Ola electric share price doubled in just 7 trading sessions after the stock made a muted debut on August 9 post IPO. The stock made a high of 157.40 on August 19 against the issue price of 72-76. While the company is having largest market share in electric two wheeler market but it has many challenges to face going ahead. Let’s analyze the optimism behind the stock and why market is valuing Ola electric richly and will it sustain?

Ola Electric: A little about company

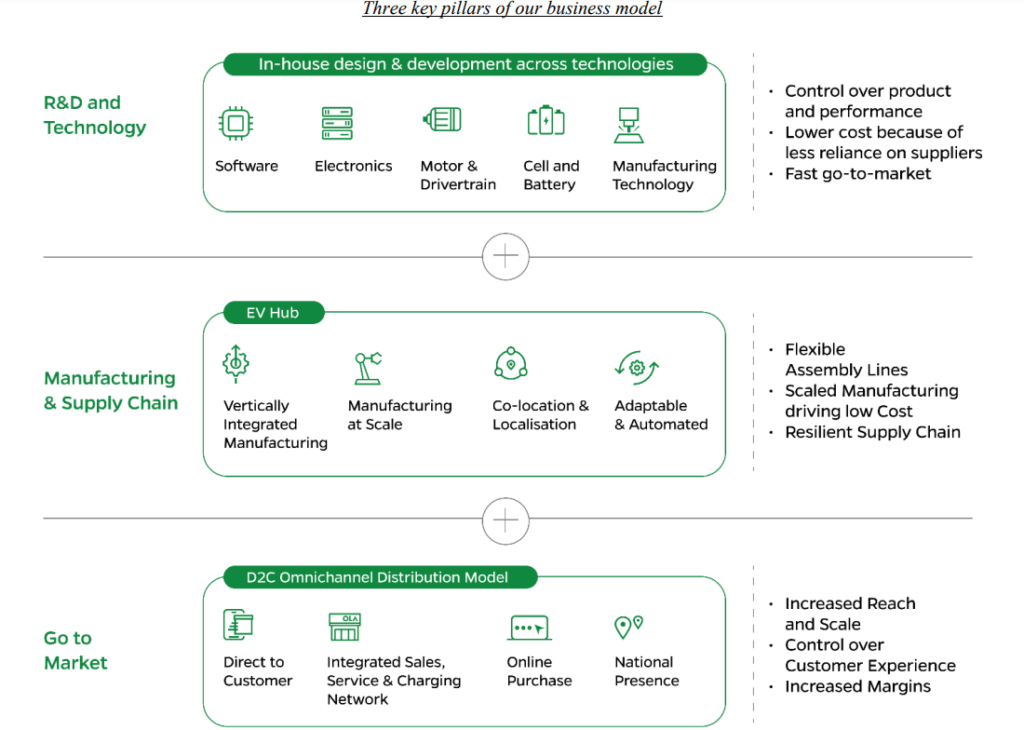

Ola electric mobility, a pure EV player in India building vertically integrated technology and manufacturing capabilities for EVs and EV components, including cells. It manufacture EVs and certain core EV components like battery packs, motors and vehicle frames at the Ola Future factory. Company’s business focuses on capturing the opportunity arising out of electrification of mobility in India and also seek opportunities to export EVs in select international markets in the future.

Company claims to have the highest revenue of all Indian incorporated electric 2Ws (“E2Ws”), original equipment manufacturers (“OEMs”) from E2W sales in Fiscal 2023, It also claims to became the best-selling E2W brand in India in terms of monthly E2W registrations on the VAHAN Portal of Ministry of Road Transport and Highways (“VAHAN”) citing the Redseer Report.

Ola electric share price: Reasons behind the rally

Ola electric’s stock had a muted debut on D-street and many investors used this opportunity to buy the stock in bulk. Later the company announced its Q1 numbers and market was happy with 32% YoY growth in topline and good growth in sales number. Next day, on August 15, Ola announced new series of electric motorcycles in Indian market. Motorcycles have wider acceptability in our market and pricing of Ola’s basic model was very aggressive.

The new motorcycle launches fueled optimism in market that Ola will further gain market share in rapidly growing Indian e2w market. Later HSBC initiated coverage on Ola electric with “Buy” rating with a target price of Rs. 140. Stock touched and surpassed the target price within next few days.

Ola Electric Q1 highlights

- Total Income: At ₹1,644 crores for Q1 FY25, marking a 32% year-on-year growth.

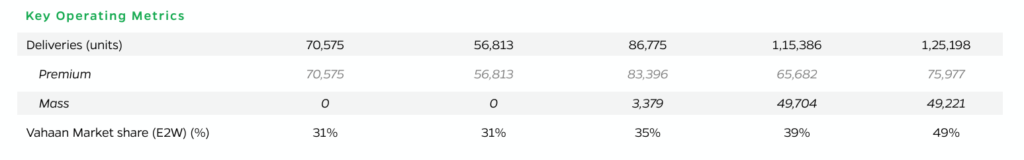

- Deliveries: Achieved 1.25 lakh deliveries, representing a 77% growth over the previous year. ( due to number of new scooter launches, specially the affordable Ola S1 X series).

- Adjusted Gross Margins: Improved to 21.94%, an increase of 873 basis points year-on-year.

- Market Share: Captured 48.6% of the electric two-wheeler market in India, with nearly one in two electric two-wheelers sold being an Ola vehicle.

- EBITDA Margin: Consolidated EBITDA margin improved to negative 7.6%, a 660 basis point improvement.

- Quarter on quarter growth in revenue is 2.8% but there is 1% dip in cost of material consumed and more than 10% dip in other expenses. QoQ expenses reduced due to introduction gen 2 platforms claims company.

- Loss for the quarter is at 347cr, a 30% jump in loss YoY but on quarterly basis loss is down from 416cr in Q4 (dip of more than 15%).

- Industry Growth: Electric two-wheeler penetration in India has increased to 7.4% overall, with 21% penetration in the scooter segment as of July 2024.

August 15 launch highlights

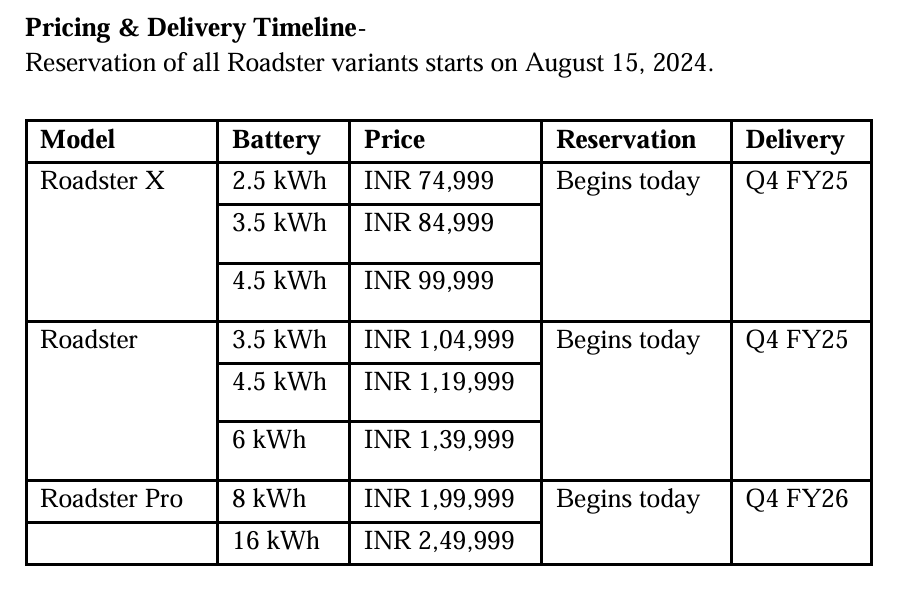

On August 15, Ola electric released most affordable electric motorcycle in Indian market, Roadster portfolio – Roadster X, Roadster, and Roadster Pro with prices starting from INR 74,999, INR 1,04,999, and INR 1,99,999 respectively, also teased two new motorcycles – Sportster and Arrowhead. Co Showcased indigenously developed Bharat 4680 Cell and battery pack; announced the integration of its cells in its own vehicles starting Q1 FY26.

Ola Electric showcased its upcoming Gen-3 platform which will be the foundation of the company’s future electric vehicles. Co claims it is the most advanced EV platform yet and will enable scalability, enhanced performance and better efficiency while also reducing the costs.

MoveOS 5 will unlock a host of new features including Group Navigation, Live Location Sharing and Road Trip Mode powered by Ola Maps. It will also feature performance-enhancing features like Smart Charging, Smart Park, TPMS alerts along with voice assistant and predictive insights powered by Krutrim AI assistant. Beta for MoveOS 5 will be available for its users by Diwali via an OTA update.

The risks and our take on valuation

Ola electric though a leader in E2W market but large established players like Bajaj auto, Hero moto, TVS should not be written off, write now they are not focusing much on EVs due to small market size so they are letting new players taste the water first, once the market broadens they will aggressively expand, they already have capability and required infra to shift gears, currently their focus is on ICEs as their are no new players to enter the market whereas EV market is (specially E2W) flooded with new entrants.

Majority of 2 wheelers sold in India are motorcycles and electric motorcycles are still in very nascent stage, once the market will start expanding and customers preference will start shifting towards electric motorcycles big brands will aggressively launch models, but currently they want new players to create an ecosystem for that. Apart from this there are many other key factors which investors should keep in mind while betting on Ola’s stock.

- Ola electric launched its first model in 2021, so they have just 3-4 years of experience of operations, batteries are a key part of electric 2 wheelers and a large amount of vehicle costs is from batteries, Ola electric provides 8-10 years of warranty on their battery pack with a option of extending it, still none of its products have completed the warranty period, if anything goes wrong with it and large replacement need arises, it will be a big negative for the company.

- The subsidies, incentives that are currently provided by state and central governments may not continue in future as the subsidies are to build an ecosystem for e2w in the country and once it is there, govts may withdraw subsidies, The availability of government subsidies may be critical to accelerate the adoption of EVs and therefore, competition with ICE vehicles that are manufactured by long-standing industry players who already have a well established brand reputation in the two-wheeler market, in the absence of such subsidies, it cannot be assured that consumers will continue to purchase EVs.

- Ola electric is investing big in its research and development, 1600cr out of total net proceeds from IPO will go to R&D, while is may be good for the company but not as good for investors, cost overrun will be frequent dragging the company’s plan to become profitable further. Company’s venture into cell and battery pack technologies and its implementation into own products will fetch heavy cost in short term, once established will become positive for company in long term but a risk in short term.

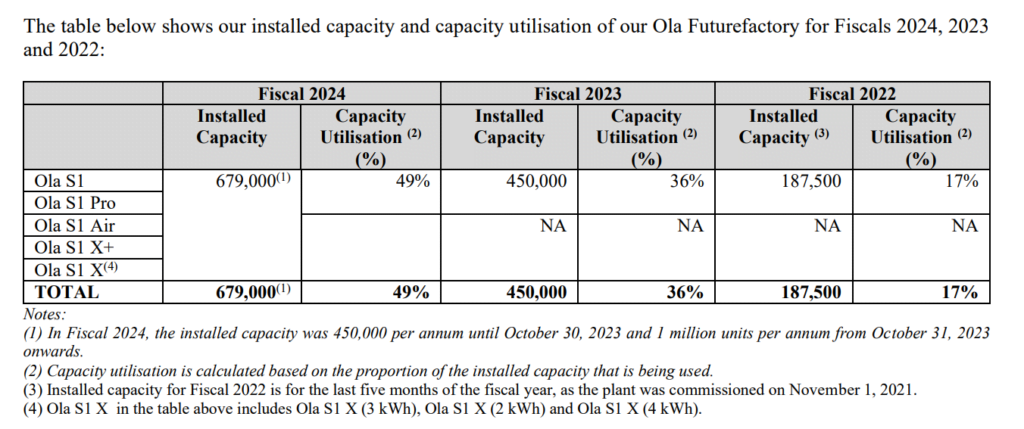

- Ola Futurefactory had a capacity utilization rate of just 49% in Fiscal 2024. Low capacity utilization of Ola future factory may limit company’s ability to leverage economies of scale.

- Ola electric’s attrition rate is too high, in many cases company is unable to retain its key talent from top management, co’s employee attrition rate was too high compared to industry standard, it was at 44.25% and 47.48% in Fiscals 2024 and 2023 respectively.

- Company is e highly dependent on the services and reputation of Bhavish Aggarwal, Founder, Chairman and Managing Director, who has significant influence on its business plan. He is also the Chairman and Managing Director of ANI Technologies Private Limited (also known as Ola Cabs) and has founded a new startup, Krutrim SI Designs Private Limited. His involvement with ANI Technologies Private Limited (also known as Ola Cabs) and Krutrim SI Designs Private Limited may detract from the time that he is able to dedicate to Company.

- Ola electric’s estimate that E2W penetration will be more than 50% in FY28 is far away from reality in our estimates, currently penetration of E2Ws in total 2W sales is approx 5.5%, estimating it to grow 10x in next 4 years is something beyond expectations, brokerages like HSBC, Nomura expects E2Ws share in overall 2 wheeler market to be between 20-25% till FY30, which is similar to our estimates.

Adoption to E-Motorcycles is proved to be a challenge for the industry as past launches like Revolt, Tork, Ultraviolette and more have not been successful. Scooters are used more commonly for daily and nearby commutes in India whereas motorcycles have a much diverse use and preferences so customers adopting to it will be a key factor to watch. Even in e-scooter segment market is shrinking (shows vahan portal), though Ola is gaining market share but sales of it mass product fell 1% QoQ, and slowdown / fall was there for premium products too compared to Q3 of FY24.

Valuation

Our optimistic case estimates suggests that Ola electric will have sales of Rs. 8500-9000cr till FY26(e) and at a current market cap of 60,800cr it is trading at a sales to mcap of 7-7.5x, which appears a very expensive valuation. While we will keep watching the company on above noted parameters but will cautious in near term due to its stretched valuations. Our view is positive on 2w space but playing it through established players (Hero moto 2.2 times sales/mcap, Bajaj auto 4.5x sales to mcap and TVS motors 3.21x sales/mcap for FY26e*) is a more sensible move for now.