FII’s, DII’s and funds buying stock is the sign of value or opportunities in most cases, recently after market moved upwards many stocks became expensive valuation vise but if you are still looking for opportunities specially in mid and small caps tracking funds or Fii buying is a good idea. Mutual funds constantly look for value/growth stocks that can boost their portfolio return and they have a set of criteria to pick stocks from a basket and in many case, multi baggers can be found this way, if big names on street or funds buying some unknown stock in big quantity, it warrants attention.

Though fund’s buying doesn’t always means that you should run to pick those stocks but you should add them in your watchlist and keep an eye on them, if some of them are qualifying your investing criteria you should then act to invest in them. Here, I’m updating list of stocks that are seeing biggie’s buying, I will also mention their technical fundamental outlook for ease of investors understanding.

Stocks that Mutual Funds bought, sold in past 1 month

Mutual funds are getting good flow of money from investors through SIP and lumpsum, in recent months due to high interest in small cap companies, funds are seeing heavy inflow in small/ midcap schemes. Some funds had to stop taking money in lumpsum in these schemes due to excess inflow and lack of opportunities/ high valuation in some sectors.

SBI Mutual fund

SBI mutual fund primarily focused on large caps as it added HDFC Bank(merger effect), Infosys, Bajaj Finance and Reliance Industries. It also added LTI Mindtree, Indiamart Intermesh, Petronet LNG, ShriRam Finance. SBI mutual fund contrary to popular opinion added IT/services stocks in its portfolio while booking profit in ICICI Bank, Bharti Airtel, ITC Ltd.

ICICI Prudential mutual fund

HDFC Bank was obvious name from large cap space as ICICI Pru added it in substantial quantity due to merger effect, apart from HDFC bank it bought smaller quantities of Infosys Ltd, Maruti Suzuki Ltd, Axis Bank, Bharti Airtel and ICICI Bank. From mid and small caps ICICI Pru added substantial quantity of Route Mobile, Intellect Design Arena, Prestige Estates, Mangalore Refineries & Petrochemicals Ltd (MRPL) and JK Cements.

It pared shares aggressively in some of popular names like Reliance industries, Sun Pharma, it also booked profit in NTPC and Larsen&Toubro.

HDFC Mutual fund

HDFC Bank was top pick for HDFC MF too as it added the bank shares in big quantity due to merger effects, apart from this HDFC MF bought ICICI Bank, Infosys Ltd, NTPC Ltd, and Axis Bank. It also picked Eris Life Sciences, Krishna Institute of Medical Sciences (KIMS), Fortis Healthcare, ACC Ltd and Pidilite Industries in good quantity.

HDFC MF was aggressive in profit booking too as it pared its stake in Reliance industries substantially, and to a lesser extent it trimmed its positions in Larsen & Toubro, ITC Ltd, SBI, and Bharti Airtel.

Nippon India Mutual Fund

Nippon India churned its stake in HDFC bank due to merger of HDFC into HDFC Bank and formers share getting converted into later. Nippon IMF aggressively added position in State Bank of India and Infosys Ltd. It added to a smaller extent in stocks like NTPC Ltd. In multi-caps it loaded names like Amara Raja Batteries, Birlasoft, Jindal Stainless, Hero MotoCorp, and KFIN Technologies (formerly Karvy Computershare Ltd) in noticeable quantity.

Nippon India MF trimmed its positions across several stocks like Axis Bank, Reliance Industries, Power Grid Corporation, ONGC and Coal India Ltd.

UTI Mutual fund

One of the oldest in India among mutual funds UTI MF added only TCS in large cap category, it also added positions in HDFC Bank out of compulsion as merger resulted in conversion of shares in HDFC bank from HDFC ltd. The fund’s top 5 stock picks based on the percentage increase in holdings included Suzlon Energy, Star Health & Allied Insurance, Jindal Steel & Power, Greenpanel Industries, and Indian Bank in recent month.

It trimmed positions in several large caps. Reliance Industries, Axis Bank and Bajaj Finance Ltd were among the top names where it pared its stake.

Axis mutual fund

Axis mutual fund contrary to other funds added positions in TCS and Reliance industries quite aggressively, Of course, the biggest accretion was its holdings in HDFC Bank, but that was more due to the merger of HDFC Ltd. Based on percentage increase its top 5 picks were Polycab India, Indus Towers, ICICI Prudential Life Insurance, Zomato and Tata Steel.

Axis mutual fund was only fund that very aggressively trimmed its positions across sector and categories, it booked profit in few prominent mid caps like Info Edge (Naukri), Avenue Supermarts (D-Mart) and Cholamandalam Investments & Finance. Among large cap it pared holdings in Bajaj Finance, Nestle India and ICICI Bank.

Aditya Birla Sun Life Mutual Fund

ABSL MF apart from HDFC bank added State Bank of India, Bajaj Finance and ICICI Bank in some quantity. The fund’s top 5 stock picks for July 2023 based on percentage accretion in holdings included Utkarsh Small Finance Bank, SAIL, Star Health & Allied Insurance, Ujjivan Financial Services and BHEL.

While it buyed some it sold more. ABSL was aggressive in selling holding in Infosys and Axis Bank, apart from these two it also pared some stake in stocks like Reliance Industries and Larsen & Toubro in recent months.

Kotak Mutual Fund

Kotak mutual fund smartly used corrections in IT/services sector to load positions as it added Infosys, Mphasis in large quantity. In addition, Kotak MF added Maruti Suzuki. HDFC was obvious addition due to merger. Top picks of Kotak in recent month was TVS Motors, Mphasis Ltd, Siemens Ltd, Hindustan Aeronautics Ltd (HAL), and Tata Communications.

There were several stocks in which Kotak Mutual Fund cut positions aggressively including State Bank of India, Larsen & Toubro, and Reliance Industries.

Mirae Asset MF equity portfolio

Mirage asset is one of the fastest growing fund house in terms of fund AUM in equity segment. Stocks that it added in its portfolio in recent months include Frontline names like HCL tech, Axis Bank and ICICI Bank apart from HDFC bank. Its top picks were Utkarsh Small Finance Bank, Motherson Sumi Wiring, SRF Ltd, Samvardhana Motherson International, and Fortis Healthcare from multi-cap verse.

It was equally active in booking profits as it sold Reliance Industries and Larsen & Toubro aggressively. It also sold smaller quantities of Infosys, Bharti Airtel, State Bank of India and NTPC Ltd.

DSP Mutual Fund

DSP bought HDFC bank due to same reason above mentioned, it also added small quantity of Samvardhana Motherson and smaller quantities of Alkem Laboratories and IPCA Laboratories. The fund’s top 5 stock picks based on percentage increase in holdings were Borosil Ltd, IIFL Finance Ltd, Adani Enterprises, Indus Towers and Gujarat Fluorochemicals Ltd.

It trimmed holding in Infosys and State Bank of India, substantially reducing its positions in both the stocks.

FM top picks among above stocks and their outlook

Infosys Ltd.(CMP 1403)

Most mutual fund added IT behemoth Infosys in their portfolio despite Infosys cutting guidance for FY-24 and ongoing macro concerns, Infosys sharply corrected after q1 results but most analysts looked that as an overreaction as poor result was already in price. Mid and small caps IT stocks are up more than 30-40% from lows but largecaps are still struggling to hold the ground. This was another reason MF’s lapping up Infosys. Valuation comfort, low chance of further downside is also comforting. Though there won’t be much upside till q2 numbers as market will wait for more clarity before making any move.

Infosys is bullish on charts, trading above all short-term moving averages and some long term moving averages too, it is trading above 200day Exponential moving average on weekly timeframe and it will catch further momentum once it cross ₹1431 as 200&50 day EMA crossover will happen. Stochastics is bullish but MACD in bearish zone. Infosys can be accumulated in dips for long term.

SHRIRAM Finance(CMP 1845)

ShriRam finance is our preferred NBFC pick from months and still available at reasonable valuation after 45% run in past six months. Institutional investors are consistently increasing holding in ShriRam fin, from 61.53% in march 2023 to 70.03% in Jun 2023 quarter. Company is trading at a forward P/E of 8(estimate). At price to book of 1.91 company is trading at discounted valuation to other peers.

UBS in a note said company is a leader in the organized high yield used commercial vehicle financing and two-wheeler segments. UBS is of view that market is underappreciating company’s medium term earning per share(eps) growth potential. ShriRam finance is looking to pare 15% stake in its housing finance arm at a valuation of $121million, It holds 85% stake in its housing finance arm and want to reduce it to 70%.

ShriRam finance is trading at above all short-long moving averages on weekly timeframe but stochastic and RSI is in overbought zone. Investors should look to accumulate it in declines and should keep adding till 1620-1660 zone if available. Chart is looking fantastic.

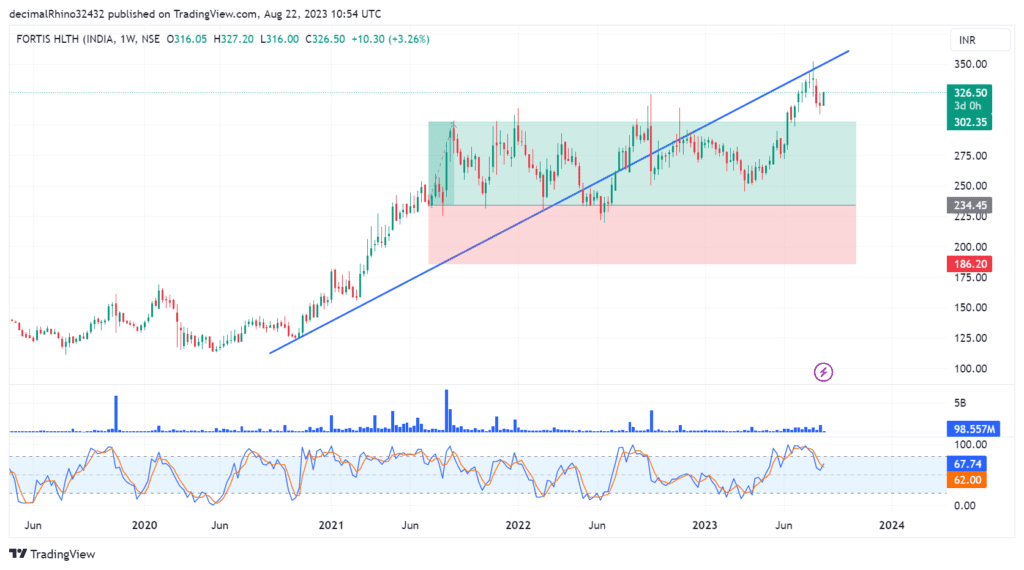

Fortis Healthcare(CMP 326)

Institutional investors are showing interest in hospital stocks, among hospital stocks Fortis garnered good interest of mutual funds. Fortis is trading at a forward P/E of 29 for FY25(estimate). Company is consistently reducing its debt and business outlook is looking healthy post covid. Jefferies in a note published in Jun pointed that Fortis is a beneficiary of CGHS(central government health scheme) as it offers subsidized medical treatment to central government employees and government subsequently reimburse Fortis.

Jefferies noted The revision of CGHS rates in April focused on in-patient (IPD) and out-patient (OPD) consultations as well as room rent charges. Rents were increased by 50 percent and OPD/IPD consultation charges were raised by 133 percent and 17 percent, respectively. The global research firm expects the revised CGHS rates to boost the financial of company as it hasn’t been factored in the Street’s earnings estimates for hospital. The revision could be a step towards earnings upgrades and even drive outperformance from the sector, Jefferies said.

“If it happens on time from July onwards, hospitals will surprise positively on ARPOB (Average Revenue Per Occupied Bed) growth from Q2 or Q3 of FY24 onwards,” Jefferies said in its report. Technically, stock is trading above all long term moving averages in weekly time frame. Both stochastic and RSI is in bullish territory. On chart, it is looking good as it is trading near all time high and recently gave a multiyear breakout from ₹300 range now it will work as strong support. The stock can be added in mild declines.

Star health and allied insurance(CMP 617)

Company registered its highest ever revenue and profit in June 2023 quarter, and institutional investors are showing interest in insurance sector. Insurance stocks are underperforming market since covid as sudden and large number of claims and other expenses dented company’s Financials but now things are coming on track. Star health has a retail-oriented product mix, large distribution channel so company is consistently improving its solvency ratio and profitability post covid.

On back of rising health awareness post pandemic and high cost of Healthcare, retail interest toward health insurance is on steady rise, low penetration of health insurance products and good mix of portfolio of Star health is moving in sync and management commentary is raising our confidence. Star health has 32% market share in retail health and management is confident of growing it consistently. Management is guiding a 20% premium growth in FY24, insurance company sees the loss ratio in range of 63-65%, and the combined ratio in 93-95% range.

Technically, stock is trading above 20,50 day moving average in weekly chart and majority of technical indicators including stochastic, MACD, RSI is in bullish zone. Investors should keep an eye on ₹750 level as it is the hurdle level for stock as it reversed multiple times from same level, in short-term if stock breaks 600 level it can see further downside but if it manages to stay above it, will try to breach 750 mark. Investors should remain watchful for above mentioned levels.

want to strategize your mutual fund investments, click here to read tips to invest in mutual funds.

read about buyback vs dividend, which one offers best value, click here.

Disclaimer: Stock mentioned above are for information purpose only, please contact your investment advisor before making buy/sell decision.