Still investing in gold ETFs or planning to buy fresh, you may have questions like, Has gold’s rally run its course, or is it the start of a fresh breakout for gold? You may also want to know if it’s time to book a profit from your gold ETF or time to top up. Here, we will consider every point that can influence gold price movement and decide how the gold price could move going forward, and what’s in it for investors.

We will explore whether holding onto your gold ETFs still makes sense. We’ll evaluate global factors like supply and demand, central bank activity (especially China’s gold purchasing), tariffs, trade wars, and institutional positioning.

Gold has long been considered a “safe haven” investment for investors, offering stability during economic uncertainty. Among the many ways to invest in gold, gold ETFs (exchange-traded funds) have gained immense popularity for their liquidity, ease of trading, and cost-effectiveness. However, with gold prices having rallied significantly in recent times, investors are now facing a crucial question: is it time to book profits and explore alternative opportunities?

What Are Gold ETFs, and Why Are They Popular?

Gold ETFs are investment funds that trade on stock exchanges just like individual stocks. They track the price of gold and allow investors to gain exposure to the commodity without owning physical gold. Here’s why gold ETFs have emerged as a go-to option for conservative investors and gold enthusiasts:

Benefits of Investing in Gold ETFs

- Liquidity

Unlike physical gold, you can buy or sell ETFs instantly during market hours. This makes them extremely accessible for investors who require flexibility.

- Cost-Effective

With gold ETFs, you don’t have to worry about expenses like storage, security, or making charges (which often accompany physical gold purchases).

- Diversification

They act as an excellent diversification tool. Adding gold ETFs to your portfolio can help hedge against inflation and economic downturns.

- Transparency

Gold ETFs are regulated financial instruments, ensuring transparency in pricing and holdings.

- Accessibility for Small Investors

You don’t need to have a fortune to start investing in gold ETFs. They allow you to own gold indirectly in smaller denominations.

While gold ETFs offer several advantages, the current gold-price dynamics demand a deeper look into whether holding onto these investments is still a profitable strategy.

Have Gold Prices Peaked? A Look at Supply and Demand Scenario

Gold prices have been on a strong upward trajectory over the last few years; in the past 12 months alone, the gold price is up more than 40%. This up-move in gold is not normal and is driven by economic uncertainty, geopolitical tensions, trade war causing inflation fears, but a crucial factor to consider is the relationship between supply and demand, which could indicate whether this rally is nearing its end.

Demand Factors

- Central Bank Purchases

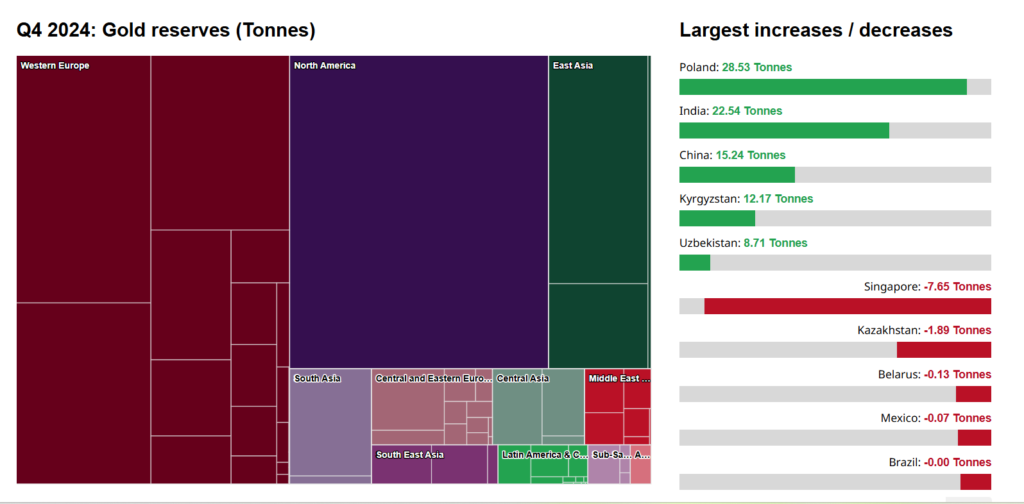

Central banks, especially in emerging markets, have been major players in the gold rally. Notably, China’s aggressive gold purchases have been a significant factor in pushing prices higher. According to the World Gold Council, central banks added over 1,000 tons of gold in 2024, which is the 3rd consecutive year where central banks have purchased more than 1,000 tons of gold in a year.

At the start of 2025, central banks are continuing their gold purchase-

- Central banks reported 18 tons of net purchases at the start of 2025

- Emerging market central banks remain at the forefront of net buying, with Uzbekistan, China, and Kazakhstan the top three buyers

- Poland and India also continue to accumulate gold reserves in 2025; both central banks added 3 tons to their respective reserves in January.

- Investor Demand

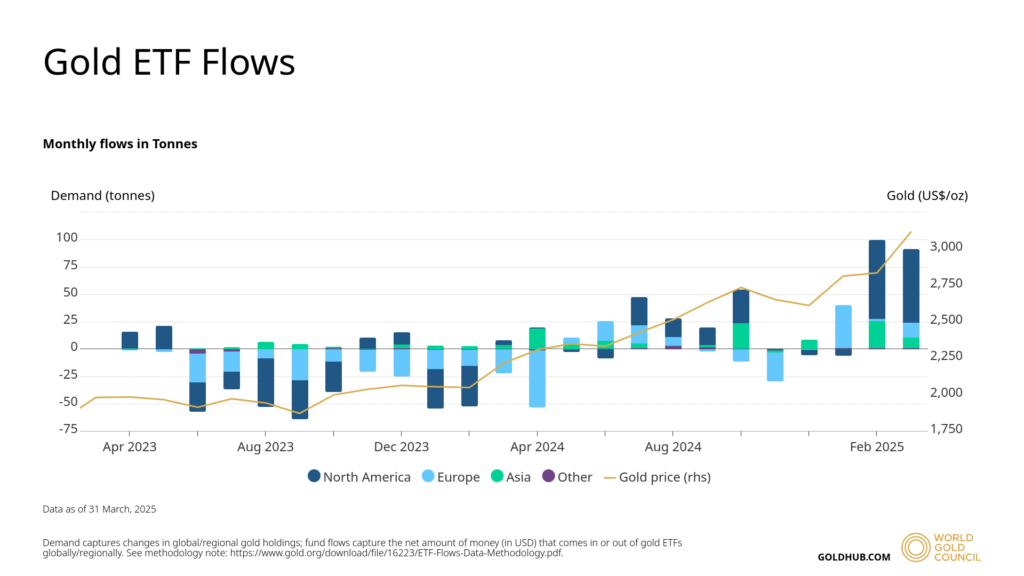

Gold’s safe-haven appeal has drawn immense interest from both institutional and retail investors. Gold ETFs have seen significant inflows, reflecting strong demand. Global physically backed gold ETFs reported strong inflows in March, totaling USD 8.6bn. This helped drive total Q1 flows of USD 21bn (226t) to the second-highest quarterly level in dollar terms, only behind Q2 2020’s US$24bn (433t).

North America (61%) and Europe (22%) represented the bulk (83%) of net inflows in Q1. Asia contributed 16%, which is impressive, given that the region’s total assets under management (AUM) only account for 7% of the global total. Additionally, the first quarter flows in Europe of USD 4.6bn stood out as the strongest quarter since Q1 2020, resulting in an AUM that reached another all-time high of USD 345bn, representing an increase of 13% in March and 28% through the first quarter.

Additionally, collective holdings rose to 3,445 tons by the end of March, a 92t addition in the month and 226t higher through Q1, reaching the highest month-end level since May 2023 and 470t shy of the record of 3,915t in October 2020.

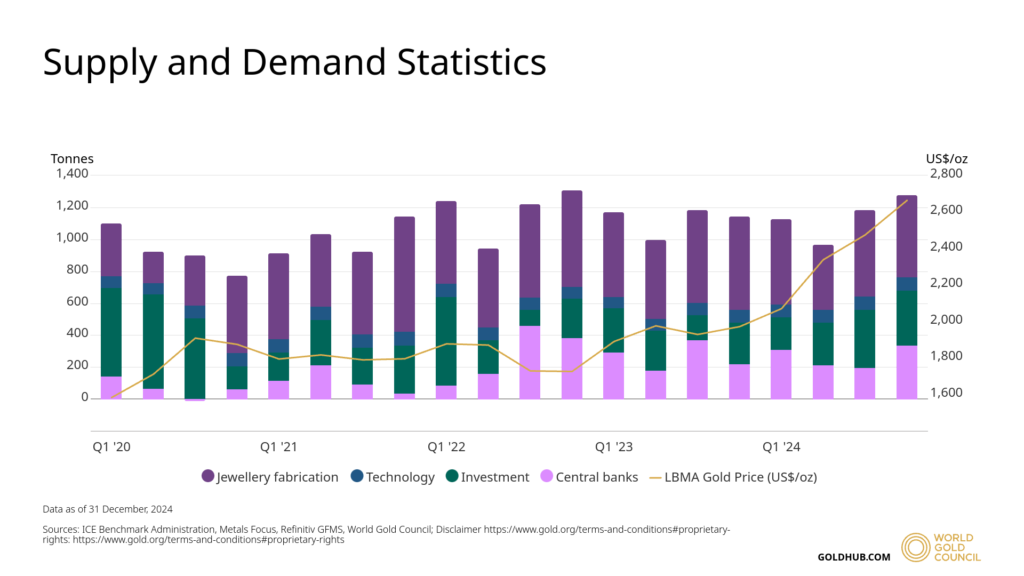

- Jewelry and Industrial Demand

While gold jewelry demand remains stable, gold also has industrial applications (e.g., electronics), which contribute to its baseline demand. Despite gold getting expensive, jewelry demand remains steady, while there is a slight uptick in industrial demand.

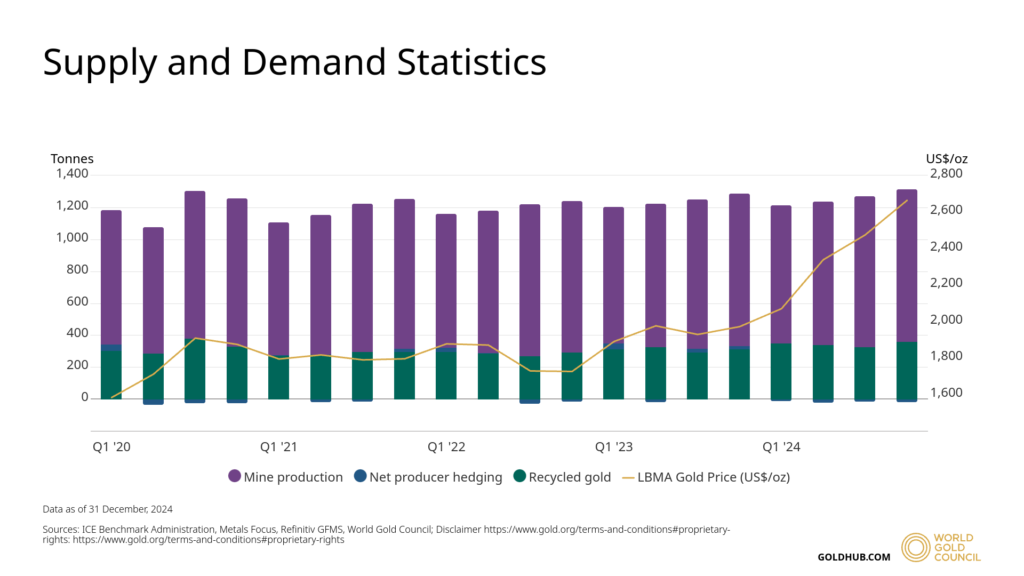

Supply Constraints

Gold supply is relatively inelastic. Global mine production has plateaued, and any sudden supply surge is unlikely. This tight supply situation generally supports elevated gold prices.

The heavy demand by central banks and restricted supply suggest there is still a bullish undertone for gold prices. However, this does not mean a guaranteed endless upward momentum.

The Impact of Tariffs, Trade Wars, and Global Politics

When geopolitical tensions sore, gold becomes a go-to asset for investors seeking stability. With military escalations already in place, The U.S.-China levying tariffs on each other escalated into a full-fledged trade war, and tariff hikes after US president Trump’s liberation day announcements have created economic uncertainties, bolstering gold prices in recent months (though he paused the tariffs on most other countries excluding China, but uncertainties are still there).

How Growth Slowdowns Influence Gold

Another element to consider is the ongoing fear of recession in major economies, including the United States. Earlier, the thoughts were that, as the central banks are gradually turning less hawkish or dovish in some countries after a series of interest rate hikes and a long pause, this would bring a temporary pause to gold’s gains, but this did not play out.

Strange as it may sound, but this gold rally has defied most of the economists and their books, the USD index touched a new high, and Stock markets in the US soared to new highs as President Trump took office, usually a strong dollar and a rally in risky assets like stocks and cryptos means a demand slowdown for gold but this time it was not the case, primary reason was central banks especially in China and other major economies were boosting their gold kitty.

Institutional Investors’ Positioning and Sentiment

One of the best ways to gauge the sustainability of gold’s rally is by examining institutional investors’ positions. Notably, large hedge funds and asset managers have gradually reduced their gold exposure, signaling skepticism about further price rises.

The Commitment of Traders (COT) report, a valuable resource that captures institutional sentiment, has recently shown more bearish positioning in gold futures. This suggests that “smart money” might be viewing the current elevated prices as unsustainable, hinting at a possible reversal in the medium term.

On the one hand, gold futures saw some bearish positions getting added in March as COMEX futures declined marginally by US$400mn (5t) likely on profit taking, but on the other, ETF buying was as usual, US funds led the charge with US$6bn (67t) of net inflows, followed by Europe, then Asia with approximately US$1bn each.

To look at it more accurately, we will take the help of history and the fundamentals of gold.

The Prospect of Gold Rallying Further

With all these factors in mind, the question becomes clearer—is gold near the end of its rally, or is there still some upside left?

Arguments for Further Upside

The behavior of gold when compared to other commodities has changed over time; now, some even do not consider gold as a traditional commodity, for a traditional commodity, as the saying goes, “high prices cure high prices,” but not for gold, gold’s sovereign and safe heaven status, its industrial use, and consumers willingness to hold and reluctance to sell make it a sophisticated commodity that is free from traditional price movements.

Here are some key arguments working in favor of more upside for gold.

- Continued central bank gold buying, particularly from China, will likely maintain strong demand. Central bank buying will continue as long as there is a trade deal between countries, especially between the US, China, and European countries.

- Any resurgence in geopolitical tensions can quickly rekindle gold’s safe-haven appeal. As long as there is no breakthrough in the Russia-Ukraine standoff or no permanent peace deal in the Middle East, gold’s safe-haven status will keep attracting investors.

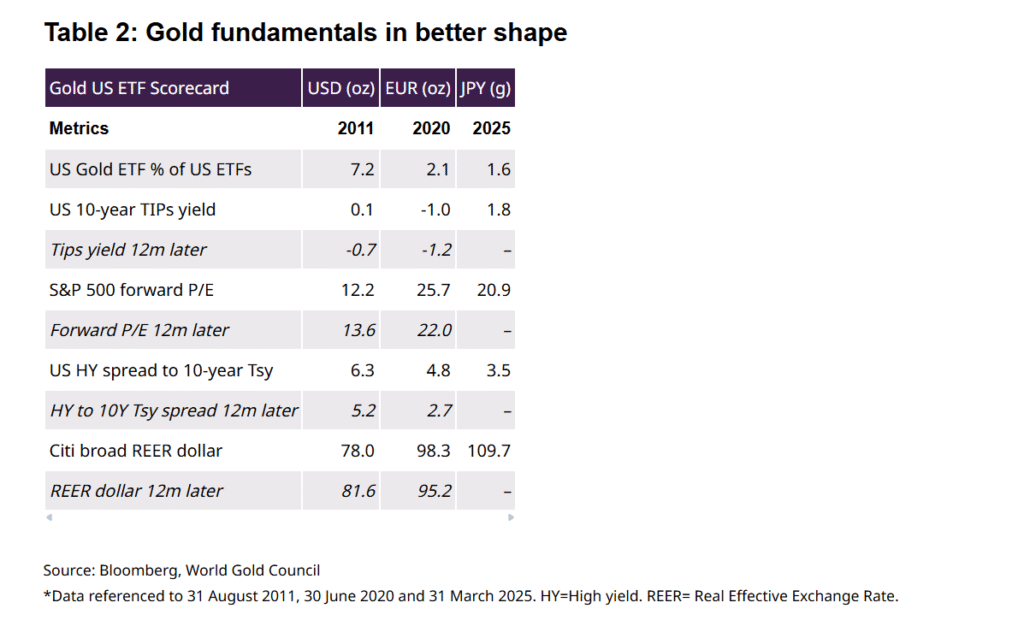

What does the data say?

The above chart shows that the US ETF is still very far from the levels of 2011 and 2020 when compared to the US gold ETFs as % of total ETFs. Similarly, S&P 500 forward P/E is overvalued compared to 2011, and any sudden shock in the macro front or further earnings slowdown could deepen the equity market fall, diverting more investors towards gold.

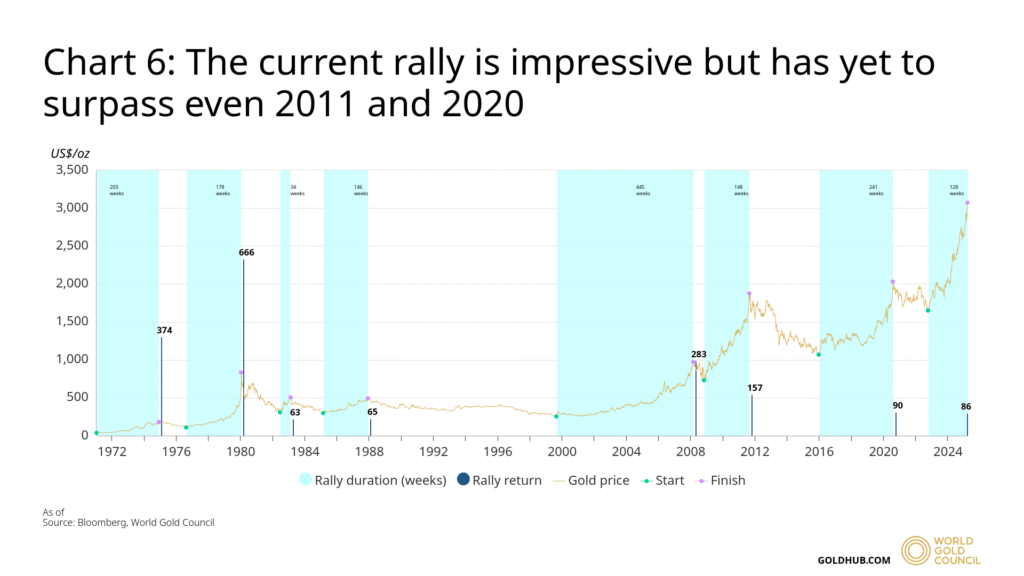

In another major research, the data team of Bloomberg and World Gold Council showed how long a gold rally lasted in the past and how much rally, in percentage terms, occurred during that period. It is significant to note that the biggest rally in terms of time happened between 2000 and 2010, lasting 445 weeks. In that period, gold prices rallied 283%.

In terms of price rally, the biggest rally came in the 1976-1980 period, where gold prices rallied 666%; this rally lasted for 178 weeks. Based on this data, we at FinMinutes Research calculated the average of the rally period in price jumps in all of these gold rallies. The average time taken for a rally to conclude is 190 weeks, and the average price appreciation of 223%.

To evaluate the performance of gold rallies in the post-2000 period, to gain another perspective, the average duration of the rally is 240 weeks, and the average gain in this period is 154%. So, going by the past data, this rally have still legs to go as the current rally is just 130 weeks old with a gain of 90%.

Pullback Scenario

- Institutional investors started to cut their positions, though small, but data showed profit booking, still no sign of shorts getting added, can be a starting counterargument to gold’s continued rally.

- If global trade wars de-escalate, the risk premium built into current gold prices may wane.

- Other assets, such as equities or even cryptocurrencies, may begin to look more attractive as economic uncertainty settles.

Latest Updates

In a significant development, the US President indicated that the Russia-Ukraine peace deal is looking closer than ever as the Russian President, Vladimir Putin, indicated, he is ready to start direct peace talks with the Ukrainian counterpart if his demands are listened to without ifs and buts, and the US seems ready to sincerely listen to Russia’s demand.

In another major development today, the IMF cut the world’s GDP growth forecast, citing global uncertainty and trade wars. The IMF also reduced the growth forecast for major world economies like the US, China, and India. But, if the global normalcy returns on the geopolitical and trade tariffs front, as the efforts are ongoing, this could positively surprise on the growth front. If the world returns to normalcy, sanctions on Russia will be removed, providing support for inflation.

Similarly, any positive news on the tariff front will also work well for risk assets and will be negative for gold, as the uncertainty premium built into the gold price will vanish.

Should You Book Profits on Gold ETFs Now?

So, what’s the verdict? If you’ve been holding onto gold ETFs during the recent price surge, there’s certainly a case to be made for booking profits. This especially applies if your ETF holdings are overweight in your portfolio or if you anticipate a rotation into other higher-yielding asset classes.

At the same time, gold remains a critical hedge against black swan events, inflation, and political instability. The decision to sell or hold depends on your financial goals and risk tolerance. A balanced approach could involve partially reducing your exposure while retaining some position for long-term stability.

What’s Next? Make Data-Driven Decisions

Investing is all about timely decisions based on the available data and your objectives. Here’s how to make an informed choice about your gold ETF holdings:

- Keep an eye on central bank purchasing trends (China, in particular).

- Consistently monitor institutional positioning, such as hedge fund activity, and track Gold ETF inflows.

- Assess how gold fits into your overall asset allocation strategy.

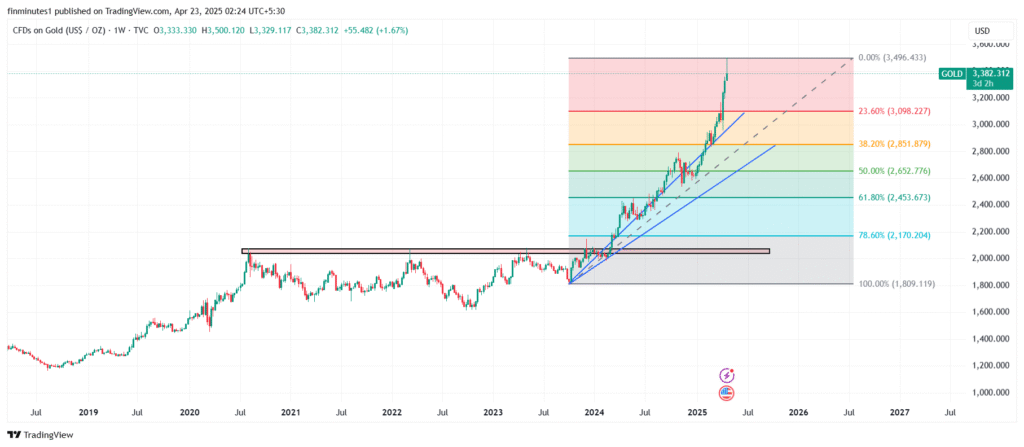

Charts suggest $3,500 is immediate resistance, and if a fall happens from here, it will be swift as no major support till $3,090-3110. High probability of gold prices touching $2750-2850 if the current rally fades, but if $3,500 is taken out, expect the prices to soar to $3,650-3750 in no time.