NPS Calculator Lumpsum + Monthly Contribution

Estimate your NPS corpus, permitted lumpsum, and pension with both one-time and monthly contributions.

Inputs

Year-by-Year Details

| Year | Invested | Nominal Corpus | Real Value | Permitted Lumpsum | Estimated Pension (₹/mo) ℹ️ Shows hypothetical pension if NPS were exited at the end of that year (illustrative only; actual pension begins post-retirement). |

|---|

Formula & Methodology (expand)

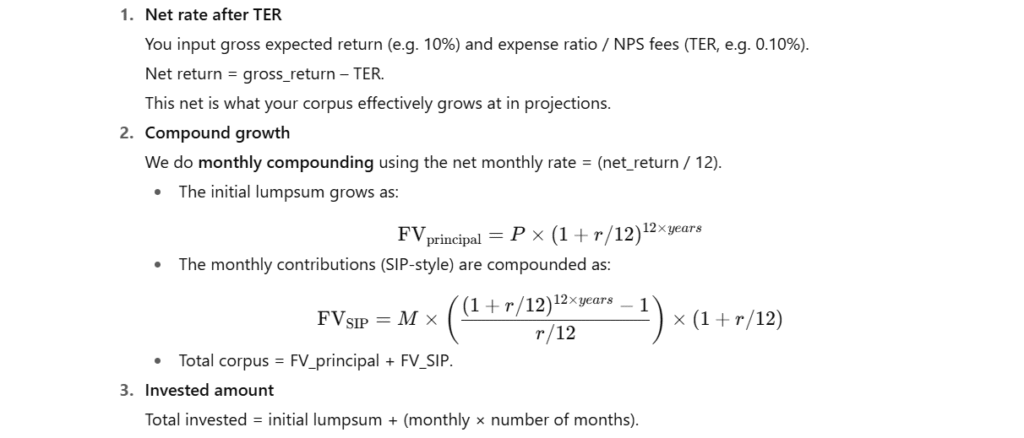

- Growth engine: month-by-month compounding using net monthly rate = (annual_return − TER)/12. Monthly contributions compound similarly.

- Nominal Corpus: future value at retirement after compounding.

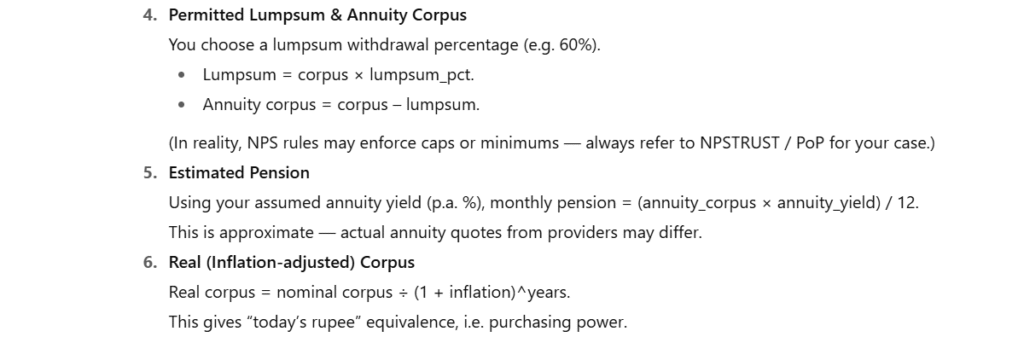

- Permitted lumpsum: lumpsum % × nominal corpus.

- Annuity estimate (approx): remaining corpus × (annuity_yield/12) = estimated monthly pension.

- Real corpus: nominal ÷ (1 + inflation)^years.

Disclaimer: This calculator is for illustration only. It implements typical NPS rules (retirement exit up to 60% lumpsum, ≥ 40% annuity). Always verify with official sources: • NPSTRUST Official Site • NPSTRUST Calculators This is not financial or tax advice. Confirm actual rules and annuity yields with your PoP or NPSTRUST.

Planning your retirement dreams is hard when you do not have the numbers. How big will your NPS corpus be? How much can you withdraw as lumpsum? What monthly pension might you get?

Our interactive NPS Calculator Lumpsum + Monthly Contribution helps you simulate all this under realistic assumptions (inflation, TER, annuity rules), and we accompany it with a full explanation. Hence, you understand how the math works.

What is NPS and Why Use a Calculator

The National Pension System (NPS) is India’s voluntary retirement savings scheme regulated by PFRDA / NPSTRUST. Over the accumulation years, your contributions (or lumpsum + monthly) are invested in a mix of equity, corporate bonds, government securities, and alternatives, depending on your chosen allocation (auto, active, lifecycle).

At retirement (or exit), NPS rules require that a portion (often ≥ 40%) of the corpus must be used to purchase an annuity (i.e., a pension). The rest (often up to 60%) may be withdrawn as a lumpsum, subject to regulatory limits and taxes.

Given these rules and market variability, projecting outcomes is complex. That’s why a calculator, where users can input return rate, inflation, expense ratio, and withdrawal percent, is valuable. It helps manage expectations and planning.

FinMinutes NPS Calculator lumpsum + SIP features

Most NPS calculators available online are either too simplistic or too technical. They often assume only one type of investment, monthly or lumpsum, and ignore the real-world elements like expense ratio, inflation, and annuity yield. Ours is different. Here’s what the FinMinutes NPS calculator does that most others don’t:

Dual Investment Options

You can input both:

- A one-time lumpsum investment (for example, if you already have some savings when starting NPS), and

- A monthly contribution, similar to a SIP that continues until retirement.

This flexibility mirrors how real investors behave; some begin early with small monthly contributions, while others add larger lumpsums later in their career.

Automatic Compounding & TER Adjustment

The calculator automatically compounds your contributions monthly using a net rate of return, i.e., your gross expected return minus the annual Expense Ratio (TER). This gives a more accurate projection because TER (though small) can eat into long-term returns.

Inflation Adjustment

It not only shows your nominal corpus, but also shows your real, inflation-adjusted corpus, and how much that money will actually be worth in today’s rupees. A ₹1 crore corpus 30 years from now isn’t the same as ₹1 crore today, and this calculator reminds you of that reality.

Built-In NPS Exit Rule Modeling

The tool automatically splits your final corpus into:

- Permitted lumpsum (typically up to 60% of total corpus), and

- Mandatory annuity corpus (usually the remaining 40%).

You can adjust this percentage as per your own scenario.

Annuity & Pension Estimator

Based on your selected annuity yield (p.a.%), it calculates an estimated monthly pension you’d receive post-retirement. This makes it easy to visualize how your corpus converts into steady income, something most calculators skip.

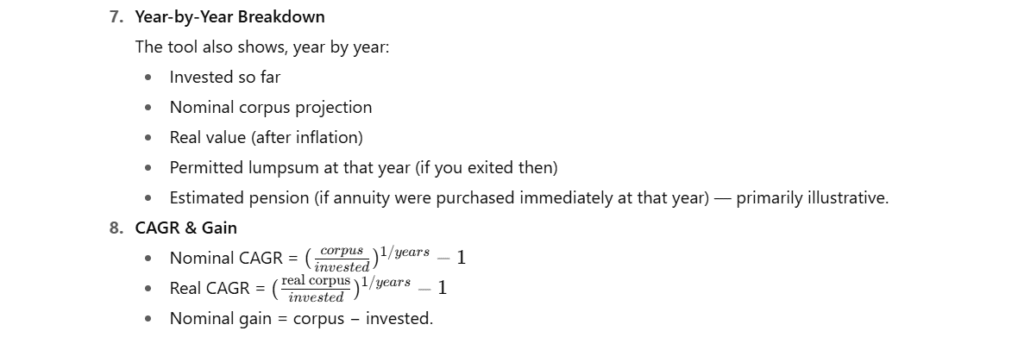

Year-by-Year Table

Our calculator builds a full year-by-year table showing:

- Total invested till that year

- Corpus accumulated

- Inflation-adjusted (real) value

- Permitted lumpsum (if exited that year)

- Illustrative monthly pension at that point

This feature is gold for anyone who likes transparency and wants to see growth every single year, not just a final number.

Visual Charts & CSV Download

We also include:

- A donut chart breaking down your invested amount vs gains

- A line chart tracking nominal vs real corpus growth

- And even a “Download CSV” option for detailed data exports

So you can analyze or share results directly, ideal for planners, advisors, and investors who like to document their retirement projections.

How the Finminutes NPS Calculator Works: Formula & Logic

Here is the logic and formula behind our calculator-

Example Scenario

Let’s say:

- You start with ₹1,00,000

- Add ₹5,000 monthly

- Expect a gross return of 10% p.a.

- TER = 0.1%

- Inflation = 6%

- Lumpsum withdrawal = 60%

- Annuity yield = 6%

- Duration = 30 years

At retirement, your projected numbers might look like:

- Total Invested: ₹18 lakh

- Nominal Corpus: ₹1.12 crore

- Real Corpus (today’s value): ₹17 lakh (approx)

- Permitted Lumpsum: ₹67 lakh

- Annuity Corpus: ₹45 lakh

- Monthly Pension (6% yield): ~₹22,500

These numbers make the long-term power of compounding visible, and remind you how inflation quietly erodes value over time.

What Returns Can You Expect from NPS?

The National Pension System does not guarantee returns; it’s market-linked. But history gives us a good idea. As per official NPSTRUST and fund manager data:

- Equity schemes (E Tier I) have delivered around 9%–12% annualized over 5–10 years.

- Corporate debt schemes average around 8%–9%.

- Government bond schemes range between 7%–8%.

In the last few years, NPS equity allocations have performed strongly, with some managers even delivering 15–17% in bull markets. However, do not assume this will continue every year. A safe assumption for balanced investors is 8%–10% net of TER over the long term.

If you’re 100% equity (allowed from 2025 onwards under new rules), you might expect more volatility but also higher long-term potential.

💬 Pro Tip: Use the calculator to simulate multiple return scenarios — e.g., one with 8%, one with 10%, one with 12% — to visualize both conservative and optimistic cases.

What Annuity Yields Should You Expect?

When you retire, the annuity portion of your NPS corpus must be converted into a pension. Currently, Indian annuity providers (LIC, HDFC Life, ICICI Prudential, etc.) offer yields around:

- 5%–6.5% p.a. for “return of purchase price” plans, and

- 6.5%–7.5% p.a. for “no return” plans.

So a 6% assumption in the calculator is quite realistic; it sits right in the middle of what’s available today. Keep in mind that once purchased, annuity rates are fixed for life and can’t be changed later.

🧾NPS Calculator Lumpsum: FAQs

Can I use both lumpsum and monthly inputs in this calculator?

Absolutely. That’s one of the main features of Finminutes NPS calculator lumpsum + SIP. You can model a scenario where you invest an initial corpus and also keep contributing monthly.

Why does it show pension in every row, year-wise?

That’s an illustration, showing what your pension might be if you were to retire at that point. Actual pension starts only when you actually retire.

How is the Finminutes NPS calculator different from other NPS calculators?

Most calculators stop at corpus size. This one shows real value after inflation, automatically adjusts for NPS rules, calculates pension, and even exports detailed yearly data.

What is a reasonable return to assume?

Historically, NPS has delivered around 9%–10%, depending on asset mix. You can assume 8%–9% for conservative planning.

What about inflation?

Inflation eats into real returns. Our tool adjusts for it so you can see your corpus in today’s money value, which is far more useful for planning.

What is the typical annuity yield today?

Currently between 5% and 7%. It depends on the type of plan and provider you choose.

Is NPS tax-free?

Up to 60% lumpsum withdrawal at retirement is tax-free under current laws. The remaining annuity income is taxed as per your income slab.

Conclusion

The FinMinutes NPS Calculator isn’t just another online widget; it’s a planning assistant. It shows what really matters: the link between your effort today and your lifestyle tomorrow. It helps you:

- Estimate your total NPS corpus with precision,

- See the real value after inflation,

- Understand how much you can withdraw,

- Visualize your expected pension, and

- Export data for deeper analysis or consultation.

The best part? You can tweak inputs live, inflation, TER, return, years, and instantly see how your retirement projection changes. If you’re serious about understanding your financial future, bookmark this tool. Because while the future can’t be predicted perfectly, it can certainly be planned smartly.