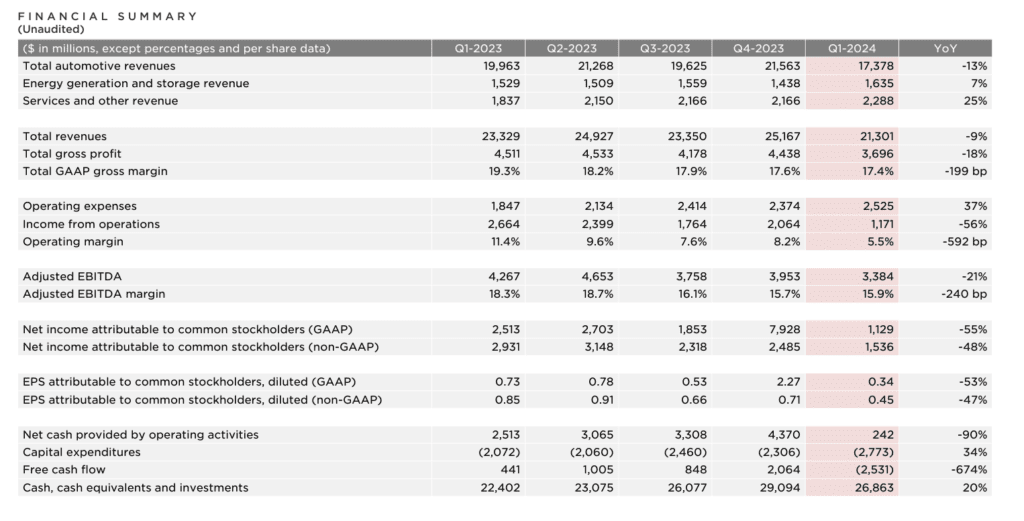

Tesla released its Q1 earnings on April 23 and result was below Wall streets expectations. Revenue came at $21.30bn which declined from $23.33bn a year earlier and from $25.17bn in the fourth quarter. The leading EV maker reported a 55% slump in its net earnings as the company made $1.13bn from January to March, against last year’s $2.51bn figure in the same period. A big drop in gross profit margin happened as it dipped to 17.4%. While it peaked in 2022’s first quarter at 29.1%, 2023 recorded it at 19.3%. Tesla’s earnings per share came at $0.45/share against wall street expectation of $0.51.

After long time the company witnessed a decline in cash and cash equivalents, Quarter-end cash, cash equivalents and investments in Q1 was at $26.9B, a sequential decrease of $2.2Bbut it was a result of negative free cash flow of $2.5B, driven by an inventory increase of $2.7B and AI infrastructure capex of $1.0B in Q1.

Slowing vehicle delivery rising competition

Almost all EV makers are facing drop in number of vehicles sold and they are slashing price to lure customers along wit it Tesla is facing intense competition in China as key competitors like BYD are providing similar feature cars at a much cheaper price. Earlier this month, Tesla reported an 8.5% year-over-year decline in vehicle deliveries for the first quarter and the company reiterated a pessimistic outlook for 2024, telling investors that “volume growth rate may be notably lower than the growth rate achieved in 2023.”

Price cut is primarily behind the slump in gross profit and it is here to stay as increasing competition in its key markets and customers focus on value will not let company hike prices anytime soon. Apart from this company also blamed the ongoing Red Sea conflict and the arson attack at giga factory Berlin.

Elon’s plan to tackle these challenges

Launch of affordable EV

After falling almost 40% in a year Tesla’s stock is rising post Q1 earnings release despite big miss, reason- Elon presented a road map to boost company’s sales and bring things on usual track. Elon promised to launch a low cost EV priced somewhere near $25,000, Model 2, a lower-cost similar features electric vehicle that’s set to roll out next year. This model will be manufactured in company’s existing manufacturing unit announced Musk as speculations were high that company will launch new plants in EM’s like India and Mexico to make low budget cars.

In my view it is very sensible move for the the moment as Tesla is adopting various methods to cut the cost including job cuts. When existing plants are not running at a full capacity, it make sense to first utilize them completely before investing into new plants and Tesla is going to do the same as the co is aiming to “fully utilize” its current production capacity and to achieve “more than 50% growth over 2023 production” before investing in new manufacturing lines.

With affordable EV’s Tesla can address multiple challenges in one go and it can also study the response of customers on these new models before expanding them to new markets. Currently Tesla’s cheapest car is Model 3, with a starting price of $40,240 USD for the rear-wheel drive (RWD) version. With the launch of model 2 which is expected to cost $25,000 company can address the demand of masses and in return this will significantly boost company’s revenue.

Launch of Robotaxi and FSD model

Tesla is focusing on to build a AI powered taxi fleet based on “cybercabs” platform. “Think of it as a combination of Airbnb and Uber,” Musk said on earnings call Tuesday. “There will be some number of cars that Tesla owns itself and operates in the fleet, and then there’ll be a bunch of cars where they’re owned by the end user.” Elon wants Tesla cars to spend as little time in garage as possible , this way Tesla owners will be able to earn by able to opt their cars into a ride-hailing robotaxi program.

Like Airbnb, owners can choose to only rent their car to users with good ratings, or just friends and family. Tesla will operate this fleet, according to Musk, which also includes a new dedicated robotaxi that will be showcased in August of this year. By this Musk emphasized Tesla’s commitment to solving autonomy problem stating “If somebody doesn’t believe Tesla is going solve autonomy, I think they should not be an investor in the company. But we will. And we are.”

Musk further added “Our purpose-built robotaxi product will continue to pursue a revolutionary ‘unboxed’ manufacturing strategy”, referring to its planned new vehicle production system intended to slash assembly costs in half. Apart from this company wants to capitalize from licensing its FSD (full self driving) model, presently company’s advanced driver-assistance software requires drivers to remain attentive with their hands on the steering wheel.

But Tesla plans to showcase its full self driving model in August this year and also planning to license it to other automakers, in-fact Musk told investors that the company is in a advanced stage of negotiations to license FSD tech to a leading US automaker. Musk urged investors to experience FSD firsthand, stating, “I once again would just likely strongly recommend that anyone, who is I guess thinking about the Tesla stock, should really drive (FSD’s latest version). It is impossible to understand the company if you do not do this.”

Optimus robots by 2025 end

Musk informed the investors that Tesla’s work in humanoid robot is progressing well and these humanoid robot named as “optimus” could be available for sales as early as year 2025 end. The emergence of humanoid robots has caught the attention of various industries, including logistics, warehousing, retail, and manufacturing, where they could alleviate potential labor shortages and undertake repetitive or hazardous tasks, he added.

Elon further reiterated that he thinks “Optimus will be more valuable than everything else combined,” saying that there is “no meaningful limit to the size of the economy” for “a sentient humanoid robot that is able to navigate reality and do tasks at request.”

Specifications (according to Tesla’s AI Day presentation):

- Designed to be humanoid, standing at 5 ft 8 in (173 cm) tall and weighing 125 lb (57 kg).

- Powered by an electric battery, with an estimated runtime of 8 hours on a single charge.

- Controlled by the same AI system used in Tesla’s self-driving cars.

- Capable of carrying 45 lb (20 kg).

Applications:

- Tesla envisions Optimus taking on dangerous, repetitive, and boring tasks, particularly in manufacturing settings.

- Elon Musk predicts Optimus could become more significant than Tesla’s car business in the long run.

To better manage costs Tesla is also cutting more than 6000 jobs in Texas and California.

Future outlook and Expert’s call

Tesla game plan is excellent but execution and meeting timeline is a challenge. Its FSD program has faced multiple challenges and criticisms in past for being in-accurate. Humanoid robot is in under development and may not go as planned by the company, humanoid robo market is becoming competitive too as companies like Boston Dynamics are also making significant advancements. But all in all Tesla’s above plans have got investors and experts excited.

After falling more than 40% in a year, experts are seeing enough tailwinds for Tesla stock. Many experts changed their rating on the company post Q1 release. The target price for Tesla ranges from as high as $310 to a low of $102. On chart eminent support is on $150 while breaking $175 is crucial for further upside.

Approaching Indian market amid evolving geopolitical conditions, click here to read.