Post Office PLI Calculator

Calculate Returns for Suraksha (Whole Life) & Santosh (Endowment).

Policy Deep Dive

Growth Schedule

| Year | Age | Bonus Added | Total Value |

|---|

Post Office PLI Calculator (2026 Edition)

The Best-Kept Secret of India’s Insurance Market: Use our Postal Life Insurance Calculator, a planner-style tool to answer all your questions.

In a market flooded with aggressive TV commercials for private term plans and complex ULIPs, the best life insurance product in India often goes unnoticed. It doesn’t have celebrity brand ambassadors. It doesn’t sponsor cricket matches. It operates quietly out of the red post boxes you pass every day. This is Postal Life Insurance (PLI).

If you are a government employee, a professional (Doctor, Engineer, CA), or work for a listed company, you are sitting on a golden ticket. Postal Life Insurance offers the highest bonus rates and the lowest premiums of any insurer in the country. It is the “Old Monk” of investments, unpretentious, effective, and legendary among those who know.

But Postal Life Insurance has a problem: it is confusing. Official websites are cluttered, and agents are hard to find. Terms like “Suraksha,” “Santosh,” and “Premium Ceasing Age” often leave investors scratching their heads.

Welcome to the FinMinutes Postal Life Insurance Calculator. We have built the most advanced, transparent, and user-friendly tool to help you decode this scheme. Whether you want to know your monthly premium, calculate your maturity corpus, or understand the “Real Value” of your money after 30 years, this guide (and our tool above) has you covered.

What is Postal Life Insurance (PLI)?

Postal Life Insurance was introduced on 1st February 1884. Yes, it is older than your grandfather. Initially, it was a welfare scheme strictly for postal employees. Over the decades, the government realised its potential and opened it up to a wider audience.

The Core Philosophy: Unlike private insurers who operate for profit, PLI is run by the Department of Posts (Government of India) as a welfare scheme.

- Low Cost: They don’t spend crores on marketing or fancy offices. They use the existing network of 1.5 Lakh+ Post Offices.

- High Returns: Because their operational costs are rock-bottom, they pass the surplus profit back to YOU in the form of massive bonuses.

The Result: You pay less premium than LIC, but you get a higher bonus than LIC. It is a mathematical win-win.

Why You Should Choose Postal Life Insurance Over Private Insurance

If you are eligible (more on that below), choosing a private endowment plan over Postal Life Insurance is often a financial mistake. Here is the data-driven comparison:

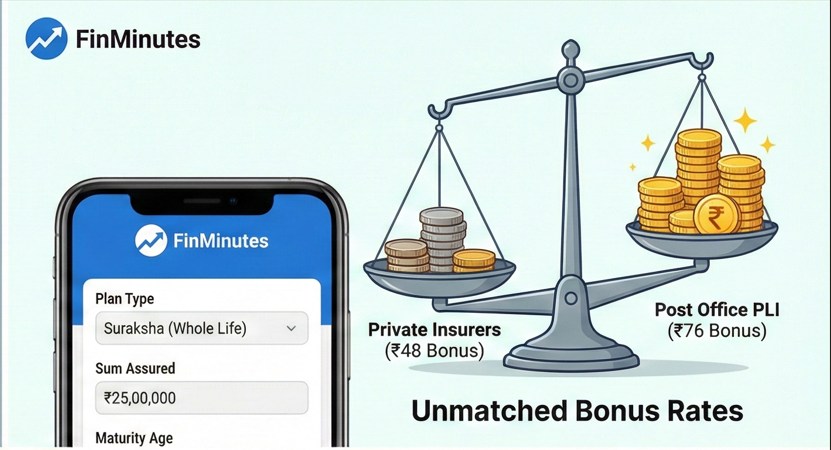

1. The Bonus Rate Gap

The “Bonus” is the extra money the insurer adds to your account every year.

- Private/LIC Endowment: Typically pays ₹40-₹48 per ₹1,000 Sum Assured.

- PLI Endowment (Santosh): Pays ₹52 per ₹1,000.

- PLI Whole Life (Suraksha): Pays ₹76 per ₹1,000.

Impact: On a ₹10 Lakh policy held for 30 years, this difference in bonus rates can result in an extra ₹8-10 Lakhs in your final payout with PLI.

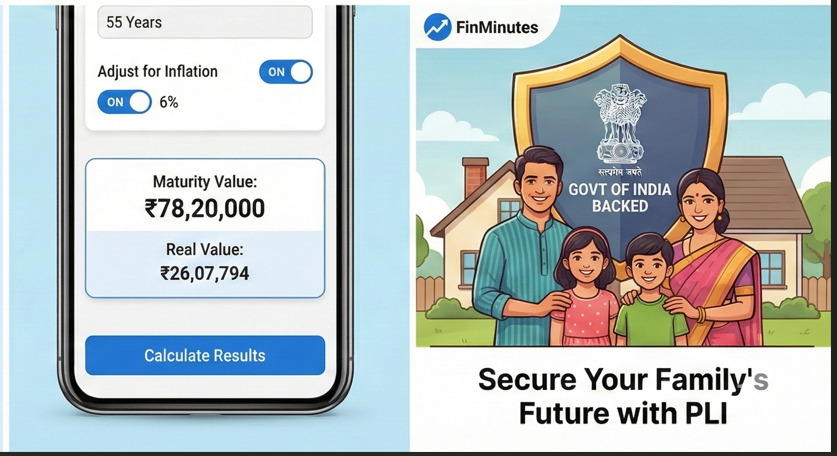

2. Sovereign Guarantee

In a world where private banks and financial institutions can face crises, Postal Life Insurance offers the ultimate safety net. Your Sum Assured and Bonus are backed by a Sovereign Guarantee from the Government of India. It is as safe as a Government Bond.

3. Lowest Premiums

Actuarial data show that PLI premiums are roughly 20-30% cheaper than comparable policies from other insurers for the same age and coverage.

Eligibility: Are You in the Club?

PLI is an exclusive club. You cannot walk in and buy it if you run a small private shop or work in the unorganised sector (for them, there is RPLI, Rural Postal Life Insurance).

You are eligible for PLI if you fall into one of these categories:

- Government Employees: Central Govt, State Govt, Defence, Para-Military forces.

- Semi-Government: PSU Banks (SBI, PNB, etc.), Railways, ONGC, BHEL, etc.

- Educational Institutes: Employees of Government Schools, Colleges, Universities, and Deemed Universities.

- Professionals: This is the massive expansion. If you are a registered Doctor, Engineer, Chartered Accountant (CA), Architect, Lawyer, or Banker (even in private scheduled banks like HDFC/ICICI), you are eligible.

- Listed Companies: Employees of companies listed on the NSE (National Stock Exchange) or BSE (Bombay Stock Exchange). IT professionals in companies like TCS, Infosys, or Wipro often qualify under this rule.

Decoding the Plans: Suraksha vs. Santosh

While Postal Life Insurance offers 6 different plans, 90% of smart investors focus on just two. Our calculator allows you to toggle instantly between them.

1. Whole Life Assurance (Suraksha): The Wealth Creator

- How it works: You pay premiums until a chosen age (55, 58, or 60). However, the policy does not “close” then. It stays active until you turn 80 (or until death).

- The Magic: Because the policy runs longer, the government pays the highest bonus rate (₹76/1000).

- Strategy: This is best for creating a massive legacy corpus or a retirement fund. The bonus accumulation over 40-50 years creates a compounding effect that rivals mutual funds in safety-adjusted returns.

2. Endowment Assurance (Santosh): The Goal Achiever

- How it works: You choose a maturity age (e.g., 35, 40, … up to 60). You pay premiums till that age, and you get the full money (Sum Assured + Bonus) exactly at that age.

- The Trade-off: The bonus rate is lower (₹52/1000) because the money is with the government for a shorter time.

- Strategy: Best for targeted goals like a child’s education (mature at age 45) or your own retirement (mature at 60).

Postal Life Insurance: Common Confusions Cleared

Our Postal Life Insurance calculator is designed to fix the specific confusions that stop people from buying PLI.

Confusion 1: “Sum Assured means I have to pay ₹10 Lakhs!”

NO. This is the biggest myth

- Sum Assured (SA) is the Coverage Amount. It is what the government promises to give your family.

- Premium is the Cost. It is a tiny fraction of the SA.

- Example: For a ₹10 Lakh Sum Assured, you might only pay ₹2,000 per month.

- Our Tool: We have added a tooltip and a “Premium Estimator” to show you exactly how small the monthly bill is compared to the coverage.

Confusion 2: “Suraksha forces me to wait till age 80!”

Technically, Suraksha is a “Whole Life” policy maturing at 80. However, Postal Life Insurance offers immense flexibility:

- Conversion: You can convert a Suraksha policy into a Santosh (Endowment) policy after 1 year and before 57 years of age.

- Loan/Surrender: You can take a loan against it after 4 years or surrender it after 3 years.

- The Hack: Most savvy investors buy Suraksha for the high bonus (₹76). If they desperately need money at age 65, they can surrender the policy. The surrender value (calculated scientifically) often still beats the returns of a standard endowment plan.

Confusion 3: “The Rebate is insignificant.”

It seems small (₹1 per ₹20,000), but it adds up.

- If you buy a ₹20 Lakh policy, the rebate is ₹100/month.

- Over 30 years, that is ₹36,000 saved directly in your pocket.

- Our Tool: The “Policy X-Ray” section explicitly calculates this “Lifetime Rebate Savings” to show you the hidden value.

How to Use the FinMinutes PLI Calculator

We have packed our Postal Life Insurance Calculator with “Pro” features you won’t find on the official India Post site.

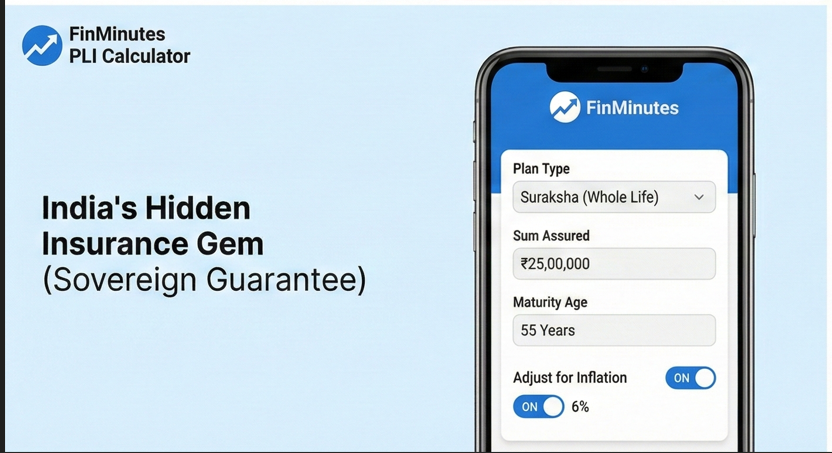

- Inflation Toggle (The Reality Check):

- Seeing “₹50 Lakhs Maturity” feels good. But what will ₹50 Lakhs buy in 2055?

- Switch on the “Adjust for Inflation” toggle. Select a rate (e.g., 5%).

- The tool calculates the Present Value. It might show that ₹50 Lakhs in future is equal to ₹8 Lakhs today. This helps you realise: You need a bigger policy.

- Policy X-Ray:

- Look at the “Deep Dive” box. It separates your Premium Ceasing Date (when you stop paying) from the Maturity Date (when you get paid).

- It calculates the CAGR (Compound Annual Growth Rate). If you see a tax-free, guaranteed CAGR of 7%+, grab the policy immediately. It beats FD returns (which are taxable) by a mile. In the case of Postal Life Insurance, note that the CAGR is low as it is not an investment scheme but an insurance scheme.

- Growth Table:

- Scroll down to the “Growth Table”. It shows year-by-year how your bonus is credited. You will see that a fixed amount (e.g., ₹76,000) is added to your “virtual account” every year. This transparency builds trust.

Step-by-Step Guide: How to Buy Postal Life Insurance

So, the Postal Life Insurance calculator says “Yes”. How do you buy it?

Method 1: The Agent (Easiest)

- Find a registered PLI Agent or Field Officer. They will come to your home/office, fill out the forms, arrange the medical checkup, and collect the first premium.

- Cost: No extra cost to you.

Method 2: The Branch (Direct)

- Visit your nearest Head Post Office or a large Sub-Post Office.

- Ask for the PLI Proposal Form.

- Documents Needed:

- ID Proof (Aadhaar/PAN).

- Address Proof.

- Employment Proof: Appointment letter, Pay slip, or ID card (Crucial to prove eligibility).

- Passport size photos.

- Medical: If the Sum Assured is high (usually >₹5 Lakhs) or depending on age, you may need a medical test at a designated centre.

- Payment: Pay the first premium via Cash/Cheque.

Method 3: Online (Limited)

- You can generate a quote on the PLI Customer Portal, but for the first policy issuance, a physical verification/medical is often required. Once the policy is active, you can pay all future premiums online effortlessly.

PLI Calculator: FAQs

Is the Bonus Rate guaranteed for the entire term in Postal Life Insurance?

Technically, the government declares bonus rates annually. However, unlike stock markets, PLI rates are remarkably stable. The rates of ₹76 (Suraksha) and ₹52 (Santosh) have been consistent for years. Even if they fluctuate slightly, they remain historically higher than private peers.

What happens if I change my job to the private sector?

This is a brilliant feature. Once you buy a PLI policy, it stays valid even if you leave the government job, provided you continue paying the premiums. You only need to be eligible at the time of purchase.

Can I transfer my policy from one city to another?

Yes. PLI is a centralised system. You can transfer your policy from Mumbai to Delhi or any village in India seamlessly. You can pay premiums at any post office in the country.

Is there a maximum investment limit in Postal Life Insurance?

Yes. The maximum Sum Assured an individual can hold (across all PLI policies combined) is ₹50 Lakhs. The minimum is ₹20,000.

Can I take a loan against my PLI policy?

Yes.

– Endowment (Santosh): Loan facility available after 3 years.

– Whole Life (Suraksha): Loan facility available after 4 years.

The interest rate on this loan (approx 10%) is usually much cheaper than a personal loan.

Are the returns tax-free in Postal Life Insurance?

Absolutely. Under Section 10(10D) of the Income Tax Act, the entire maturity amount (Sum Assured + Bonus) is 100% Tax-Free. Additionally, the premiums you pay qualify for a tax deduction under Section 80C (up to ₹1.5 Lakhs).

The Final Verdict: Is PLI Policy Worth It?

In the age of 10-minute grocery delivery and AI chatbots, Postal Life Insurance feels like a relic from the past. But do not let the lack of digital glitz fool you.

When you strip away the marketing noise and look at the raw math, Premium vs. Payout, PLI is the undisputed king of guaranteed return insurance schemes in India. It offers the safety of a Sovereign Bond with the returns of a high-yield debt fund.

If you are eligible, not having a PLI policy is a missed opportunity. Use the FinMinutes Postal Life Insurance Calculator above to design your perfect plan, verify the returns against inflation, and lock in your financial safety net today.