• Times of India yesterday morning reported that Adani is in talk to acquire a stake in Paytm and Paytm share price soared 5% to hit upper circuit.

• Later in the day Paytm issued clarification to exchanges calling such reports “speculative”, the company wrote, the news item is speculative and the Company is not engaged in any discussions in this regard. Adani group also denied any such developments. An Adani group spokesperson said, “We categorically deny this baseless speculation. It is totally false and untrue,”

• Let’s deep dive into Paytm’s future outlook and what cues to take from company’s Q4 numbers as post RBIs action company is trying hard to gain its lost glory and why any partnership/ stake sale to big groups like Adani can work as a boost for the company. Read along-

A look on company’s Q4 number and Paytm share price movement

FY-24 was a mixed year for the company, on one side it achieved the first full year of EBITDA profitability since IPO at ₹559 crores but on the other RBI imposed a complete ban on it’s payments bank citing corporate governance lapse. Ban was implemented from start of April so most of the effects were not visible in this quarter but company was able to analyze the impacts and predicted how will things shape up in future.

- In Q4, company reported revenue of ₹2267cr down 3% y-o-y and down 20% on quarter basis.

- Company’s contribution profit were at 1288cr, contribution margin were flat at 57%.

- EBITDA before ESOP cost was at 103cr, down 56% yoy and 53% qoq. EBITDA before margin dipped to 5% from 10% on year basis. Numbers take a hit due to RBI ban and uncertainty arising from it.

- ESOP cost for the company was at 326 cr in q4, loss for the period was at 550cr, more than doubled yoy due to significant dip in revenue. ESOP cost for the company to gradually decline and extinguish from FY27.

Management commentary

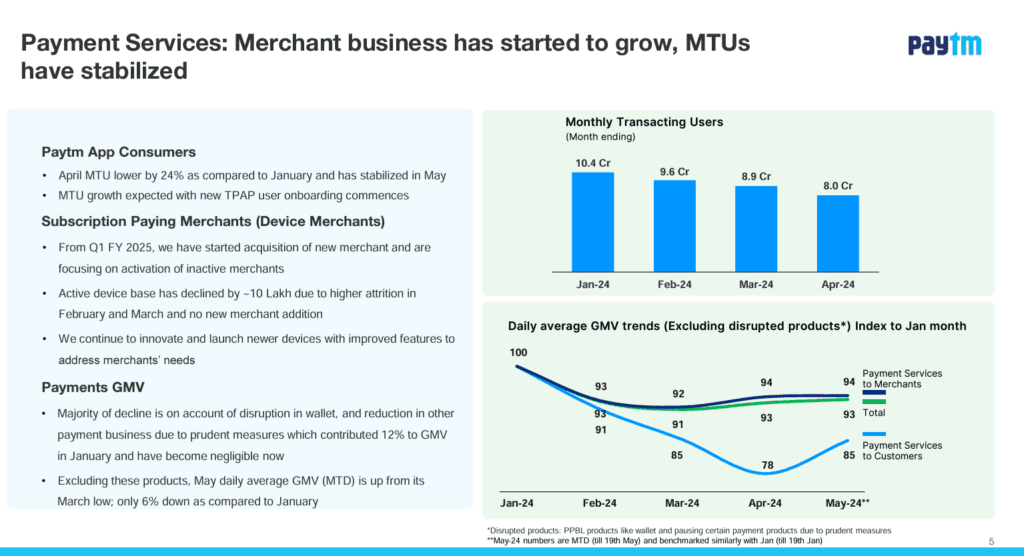

Management acknowledged the challenges that company is facing post RBI dictate. Active merchant base declined by 10 lakhs due to higher attrition in February and March, it was mostly a panic reaction of ban on payments bank but after a slowdown in March the merchant business is showing signs of recovery in April and May as MTUs stabilized in May. In financial services, company will focus on expansion into insurance broking and equity broking.

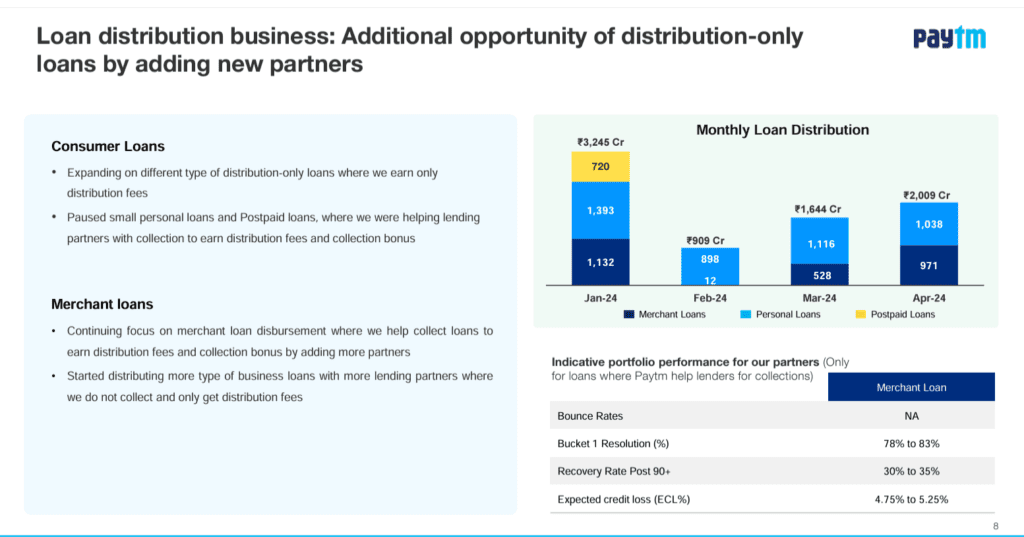

In personal loans business, Paytm aims to focus on distribution-only model due to stress in credit disbursements for personal loans. Company is taking a temporary pause on collection-incentive led volume until the market recovers. Focus will be on merchant side loans which is performing well. In Payment services focus will be on UPI, card processing, and EMI payments. Marketing services are doing well as they remain unaffected of any slowdown in other segments.

In terms of cost management, Paytm is Looking to create a leaner organizational structure. Management is expecting annualized people cost savings of ₹400 to 500 crores primarily driven by headcount reduction. Also company is Pruning non-core assets to create a leaner organization. Paytm want to utilize more money towards investment in sales and marketing to drive market share and customer count which is fair enough strategy given its recent market share loss.

Good thing is Paytm management is keen on improving governance and compliance, primary reason behind RBI action and it will be a key driver for Paytm share price. Co is adding independent board members and subject matter experts. For future plans and partnership Co is exploring opportunities to re-introduce certain products like Postpaid or wallet in alignment with partner banks. Focus will also be on increasing the number of lending partners to diversify offerings and strengthen the lending business.

Investors keep a eye on cash pile that Paytm have on its balance sheet of around ₹8,300 crores excluding PML customer funds. Co is Planning discussions with the board on the best use of excess cash. It can be used for options like customer acquisition investments and potential buybacks.

Financial outlook and Margin guidance

Paytm is expecting a meaningful movement from Q2 onwards in terms of recovery in affected business segments. Focus will be on maintaining a healthy financial performance and growth trajectory. Co is expecting an EBITDA loss of ₹400 to 500 crores (annualized EBITDA impact) , Indirect cost base estimated to be around ₹1200 crores, aim will be for high 40s to 50% contribution margin. Expected payment processing margin is expected to be in the range of 5 to 6 basis points.

Due to 10 L device deactivation, merchant subscription per device was ~₹90 per device per month in Q4. Paytm expects it to bottom out at ~₹80 in Q1 FY 2025, post which it should increase subject to market forces. Further, Due to temporary disruption in operating metrics (MTU, merchant base, GMV), there will be incremental EBITDA impact of ₹100 – ₹150 Cr in Q1 FY 2025 and improvement is expected from Q2 FY 2025 on stabilization or growth in consumer and merchant base from April/May.

Q1 FY25 outlook

• Expected Q1 FY-2025 revenue to be in the range of ₹1,500 ₹1,600 Cr and EBITDA before ESOP to be negative (₹500) (₹600) Cr. This includes increased investment in marketing to acquire customers, Incremental EBITDA impact of ₹75 – ₹100 Cr, in Q1 FY 2025 due to temporary impact basis various prudent measures in line with regulatory guidance (included in estimates of (500-600 cr) EBITDA in Q1).

Full year outlook and valuations

• In base case, I expect overall (full year) revenue to be in the range of ₹7900-₹8300cr, and total loss to be around (₹1100-1400cr) including ESOP cost, which is expected to be around ₹1174cr for FY-25.

• Paytm’s current market cap of around ₹24000cr suggests that the stock trades at 3 times sales to Mcap ratio which seems to be a fair valuation given the challenges that the company is facing, if some positives happen going forward in terms of getting new licenses or securing partnership with large firms for lending and other operations, stock could fetch a 4 times sales to Mcap (Target ₹480-500).

Read our earlier report on Paytm, click here

Factors to watch for

Recently reports were surfacing that key lending partner of Paytm like Aditya Birla Finance, is learnt to have invoked loan guarantees which the fintech firm had provided to the lender in lieu of repayment defaults from customers, others like Piramal Finance and Clix Capital have also pulled the plug on their partnerships with One97 Paytm, signaling the stress in the company’s lending business in the aftermath of RBI’S ban on Paytm Payments Bank and an overall slowdown in unsecured consumer lending.

Given the data presented by company these reports may be a speculation as there is good growth in merchant loans in month of April but given the challenges that company is facing, any partnership with large firm could solve the capital availability problem for the Paytm, that’s why market was so excited about Adani stake buy news in Paytm and despite denial from both companies stock is having 2 consecutive upper circuits. Market is of the view that a potential partnership between two firms could be a win-win for both firms.

Conclusion

Port to power conglomerate entering into FinTech will spice up the race to top among the sectoral participants. Sector which is largely ruled by likes of PhonePe, Google pay is seeing new entrants as jio financial services is looking to enter the market. Any update in terms of a deal between two firms is a hit topic among market participants and should be keenly watched to take further cues on Paytm share price movement.

More about Paytm financial updates, click here