NPS Vatsalya Calculator — Plan Your Child’s Future

Estimate how an early start (lumpsum + monthly contributions) can turn into a retirement corpus and pension for your child.

Inputs

Year-by-Year Details

| Year (Age) | Invested | Nominal Corpus | Real Value | Permitted Lumpsum | Estimated Pension (₹/mo) ℹ️Shown only for retirement year — pension starts post-retirement; other rows are illustrative if exit happened then. |

|---|

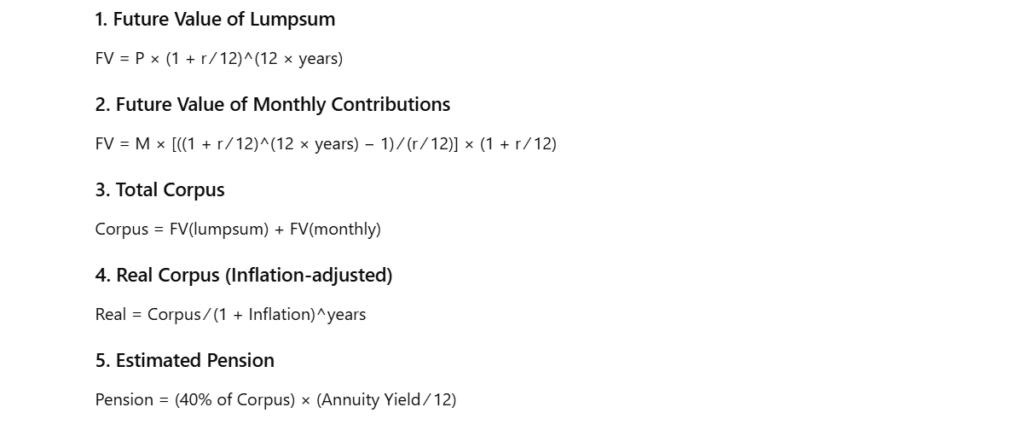

Formula & Methodology (expand)

- Net return: net = gross_return − TER.

- Monthly compounding: we use net monthly rate = net/12 for compounding.

- Lumpsum FV: FV = P × (1 + r/12)^(12×years).

- Monthly FV: FV = M × [((1 + r/12)^(12×years) − 1) ÷ (r/12)] × (1 + r/12).

- Permitted lumpsum: corpus × chosen% (typically ≤ 60%).

- Annuity / Pension: (remaining corpus) × (annuity_yield/12) = estimated monthly pension. Use actual annuity quotes for precise income.

Disclaimer: This is an educational projection tool. NPS rules, tax treatment, and annuity rates change; always verify with official sources:

• NPSTRUST official site — npstrust.org.in

• NPSTRUST calculators & guidance — NPSTRUST calculators

• NPS Vatsalya coverage & updates — check official NPSTRUST notices.

This tool does not provide financial or tax advice.

The National Pension System (NPS) has long been one of India’s most trusted retirement-planning vehicles. In 2024, the Pension Fund Regulatory and Development Authority (PFRDA) launched NPS Vatsalya, a version designed specifically for minors.

The FinMinutes NPS Vatsalya Calculator helps you project how your small contributions for your child’s future today can grow into a significant retirement corpus tomorrow, all using verified compounding and annuity formulas based on official NPS norms.

What Is NPS Vatsalya? 🍼

NPS Vatsalya is a minor account under the National Pension System (NPS) that allows parents or guardians to open and contribute on behalf of their children (below 18 years of age). When the child turns 18, the account automatically converts into a regular NPS Tier-I account, and the child becomes the primary holder.

It’s essentially a retirement-planning gift; parents start early, so the child benefits from decades of compounding.

Key Highlights

- Available for Indian citizens below 18 years.

- Operated and funded by parents or legal guardians.

- Converts seamlessly to a regular NPS account at 18.

- Contributions enjoy the same tax benefits (subject to Section 80CCD limits).

- Managed by PFRDA-registered pension fund managers with full transparency.

Why Start an NPS Vatsalya Account Early?

The biggest advantage of NPS Vatsalya is time. A small monthly investment made for your child today can grow exponentially over 40 years or more. Let’s say you start with ₹1,000/month when your child is 5 years old.

If the NPS portfolio earns a net return of 9% p.a., by the time your child retires at 60, the corpus could exceed ₹75 lakh, and that’s excluding any top-ups or bonuses. This is the power of compounding that our FinMinutes NPS Vatsalya Calculator illustrates in an easy-to-understand, year-by-year way.

How the FinMinutes NPS Vatsalya Calculator Works

The calculator is built using the verified compounding engine of our flagship NPS Lumpsum + Monthly Calculator, but redesigned for the child-investment perspective.

✳️ Input Parameters

You can customize:

- Child’s current age

- Initial one-time lump-sum contribution

- Monthly contribution (guardian-funded)

- Expected return (p.a.)

- Expense ratio (TER %)

- Inflation rate

- Lumpsum withdrawal % at retirement (default 60%)

- Assumed annuity yield (p.a.)

- Option to stop contributions at 18 (typical NPS Vatsalya behavior)

✳️ Outputs

The calculator instantly shows:

- Total invested amount

- Corpus at retirement (nominal & inflation-adjusted)

- Permitted lumpsum

- Mandatory annuity corpus

- Estimated monthly pension

- CAGR & real CAGR

- Year-by-year investment and corpus growth table

- Downloadable CSV file and interactive line / donut charts

Everything updates dynamically and matches actual NPS compounding logic, month-by-month growth after TER.

Example: How ₹1,000 a Month Can Secure Your Child’s Future

| Parameter | Value |

|---|---|

| Child’s age | 5 years |

| Monthly contribution | ₹ 1,000 |

| Expected return (net) | 9% p.a. |

| Investment period | 55 years (till age 60) |

| Inflation | 6% p.a. |

| Lumpsum withdrawal | 60% |

| Annuity yield | 6% p.a. |

Result (approximate)

🔹 If contributions stop at age 18

- Total invested: ₹ 1.56 lakh

- Corpus at retirement: ₹ 1 crore 22 lakh (approx.)

- Inflation-adjusted corpus: ₹ 5 lakh (in today’s money)

- Permitted lumpsum: ₹ 73 lakh

- Annuity corpus: ₹ 49 lakh

- Estimated pension: ₹ 24,392/month

🔹 If contributions continue till age 60

- Total invested: ₹ 6.6 lakh

- Corpus at retirement: ₹ 1crore 77 lakh (approx.)

- Inflation-adjusted corpus: ₹ 7.4 lakh

- Permitted lumpsum: ₹ 1crore 6 lakh

- Annuity corpus: ₹ 70 lakh 75 thousand

- Estimated pension: ₹ 35,378/month

That’s how NPS Vatsalya turns small beginnings into major outcomes.

The Formula Behind the NPS Vatsalya Calculator

The FinMinutes NPS Vatsalya Calculator uses precise compounding formulas identical to those used in the NPS ecosystem:

What Makes FinMinutes’ Vatsalya Calculator Unique

Unlike most simple NPS calculators online, the FinMinutes Vatsalya version:

- Models both one-time and monthly contributions.

- Offers “stop at 18” logic to match the official NPS Vatsalya policy.

- Adjusts for expense ratio and inflation.

- Provides full year-by-year breakdowns and interactive charts.

- Includes verified disclaimers with direct NPSTRUST links for transparency.

- Works instantly in both backend and frontend WordPress editors.

Our design combines financial accuracy and visual clarity, so even first-time investors can understand how NPS Vatsalya works.

Difference Between NPS Vatsalya Calculator and NPS Lumpsum Calculator

Both calculators share the same FinMinutes compounding logic, formulas, and accuracy standards.

| Feature | NPS Vatsalya Calculator | NPS Lumpsum + Monthly Calculator |

|---|---|---|

| Target audience | Parents investing for a minor (below 18) | Individual investor |

| Age input | Child’s age → retirement age | Years until retirement |

| Contribution type | Guardian’s lump-sum + monthly till 18 (default) | Investor’s lump-sum + monthly till retirement |

| Stop at 18 option | ✅ Yes (auto-stop guardian contributions) | ❌ No (continuous contributions) |

| Pension shown | Only at retirement year | Shown yearly for simulation |

| Use case | Long-term wealth building for child | Retirement planning for self |

What Returns Can You Expect from NPS Vatsalya?

Historical Performance

NPS Tier I equity (E) schemes have historically delivered 8 – 10% annualized returns over 10 years.

Corporate (Debt) plans average 7 – 9%, and Government (G) plans around 6 – 7%.

(Ref: NPSTRUST performance dashboard)

Future Expectations

- With disciplined allocation (e.g., 75% equity + 25% debt early in life), a long-term 9% net return is a practical estimate.

- The calculator subtracts TER (Expense Ratio) automatically to keep projections realistic.

- As per the latest PFRDA updates (2024–25), TERs are very low, making NPS one of the most cost-efficient retirement products.

What About Annuity Returns?

At the time of retirement, 40% of the NPS corpus must be used to purchase an annuity from a PFRDA-approved insurer. Current annuity rates range from 5.5% – 7.5% p.a., depending on the option (life, joint life, or return of purchase price).

Our calculator uses 6% p.a. as a base assumption; you can change this input to match current quotes from insurers like LIC, HDFC Life, and SBI Life.

FAQs: NPS Vatsalya Calculator

Who can open an NPS Vatsalya account?

Any parent or guardian of a minor Indian citizen (below 18 years) can open it under the guardian’s KYC documents.

How much can be invested?

Minimum ₹1,000 per year. No fixed upper limit, you can invest monthly, annually, or via lump-sum payments.

What happens when the child turns 18?

The account is converted into a standard NPS Tier-I account. Ownership shifts to the child, and he/she can continue contributing directly.

Can contributions continue beyond 18?

Yes, after conversion, the now-adult investor can continue regular NPS contributions till retirement (usually 60 years).

What are the tax benefits?

Investments qualify under Section 80CCD(1) and 80CCD(1B). Parents can claim these benefits while contributing on behalf of the minor.

How accurate is the FinMinutes NPS Vatsalya Calculator?

It uses the same compounding methodology as NPSTRUST and adjusts for TER & inflation. The results are illustrative but realistic.

Is NPS Vatsalya safe?

Yes. Funds are regulated by PFRDA, managed by professional pension fund managers, and backed by government oversight.

Conclusion

Starting an NPS Vatsalya account is one of the smartest financial gifts parents can give their children.

By combining low costs, decades of compounding, and government oversight, it provides unmatched retirement security.

Use the FinMinutes NPS Vatsalya Calculator to simulate realistic projections, compare contribution options, and make informed, long-term plans. When your child’s financial journey begins early, the power of compounding does the heavy lifting, and a small investment today could mean a comfortable, worry-free tomorrow.