Planning to invest a big amount in mutual funds, and how much it could grow over time?

The FinMinutes Mutual Fund Lumpsum Calculator helps you estimate the future value of your one-time investment by factoring in returns, inflation, taxes, and even periodic top-ups, just the way smart investors actually invest in real life.

Advanced Mutual Fund Lumpsum Calculator — Inflation, Tax, TER & Top-Ups

Estimate your lump-sum investment growth with realistic options: inflation, LTCG tax, expense ratio, and periodic top-ups till a chosen year.

Inputs

Enter top-up details. Example: ₹5,00,000 every 5 years till year 20. Leave amount as 0 to skip top-ups.

Year-by-Year Details

| Year | Invested | Nominal FV | Real FV | Post-tax FV |

|---|

Formula & Methodology (expand)

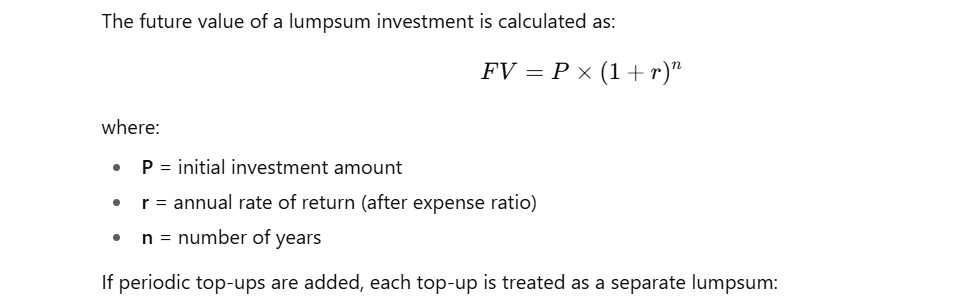

- Future Value: FV = Σ [Investment × (1 + r/n)^(n×t)] — each top-up compounds for its remaining years.

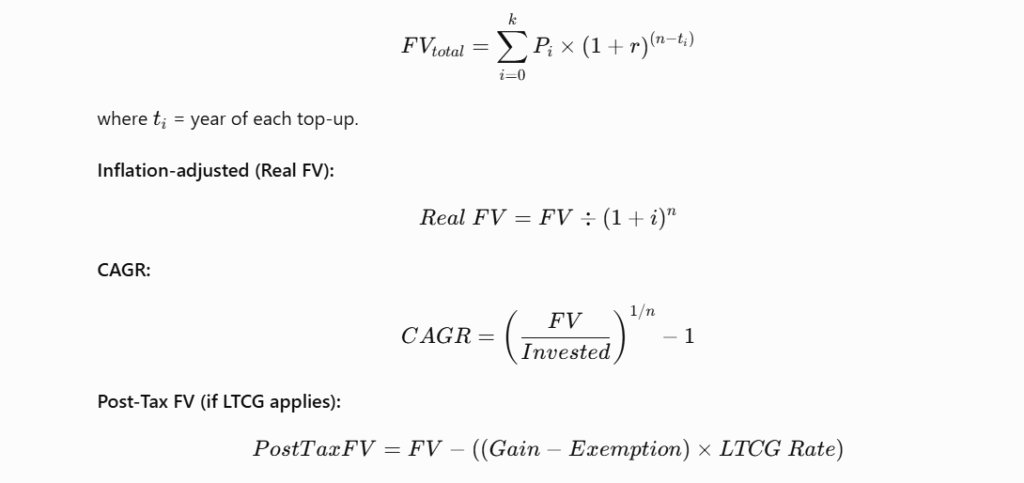

- Inflation Adjustment: Real FV = Nominal FV ÷ (1 + inflation)^years.

- LTCG Tax: Tax = max(0, Gain − exemption × years if harvesting) × tax rate.

- TER: Annual return reduced by TER before compounding (net = gross − TER).

- Top-Ups: Added periodically (every N years) until selected year.

Unlike most online calculators that stop at simple compounding, our advanced version gives you a complete picture, nominal vs real value, post-tax value, CAGR, and the impact of adding extra lumpsum amounts in future years.

What Is a Lumpsum Investment?

A lumpsum investment is when you invest a single large amount in one go, for example, ₹5,00,000 into a mutual fund today, instead of investing through monthly SIPs. It’s ideal for investors who:

- Receive bonuses, incentives, or inheritances,

- Have idle funds in savings or FDs, or

- Want to deploy profits or sale proceeds strategically.

While SIPs spread investments gradually, a lumpsum starts compounding right away, meaning your money begins working sooner.

What Is a Mutual Fund Lumpsum Calculator?

A mutual fund lumpsum calculator is a digital tool that projects how your investment will grow over a period, assuming a fixed rate of return. It helps you estimate:

- Future Value (FV) of your investment,

- Total gains,

- Inflation-adjusted (real) value, and

- Annualized return (CAGR).

The FinMinutes mutual fund lumpsum calculator goes beyond this; it includes tax and expense ratio, and offers an optional top-up feature that lets you model future one-time additions every few years — something almost no other platform currently offers.

Features of the FinMinutes Advanced Lumpsum Calculator

Our calculator is not just about mere numbers; it is about helping investors make realistic, data-driven decisions. Here is everything that our calculator offers:

One-Time Lumpsum Input

Start by entering your initial investment amount, say ₹5,00,000, and the investment period (e.g., 20 years). This is your base amount that compounds annually.

Periodic Top-Up Lumpsum (Optional)

This is the game-changer feature unique to FinMinutes. Investors can now simulate additional one-time investments every few years, for instance: Many investors who prefer to invest via lumpsum invest in a staggered way, one large amounts at start and some periodically every few years.

“I’ll invest ₹5 lakh now, and then another ₹5 lakh every 5 years.”

This reflects how real investors deploy bonuses, business profits, or asset sale proceeds over time.

Our calculator compounds each top-up separately, showing a more realistic corpus projection than a static lumpsum model.

Expected Return (p.a.)

Choose between Conservative (6%), Moderate (10%), Aggressive (14%), or a Custom rate.

This represents your mutual fund’s average annual growth rate (CAGR).

Pro Tip: Equity funds typically yield higher long-term returns, while debt or hybrid funds may fall into conservative or moderate categories.

Expense Ratio (TER)

Every mutual fund charges a Total Expense Ratio (TER) to manage your money. FinMinutes allows you to input this percentage (e.g., 1.0%), automatically adjusting your returns to reflect net gains after expenses.

Inflation Adjustment

Inflation eats away your returns. Our calculator lets you select a typical rate (3%–7%) or define a custom inflation value. This helps you see both:

- Nominal Future Value (FV): The corpus in absolute terms.

- Real Future Value (Inflation-Adjusted): The purchasing power of your corpus.

This distinction is crucial for long-term goals like retirement or education planning.

LTCG Tax Simulation

Post-2024, mutual fund capital gains are taxed at 12.5% above ₹1.25 lakh (for most equity funds).

The FinMinutes calculator automatically computes post-tax returns, showing your true take-home corpus. This is an optional but necessary feature to show you the true value of your money post-tax.

Year-by-Year Breakdown

A dynamic year-by-year table reveals:

- Total invested till that year

- Nominal and real FV

- Post-tax corpus (if applicable)

This helps investors visualize steady growth instead of a single lump figure at the end.

CAGR, Real CAGR & Post-Tax CAGR

Our calculator breaks down growth into three powerful metrics:

- CAGR (Nominal): Average annualized growth before inflation/tax.

- Real CAGR: CAGR after adjusting for inflation.

- Post-Tax CAGR: CAGR considering both inflation and tax impact.

This multi-angle insight lets you see your true effective return, not just on paper, but in purchasing power terms.

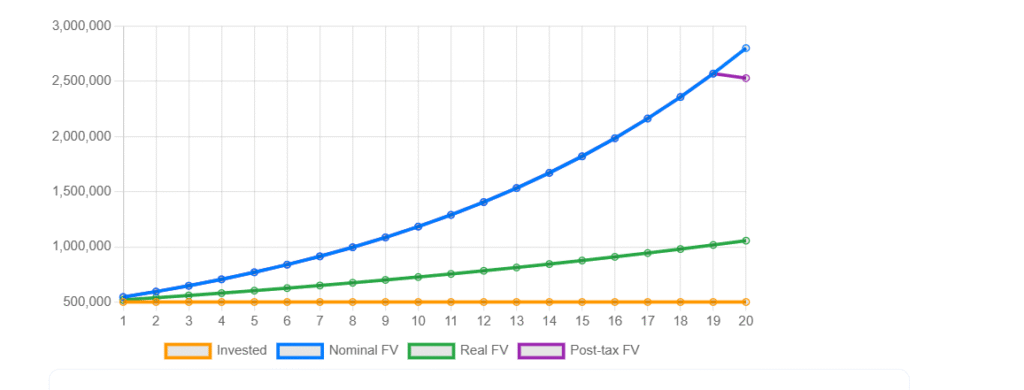

Interactive Charts & Visualization

A donut chart instantly shows your Invested vs Gain composition, while a line chart tracks the trajectory of invested, nominal, real, and post-tax values year by year. It’s clean, fast, and responsive, designed for both mobile and desktop users.

Expandable Formula & Transparency

FinMinutes calculators are built for transparency. Scroll down and you will find a collapsible section explaining the exact formulas used, including FV, CAGR, and inflation adjustments. You can even copy them for your own reference, a feature professionals love.

Formula Used in Mutual Fund Lumpsum Calculator

Example: Understanding with a Real Case

Let us say you invest ₹5,00,000 for 20 years, expect 10% returns, 5% inflation, and a 1% expense ratio. Now, you also decide to add ₹5,00,000 every 5 years (at years 5, 10, 15). By the end of 20 years:

- Total invested: ₹20,00,000

- Nominal FV: ₹67,27,000

- Real FV (inflation-adjusted): ₹25,25,000

- Post-tax FV: ₹64,80,000

- CAGR: ~10%

- Real CAGR: ~4.9%

This shows how even with inflation, your money doubles in real terms when invested wisely and periodically topped up.

Why You Should Use the FinMinutes Lumpsum Calculator

| Benefit | Description |

|---|---|

| Accurate & Transparent | Uses real mutual fund formulas — no hidden assumptions. |

| Advanced Inputs | Inflation, expense ratio, LTCG, and top-ups included. |

| Practical | Mirrors real-world investor behavior — not just textbook models. |

| Visual & Intuitive | Beautiful charts and breakdowns make it simple to interpret. |

| Future-Proof | Updated with post-2024 tax norms and inflation logic. |

Important Notes

- The calculator assumes constant annual returns; actual results may vary with market volatility.

- For equity mutual funds, long-term growth rates (10–12%) are reasonable, but not guaranteed.

- Inflation and tax rates may change in the future.

- This tool is for educational and planning purposes, not financial advice.

FAQs

What is the difference between SIP and a lump sum?

SIP (Systematic Investment Plan) invests monthly, spreading risk over time. Lumpsum is a one-time investment that starts compounding immediately.

Is it better to invest SIP or Lumpsum?

What is a Periodic Top-Up Lumpsum?

It’s when you add additional lumpsum investments at intervals, for example, every 5 years, to grow your corpus faster.

Can I invest lumpsum every year?

Yes! Mutual funds allow multiple one-time purchases. Each new investment buys units at that day’s NAV and compounds separately.

Does Finminutes’ mutual fund lumpsum calculator include tax?

Yes, it includes LTCG tax at 12.5% on gains exceeding ₹1.25 lakh per year, as per the latest norms.

How is Real FV different from Nominal FV?

Nominal FV is the absolute amount, while Real FV shows what that amount will be worth after inflation, i.e., its true purchasing power.

What is a good return rate to assume?

For long-term equity funds, assume 11–13%. For hybrid or debt funds, 7–8% is realistic.

Conclusion

The FinMinutes Mutual Fund Lumpsum Calculator isn’t just another financial tool; it’s a real-world investment simulator. It helps you understand the true value of your money by factoring in inflation, tax, and expense ratio, and uniquely lets you plan future top-ups for realistic growth modeling.

Whether you’re a first-time investor or an experienced professional planning structured wealth accumulation, this calculator ensures your financial planning stays transparent, data-driven, and goal-oriented.