POMIS "Wealth Loop" Calculator

Calculate Monthly Income or Simulate the MIS + RD Strategy.

Don't need monthly cash? Reinvest it in an RD to compound your returns.

With the Finminutes Post Office Monthly Income Scheme Calculator, calculate your monthly interest from the Post Office Monthly Income Scheme (POMIS). Discover the “Wealth Loop” strategy to reinvest monthly payouts into an RD for higher returns.

POMIS: The “Salary” That Never Retires

We all work hard for our salary. But the dream of every investor is to reach a point where their money starts working for them. Imagine getting a text message on the 1st of every month: “Your account XXXXX has been credited with ₹9,250.” No boss to report to, no deadlines to meet, just pure, guaranteed passive income.

This is the promise of the Post Office Monthly Income Scheme (POMIS). Backed by the Government of India and currently offering a stellar 7.4% interest rate, it is the bedrock of retirement planning for millions of Indians. It is safe, it is simple, and unlike the stock market, it pays you like clockwork.

But here is the secret most people miss: POMIS isn’t just for spending. If you don’t need that monthly cash immediately, you can turn this “Income Scheme” into a massive “Wealth Generator” using a smart reinvestment trick. The FinMinutes POMIS Wealth Loop Calculator is the first tool of its kind designed to help you plan both scenarios:

- Income Mode: How much cash will I get every month?

- Wealth Mode: How much will I make if I reinvest that cash into a Recurring Deposit (RD)?

What is the Post Office Monthly Income Scheme?

Let’s start with the basics. POMIS is a government-backed small savings scheme designed solely to generate regular monthly income.

The Key Specs (Q4 2025-26)

- Post Office Monthly Income Scheme Interest Rate: 7.4% per annum (payable monthly).

- Tenure: 5 Years (Lock-in).

- Risk Profile: Zero Risk (Sovereign Guarantee).

- Entry Age: Any Indian adult (18+). Minors (10+) can open in their own name.

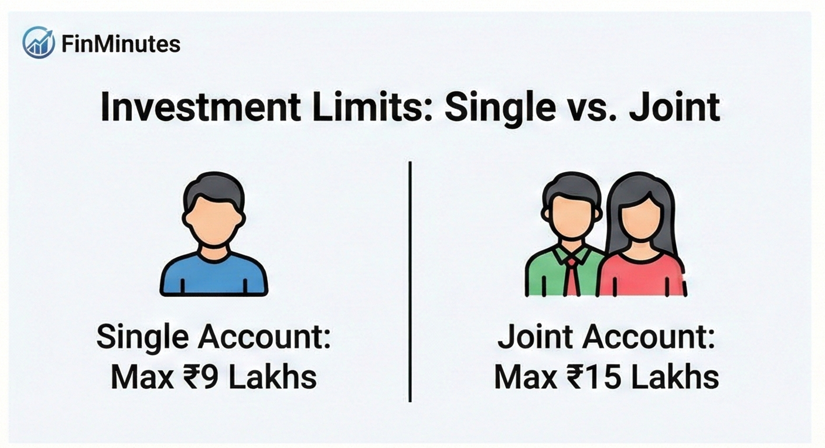

Investment Limits (The 2023 Upgrade)

In the 2023 Budget, the government significantly increased the deposit limits, making the scheme far more attractive:

- Single Account: Limit increased from ₹4.5 Lakhs to ₹9 Lakhs.

- Joint Account: Limit increased from ₹9 Lakhs to ₹15 Lakhs.

Note: In a Joint Account, the investment is treated as belonging equally to all holders. You can have up to 3 joint holders.

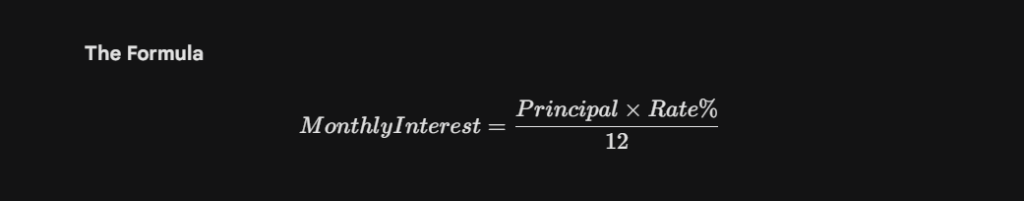

POMIS Calculator: How Much Do You Actually Get?

Many investors get confused converting the “Annual Rate” (7.4%) into a “Monthly Payout.” Let’s simplify it.

Scenario A: Maximum Single Investment (₹9 Lakhs)

- Investment: ₹9,00,000

- Annual Interest: ₹66,600

- Monthly Payout: ₹5,550

Scenario B: Maximum Joint Investment (₹15 Lakhs)

- Investment: ₹15,00,000

- Annual Interest: ₹1,11,000

- Monthly Payout: ₹9,250

Imagine having nearly ₹10,000 credited to your account every month, guaranteed for 5 years. For a retired couple, this covers utility bills, groceries, and medicines, providing immense peace of mind.

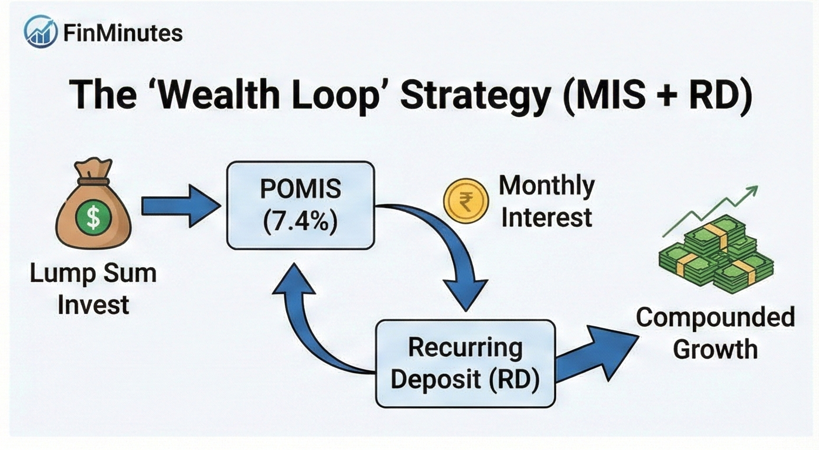

Finminutes POMIS Calculator “Wealth Loop” Strategy

This is the “Killer Feature” of our calculator and the strategy used by smart investors.

The Problem: Suppose you are 40 years old. You have ₹9 Lakhs to invest safely. You like the safety of the Post Office, but you don’t need the ₹5,550 monthly income right now. You want your money to grow.

- Issue: POMIS does not compound. The interest is paid out. If you leave it in your Savings Account, it earns a pathetic 4%.

The Solution: The Auto-Sweep Reinvestment You instruct the Post Office to take your monthly MIS interest (₹5,550) and automatically invest it into a Post Office Recurring Deposit (RD).

How the Math Works:

- Step 1 (MIS): You invest ₹9 Lakhs in POMIS @ 7.4%.

- Step 2 (Payout): You generate ₹5,550/month.

- Step 3 (RD): This ₹5,550 goes into a 5-Year RD earning 6.7% (Current Rate).

The Result (after 5 Years):

- Principal Back: ₹9,00,000

- RD Maturity Value: ~₹3.95 Lakhs (Your reinvested interest + RD interest)

- Total Corpus: ~₹12.95 Lakhs.

The Magic: Your effective yield jumps significantly because you are earning “Interest on Interest.” Use the “Reinvest in RD?” toggle in the FinMinutes calculator above to simulate this exact scenario and see the boosted returns.

POMIS vs. Senior Citizen Savings Scheme (SCSS)

If you are over 60, you might be confused between POMIS and SCSS. Both offer regular income. Which one wins?

| Feature | POMIS | SCSS |

| Eligibility | Anyone (18+) | Seniors Only (60+) |

| Interest Rate | 7.4% | 8.2% |

| Payout Frequency | Monthly | Quarterly |

| Max Limit | ₹9L (Single) / ₹15L (Joint) | ₹30 Lakhs |

| Tax Benefit | None | Section 80C Deduction |

| Lock-in | 5 Years | 5 Years |

Verdict:

- If you are < 60: POMIS is your best bet for safe, monthly income.

- If you are > 60: Maximise your SCSS limit (₹30L) first because of the higher rate (8.2%) and tax benefit. Use POMIS only as a top-up if you have surplus funds.

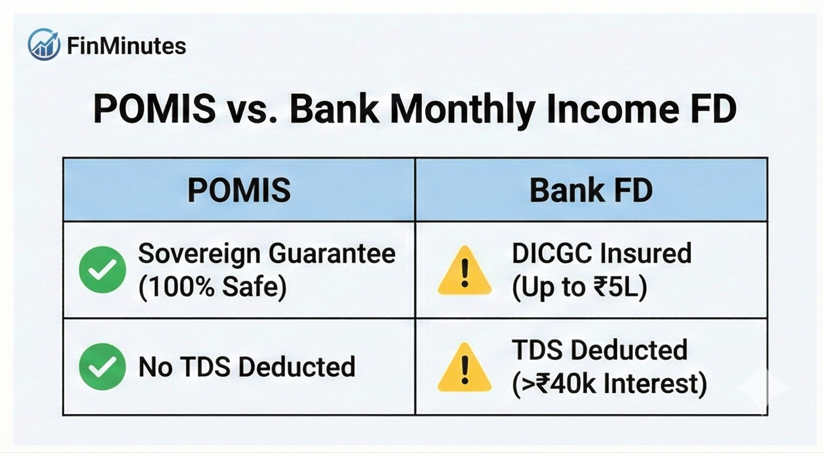

POMIS vs Bank Monthly Income FD

Why go to the Post Office when your bank offers Monthly Income FDs?

1. Sovereign Guarantee: Bank FDs are insured only up to ₹5 Lakhs (by DICGC). If a cooperative bank fails, anything above ₹5 Lakhs is at risk. POMIS has no upper limit on safety. Even if you invest ₹15 Lakhs, every paisa is backed by the Government of India.

2. Interest Rate Stability: Banks change rates frequently. Post Office schemes generally offer a premium over large commercial banks (like SBI or HDFC), which typically offer ~6.5% – 7.0% for non-seniors. POMIS gives 7.4% to everyone.

3. No TDS (Tax Deducted at Source):

- Bank FD: If interest exceeds ₹40,000/year, the bank cuts 10% TDS.

- POMIS: No TDS is deducted, regardless of the interest amount. You settle the tax yourself when filing returns. This is great for cash flow.

Taxation Rules

While POMIS is safe, it is not tax-free.

- Principal: There is NO Section 80C deduction for the amount you invest.

- Interest: The monthly interest is fully taxable. It is added to your total income and taxed as per your slab.

- Tip: If you are in the 30% tax bracket, the post-tax return of 7.4% drops to roughly 5.18%. In that case, Debt Mutual Funds (with their deferred taxation) might be more efficient for growth, but they lack the guaranteed monthly payout.

Premature Withdrawal Rules

Life happens. What if you need your ₹9 Lakhs back before 5 years?

- 0 – 1 Year: No withdrawal allowed.

- 1 – 3 Years: Allowed, but 2% of the principal is deducted as a penalty.

- 3 – 5 Years: Allowed, but 1% of the principal is deducted as a penalty.

Advice: Only invest funds you are sure you won’t need for at least 3 years to avoid the steeper 2% hit.

How to Open a POMIS Account

You have two options:

Option 1: Offline (The Traditional Way)

- Visit your nearest Post Office.

- Fill out the Common Application Form.

- Submit KYC (Aadhaar, PAN, Photos).

- Carry the cash or cheque.

- Crucial Step: Fill out the Auto-Credit Form to link your POMIS account to your Post Office Savings Account. This ensures the monthly interest doesn’t just sit there as cash but goes into your savings (or RD).

Option 2: Online (Netbanking) If you have a Post Office Savings Account with enabled Internet Banking:

- Log in to India Post Internet Banking.

- Go to “General Services” > “Service Request” > “New Requests”.

- Select “POMIS Account Opening.”

- Enter the amount and submit.

Who Should Use the “Wealth Loop”?

The MIS + RD Strategy simulated by our calculator is ideal for:

- Conservative Parents: Saving for a child’s education 5 years away. You have a lump sum now, but you want to grow it safely without market risk.

- Tax-Averse Investors: You hate seeing TDS cut from your Bank FD interest. Since neither POMIS nor RD cuts TDS, you get the full amount compounding (though you must pay tax later).

- The “Forced Saver”: If you receive the interest in your savings account, you might spend it. By automating the transfer to an RD, you force yourself to save the interest.

Conclusion

In a world of volatile stocks and unpredictable crypto, the Post Office Monthly Income Scheme remains a fortress of stability. Whether you need the cash to run your kitchen or you want to use the Wealth Loop to compound your savings safely, POMIS is a powerful tool in your arsenal.

Don’t just guess your returns. Use the FinMinutes POMIS Calculator above to see exactly how much your ₹9 Lakhs or ₹15 Lakhs can earn you every single month. Plan. Invest. Relax.