Sanstar ltd IPO opened for subscription on July 19, 2024 and received decent response from investors till day 2 of subscription. Till 5:30 pm on the second day of bidding on Monday, July 22, the 510.15cr issue received a 13.53x subscription, garnering bids for 50,86,31,850 shares as against 3,75,90,000 shares on offer. The retail quota received a 12.23 times subscription, while the non-institutional investors category got a massive 32.88 times subscription. The qualified institutional buyers (QIB) category received a 1.29 per cent subscription.

Sanstar ltd: about the company

Sanstar Limited is a leading manufacturer of starch and starch derivatives. The company operates in various sectors including food and beverages, paper and packaging, pharmaceuticals, textiles, and more. Its extensive product portfolio caters to a wide range of industrial applications, making it a significant player in the starch industry in India.

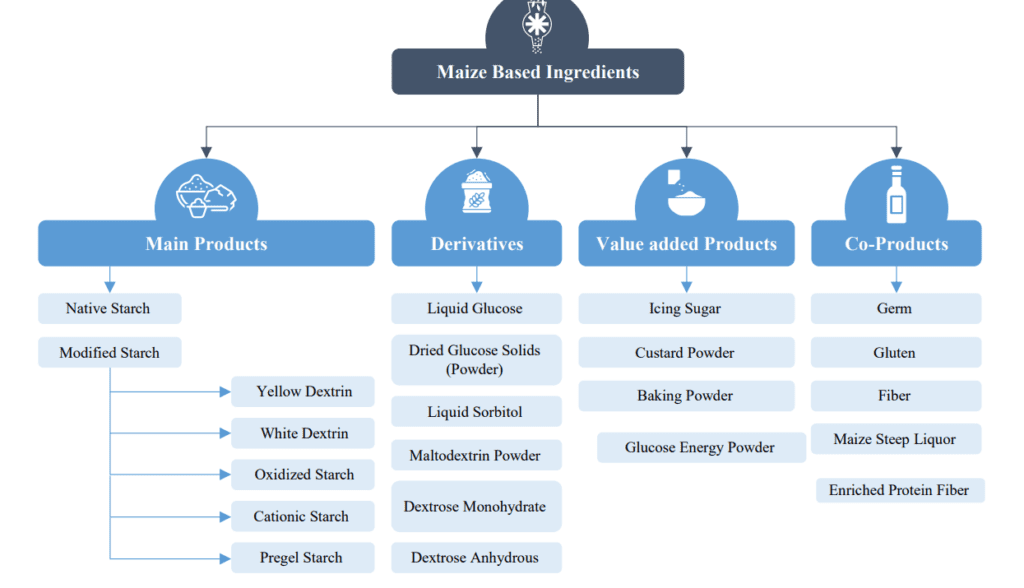

Sanstar’s products include liquid glucose, dried glucose solids, maltodextrin powder, dextrose monohydrate, native maize starches, modified maize starches and co-products like germs, gluten, fiber and enriched protein, amongst others. With an installed capacity of 3,63,000 tons per annum (1,100 tons per day), co is the third largest manufacturer of maize based speciality products and ingredient solutions in India.

Company’s speciality products and ingredients solutions add taste, texture, nutrients and increased functionality to (i) foods as ingredients, thickening agents, stabilizers, sweeteners, emulsifiers and additives (in bakery products, confectionery, pastas, soups, ketchups, sauces, creams, deserts, amongst others), (ii) animal nutrition products as nutritional ingredients, and (iii) other industrial products as disintegrants, excipients, supplements, coating agents, binders, smoothing & flattering agents, finishing agents, among others.

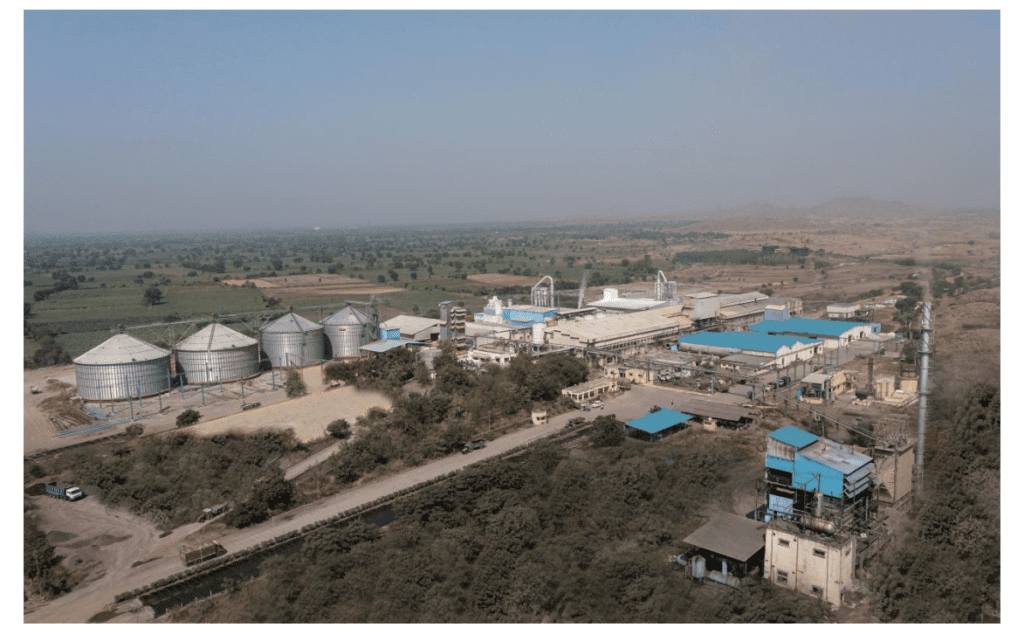

Sanstar’s two manufacturing facilities spread across cumulative area of 10.68 million square feet (approximate 245 Acres) are located at Dhule in the state of Maharashtra and Kutch in the state of Gujarat. Company proposes to expand the capacity of the Dhule Facility by utilizing the existing land available for

expansion. The capital expenditure for the proposed expansion is estimated at ₹ 2,01.55cr, which is proposed to be funded entirely out of the Net Proceeds of this Offer. Once operational, the aggregate installed capacity of the Dhule Facility is expected to be at 1,750 tons per day.

Santar ltd: What we like about the business

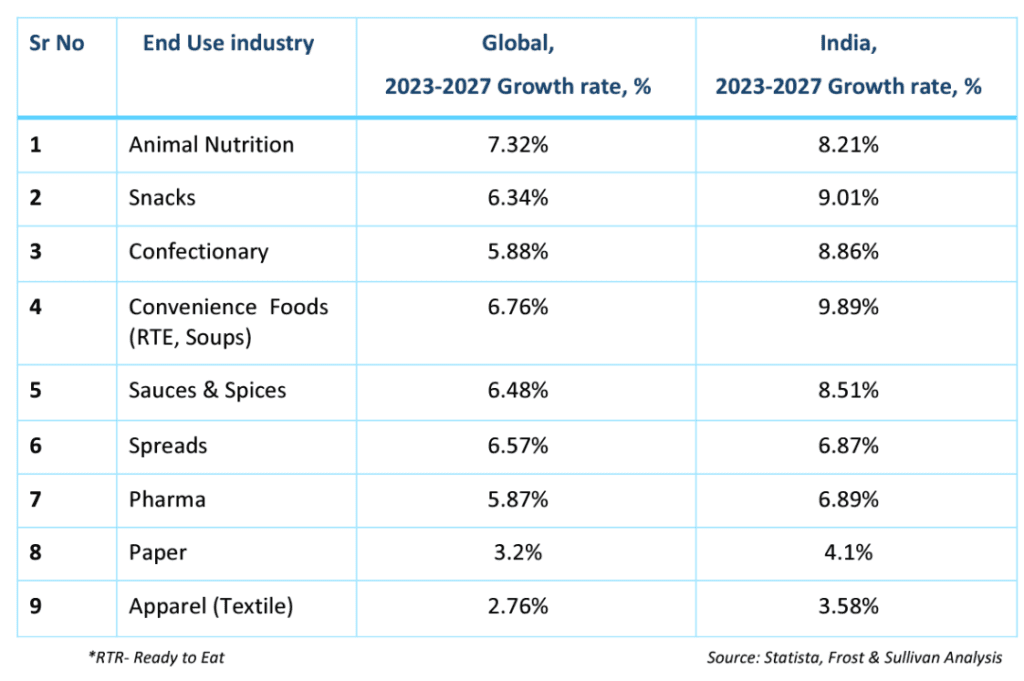

- Company is operating in the segments where growth is going to be excellent in next few years.

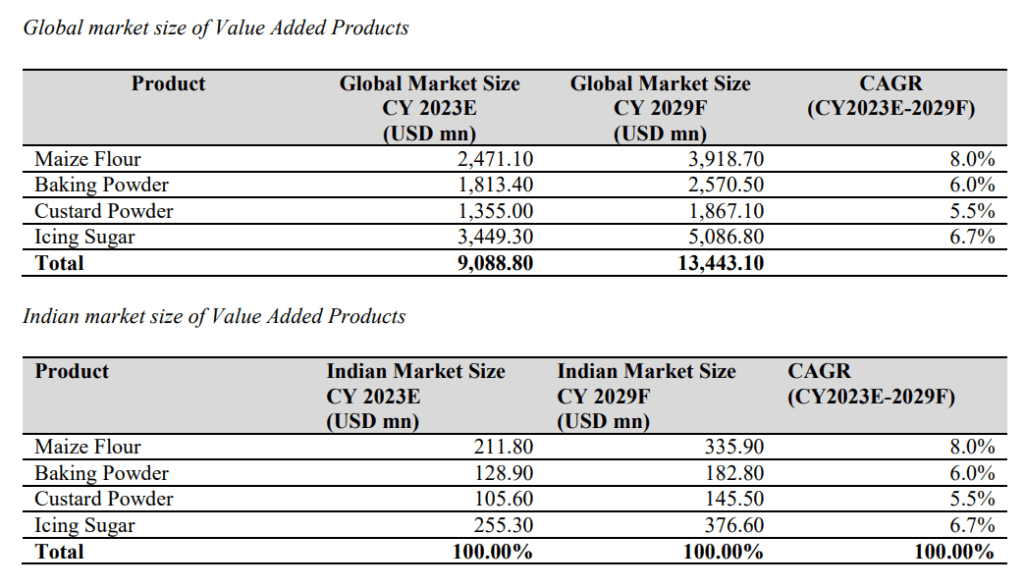

Sanstar’s majority of revenue comes from food & beverage, paper, and packaging industries which are predicted to grow at a fast pace. It has well diversified product basket which includes maize starch and its various maize based specialty products and ingredients solutions such as dextrin, high maltose maize syrup, dextrose monohydrate, maltodextrin, sorbitol, and co-products. These products find applications in a wide array of industries including food, pharma, textiles, paper, industrial, oil and gas etc.

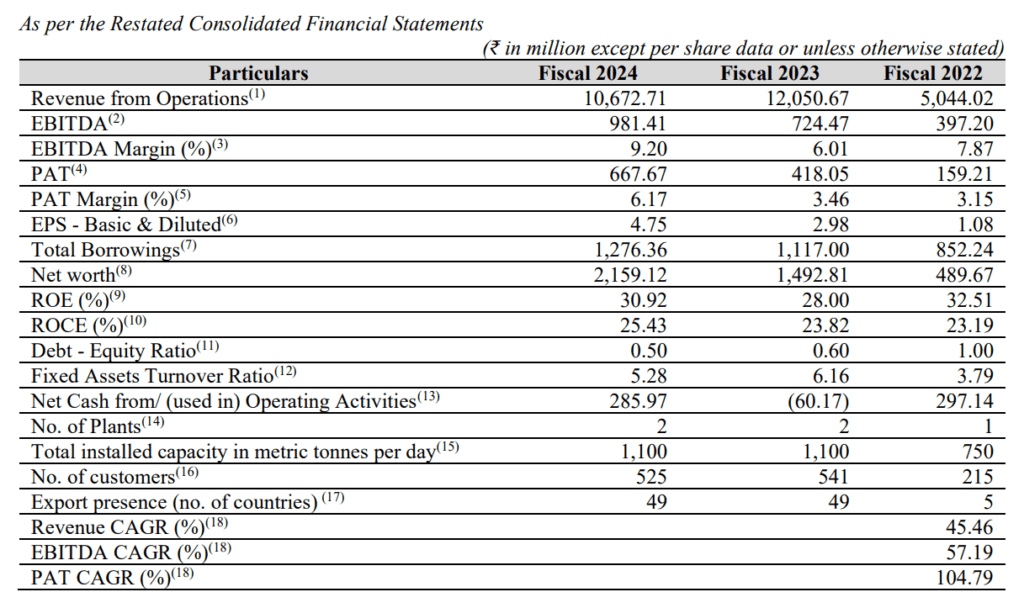

2. Sanstar’s financial performance is robust, though there was a dip in last year’s revenue due to stress in export market (supply chain issues, inflation etc) but company increased its end margin showcasing its ability to manage tough macro situation with ease.

3. Company is well diversified in terms of geography, customer concentration and product mix. Co’s 63% sales comes from starch products, 6.47% comes from derivatives, 16% comes from co-products and 13.88% of sales comes from other products. In terms of customer concentration 26% sales comes from top 5 clients and 34.88% comes from top 10% clients which is reasonable. In fiscal 2024, Company’s 65% revenue comes from domestic market and 35% sales comes from export market.

For revenue from exports, co’s 60% of it comes from Asia, 23.3% from Africa, 5.44% from middle east and 9.83% comes from Americas. Co intends to expand its exports presence in markets where current penetration is low or negligible including into North America, Europe and Africa. For example, cos Kutch, Gujarat facility is registered with United States Food and Drug Administration (USFDA) which is regarded as a crucial certification for selling the goods in United States.

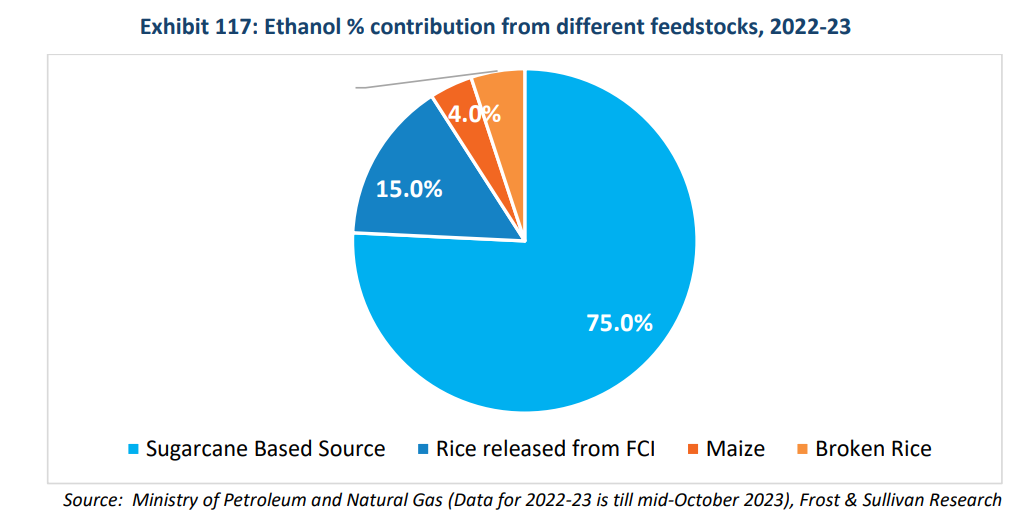

4. Company have 2 unique opportunities in hand namely, ethanol and organic starch, expansion in both of these sectors can be a game changer for company. According to Ministry of Petroleum and Natural Gas, Govt. of India, ethanol market is predicted to expand by 500% domestically. At a 20% blending level, the demand for ethanol is expected to rise to 1016 billion ltrs by 2025. Consequently, the value of the ethanol sector will increase from about Rs. 9,000 crores to over Rs. 50,000 Crore, a growth of more than 500%.

Separate price for maize based ethanol was established in October 2022 which will benefit the manufacturers of maize based ethanol. With increasing demand use of Damaged Food Grains(DFG) or Maize will increase so as to meet the target of 20% blending by 2025.

Here is how to check the IPO allotment status with PAN number.

Though currently production of Ethanol is low from maize but looking at the constraints for ethanol production from sugar based sources, govt is incentivizing production of maize based ethanol. The increasing demand for Ethanol cannot be sustained only by molasses and other feedstocks such as maize will contribute in greater terms.

Sanstar Ltd will have advantage for ethanol manufacturing due to already established mechanism for procuring maize at competitive prices. In 2022 -23 India produced roughly around 4.94 billion litres of Ethanol of which majority came from B-Heavy Molasses & Juice followed by rice released by FCI, broken rice and from Maize.

Sanstar plans to expand its organic corn starch sales as popularity of the same is growing at a very fast pace due to growing awareness towards organic products. Growth Drivers for Organic Starches:

- Increased adoption of non-GMO sustainable practices among manufacturers.

- Increased use of organic starches in plant-based foods market/ alternative meat market is showing exponential growth,

- Increasing consumer consciousness for clean label food products;

- Stringent regulations on synthetic additives in food, pharma, and nutraceutical industry;

- Changing consumer lifestyles and food preferences along with growth in per capita income;

Risks

Market Competition: The starch industry is competitive, with several players vying for market share. Sanstar needs to continuously innovate and maintain cost efficiency to stay ahead.

Raw Material Prices: Fluctuations in raw material prices, particularly maize and other inputs for starch production, can impact profitability.

Regulatory Changes: Changes in industry regulations, environmental norms, or trade policies could affect operations and financial performance.

Valuation and peer analysis

| Co name | Mcap(cr) | Revenue(cr) | EPS(rs) | P/E | ROE(%) |

| Gujarat Ambuja | 6,208 | 4,927 | 7.54 | 18 | 13.3 |

| Sukhjit starch | 7,56 | 1,375 | 31.98 | 16.5 | 9.44 |

| Gulshan poly | 1,191 | 1,378 | 2.83 | 67 | 3.05 |

| Universal starch | 92.6 | 527 | 16.64 | 13.2 | 11.2% |

| Sanstar ltd | 1,730 | 1,067 | 4.75 | 20 | 29.9% |

Co at the upper price band of 95 is priced at a p/e of 20, at a premium to other listed peers. Though the company’s growth outpaces listed peers so it can be said that the issue is fully priced. One can either apply for long-term or wait for listings to buy, in our view on the Sanstar IPO. Click here to read more of our IPO coverage.