NPS Calculator with Increasing Contribution

Estimate your growing NPS corpus, permitted lumpsum, and monthly pension based on yearly step-up contributions.

Inputs

Year-by-Year Details

| Year | Invested | Nominal Corpus | Real Value | Permitted Lumpsum | Estimated Pension (₹/mo) ℹ️ |

|---|

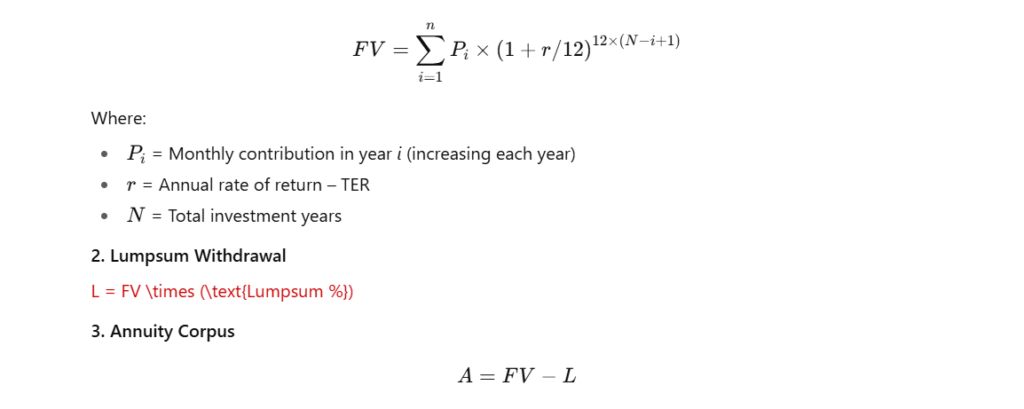

Formula & Methodology (expand)

- Corpus Growth: Each year’s contribution grows with both compounding and annual step-up percentage.

- Nominal Corpus: Future Value = Σ [Monthly Contribution × (1 + step-up)^n × compound factor]

- Permitted Lumpsum: Corpus × (Lumpsum% ÷ 100)

- Annuity: Remaining Corpus × (Annuity Return ÷ 12) = Monthly Pension

- Real Corpus: Nominal ÷ (1 + Inflation)^years

Disclaimer: This calculator is for illustration only. It follows NPS norms (retirement exit: up to 60% lumpsum, ≥40% annuity). Verify with official sources:

• NPSTRUST Official Website

• NPS Official Calculators

This tool is not investment advice. For official guidelines and annuity quotes, please consult NPSTRUST or your PoP.

The National Pension System (NPS) is one of India’s most reliable and regulated retirement investment plans. However, unlike static calculators that assume a fixed monthly investment, in reality, most investors increase their contribution every year, either due to salary increments or improved savings discipline.

That’s where FinMinutes’ NPS Calculator with Increasing Contribution comes in, it provides a more realistic projection of your future NPS corpus, lumpsum eligibility, and pension.

What is an NPS Calculator with Increasing Contribution?

A step-up or NPS calculator with increasing contribution allows users to estimate their retirement corpus by assuming that monthly contributions grow by a fixed percentage every year, for example, a 5% yearly increase in investment.

This mimics how salaried professionals naturally raise their NPS investments as their income grows, producing a much closer projection of actual returns. FinMinutes’ tool calculates:

- 📈 Total corpus at retirement

- 💰 Tax-free lumpsum withdrawal (up to 60%)

- 🏦 Mandatory annuity corpus (at least 40%)

- 🧓 Estimated monthly pension

- 💵 Real (inflation-adjusted) corpus value

- 📊 Nominal and real CAGR

All these metrics are computed using the same compounding formula that NPS fund managers apply to actual contributions.

How Does Our Calculator Work?

Our NPS calculator with increasing contribution considers both monthly investments and annual step-up percentage, alongside your chosen:

- Years until retirement

- Expected annual return (gross)

- NPS expense ratio (TER)

- Inflation rate

- Lumpsum withdrawal percentage

- Assumed annuity yield

It then computes month-by-month compounding using the following formulas:

Formula & Methodology

1. Future Value (FV) of Contributions

Example Calculation

Let’s assume:

- Monthly investment: ₹5,000

- Annual increase: 5%

- Years until retirement: 30

- Expected return (gross): 10% p.a.

- Expense ratio: 0.10%

- Inflation: 6%

- Lumpsum: 60%

- Annuity yield: 6%

Results:

| Parameter | Estimated Value |

|---|---|

| Total Invested | ₹34.8 lakh |

| Nominal Corpus | ₹98.5 lakh |

| Lumpsum Withdrawal | ₹59.1 lakh |

| Annuity Corpus | ₹39.4 lakh |

| Estimated Monthly Pension | ₹19,700/month |

| Real (Inflation-Adjusted) Corpus | ₹17.0 lakh |

| Nominal CAGR | 10.07% |

| Real CAGR | 3.6% |

Features of FinMinutes’ NPS Calculator with increasing contribution

Our calculator is built with accuracy, trust, and transparency in mind:

- 🧮 Dual Compounding Logic: Models both monthly contributions and yearly step-ups with precision.

- 💬 Smart Tooltips: Every metric is explained — hover to understand formulas and assumptions.

- 📈 Interactive Charts: Donut chart for corpus composition and line chart for growth trends.

- 📅 Year-by-Year Table: See your corpus evolution, lumpsum, and pension value across years.

- 📥 CSV Download Option: Export your year-wise projection for record-keeping or financial planning.

Also, if you are looking to secure your child’s future, the NPS Vatsalya scheme is a great option.

It’s an NPS variant designed to secure your child’s financial independence through disciplined, tax-efficient investment.

You can try our NPS Vatsalya Calculator to estimate the potential corpus for your child’s future needs, compare maturity projections, and visualize returns with the same trusted FinMinutes interface, colorful, accurate, and transparent.

Expected Return from NPS: Realistic Insights

Historically, NPS equity and government debt allocations have delivered 8%–10% annualized returns over the past decade (as per PFRDA and NPSTRUST data). Actual returns depend on:

- Asset allocation (E, C, G tiers)

- Fund manager performance

- TER (total expense ratio)

- Market volatility

What’s a Reasonable Expectation?

- Equity-heavy Tier I NPS: 10–11% p.a. long-term

- Corporate + Govt mix: 8–9% p.a.

- Conservative mix: 7–8% p.a.

With a TER under 0.1% for most NPS funds, your net compounding rate remains among the highest across regulated retirement plans.

What About Annuity Returns?

Upon retirement, at least 40% of your NPS corpus must be invested in an annuity plan. As of 2024-25, annuity returns in India typically range between 5.5% and 7% per annum, depending on:

- Annuity provider (LIC, SBI Life, HDFC Life, etc.)

- Option selected (lifetime pension, joint life, return of purchase price, etc.)

Our calculator allows you to modify the assumed annuity yield to estimate pension accurately.

Benefits of Step-Up NPS Planning

| Benefit | Description |

|---|---|

| Realistic Growth | Reflects natural increase in savings with income. |

| Inflation Hedge | Helps contributions grow with inflation. |

| Discipline | Encourages steady, structured savings. |

| Better Corpus | Higher compounding effect with rising investment base. |

| Tax Benefits | Continue enjoying Sec 80C and 80CCD(1B) deductions. |

NPS Calculator with step up: FAQs

What is the ideal annual increase to assume?

Typically, 5%–10% is realistic, matching average salary hikes in India.

Can I still withdraw 60% lumpsum?

Yes, NPS allows up to 60% tax-free withdrawal at retirement; at least 40% must be used for annuity.

Are returns guaranteed in NPS?

No. NPS is market-linked and regulated by PFRDA. However, it is one of the most stable long-term investments in India.

What if I exit early?

If you exit before 60, only 20% can be withdrawn, and 80% must be used for annuity purchase.

What is a good annuity yield assumption?

Between 5.5%–6.5% p.a. is conservative and realistic as of FY2024-25.

How does the NPS calculator with increasing contribution help in financial planning?

FinMinutes’ NPS calculator with increasing contribution helps the user in planning realistically by assuming an annual percentage increase in NPS contribution, similar to his salary hike, leading to better future financial planning, thus making our NPS calculator more effective.

Conclusion

The FinMinutes NPS Calculator with Increasing Contribution helps you plan your retirement with precision and realism, ensuring that every year’s salary increment works towards your secure future.

It combines financial literacy, regulatory accuracy, and simplicity, so you can make confident, data-backed decisions for your golden years.