Saraswati Saree IPO was open for subscription on Aug 12, 2024 and will close today. The 160cr issue received a 16.35 times subscription on the second day of bidding on Tuesday, Aug 13. According to the latest data, the retail investors quota received a strong 20.32 times subscription, while the non-institutional investors category also got a whooping 57.19 times subscription. The QIB (qualified institutional buyers) category has been subscribed only 1.32 times.

At the time of writing, the shares of Saraswati Saree Depot were trading at a GMP of Rs. 65, so it is trading at a premium of Rs. 65 in the unlisted market, or the expected listing is at a 41% premium over the issue price of Rs. 152-160.

Saraswati Saree IPO: An overview of the company

The company is a key player in sarees wholesale (B2B) segment and the origin of it into the sarees business dates back to the year 1966. The company also engaged in the wholesale business of other

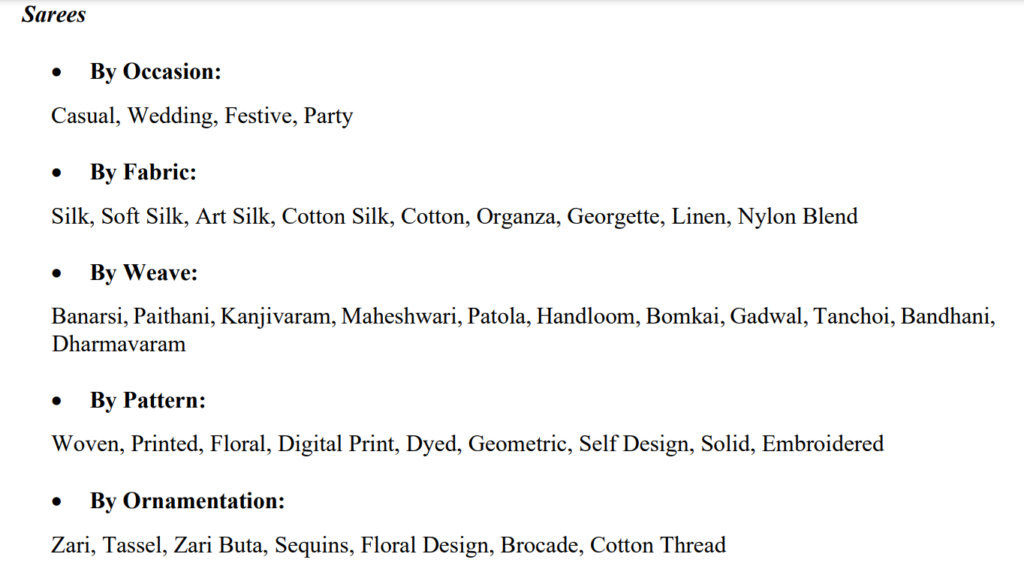

women’s apparel wear such as kurtis, dress materials, blouse pieces, lehengas, bottoms, etc. In Fiscal 2024, Sasaswati saree have served over 13,000 unique customers and the product catalogue consists of more than 3,00,000 different SKUs which shows the strength of the business.

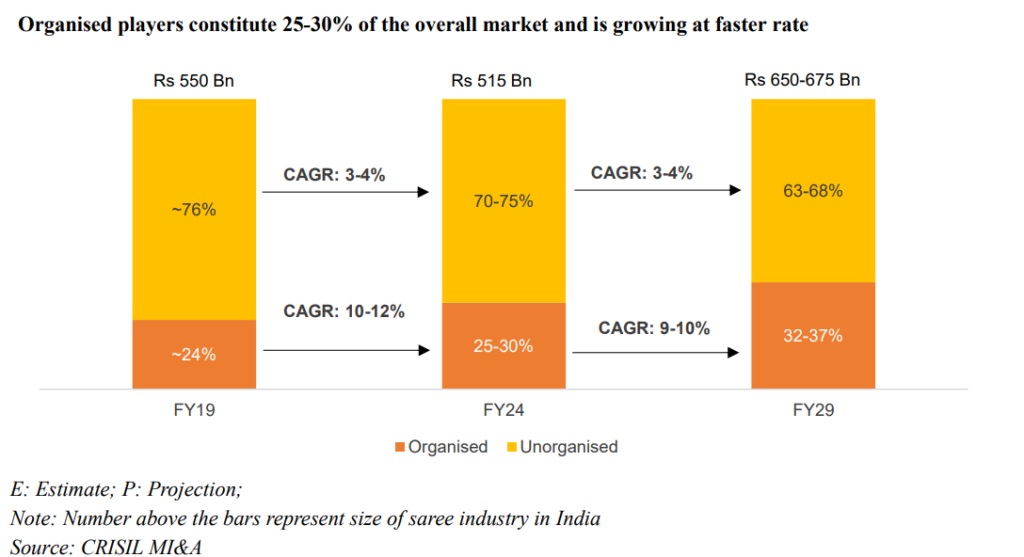

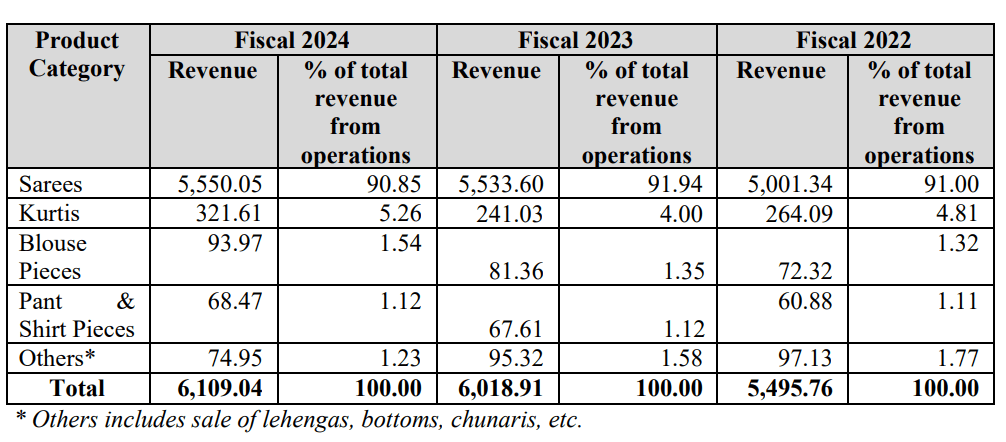

On an average, more than 90% of the company’s sales is from sarees, approx 4% from kurtis and rest from others. The saree market in India has been traditionally dominated by small retail shops and unorganized players who usually have standalone outlets which is characterized by loyal customer group. The unorganized players usually have fewer number of SKUs, and many of these players stock the sarees based on the local or region specific demand.

On the other hand, with rising aspiration of the country’s middle class and rising disposable income, the organized players are tapping in to this demand for branded and quality products. The organized retailers in particular are targeting the saree market with offerings in the mid to premium range.

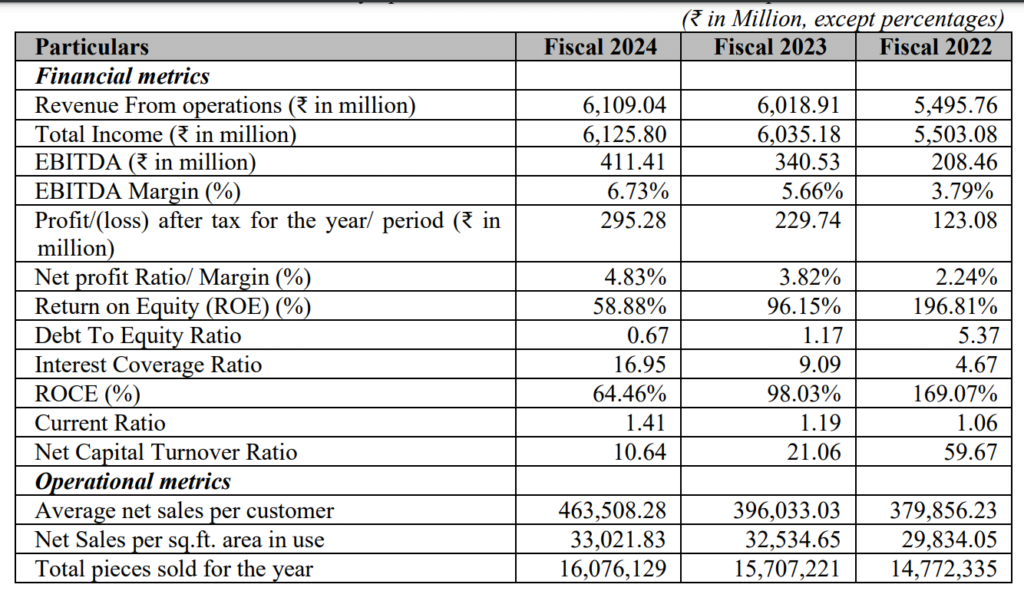

Company’s financials

Company’s topline growth remains below par as it grew 9.4% in 2023 and just 1.5% in 2024 but bottom line saw good growth due to better cost management as its PAT (profit after tax) grew 83.3% in 2023 and 28.8% in 2024. Margins saw good improvement too as EBITDA margin rose to 6.62% in 2024 from 3.79% in 2022. Saraswati saree depot saw good growth in end margins too as PAT margin rose too 4.83% in 2024 from 2.24% in 2022.

Positives of the company Saraswati saree depot

- Simple family type business with straight forward business model, company pick product from different weavers and supply it to whole sellers. In Fiscal 2024, the co have served over 13,000 unique customers and the product catalogue consists of more than 3,00,000 different SKUs.

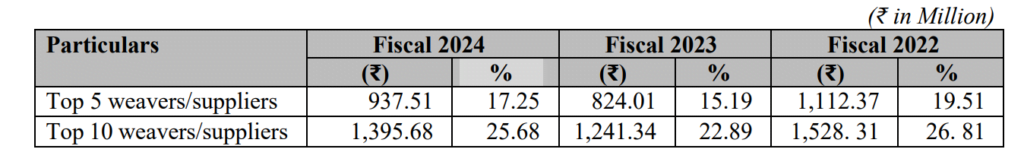

- Sarees are sourced from different manufacturers across India. Over the years, the co have developed relationships with these manufacturers in hubs like Surat, Varanasi, Mau, Madurai, Dharmavaram, Kolkata, and Bengaluru. it regularly source sarees and other women’s apparel from more than 900 weavers/suppliers across different states in India, so very well diversified suppliers.

- Well diversified customer base, In Fiscals 2024, 2023 and 2022, revenues from top 10 customers represented 7.85%, 8.91% and 7.90%, respectively of co’s total revenues.

- Very experienced promoters, the family in Saree business from 1966 and currently fourth generation is looking after the business operations.

- Existing client and supplier relationships are very strong for the co as it is in the women ethnic wear business for more than 5 decades. Due to its special relationship with suppliers company enjoys attractive price, exclusivity in designs, and payment terms, all of which is passed on to customers by the way of attractive prices, an exclusive product range, and high-quality products.

- A varied range of product portfolio.

- Saraswati saree depot aims to diversify its product portfolio by launching men’s ethnic wears post ipo. Men’s wear dominates the market with a substantial share of 42% in fiscal 2024. Ethnic wear contributed to approximately 30% of the overall apparel market in India. The share of ethnic wear segment in overall men’s wear stands at ~7%. The men’s wear segment is projected to increase to Rs.3.8 – 3.9 trillion by FY29, implying a CAGR of nearly 10-11% between fiscals 2024 and 2029. (Source: CRISIL Report).

- Saraswati saree depot intends to leverage technology and sell products both online (e-commerce to benefit from growing e-commerce penetration) and offline (physical stores) going ahead for both B2B AND B2C, this way the company will have better analytics and customer retention bringing down various costs and further enhancing margins.

- Organized players are gaining market share in ethnic wear (saree) market and are projected to grow at a faster pace between 2024-29, also they’re having better pricing power due to diverse range of product on offer and Saraswati saree depot will be a key beneficiary of it.

Negatives of the company Saraswati saree depot

- Business is highly concentrated on the sale of women’s sarees and is vulnerable to variations in demand. Any changes in consumer preference could have an adverse effect on business, results of operations and financial condition. Though company is diversifying its business to other women wear and men ethnic wear but it will take time and co will face intense competition from existing established players.

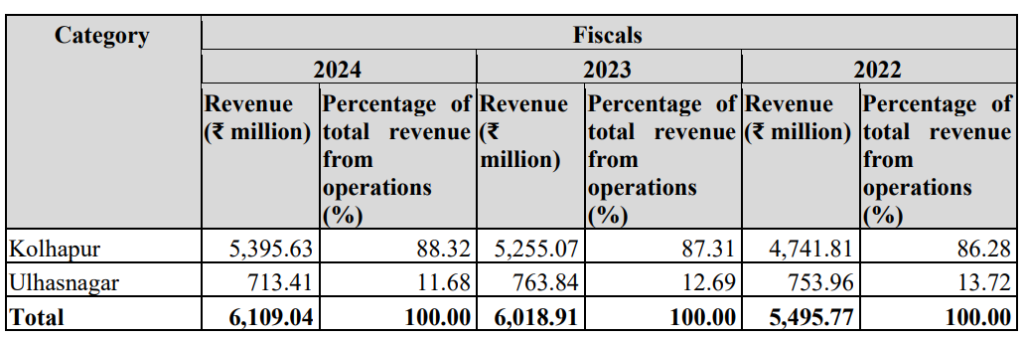

- Saraswati saree depot operate out of two stores in Maharashtra which are located at Kolhapur and Ulhasnagar. Any localized social unrest, natural disaster or breakdown of services or any other natural disaster in and around Maharashtra or any disruption in production at, or shutdown of, stores could have material adverse effect on co’s business and financial condition. Concentration is a big risk.

- A significant portion of company’s sales are derived from the western zone and any adverse developments in this market could adversely affect its business. Co’s 78.98% sales is from Maharashtra, 16.91% from Karnataka and 3.39% from Goa, here too concentration is high, though Maharashtra and Karnataka are very stablished and reliable market but more diversification is needed.

- Company’s margins need improvement, though they are witnessing a constant uptick but still significantly low from listed peers. EBITDA margin of 6.73% and PAT margin of 4.83% is low compared to peers.

Valuation and our view

At price band of Rs 160 per share the issue is priced at a p/e multiple of 21x on post issue FY24 PAT basis which is at lower side when compared to industry peers. Due to its small size of issue investors should ‘apply‘ for the IPO for good listing gains and we will review the IPO post listing once it settles. We will monitor the company for topline growth and margin expansion post listing.

Click here for more of our IPO coverage.