Mutual funds buying stocks amid market turmoil can signal the confidence that fund managers have in those particular stocks. Mutual fund managers do thorough due diligence before acquiring any stock and currently, as the market is going through a correction and fund inflows are slowing down, especially in mid and small-cap funds warrant more caution from fund managers’ side in picking stocks.

According to the latest fund inflow data, inflows remained positive for the 48th consecutive month in Feb 2025, coming in at Rs 29,303 crore but marked a 26% decline compared to January. Systematic Investment Plan (SIP) contributions remained strong at Rs 25,999 crore, a minor dip from Rs 26,400 crore in Jan 2025 but surpassing the September figure of Rs 24,509 crore (current market rally peaked in Sept 2024) and underscoring retail investors’ growing trust and financial discipline.

So, common investors should track fund managers picking stocks to get a cue of their possible future movements. Here is the list of some names that mutual funds added and they caught our attention, we tried to figure out the rational behind MFs picking them and other key cues that keep those stocks afloat going ahead.

Mutual Funds Buying Stocks

In Mutual funds buying stocks, they increased their stake in 453 small-cap names in February, while decreasing holdings in around 300 names. In the midcap universe, more than 90 stocks saw an increase in the stake held by mutual funds while nearly 60 saw funds trim their holdings.

Max Healthcare

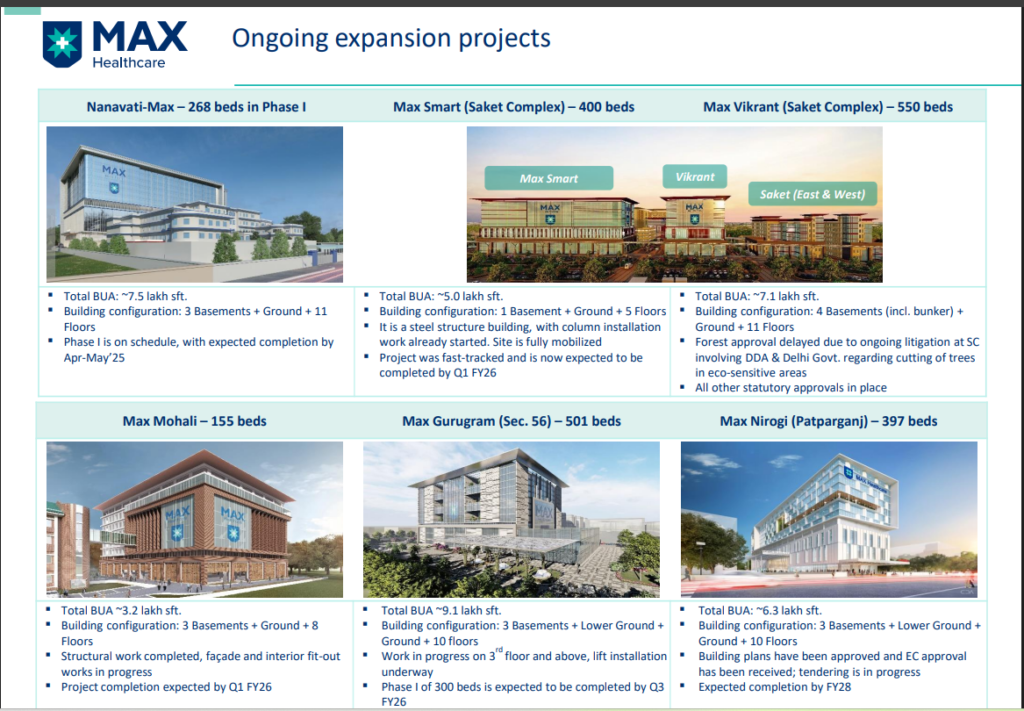

Max Healthcare Institute Limited (Max Healthcare) is one of India’s largest healthcare organizations. It is committed to the highest standards of clinical excellence and patient care, supported by the latest technology and cutting-edge research. Max Healthcare operates 22 healthcare facilities (5,000+ beds) with a significant presence in North India.

The network consists of all the hospitals and medical centers owned and operated by the Company and its subsidiaries, partner healthcare facilities, and managed healthcare facilities, which include state-of-the-art tertiary and quaternary care hospitals.

In addition to the hospitals, Max Healthcare operates homecare and pathology businesses under the brand names Max@Home and Max Labs, respectively. Max@Home offers health and wellness services at home while Max Lab provides diagnostic services to patients outside its network.

Mutual funds added Max Healthcare stocks as the company is consistently posting solid numbers, and the earnings visibility going ahead is strong. India’s underpenetrated healthcare market presents a huge opportunity for leading players like Max. Brokerage firm Jefferies believes the sector offers strong earnings visibility in an uncertain market, making it a compelling investment opportunity.

In the next few years, Max Healthcare will add more than 3,700 beds to its existing and new facilities significantly boosting the top and bottom lines. The company’s cash generation capabilities are strong and its current low debt profile offers company headroom to grow aggressively through leverage.

In the next 12 months, brokerages have a consensus target of 1300+ for the stock suggesting more than 30% upside from current levels. Technically too, 980-1,000 is a strong support zone for it, and above that level bias will remain positive.

AU Small Finance Bank

AU Small Finance Bank Limited is engaged in providing a range of banking and financial services including retail banking, wholesale banking, treasury operations, and other services.

Stock performance-wise, the bank is at a 2020 level, broadly did not make any money for investors in the last 5 years. The last few quarters were painful for the bank due to an unsecured loan portfolio, microfinance uncertainty, and liquidity crunch but now liquidity is easing as RBI is providing a big boost to it and MFI and small finance banks, NBFCs are expected to gain big from it.

MFI loan collections were better than the industry for AU Small Finance but due to some stress and seasonality, the bank’s GNPA and NNPA rose slightly in Q3, now bank expects a good recovery from Q1 FY26.

Bank sees signs of a bounce back in rural consumption and government CAPEX, yet overall momentum remains below expectations. Management anticipates credit costs to remain elevated but expects to stay within ROA guidance of 1.6%. GLP growth is projected around 20%, with secured assets expected to grow 23-24%. Universal Bank License application is in progress with regulators.

Challenges in MFI and credit card segments will be largely offset by RBI’s liquidity infusion and rate cut, this accompanied by strong performance in secured assets will significantly boost the bank’s performance from Q1 FY26. This may have prompted MFs to raise a stake in AU Small Finance Bank where it rose from 17.76% to 19.89%, with holdings increasing from 132.17 million shares to 148.02 million shares.

Technically the stock is weak as it is below all-important moving averages, and RSI is oversold. Immediate resistance will be in the 530-540 range (20D EMA) post that, the stock could go to 600 where it will face a large supply zone. 480-500 is a support range and as long as the stock is above it, bias should remain positive.

HPCL

Hindustan Petroleum Corporation Ltd is mainly engaged in refining crude oil and marketing petroleum products, producing hydrocarbons, and providing services for managing E&P Blocks. The company posted a solid set of Q3 numbers. It reported a Profit After Tax (PAT) of ₹3,023 crores, a significant increase from ₹529 crores in Q3 of FY24.

HPCL’s Average Gross Refining Margin (GRM) was $6.01 per barrel, down from $8.49 per barrel in Q3 FY24, with core GRM at $6.89 per barrel compared to Singapore GRM of $5 per barrel. The company reported the highest-ever crude throughput at 18.53 million metric tons, operating at 106% of installed capacity, marking a 12.4% increase over the previous year.

HPCL is going through an aggressive capex cycle, the company is expecting new capacities to come in every quarter, HPCL recorded a market share gain of 0.36% in Q3 FY24, outperforming industry growth rates (8.2% for HPCL vs. 6.3% industry growth). Though there is under recovery in LPG, but co is hopeful of government consideration of subsidy allocation.

With crude prices remaining in range and the Russian oil deal, HPCL is looking at better upcoming quarters. After falling more than 20% from the top, the stock is a value buy for investors, this may be the reason mutual funds accumulated the stock.

After making a base in the 290-300 zone, the stock reversed direction and today closed above 20EMA which was at 325. RSI is indicating bullishness in the chart and the next resistance for the stock will be in the 347-355 zone, which is also the 50 and 200 EMA for it. Post that stock could rally to 410-430. The analysts that track HPCL have a “buy” call on the stock with a consensus target price of 450 in next 12 months suggesting more than 30% upside from current levels.

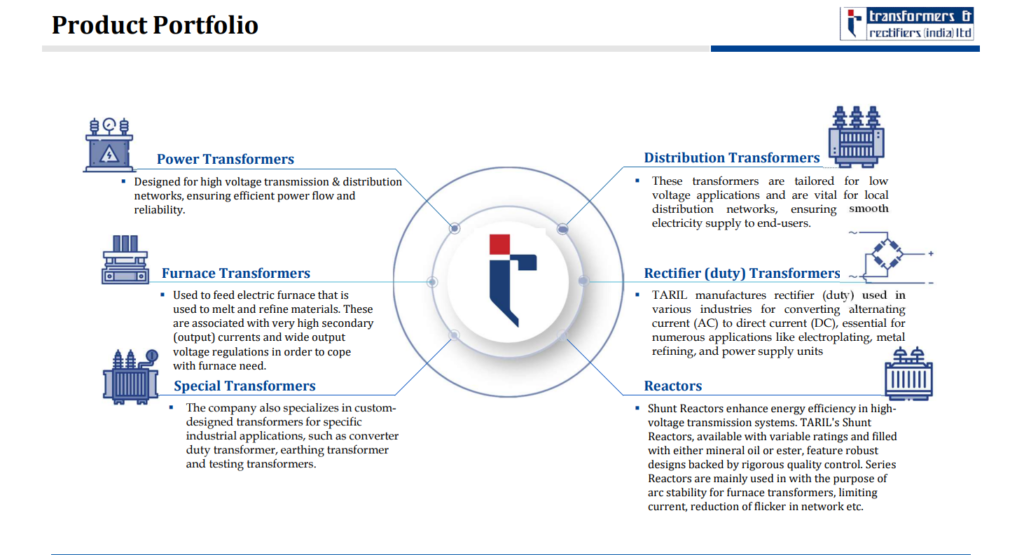

Transformers & Rectifiers India Ltd

Transformers and Rectifiers (India) manufactures Power, Furnace, and Rectifier Transformers. The company is a leading Indian manufacturer of transformers & reactors. Its product portfolio includes Single-phase power transformers up to 500MVA & 1200kV Class, Furnace Transformers, Rectifier & Distribution Transformers, Specialty Transformers, Series & Shunt Reactors, Mobile Sub Stations, Earthing Transformers, etc. It operates on a B2B model, catering to power generation, transmission, distribution, and industrial sectors.

Q3 FY25 was exceptional for the company as it presented a robust set of numbers, Q3 FY25 standalone revenue from operations stood at ₹545 crores, reflecting a year-on-year growth of 49%. EBITDA for the quarter was at ₹87 crores, a significant increase of 136% year-on-year, with an operational EBITDA margin of 15.69%.

Profit after tax (PAT) for Q3 was at ₹50 crores, showing a healthy YoY growth of 276%, with a PAT margin of 9.12%. The unexecuted order book as of December 31, 2024, stands at ₹3,686 crores, apart from that the company received 1,242 crores of orders in the last one month from domestic and export customers, these orders are to be executed in 12 to 18 months. The company is prioritizing high-margin orders with favorable payment terms.

The company recently acquired a controlling stake in the CRGO processing unit, achieving 100% backward integration, which is expected to reduce raw material costs by approximately 4%, further increasing the end margins. Capex project for a 15,000 MVA capacity expansion is on track, expected to be operational by February-March 2025, with order taking anticipated to start from Q1 FY26.

The revenue target for FY25 is set at ₹3,500 crores, with a goal of achieving $1 billion in revenue in the next 3-4 financial years. The company is optimistic about the green hydrogen transformers project, currently in the prototype phase, and aims to gain future market share in EHV transformers.

Despite the stock’s high P/E (currently at 83), it is a preferred pick for FIIs and DIIs, as both investors are raising their stakes in the company despite the ongoing correction in mid- and small-cap names. The reason is revenue visibility due to a strong order book, execution of orders, and continued improvement in end margins. With management’s target to achieve $1 billion in revenue in the next 3-4 years and a 10%+ PAT margin, the valuation is not a concern for growth hunting investors.

A breakout for Transformers and Rectifiers stock as it crossed all its important moving averages (20,50 and 200 EMA) in the last few trading sessions and now the 445-455 zone will work as a good support for the stock. With this breakout, the stock could go to 545-550 in the near timeframe and will face a minor resistance there. The stock should be in growth-seeking investor’s watchlist.

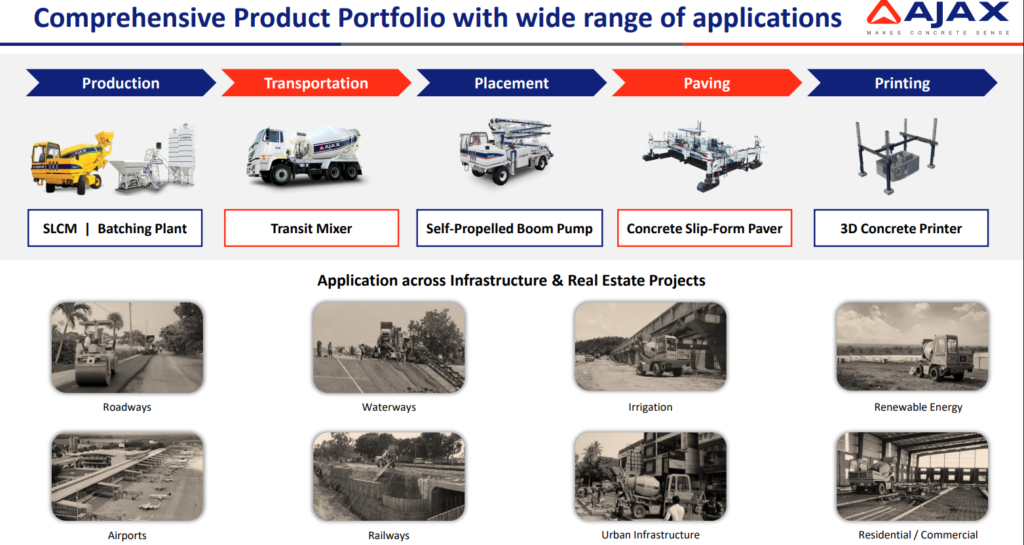

AJAX Engineering

AJAX Engineering Limited is a leading concrete equipment manufacturer headquartered in Bangalore with three assembly cum manufacturing facilities in Karnataka, India. The company Specializes in a comprehensive range of concrete equipment, services, and solutions across the application value chain.

AJAX commands a dominant market share of approximately 75% in the self-loading concrete mixer segment, contributing about 85% of total revenue and the company’s core market, mechanized concrete equipment in India is projected to grow from INR 6,100 crores in FY24 to INR 17,800 crores by FY29, indicating significant growth potential.

With the infra boom in India, Ajax stands to gain big with its large concrete mixer and other affiliates’ portfolios, while maintaining leadership in the SLCM market, it wants to strengthen capabilities in the non-SLCM business and expanding its international footprint by focusing on enhancing its non-SLCM product portfolio, which currently contributes 7-8% of total revenue.

In terms of business outlook, management projects robust growth in H2 of FY25 due to the government aggressively pushing capex after a brief slowdown due to elections and seasonality. The recent debutant on D-street, Ajax is gaining FII and DII investor’s attention as both of them added the stock for the first time in their portfolio.

Stock is available at an attractive valuation, combined with its growth prospectus, it is a ‘value’ bet of mutual funds. Due to being a recent entrant, very little trading data is available for the stock so there is nothing much on the charts. In its limited data, the stock has support in the 571-575 range but if broken, and if the stock falls below 565 (its listing price), it will be a negative development for it.

Conclusion

Mutual funds buying stocks can be a good indicator for common investors to start studying the stock but can not be the sole ground to make a ‘buy’ call. Investors should use this data to further research the stock and if it meets all their criteria, they could consider adding it by taking their IA’s advice.