NPS Calculator for Government Employees

Calculate estimated NPS corpus, permitted lumpsum and monthly pension. Tailored for Central & State government employees.

Inputs

Year-by-Year Details

| Year | Invested | Nominal Corpus | Real Value | Permitted Lumpsum |

|---|

Formula & Methodology (expand)

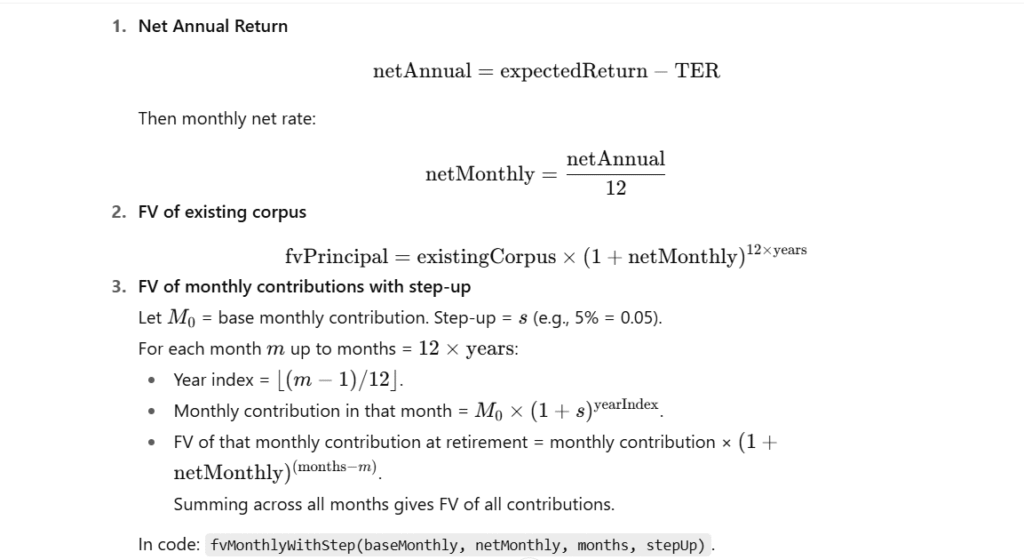

- Monthly net rate: (expected_return − TER) ÷ 12

- FV of lumpsum: principal × (1 + net_monthly)^(12×years)

- FV of monthly contribution: monthly each month compounded net_monthly until retirement (supports annual step-up).

- Corpus: FV_lumpsum + FV_monthly + FV_employer_contributions

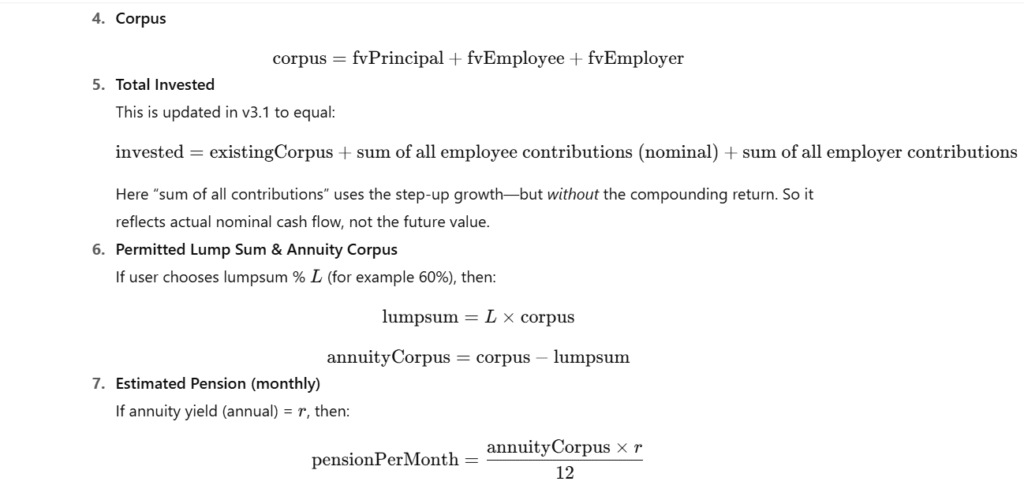

- Permitted lumpsum: lumpsum% × corpus

- Annuity (approx): (corpus − lumpsum) × (annuity_yield ÷ 12) = estimated monthly pension

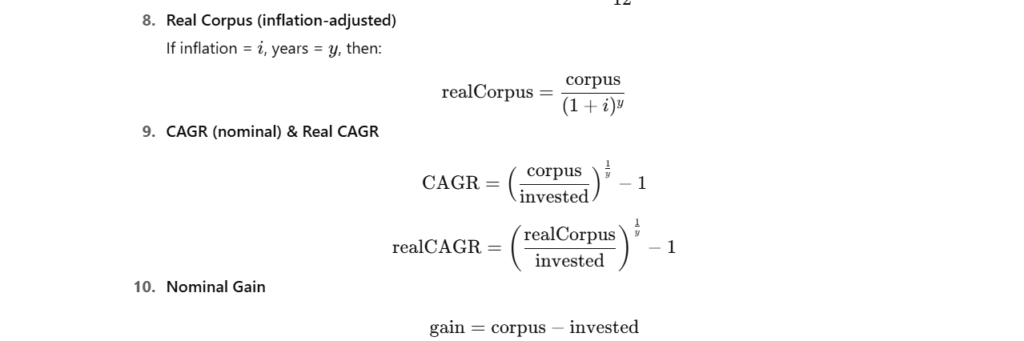

- Real corpus: nominal ÷ (1 + inflation)^years

Disclaimer: This tool is for illustration only. Always verify with official sources:

• NPSTRUST official site

Use Finminutes’ NPS calculator for government employees to plan for retirement accurately, know the estimated pension, lumpsum corpus, mandatory annuity, and much more.

Why a Separate NPS Calculator for Government Employees?

For many government employees, whether central or state, the National Pension System (NPS) is mandatory or effectively the default retirement savings vehicle. As per the National Pension System Trust (NPS Trust), NPS is a market-linked defined-contribution pension scheme introduced for central government employees from 1 Jan 2004.

In this model:

- The employee contributes a fixed percentage (10%) of Basic + DA.

- The government (employer) contributes a matching amount or a mandated percentage (e.g., 14% of Basic+DA in many central‐government cases).

- The corpus at retirement is built up from these contributions over the service life, grows via returns, and part of it is withdrawable, while the remainder must be annuitised to provide a monthly pension.

Because of this structure, fixed contribution percentages, government match, long tenure, compounding returns, inflation risk, and annuity requirement, a tailored calculator for government employees becomes very valuable.

A generic “retirement corpus calculator” might allow arbitrary contributions, but for government employees, the patterns are specific. Our calculator thus:

- Differentiates between employee type (central vs state) so the employer match percentage is correct.

- Allows a “step-up” (annual salary/contribution growth) input, which is realistic for long-service government employees whose pay and contributions rise over the years.

- Handles both “basic mode” (user enters monthly contribution manually) and “advanced mode” (employee enters Basic Pay + DA and contributions are auto-calculated).

- Computes taxable and non-taxable components (lumpsum vs annuity) indirectly in the sense of corpus breakdown.

It’s better tailored for government service NPS users than generic calculators, hence we made this separate version apart from our regular NPS calculators.

How to Use the Finminutes NPS Calculator, a Step-by-Step guide

Using our NPS calculator for government employees is simple and straightforward, here is how:

- Select Mode: Basic or Advanced.

- Choose Employee Type: Central or State Government.

- Choose Scheme Type: (e.g., G, LC25, LC50), this will set a default expected return but you may override it.

- Enter your Existing NPS Tier I Corpus (if any).

- In Basic mode: Enter your monthly contribution.

- In Advanced mode: Enter Basic Pay and DA %; the tool computes employee + employer monthly contributions.

- Enter Step-up (annual %) to simulate increasing contributions each year.

- Enter Years until Retirement.

- Enter expected annual return, expense ratio, inflation, lumpsum withdrawal %, annuity yield.

- Click Calculate.

- View results:

- Total Invested, Nominal Corpus, Real Corpus, Lump Sum, Annuity Corpus, Estimated Pension/month, Nominal & Real CAGR, Gain.

- In Advanced mode also see Employee & Government contribution cards.

- Visual charts and table for year-by-year detail.

- Download CSV as needed.

Key Features of the NPS Calculator for Government Employees

FinMinutes NPS calculator for government employees includes the following features:

- Mode selector (Basic / Advanced)

- Basic mode: The user enters their existing NPS Tier I corpus, monthly contribution, step-up percentage (for contribution increase), expected return, inflation, lumpsum % withdrawal, annuity yield, and years until retirement. Employer contribution is hidden.

- Advanced mode: The user enters the existing corpus, Basic Pay (₹), DA%, and step-up. The calculator then automatically computes employee contribution (10% of Basic+DA) and employer contribution (14% for central government employees, 10% for many state government employees). Monthly contributions are derived, and the step-up applies to both employee and employer contributions.

- Support for government employee rules

- Distinction between central and state governments to correctly select employer contribution rates.

- Assumes standard government percentages (10% employee, 14% central-gov employer / 10% state-gov employer) so users do not have to figure it out manually.

- Compounding of contributions & step-up

- The calculator applies monthly compounding of net return (expected return minus expense ratio / TER) over the tenure until retirement.

- For contributions, a step-up (annual % growth) is applied, for example, if contributions grow 5% each year, the monthly contribution in years 2, 3, etc, increases accordingly.

- Existing corpus is compounded likewise.

- Detailed outputs

- Total Invested (Employee + Government + Existing Corpus) with tooltip explaining the definition.

- Nominal Corpus at retirement (before inflation adjustment).

- Real Corpus (inflation-adjusted purchasing power).

- Permitted Lump Sum (percentage of corpus user can withdraw as lump sum at retirement).

- Mandatory Annuity Corpus (corpus minus permitted lumpsum) which must be used for purchasing annuity.

- Estimated Pension (monthly pension computed by applying annuity yield on annuity corpus).

- CAGR (nominal) and real CAGR (inflation-adjusted).

- Nominal Gain (difference between corpus and invested amount).

- In Advanced mode only: cards showing “Total Employee Contribution” and “Total Government Contribution (employer)” as separate breakdowns with tooltips.

- Visuals & table

- A donut chart showing Invested vs Gain.

- A line chart showing year-by-year growth of Invested, Nominal Corpus and Real Corpus.

- A downloadable CSV with year-by-year data for further analysis.

- Year-by-year table showing Year, Invested, Nominal Corpus, Real Value, Permitted Lumpsum.

- Tooltips & accessibility

- Each descriptive heading or icon includes a tooltip explaining what it means.

- Keyboard accessibility: tooltips focusable via tab, appropriate aria attributes.

- Debounce applied to input events so the calculation doesn’t fire excessively on each keystroke.

Formula & Methodology behind Finminutes NPS Calculator

Here’s how our NPS calculator for government employees computes the various values:

Why Our NPS Calculator Is Especially Important for Government Employees

- Fixed contribution structure: Government employees often have deductions each month (10% of Basic+DA), and the employer contribution is structured. our tool mirrors that and avoids guesswork.

- Compounding horizon: Many government employees serve for 20–35 years; small differences in step-up, returns, or inflation will significantly affect the corpus. We already factor it into the calculator.

- Lumpsum + annuity rules: In NPS for government employees, typically 60% can be withdrawn as lump sum (tax rules may apply) and 40% must go into an annuity. The tool enables simulation of these choices.

- Inflation risk & real purchasing power: Especially for long tenures, real corpus is a critical metric to assess whether the retirement corpus will sustain real spending.

- Government match leverage: The “employer contribution” piece is often 14% for central government employees; this is a significant inflow that many tools don’t highlight properly. Our calculator does.

- Step-up realistic modelling: Government pay scales, DA hikes, promotions, etc imply contributions increase over time rather than just staying flat. Incorporating step-up gives more realistic projections than flat monthly contributions.

If you are a non-government employee and planning to invest in NPS, you can use our other advanced NPS calculators. If planning a futuristic investment for your kid, NPS Vatsalya is a scheme to consider.

NPS calculator for government employees: FAQs

Why do we have two modes (Basic and Advanced) in the Finminutes NPS calculator for government employees?

The “Basic” mode is for users who know their monthly contribution and just want a quick projection. The “Advanced” mode is tailored for government employees who prefer entering their Basic Pay + DA and letting the tool compute contributions (employee + employer) automatically. It reflects the typical NPS deduction structure for government employees.

What is Step-up (annual %)?

Step-up is the annual percentage increase in your contribution (monthly) reflecting salary growth, promotions, DA hikes, etc. For example, a 5% step-up means contributions in year 2 will be 5% higher than year 1, in year 3, 5% higher than year 2, and so on. Our NPS calculator uses this to simulate realistic long-term growth.

What assumptions are built into this NPS calculator?

Key assumptions:

– Employee contribution rate (10% of Basic+DA) in Advanced mode.

– Employer match (14% central / 10% state) in Advanced mode.

– Compounding monthly at net return (expected return minus TER).

– Step-up applied annually to contributions.

– Inflation constant (user adjustable).

– Lumpsum withdrawal % fixed by user.

– Actual outcomes depend on real salary growth, asset returns, inflation, and annuity quotes, which vary.

Why is there a separate Real Corpus and Nominal Corpus figure in the Finminutes NPS calculator for government employees?

Nominal corpus shows how much value your investments grow to in rupee terms, but inflation erodes purchasing power. “Real Corpus” adjusts the nominal corpus for inflation across the years, so you see what today’s rupees will be worth at retirement.

How do the lumpsum withdrawal and annuity yield inputs work in the NPS calculator?

At retirement, under NPS for government employees, you typically withdraw a lumpsum portion (for instance, 60%, which is the maximum lumpsum withdrawal allowed by the government) and use the remaining corpus to buy an annuity which pays you a monthly pension. The user selects lumpsum %, and enters an assumed annuity yield (annual %), and the tool computes the monthly pension accordingly.

Are the investment return assumptions realistic for government employees under NPS?

Returns are market‐linked in NPS (for example, equity, bonds, lifecycle schemes), and fees (TER) apply. The tool allows the user to set “Expected Return (p.a.%)” and “Expense Ratio / NPS fees (TER% p.a.)” so they can customise based on their chosen scheme (G, LC25, LC50, etc). According to NPS Trust, the scheme returns data that is publicly available. For each scheme, we have used historical returns as a default value.

What if I retire early or leave service before retirement age?

This tool is designed for retirement at a given “Years until Retirement” input. If you retire early, you can adjust the years input accordingly, but you should also be aware of NPS exit/withdrawal rules (e.g., mandatory annuitisation if you exit before age 60)

Conclusion

FinMinutes NPS calculator is purpose-built for government employees under the NPS regime. It offers realism (contribution structure, step-up), clarity (employee vs employer contributions, lump sum vs annuity), transparency (visuals, downloadable table) and flexibility (customisable return, inflation, step-up).

By using it, government employees can better plan their retirement corpus, understand the pension impact, and make informed decisions such as whether to increase contributions, adjust retirement age, or evaluate annuity yield assumptions.