Paytm share price target 2025: RBI banned Paytm payments bank from Feb 29 and many of its operations will cease to exist post the mentioned date. This RBI diktat brought panic to the company’s shares as they fell from ₹760 to a new all-time low of ₹340. Stock is down more than 80% from its IPO price and many are asking at what price it will become a value buy or does buying the stock makes sense at all as most of its operations will be severely impacted post 29?

Paytm got a deadline extension from RBI to wrap up payments bank and affiliated business before March 15 and they opened an escrow account with Axis bank to shift their nodal bank account from Paytm payments bank, this way their sound box and other POS devices will continue to work post 15th March and merchant payment will keep happening as before. But did this solves all the problem and enough to lift stock up, Lets analyze-

Paytm’s business model

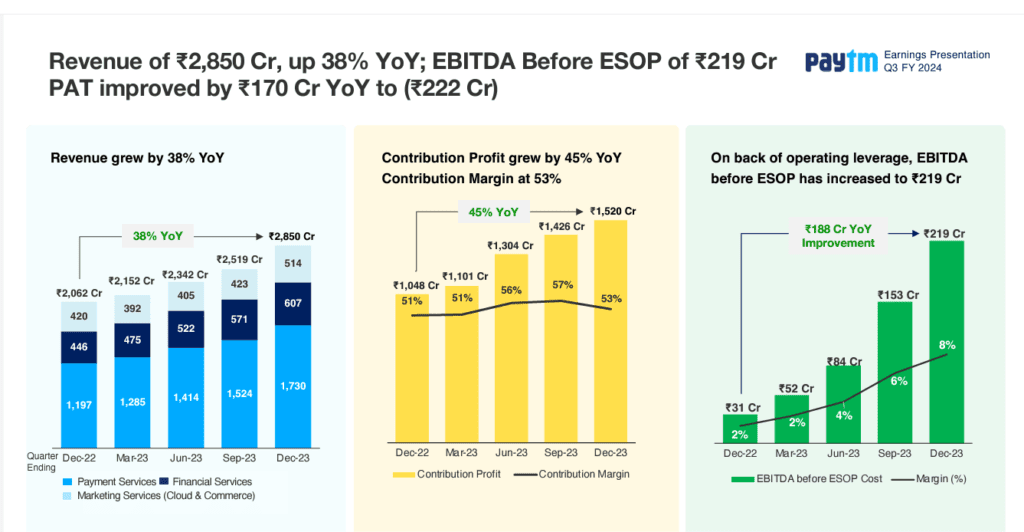

The company primarily garners its earnings from 3 segments namely, Payment services, financial services and marketing services(cloud and commerce). Let’s bifurcate these segments into what comes under each of them-

Payment services- under this segment it offers payment instruments like Wallet, Postpaid (BNPL), and QR Code to customers. To merchants it offers certain products and services such as Paytm Soundbox and POS. UPI credit, auto pay etc also are the emerging sub segments of this category.

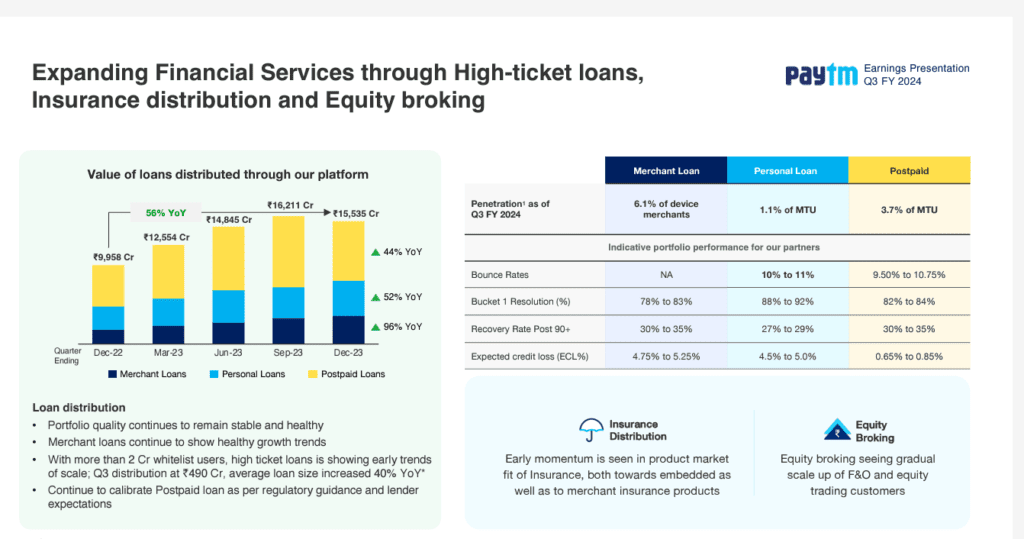

Financial services- in this segments company’s lending business like offering personal loans, merchant loans, cross selling of insurance products etc are there. Lending is divided into big and small ticket accordingly.

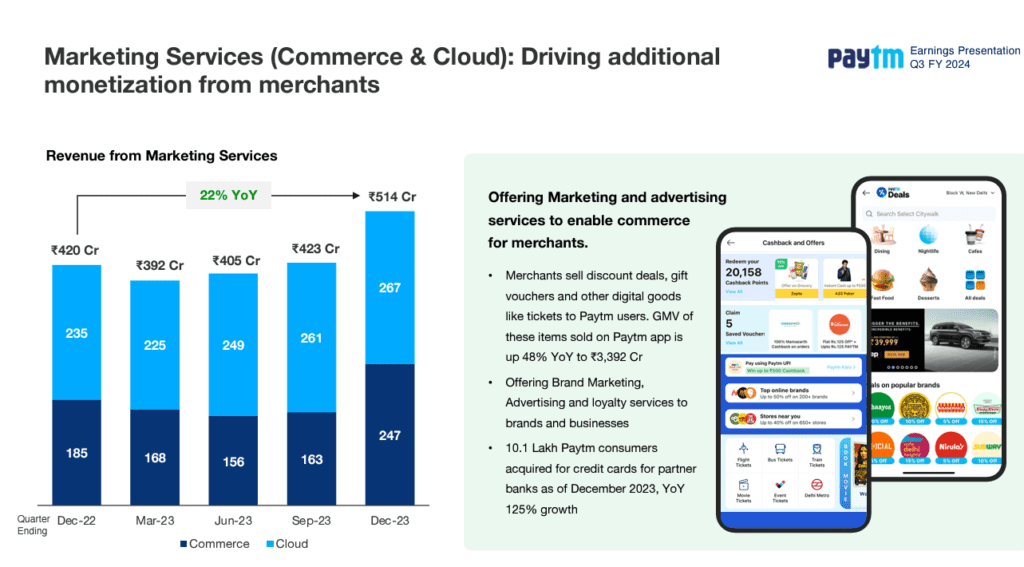

Cloud and Commerce- In this company’s services include travel and entertainment ticketing, mini app store, games and Paytm First subscription, Mall and E-commerce comes. Advertisement for various brands, businesses and credit card users also falls in same segment.

How they generate revenue from these segments?

Payment services:

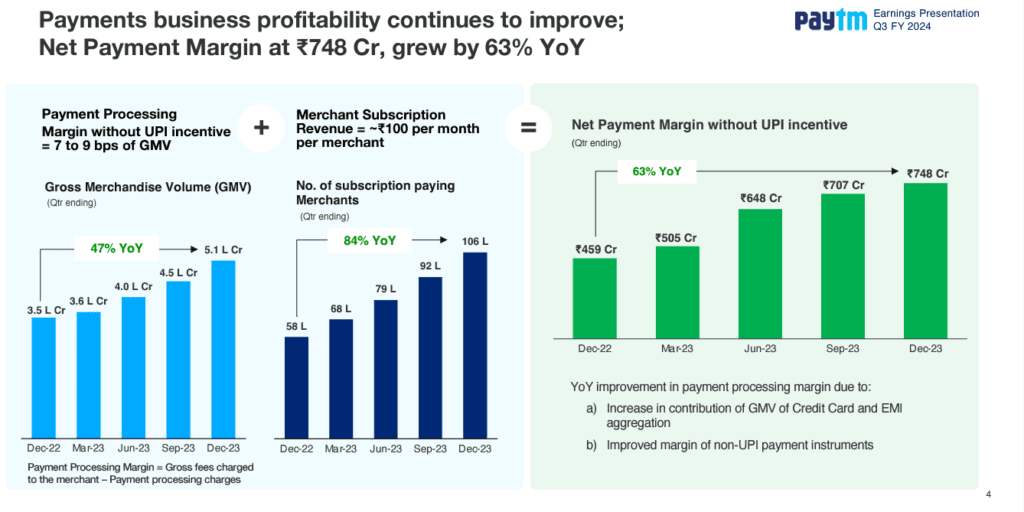

In payment services segment, charging transaction fee is their primary source of revenue, merchant fees as a percentage of transaction value for accepting payments through various methods like QR codes, mobile wallets, and Paytm cards. It also charge convenience fee for bill payments, mobile recharge etc on the platform.

Merchant services: Paytm offers additional services to merchants like settlement services, marketing tools, and data analytics, earning income through subscriptions or usage-based fees. Apart from this Soundbox and POS devices play a crucial role in its payment services segment. Paytm charges annual or monthly transaction fee for offering soundbox and POS(point of sales) devices. This fee covers the cost of the device itself, ongoing support, and access to additional features like real-time transaction notifications and voice confirmations.

Financial services:

- Loan facilitation fees: Paytm acts as a platform connecting borrowers and lenders, earning fees for facilitating peer-to-peer lending, merchant loans, and personal loans.

- Financial product commissions: They earn commissions by selling insurance policies, mutual funds, and other financial products offered by partner companies.

- Payment gateway fees: Businesses using Paytm as a payment gateway pay processing fees for transactions.

Cloud and E-Commerce:

- Subscription fees: Paytm offers cloud services like software and computing resources to businesses on a subscription basis.

- Transaction fees: Paytm charges merchants a commission on every transaction happening through their e-commerce platform.

- Advertising: Businesses can advertise their products and services on the app and website, generating advertising revenue for the company.

So what segments will be effected post 15th March?

RBI ordered Paytm to shut its payments business before 15th March, this includes stop onboarding new clients, closing deposits, credit products and its popular digital wallets. They will loose existing bank deposits so does the interest income, commission and other fee that it used to make through various transactions that went through payments bank. For merchant settlements that had huge GMV processing through Payments bank but now they will lose the commission income and instead may pay a fee to Axis bank for these settlements.

Their popular wallet services will also stop working post 15th March so the revenue that Paytm was getting in form of convenience fee will vanish too. Likewise debit and credit card issued by the payments bank will no longer work post 15th March, so Paytm will lose the associated income from these services. Fast Tags that were issued by Paytm payments bank will not work post March 15, FAST TAGS though were not for generating huge revenue(as there was a minor issuance fee only) but FAST TAG was data goldmine.

In company’s merchant payment services merchant won’t be able to receive payments through soundbox and POS devices if their account is attached with Paytm payments bank, with other banks these services will keep functioning even after 15th March. As it is a compliance issue based regulatory action so Co’s lending businesses may get a little effected too predicted some reports( Paytm doesn’t lend any money on its own instead they have partnerships with various lending partners like banks/NBFCs for it and it earns commission) as reports were there lending partners may re-evaluate their relationship with the Co.

Different possible scenarios for Paytm

Lets make 2-3 different scenarios for the company that may happen, first in a Bull case–

In payments business company loses only 10-15% revenue due to restrictions put by RBI( assumptions- Co is able to onboard new merchants as there are no restrictions on merchant onboarding for payment services through soundbox, POS devices, QR codes if the account is associated with any bank other than Paytm payments bank. For other businesses assumption is there will be no or very minimal loss.

So assumptions are In financial services and cloud, e-commerce segment(which is Co’s very fast growing segments, showing a growth 20+% CAGR) Co is able to retain lending partners without much rejig and broadly focus is on big ticket lending( which is already focus area for the company). Broadly cloud and e-commerce revenue will be unaffected.

- Assumptions are there will be 15-16% dip in payment service revenue in next one year, 12% growth in financial service revenue and 20% growth in cloud and e-commerce service revenue. So this way our estimate suggests approx. ₹11,000cr revenue and will do an 1250-1300cr of adjusted EBITDA while an 300cr of EBITDA. Given the assumptions Paytm can be valued at 4 times sales to Mcap( average drawn from global average of similar cos) so a fair value of ₹700(based on assumptions).

- In bear case scenario when there is mass migration of customers and significant drop in lending revenue due to lending partners keeping distance from offering loans on Paytm’s platform. In this case a 50% drop in payment services and financial service revenue and 10% fall in e-com and cloud services revenue(due to sentimental loss). In this case Co doing ₹7000-8000cr of sales and negative EBITDA. Due to pessimism Co will fetch 3 times sales to Mcap ratio and price target will be of around ₹350-360.

- In base case an in between value of ₹450-500 as an price target.( based on 1y forward estimates).

- In P/B ratio term bullish approach will be a 3-3.5 times p/b for the company and bearish will be of 1.5to 2 times, this way also price targets are similar ranging from ₹350-650.

Factors to watch for in Paytm

Trust is the most important factor that company needs to install in its customers and lending partners. As the company is in trouble due to a regulatory action so trust of customers on the company is less, they’re unsure of their data’s safety and handling. Paytm needs to take steps to strengthen customers confidence and insure to spread the message that Co is operational as before and they’re very stringent in their customer data handling policy.

Likewise they should keep looking for more partnerships with other reputed banks so that they can offer effected services. Though the company is handling most of these issues effectively but its just the beginning and need to be tracked constantly. That is behind the optimism that market is showing and the stock is up approx 10% in past 2 days and sitting on a 5% upper circuit even today. But jumping to ‘buy’ the stock at this point of time is very ‘risky’ bet in my view and one should wait to get more clarity before making any decisions.

Paytm share target price 2025, what to expect

Technically, stock is trading below all important moving averages on weekly timeframe, stochastic is ‘oversold’, RSI is bearish. On weekly chart gap area between ₹420-480 is a huge supply zone and will work as strong resistance too, till that level is crossed, weakness will be there.

Note: The valuation and price estimates are purely for information purposes.

About US economy and rate cut forecast, click here