One of the largest domestic pharma player Mankind Pharma IPO is about to open for subscription from April 25 till April 27, It has at a price band of 1026-1080. IPO is an entirely offer for sale(OFS) by promotors and existing shareholders. The OFS issue of 40 million equity share in looking to raise around INR4326 crore ($523m).

About the company

Incorporated in 1991, Mankind pharma is India’s fourth largest pharma company in terms of domestic sales and third largest in sales volume as of Dec 2022. They are engaged in developing, manufacturing and marketing a diverse range of pharmaceutical formulations across various acute and chronic therapeutic areas, several consumer healthcare products as well. with aim to provide quality products at affordable price, company operate 25 manufacturing facilities in six states across India. These manufacturing facilities have a total installed capacity of 42.05 billion units per anum across a wide range of dosage forms including tablets, capsules, syrups, vials, ampoules, blow fill real, soft and hard gels, eyedrops, creams, contraceptives and other otc products, as of Dec 2022.

About the IPO issue

The IPO backed by chrys capital and capital International is a completely offer for sale(ofs) of 40 million shares by promotors and shareholders. company has set a price band of 1026-1080, size of the IPO is approx. 4400crore. At upper price band of 1080 company is seeking a valuation of Rs 43,264 crore(5.27billion). company will not be getting any money from proceed as it is a complete ofs issue and money will go to selling shareholders. Issue will open for subscription on April 25 and close on April 27. Anchor bidding will start on April 24, equity shares will be credited on may 8 and stock will be listed on exchanges on may 9.

Company’s major products and market share

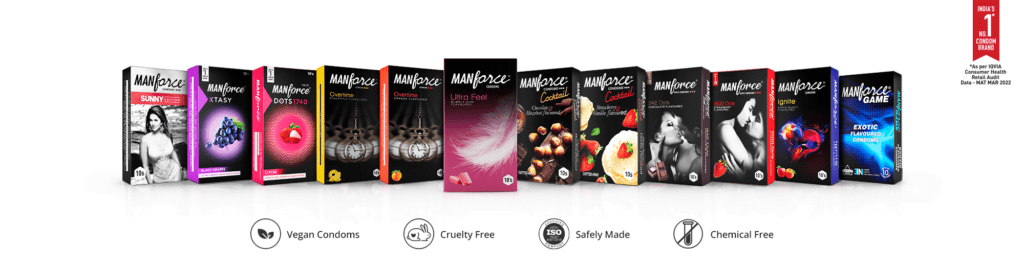

On the consumer side, company has many iconic brands. Manforce condoms one of the India’s highest selling condoms with 30+% market share, Prega news pregnancy test kit with 80% market share, Unwanted-72 contraceptive pill with 60% plus market share, Gas-o-fast a Mankind’s fast- relief stomach formulation is also doing good . Acne Star a face soap & gel acne treatment formulation is number two in this segment. Vitamin and minerals supplement brand Health OK is also making its presence felt in the given segment. Ring-out ointment used for ring worm elimination is another over the counter famous product from Man kind.

Mankind Pharma has a strong focus on domestic market, with revenue from operations in India accounting for 97.60 % of it’s total revenue in the financial year 2022. company has developed 36 brands in the pharma business and claims one of the largest network of medical representative in Indian pharmaceutical market.

Revenue and Financial

In Fy22, Mankind Pharma’s revenue from operations and net profit came in at Rs 7,781 crore and Rs 1,433 crore growing 25% and 13% year-on-year respectively with operating margins standing at 26 percent. The company has recorded consolidated profit at Rs 996 Crore for nine month period ended Dec fy23, a decline of 20% compared to year ago period due to higher employee cost and weak operating performance.

Consolidated revenue for the quarter grew by 10.6% yoy to Rs 6,697 Crore. On operating front, EBITDA(earnings before interest, tax, depreciation and amortization) dropped nearly 13 percent to Rs1,484 crore with margin falling 5.98% compared to corresponding period of last fiscal.

| Particulars | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar2022 | |

|---|---|---|---|---|---|---|

| Sales | 3,918 | 3,829 | 4,794 | 5,523 | 7,257 | |

| Expenses | 3,141 | 3,124 | 3,550 | 4,151 | 5,457 | |

| Operating Profit | 778 | 705 | 1,244 | 1,372 | 1,800 | |

| OPM % | 20% | 18% | 26% | 25% | 25% | |

| Other Income | 209 | 64 | 94 | 154 | 163 | |

| Interest | 18 | 40 | 11 | 8 | 44 | |

| Depreciation | 28 | 38 | 62 | 78 | 121 | |

| Profit before tax | 941 | 691 | 1,265 | 1,440 | 1,798 | |

| Tax % | 26% | 26% | 24% | 25% | 26% | |

| Net Profit | 694 | 514 | 958 | 1,084 | 1,335 |

Current Valuation

| PARTICULARS | VALUE |

|---|---|

| Upper Price Band | Rs 1080 |

| Existing Shares (Qty) | 40.05 Cr |

| EPS | Rs 35.78 |

| PE Ratio | 30.18x |

| Sector PE | 25.76x |

Future plan

Though company have great reach among consumers, exceptional research & development it plans to strengthen the market presence of it’s brands by going premium. company last year launched Manforce Epic brand in premium condom category. while asked for IPO being a complete offer for sale issue top management said company is almost debt free and have enough cash to fulfill business operational needs. management pointed out that it is looking for good opportunities through India centric acquisitions, recently company acquired formulation brand from Panacea Biotech for 1,872 crore, though valuation at which acquisition happened raised eyebrows but company see value coming from business in near future.

Company represents itself as ‘Bharat’ brand as its 97% sales is coming from India. It has a very robust domestic sales network and company want to consolidate it in future launches. Co’s Manforce Condom, Prega news and Unwanted 72 brand almost enjoy monopoly in the market and company plans to launch more products in same brand category in future to further strengthen it’s presence.

Important IPO Information

| Particulars | Details |

| IPO Size | 4,00,58,844 shares |

| Fresh Issue | – |

| Offer for Sale (OFS) | 4,00,58,844 shares |

| Opening date | April 25, 2023 |

| Closing date | April 25, 2023 |

| Face Value | ₹1 per share |

| Price Band | ₹1026 to ₹1080 per share |

| Lot Size | 13 Shares |

| Minimum Lot Size | 1 (₹14,040) |

| Maximum Lot Size | 14 (₹196,560) |

| Listing Date | May 8, 2023 |

| Grey Market Premium | 90rs as on 21st April 2023 |

Strength and Weakness

| 👍 strong brand and largest formulation business | 👎 Regulatory approvals from govts |

| 👍 16% sales CAGR(1.5 times domestic sales growth) | 👎 Govt can control price reducing operating margin |

| 👍 India centric business model so no fear of frequent USFDA inspections | 👎 operates in high competition segments |

| 👍Company is market leader in many products | |

| 👍 It has one of the largest distribution network in Indian market | |

| 👍 Experienced manage working aggressively to consolidate its market leader position | |

| 👍 Enough room to expand further |

Larger competitors are available at lesser valuation so it will be interesting to watch whether IPO sales through with full subscription from each segment. More details will be available once the brokers provide rating to the IPO.