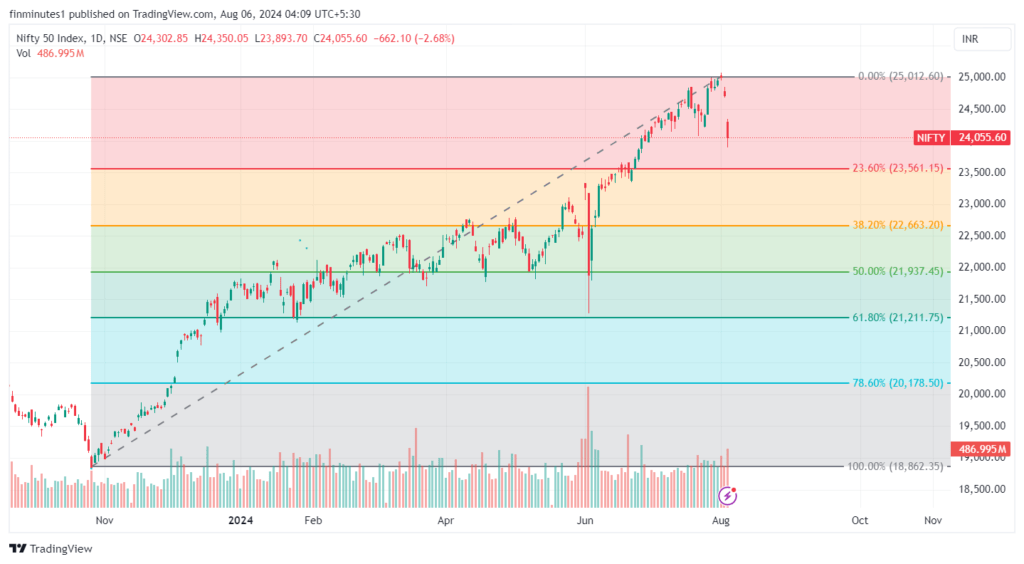

Today’s stock market crash spooked investors around the globe, markets were seeing a one way rally from last few months but today’s sudden crash surprised many and made them to run for knowing reasons behind it. India’s key benchmark Nifty 50 index and Sensex today fell more than 2.5%, Nifty 50 was down 2.68% or 662 points trading at 24,055 and Sensex was down 2.74% or 2222 points trading at 78,759 at close. The rout today eroded more than 17 lakh crore from the investors kitty.

The way markets were rallying from past few months and touching new highs, many seasoned investors cautioned the market and moved to cash to protect themselves against any possible correction or crash but sudden crashes as today affect investors portfolio badly. The investors we talked to were suffering from losses ranging from 3.5 to 7% depending upon the kind of stocks in their portfolios. While reasons for today’s crash is more global than local but everyone is asking, what’s next? Let’s analyze the reasons and predict how will our perform in rest of 2024.

Stock market crash: reasons behind it

While there were many reason behind the market crash today but key reason came from Japan, Bank of Japan recently hiked the interest rates first time in more than 15 years, Due to very low growth and ample liquidity, the country was at 0 to 0.1% interest rate for many years but Japan’s central bank on Wednesday raised its benchmark interest rate to “around 0.25%”, which is a very high jump in the interest rate for an economy which is used to seeing near zero rates from decades.

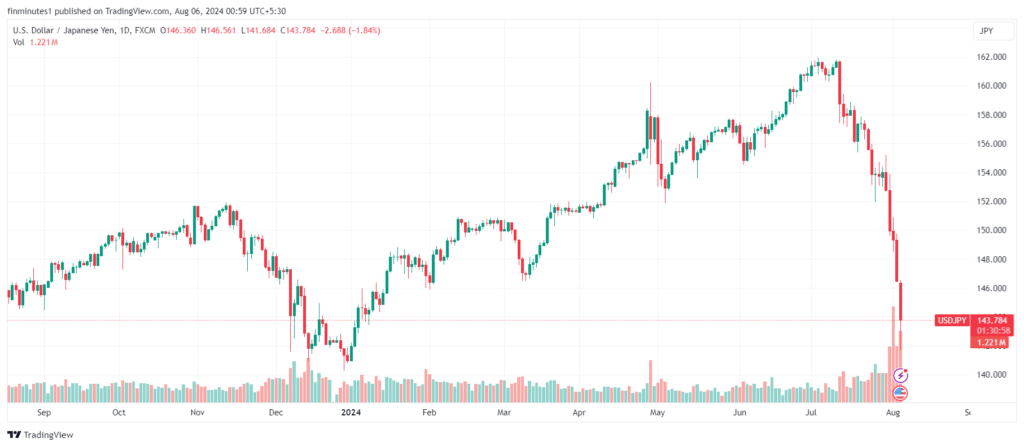

The move was primarily aimed at taming falling currency as the country’s currency yen fell to a 38-year low against the U.S. dollar this week. Also Japanese authorities spent 5.53 trillion yen, or $36.8 billion, to shore up the yen in July, official data published Wednesday showed. The yen rose sharply after the BOJ’s decision and was last seen trading at around 143 per dollar. It marks a stark contrast from the start of the month, when the Japanese currency fell to 161.96 per dollar for the first time since December 1986.

The investors were accessing the near and long term implications of this hike when minutes of BoJ June meeting dropped another shocker and that was “change in tone” towards hawkishness from BoJ policy members. At least two of the Bank of Japan’s nine board members called for an early interest rate increase at a policy meeting in June, minutes showed on Monday, underlining the central bank’s hawkish tilt that provides scope for further hikes ahead.

So, signals of further rate hikes spooked investors in Japan. The massive 12.5% in Japanese key index Nikkei 225 was primarily because of 2 reasons,

- First, Japan being a export based economy has a significant benefit for its companies when the yen is weak against USD, majority of large Japanese companies fetch their large part of earnings from overseas and weaker yen boost their earnings, but when Japanese central bank (BoJ) raised rates to tame inflation and falling yen, it significantly boosted the yen against USD (see the above chart), and investors felt that now with stronger yen, Japanese companies are less attractive as their export earnings will take a hit.

- Second, the unwinding of yen carry trade, a hugely popular trading strategy. With interest rates having been extremely low in Japan for decades, many investors have borrowed cash cheaply there and converted it to other currencies and invested in higher-yielding assets. Understand it by this example, If you can borrow money for 10 years interest free and can invest it in some other assets, even a risk free asset will fetch somewhere 6-7% return in a country like India.

- similarly many used to borrow money from Japan and invest in either risk free or risky assets around the globe, but as Japan raised the rates and indicated further hikes yen borrowers felt that it will be less attractive for them to carry their loan so they started unwinding the yen carry trade.

Recession fears in USA

Slowing US economy was another major concern behind today’s stock market crash. Recently released job data and other key numbers which showcase the growth of economy in US were weak and investors feared that Fed has pressed the brakes on US economy for too much and too long and the chance of soft landing looks gloomy. Investors fear intensified post weaker earnings report from large US tech companies.

Fears of a sharp slowdown in the US economy have raised expectations that the Federal Reserve will have to slash interest rates, some were even started predicting that Fed will need to hold an emergency meeting to cut rates before their next scheduled meet in September. Fear was as high as the US 10y treasury yield fell to 3.66% from 3.82% (last day’s close) but later recovered to 3.77% at close.

Middle east crisis

Rising tensions in Middle east were also behind today’s stock market crash. Israel’s fight with Hamas and it effect spilling over in other nearby regions were key concern for markets as possibility of direct involvement of Iran sparked fears of wider conflict in the region. The world is battling a toughest geopolitical situation in decades, situation in Europe due to Russia-Ukraine conflict, scattered conflict in African region, un stability in our neighboring countries like Bangladesh etc is enough to instill fears in investors.

What’s next for markets

Our view is very cautious on markets in near term due to tons of events unfolding in next few months and sharp run up in markets from past few months. Specially for Nikkei, thoughts are if the way US economy is showing signs of weakness, FED will be forced to cut the rates at least thrice in next few months altogether BoJ has indicated that it will hike rates more from current level. Dollar will weaken from Fed cuts and Yen will strengthen due to hikes.

So Japanese equities will become less and less attractive to investors and cheap Japanese money that is circulating around the world will also become un-attractive and less sought for. This unwinding of Yen carry trade and continue creating a cascading affect, whether the weakness from it will spill to other markets is a question only time will answer but reducing exposure in equities seems a wise decision for now.

Though some analysts in firms like UBS suggest that the US economy will achieve a soft landing, despite recent weaker-than-expected economic data. After recent data release it expects the Fed to implement more aggressive rate cuts. UBS projects that the Fed will cut rates by a total of 100 basis points by the end of the year, with reductions of 50 basis points in September and 25 basis points each in November and December. This marks an upgrade from their previous forecast of 50 basis points in total.

Soft landing in US a high possibility as Fed is a sitting at a very comfortable stage, rates are at decadal high and inflation is easing at a fast pace to Fed’s comfortable target zone of 2% ( inflation will fall further due to fear of hard landing and recession having a negative effect on consumption crashing commodity prices) and Fed have enough tools to achieve a soft landing but market had most of it in price.

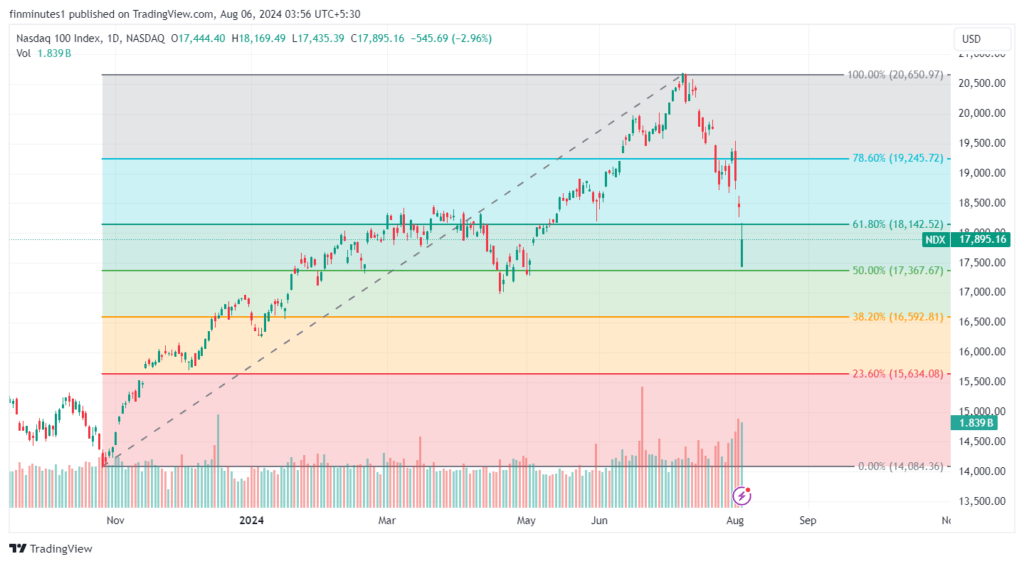

Japanese market has already entered “bear market” territory as it is down more than 20% from recent July highs, tech heavy Nasdaq is also in correction zone as it is down more than 10% from recent highs. A lot of Japanese money is invested into US markets and any negative event in Japan will further affect US, also US will see its key presidential election in next few months so given the all above events volatility will be very high.

Nasdaq falling further 1000-1200 points from current levels and trading in a narrow range thereafter is a high possibility. For our markets, fear of yen effect is low as we have a very limited Japanese money in our markets but any negative issues around the globe will also effect us in similar way. Going forward, our markets will be largely driven by global cues and earnings.

Conclusion

“I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.” — Warren Buffett, so keeping it simple is the key. When time warrants caution, we should pay attention to it and currently it is best to take profit home and keep some dry powder ready in case a good opportunity emerges. Always remember good prices and good times never comes together so keep using others greed and fears wisely.