Q4 results live updates: 3 of Adani Group companies, namely Adani Green Energy, Adani Total Gas, and Adani Wilmar (now AWL Agri Business), were to release their Q4 performance report. In other Q4 numbers, companies like Ultratech Cement, IRFC, TVS Motors, Oberoi Realty, Hexaware Tech, KPIT Tech, Firstsource Solutions, Hatsun Agri Products, etc, released their numbers. But here our focus will be on Adani group companies’ Q4 updates.

Q4 results live updates

Adani Green Energy

Adani Green Energy presented a strong set of Q4 numbers, with a 37% jump in revenue. The company’s revenue in Q5 was Rs. 2,666 crore, up from Rs. 1,941 crore in Q4 last year. The company’s sale of energy increased by 28% YoY to 27,969 million units in FY25. EBITDA for the Q4 was at 2,453 crore, up 35% from last year’s Q4; EBITDA margin was at 91.7%. PAT jumped 18% to 1,231 crore. Robust growth in revenue, EBITDA, and cash profit is primarily driven by the capacity addition of 3,309 MW over the last year.

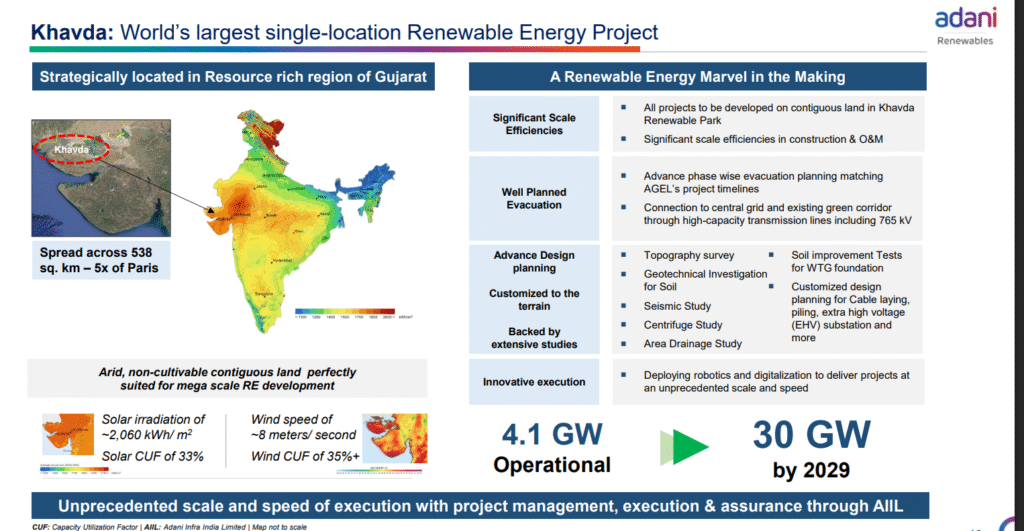

Adani Green Energy Ltd is developing a massive 30 GW renewable energy plant at Khavda in Gujarat. This is spread over an area of 538 sq km, almost 5 times the city of Paris. This project will set a global benchmark for the development of ultra-large-scale renewable energy plants.

AGEL’s Operational capacity increased by 30% YoY to 14.2 GW and is expected to increase to 15.2 GW with the addition of 1 GW which is near completion.

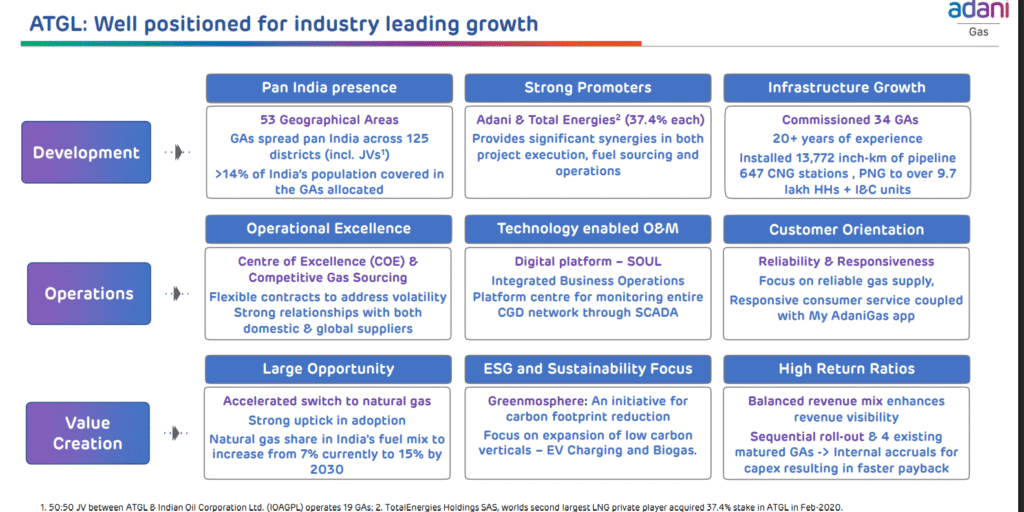

Adani Total Gas

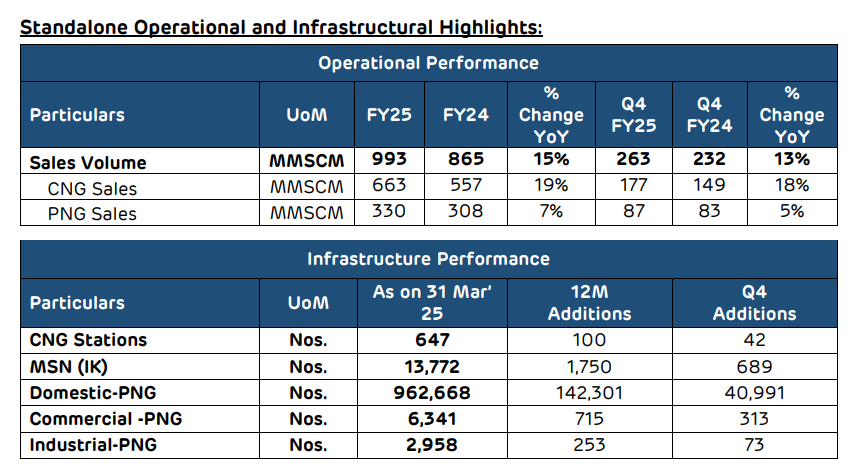

Adani Total Gas (ATGL), India’s leading energy transition company, continues its mission of transforming India’s energy landscape through extensive infrastructure development. The company presented a mixed set of Q4 numbers for FY25. Co’s revenue from operations rose by 15% on account of higher volume, primarily on the CNG segment. EBITDA fell by 10% to 274 crore primarily due to a 27% jump in natural gas cost. Co informed “with lower allocation of APM gas to CNG segment and replacement with higher price gas, the cost of Natural gas rose by 27%. Allocation to the DPNG segment continued at 105%.

Infrastructure & Operations Commentary – Q4FY25

➢ The CNG stations network has reached 647 CNG stations across 34 GAs

➢ Over 9.6 lakh homes are now connected with Piped Natural Gas

➢ CNG Volume increased by 18% Y-o-Y on account of CNG network expansion across Multiple Geographical Areas (GAs)

➢ With the addition of new PNG connections, PNG Volume has increased by 5% Y-o-Y

➢ Overall volume has increased by 13% Y-o-Y

In another major update, ATGL informed that Phase-1 of the Barsana plant has achieved increased

production of biogas at 6.9 TPD and is expected to ramp up to 9-10 TPD in this financial year. Co also highlighted that it achieved the highest daily feeding of 219 TPD, comprising 153 tons of cow dung and 66 tons of Paddy straw, and over 730 tons of CBG dispatched to GAIL Gas Ltd.

ATGL informed that it dispatched the first batch of fermented organic manure (FOM) under the “Harit Amrit” brand. Initial off-take of 30+ tons completed, and 100+ tons of Fermented Organic Manure (FOM) have been successfully packaged. In Q4, 2000+ tons of total FOM were sold in the digested organic material (Loose form) & 40+ tons of FOM were sold in Packaging form.

Adani Wilmar ltd (AWL Agri Business)

AWL Agri Business Ltd. (formerly Adani Wilmar Limited) is one of India’s largest Food & FMCG companies,

offering a diverse portfolio of essential kitchen staples, including edible oils, wheat flour, rice, pulses, and

sugar. Its flagship brand, Fortune, commands the trust of more than 123 million households, reaching every 1 in 3 Indian families.

With 24 manufacturing facilities across 11 states, including India’s largest single-location refinery in Mundra (5,000 tons per day capacity), AWL ensures seamless production and distribution. Its extensive supply chain, supported by 97 stock points, over 10,000 distributors and sub-distributors, along with a retail network of 2.1 million outlets, guarantees widespread accessibility across urban and rural India.

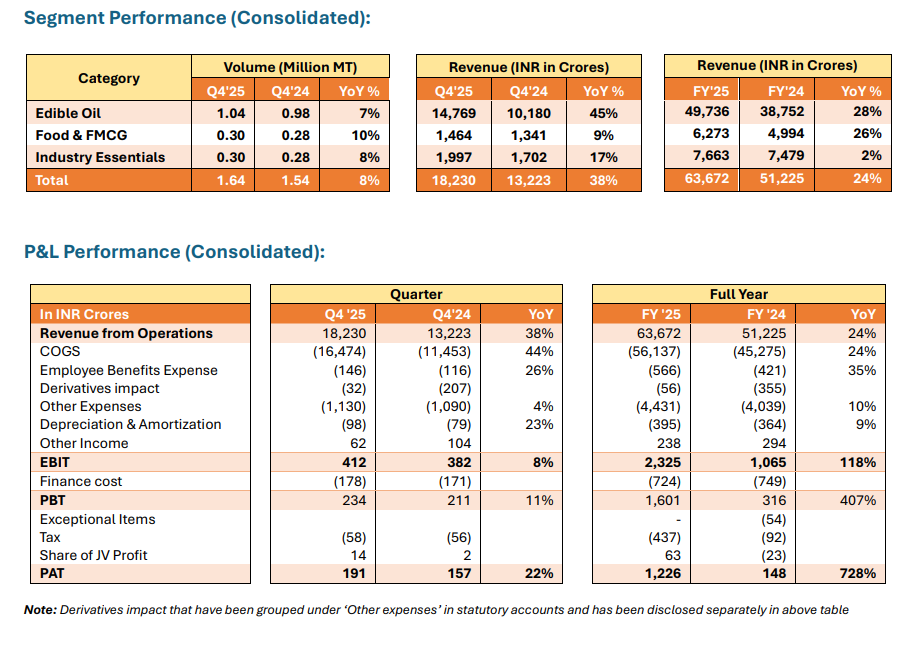

AWL Agri Business presented a strong set of Q4 numbers despite the sudden jump in palm oil prices. AWL’s Q4 FY25 revenue was at INR 18,230 crores, up 38% YoY, with 8% underlying volume growth. Also, AWL recorded the highest-ever revenue for the quarter as well as for the full year FY25, revenue of INR 63,672 crores for full year FY25, up 24% YoY, with 9% underlying volume growth. Co’s Food & FMCG revenue saw robust growth and reached INR 6,273 crores in FY25, up 26% YoY, driven by 26% underlying volume growth.

In Q4 of FY25, AWL’s segment-wise revenue saw bumper growth. From Edible oils it rose 45% YoY, Food & FMCG grew it 9%, and Industry Essentials, it posted a 17% increase. The Company delivered its highest-ever annual operating EBITDA of INR 2,482 crores in FY25. In Q4 FY25, Operating EBITDA stood at INR 448 crores, with Profit After Tax (PAT) at INR 191 crores (up 22% YoY).

While Adani Green Energy and AWL Agri Business’s stock should react positively in tomorrow’s trading session due to strong Q4 and robust future updates, the stock of Adani Total Gas may remain subdued due to its mixed performance.

Strong Q4 numbers from Adani show good momentum. At the same time, Avaada Group continues to lead the way in renewable innovation, particularly with its growing investments in wind energy projects across India.