Stocks of companies from various sectors that should be on every investor’s radar, as all exit polls predict a comfortable victory for the Narendra Modi-led NDA government. The NDA government is a favorite of the market due to its clean governance and progressive reform policies, and a comfortable win for the ruling party will further cement the market’s view that ongoing reforms will continue. Most of the exit polls are predicting 350+ seats to NDA, and some are even predicting 400+ seats for the ruling party, and these stocks will be the primary beneficiaries of government policies going ahead.

A little on Exit poll 2024: Narendra Modi wave still intact

Sh. Narendra Modi, “the biggest” political face in country and one of the most popular political personalities in the world right now is about to pull another stunner for his party once again as NDA is set to get its third term with a bang. Opposition’s unity once again proved to be hollow as voters rejected their lucrative poll promises and chose to go with ‘Modi ki guarantee’, a key term popularized by the prime minister in this election.

Coming to exit polls most of them are predicting a clear mandate of “a historic third term” for the ruling party NDA. The Bharatiya Janata Party (BJP)-led National Democratic Alliance is projected to secure more than 350 seats, crossing the required halfway mark, while the Opposition I.N.D.I.A. bloc is expected to win less than 200 seats.

Among 13 exit polls, ten suggest though the BJP-led NDA will win at least 350 seats, it will fail to cross 400 seat milestone ( 400 seat milestone, a key term this election popularized by PM Narendra Modi as ‘Abki bar 400 par’) but three exit polls – India Today-My Axis India, India TV-CNX, and News24-Todays Chanakya exit polls have predicted 400 plus seats for the NDA.

| Survey done by | Seats (NDA) | Seats (I.N.D.I.A bloc) | Seats (others) |

| India Today-My Axis India | 361-401 | 131-166 | 8-20 |

| India TV- CNX | 371-401 | 109-139 | 28-38 |

| News 24- Today’s Chanakya | 400(+/- 15) | 107(+/- 11) | 36(+/- 9) |

| News Nation | 342-378 | 153-169 | 21-22 |

| News 18 mega exit polls | 355-370 | 125-140 | 42-52 |

| NDTV poll of polls | 366 | 144 | 33 |

| ABP C- voter | 353-383 | 152-182 | 4-12 |

| Times now ETG | 358 | 152 | 33 |

| Republic Bharat- matrize | 353-368 | 118-133 | 30 |

| Jan ki bat | 362-392 | 141-161 | 10-20 |

| India news- D dynamics | 371 | 125 | 47 |

| Daniil Bhaskar | 281-350 | 145-201 | 33-49 |

| Average | 354-379 | – | – |

4 stocks to keep on watch for long term

Government focus on overall wellbeing of economy and significant Capex is the reason behind optimism in markets. Sectors like Defense, Engineering and Infra, government backed strategic companies, power sector, government banks will be key sectors benefitting from continuance of government’s progressive policies. Here is the list of top 10 companies that could do very well in Narendra Modi 3.0.

• Welspun corp

Welspun Corp Ltd (WCL) is the flagship company of Welspun World, one of India’s fastest-growing multinationals with a leadership position in line pipes and home solutions, along with other lines of businesses in infrastructure, pipe solutions, building materials, warehousing, retail, advanced textiles, and flooring solutions.

Welspun Corp Ltd is one of the largest manufacturers of large diameter pipes globally and has established a global footprint across six continents and fifty countries by delivering key customized solutions for both onshore and offshore applications. The company also manufactures BIS-certified Steel Billets, TMT (Thermo-Mechanically Treated) Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars. The company has state-of-the-art manufacturing facilities in Anjar (Gujarat), Bhopal (Madhya Pradesh), Mandya (Karnataka) and Jhagadia (Gujarat) in India. Overseas, WCL has a manufacturing presence in Little Rock, Arkansas, USA.

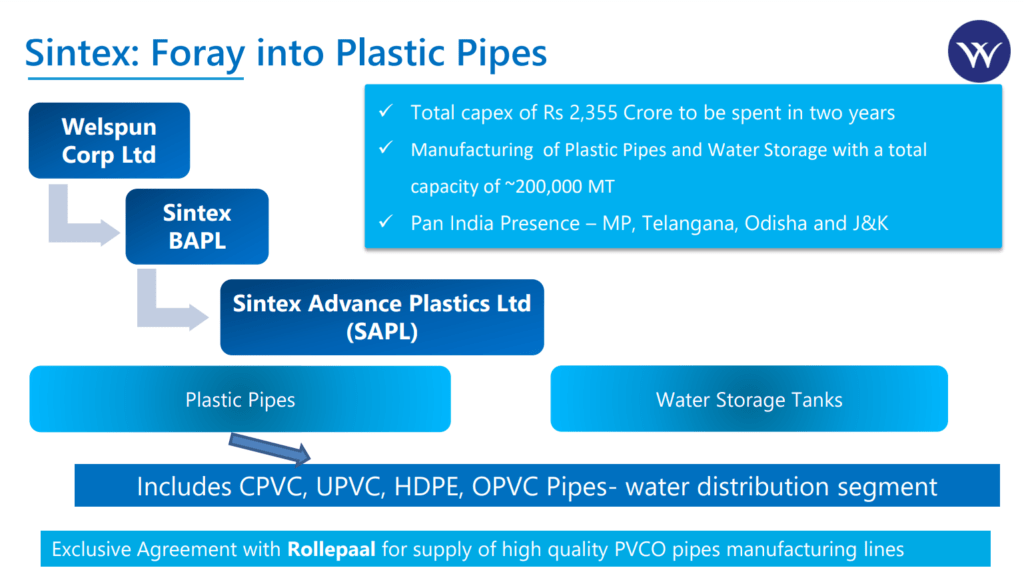

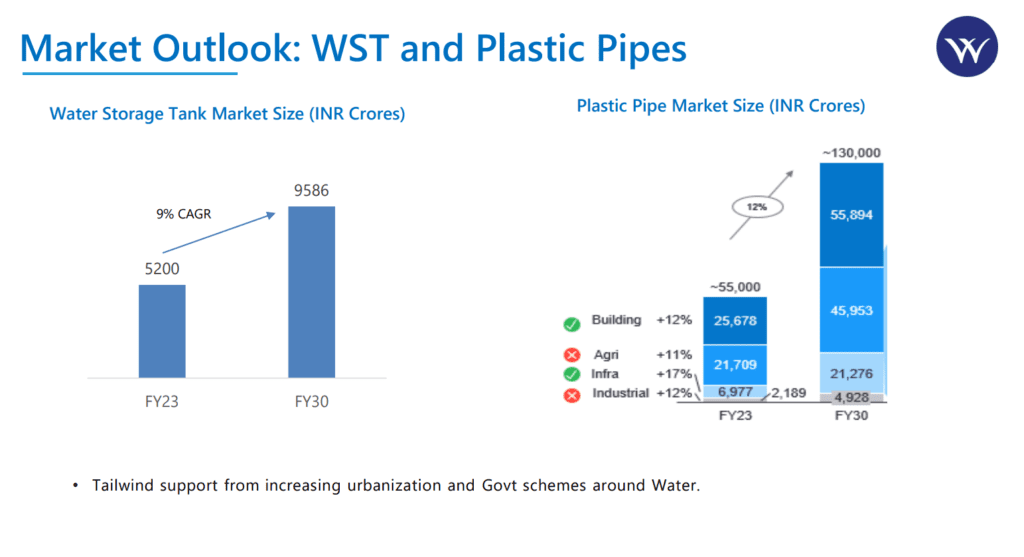

Recently, the company acquired Sintex-BAPL, a market leader in water tanks and other plastic products, to expand its building materials portfolio. It has also made strategic acquisition of specified assets of ABG Shipyard.

Key drivers-

In India, Focus on water infrastructure, Policy initiatives and execution to continue support demand for pipes (line pipes, DI Pipes) for water distribution. The Department of Drinking Water and Sanitation (DoDWS) has been allocated a budget of INR 77,390 Crores. Out of this amount, INR 69,926 Crores has been allocated to the Jal Jeevan Mission in the interim budget and company’s pipe business is key beneficiary of this scheme. Company have strong order backlog of ~328 KMT valued at ~ INR 2,741 crore from DI pipe segment.

City Gas Distribution (CGD), PNGRB launched campaign to increase adoption of PNG in the households. Central government seeks to supply piped gas to most households and the government has recently sanctioned the scheme for development of pipeline infrastructure for the injection of compressed biogas (CBG) into city gas distribution (CGD). Apart from that strong demand to also come from Oil pipelines as additional 10,000 km of pipelines are likely to be installed in the next 2- 3 years.

Further, Sintex to see traction in demand. FY24 Sintex revenue was at ₹635 cr (+23% YoY).

In USA and Saudi Arabia natural gas exports, New Energy including Carbon Capture, Hydrogen and Ammonia pipelines to drive demand. In Saudi Arabia the total allocation of US$ 80 billion towards water projects by 2030; 90% of water demand to be met through desalinated water by 2030. This presents Huge opportunity for Line Pipes and DI Pipes business. Today, Welspun Corp Ltd said its associate entity EPIC has signed multiple agreements worth SAR 1.65 billion (about Rs 3,670 crore) with Saudi Arabian Oil Co. (Aramco) for the supply of steel pipes.

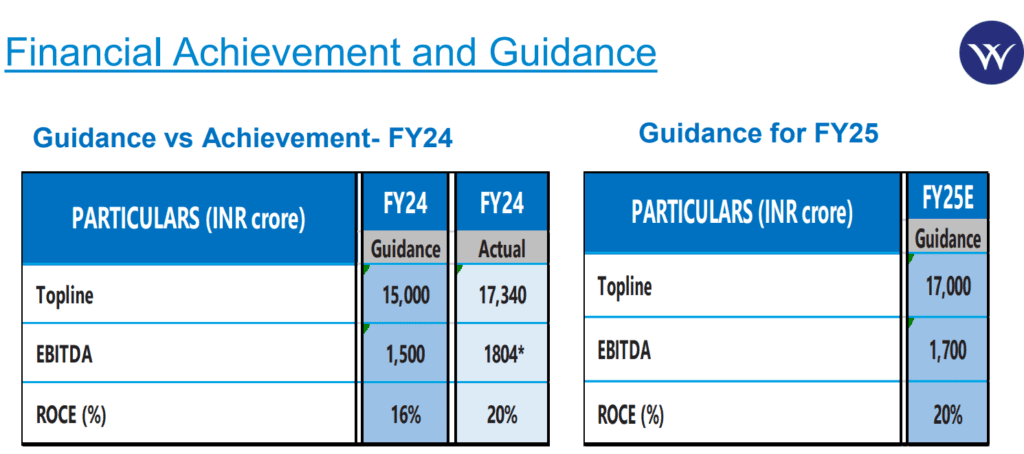

The duration of the contracts is 19 months, and the financial impact of the contracts will be reflected from the fourth quarter of the financial year 2024-25 to the last quarter of the financial year 2025-26. My view is like FY24 company will easily surpass its FY guidance.

Stock price movement and valuation

Welspun Corp did an EPS of ₹42.45 and Stock trades a P/E of 13 against an industry average of 29. Stock is in my coverage list from long and already more than doubled in last 12 month. Technically, it crossing and staying above marked zone will further pave the way for new highs.

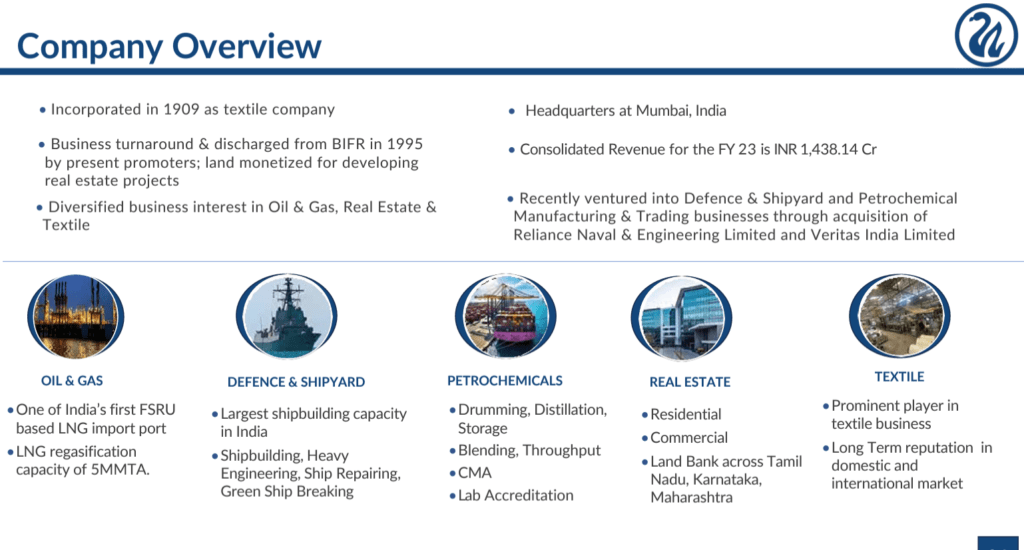

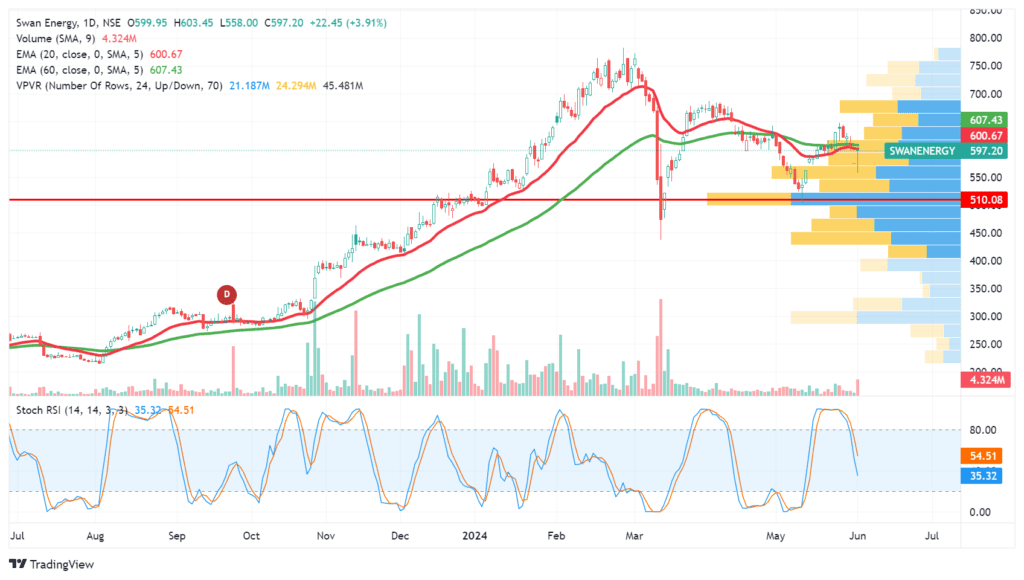

• Swan energy

Key drivers for the stock

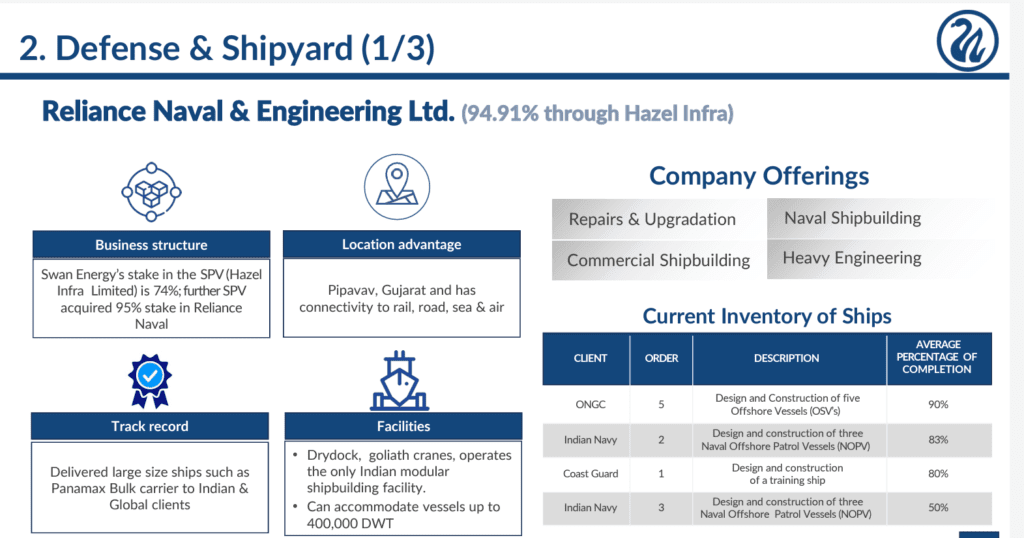

Swan energy recently acquired Reliance naval (owns 94.91% through Hazel Infra), through Reliance Naval Swan energy will foray into repairs & Upgradation, commercial shipbuilding, naval Shipbuilding heavy Engineering. With govt’s focus on make in India in defense shipbuilding space, Swan energy will be a key beneficiary. Apart from that company’s LNG port, petrochem and energy business will also show a fast growth due to growing energy needs and Govt’s LNG plan.

RNEL has a fully developed offshore yard measuring 750 m x 265 m, which is capable of fabrication, erection, and loading out of offshore structures. This will soon expect a business boom due to ONGC’s offshore expansion plans. The RNEL yard can support 50% of the estimated cost of the well and process platform projects by undertaking fabrication activities. In addition to the above, PSU’s 6 rigs require repairs on periodic basis. The yard also has a dry dock which facilitates quick turn around of the repair works saving significant time and cost to the rig owners.

Stock price movement and valuation

From a low of ₹215 to a high of ₹780, stock went more tan 3x in last one year. It corrected after making an all time high of ₹780 and currently trades at ₹597. Stock trades at a p/e of 22 against sector average of 102.

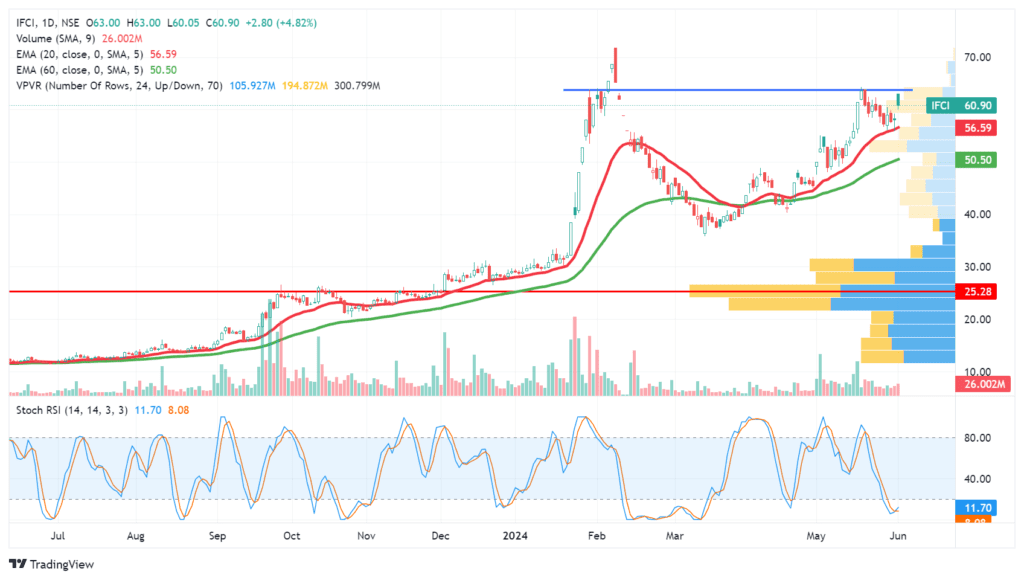

IFCI Ltd

IFCI is having mandate to provide financial support for the diversified growth of Industries across the spectrum. The financing activities cover various kind of projects such as airports, roads, telecom, power, real estate, manufacturing, services sector and such other allied industries. During its 75 years of existence, mega projects like Adani Mundra Ports, GMR Goa International Airport, Salasar Highways, NRSS Transmission, Raichur Power Corporation, to name a few, have been setup with financial assistance of IFCI.

IFCI also provides Government Advisory services and Corporate Advisory services. In Government Advisory, IFCI is appointed as a Project Management Agency (PMA) for various Production Linked Incentive (PLI) schemes launched under the aegis of “Atmanirbhar Bharat” by the Government of India. These schemes are aimed at boosting domestic manufacturing and to attract large investment in the identified sectors.

IFCI is also the Verifying & Monitoring Agency for various capital subsidy schemes under Corporate Advisory, IFCI is offering financial advisory, ESG advisory and other Project advisory services to the Corporate & Government sectors. IFCI is also the Nodal Agency for monitoring loans of Sugar Development Fund (SDF) since 1984.

Key drivers

• Government’s growing focus on infra building and IFCI foray into consultancy / advisory is a key growth driver for the company. Govt through President of India owns 71% stake in the company and government recently infused money into the company to de-leverage its balance sheet. Both govt and institutions recently raised stake in the company.

• Company is focusing more on the Advisory Services business and it has become a mainstay of its business. It has bagged 31 assignments in FY23 including business restructuring, debt syndication and strategic investment analysis across industries.

Stock price movement and valuation

Stock is already a 6 bagger in last one year as it rose from ₹11 to ₹66. Currently it is trading near all time highs at ₹61. Stock trades at 2.25 times book value and trades at a p/e of 26 ( FY-25 e* against the base case expectations of EPS of ₹2.5)

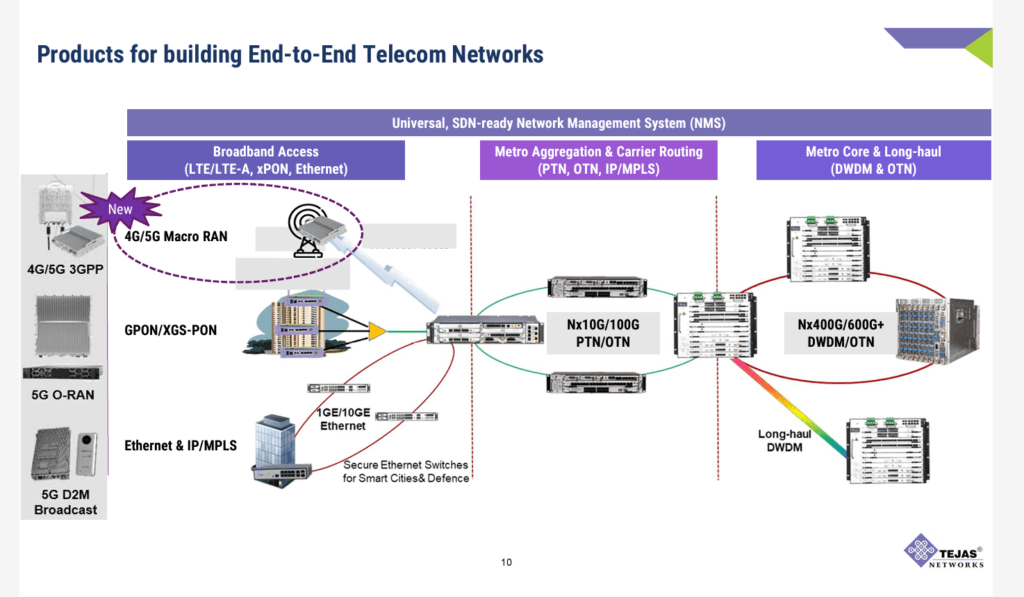

Tejas Networks

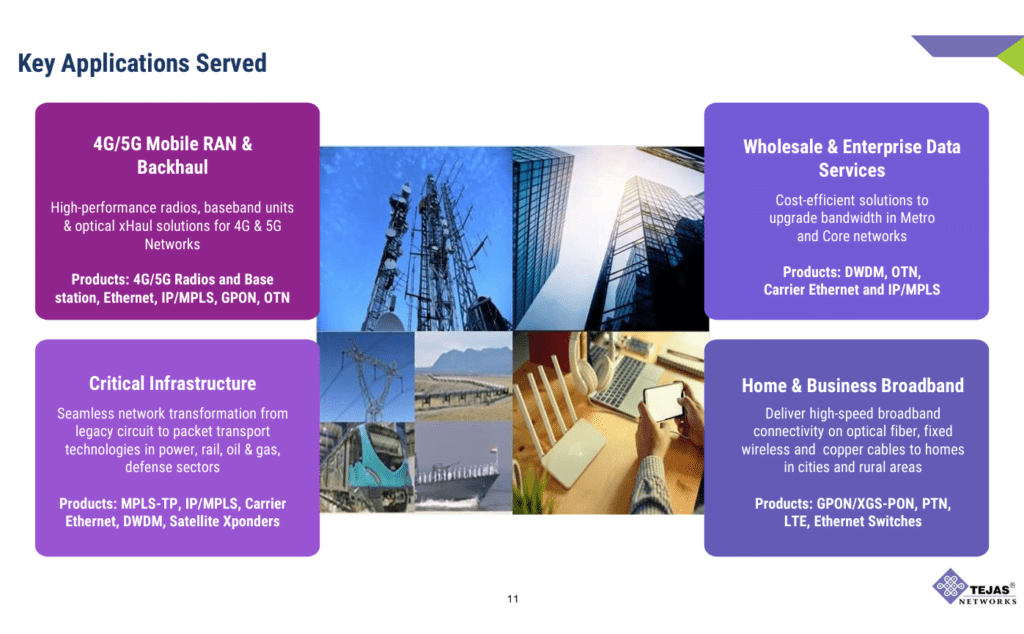

Tejas Networks Ltd designs and manufactures wireline and wireless networking products, with a focus on technology, innovation and R&D. TNL carrier-class products are used by telecom service providers, utilities, governments, and defense networks in 75+ countries. Company is currently a part of Panatone Finvest Limited (a subsidiary of Tata Sons Private Limited).

Key drivers

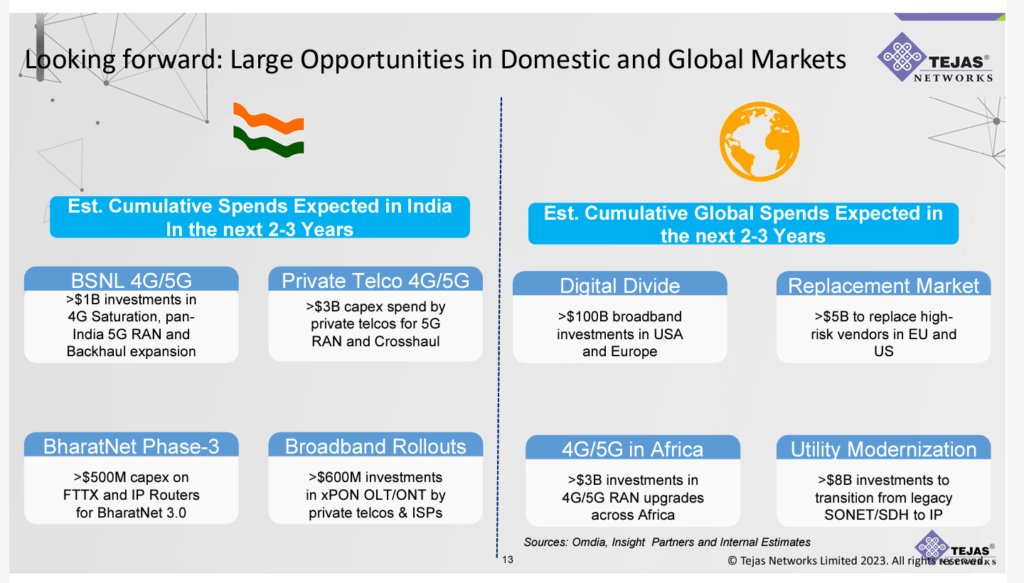

Growing internet penetration and implementation of 5G services across the country. Company already is key equipment provider for many domestic and international companies including state owned BSNL. Company’s order book at end of FY-24 was at approx ₹9000cr. Apart from that company will be key beneficiary of GoI’s Bharat net program.

*Please refer the above info graphics to see how large the opportunity size is for the company.

Stock price movement and valuation

Tejas network’s stock is up 2x in last 12 months. With Tata group’s entry and start of payments from BSNL the stock is expected to do great in coming quarters. March quarter was good for the company with some large order wins. Stock trades at a p/e of 30 (FY-25 d* against the base case EPS of ₹35).

for more on technicals and charting, visit trading view, click here

You can read more on our stocks coverage by visiting our stocks page.