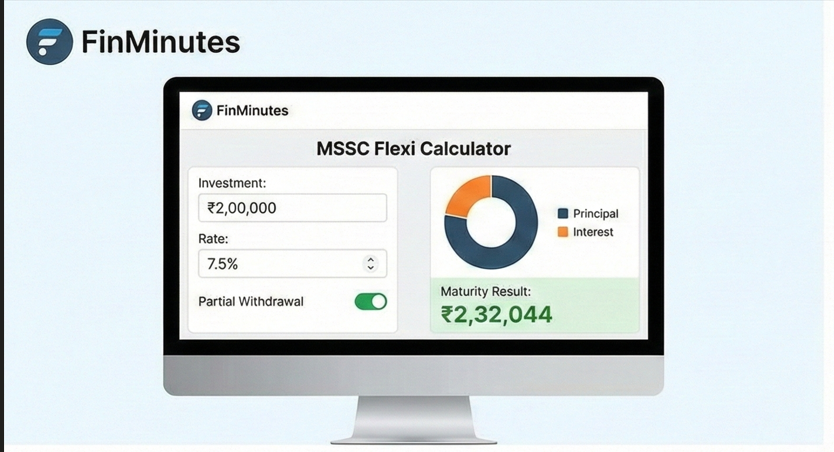

MSSC "Flexi" Calculator

Calculate 2-Year Maturity & Simulate Partial Withdrawals.

Max Limit: ₹2 Lakhs per account.

Compounded Quarterly.

Your MSSC Timeline

- Start Invest ₹2L

- After 1 Year Eligible for 40% Withdrawal

- End of Year 2 Maturity Payout

Using the Mahila Samman Savings Certificate Calculator for Optimal Returns

Empowering Women, One Interest Payment at a Time.

In the landscape of Indian small savings schemes, women have often been the silent savers, tucking cash into kitchen jars or low-interest savings accounts. In the 2023 Union Budget, the Government of India changed that narrative by launching the Mahila Samman Savings Certificate (MSSC).

Designed exclusively for women and girls, this scheme offers a compelling combination of safety (sovereign guarantee), high returns (7.5%), and short tenure (2 years). It bridges the gap between a regular savings account and a long-term lock-in like the PPF.

But here is the problem: calculating returns on MSSC isn’t straightforward. It involves quarterly compounding, and more importantly, a “Flexi” partial withdrawal option that changes your maturity value.

Welcome to the FinMinutes Mahila Samman Savings Certificate Calculator, the only tool designed to simulate real-world scenarios, including withdrawals, to show you exactly how much your money will grow.

Why Use the FinMinutes MSSC Calculator?

Most online MSSC calculators are simple “Compound Interest” machines. They take your principal, apply 7.5%, and show you a final number. But life isn’t that simple. What if you face a medical emergency after 1 year? What if you need to pay for your child’s tuition fees halfway through the tenure?

The MSSC scheme allows for a partial withdrawal of up to 40% of the balance after one year. This creates a complex calculation:

- Your money compounds for the first 4 quarters.

- You withdraw a chunk.

- The remaining balance compounds for the next 4 quarters.

Our tool handles this “split-timeline” math instantly. It visualises your investment journey, helping you plan your cash flows without the headache of spreadsheets.

Decoding the MSSC Scheme

The Mahila Samman Savings Certificate is a one-time small savings scheme backed by the Ministry of Finance. Here is the snapshot of the scheme at a glance:

| Feature | Details |

| Eligibility | Any woman (for herself) or a guardian (for a minor girl). |

| Tenure | 2 Years (Fixed). |

| Interest Rate | 7.5% per annum (Compounded Quarterly). |

| Investment Limits | Minimum: ₹1,000 |

| Safety | 100% Government Backed (Sovereign Guarantee). |

| Taxation | Interest is taxable as per your income slab. No TDS deduction (usually). |

Who is it for?

This MSSC scheme is ideal for:

- The Homemaker: Who wants to move savings from a 3% savings bank account to a 7.5% government scheme.

- The Student: Parents looking to park funds for short-term education goals (2 years).

- The Senior Citizen: Women looking for safer alternatives to risky corporate FDs.

The Mathematics of 7.5% (Quarterly Compounding)

You might see “7.5%” and think it’s a simple calculation. However, the magic of the MSSC scheme lies in Quarterly Compounding. Unlike a bank FD that might payout interest yearly or at maturity, MSSC adds the interest back to your principal every 3 months.

- Quarter 1: You earn interest on your initial deposit.

- Quarter 2: You earn interest on (Deposit + Q1 Interest).

- Quarter 3: You earn interest on (Deposit + Q1 + Q2 Interest).

The Result: The effective yield is actually higher than 7.5%. On a ₹2 Lakh investment, you don’t just earn ₹30,000 (simple interest); you earn roughly ₹32,044. That extra ₹2,000 is the power of compounding working for you.

The “Flexi” Feature: Partial Withdrawals Explained

This is the USP (Unique Selling Proposition) of the MSSC scheme, and the core feature of our MSSC calculator. The government understands that women often need liquidity for household emergencies. Unlike a 5-Year Tax Saver FD, where your money is locked tight, MSSC offers a window of liquidity.

The Rules of Withdrawal:

- Timing: You can only withdraw after 1 year from the date of account opening.

- Limit: You can withdraw up to 40% of the balance.

- Note: The “Balance” includes the principal plus the interest accrued in the first year.

- Frequency: This is a one-time facility.

Example Scenario:

- Start: You invest ₹2,00,000.

- Year 1 End: Your money grows to approx ₹2,15,578 (due to interest).

- The Need: You need money. You can withdraw 40% of ₹2,15,578 = ₹86,231.

- The Result: The remaining balance (~₹1.29 Lakhs) continues to earn 7.5% for the second year.

Our Mahila Samman Savings Certificate calculator automates this logic. Simply toggle the “Need money after 1 Year?” switch, and we will tell you the maximum amount you are allowed to take out.

MSSC Scheme vs Other Small Savings Schemes

Is MSSC the best option for you? Let’s compare it with the heavyweights: Sukanya Samriddhi Yojana (SSY) and Bank Fixed Deposits (FD).

| Feature | MSSC (Mahila Samman) | SSY (Sukanya Samriddhi) | Bank FD (Regular) |

| Who can open? | Any Woman/Girl | Girl Child (Below 10 Yrs) | Anyone |

| Interest Rate | 7.5% (Fixed) | ~8.0 – 8.2% (Variable) | 6 – 7.5% (Variable) |

| Tenure | 2 Years | 21 Years | Flexible (7 days to 10 yrs) |

| Liquidity | High (1-time withdrawal) | Low (Locked till age 18) | High (Penalty applies) |

| Max Investment | ₹2 Lakhs | ₹1.5 Lakhs/year | No Limit |

| Tax Benefit | No 80C Benefit | 80C Benefit Available | 5-Yr Tax Saver FD only |

Verdict:

- Choose SSY for long-term goals like your daughter’s marriage or higher education (10+ years horizon).

- Choose MSSC for short-term parking of funds (2 years) where you want better returns than a savings account but total safety.

Premature Closure: Breaking the Lock-in

Life is unpredictable. While the scheme is designed for 2 years, there are specific conditions under which you can close the account early.

1. Penalty-Free Closure

The account can be closed immediately without any penalty in the following tragic events:

- Death of the account holder.

- Extreme compassionate grounds (e.g., life-threatening disease of the account holder or guardian).

- Note: Documentation/Proof will be required by the Post Office or Bank.

2. Penalty-Based Closure

If you just want to close the account for personal reasons (and it doesn’t fall under the categories above), you can do so after 6 months.

- The Penalty: The interest rate will be reduced by 2%.

- Instead of 7.5%, you will be paid interest at 5.5% for the period the money was with the bank.

Taxation: The Elephant in the Room

How much of that ₹32,000 profit do you get to keep?

- TDS (Tax Deducted at Source): The government has clarified that no TDS will be deducted on interest earned from MSSC, provided the interest amount does not exceed ₹40,000 (standard FD limits). Since the max investment is ₹2 Lakhs, the interest (~₹32k) is usually below the TDS threshold.

- Income Tax: However, “No TDS” does not mean “Tax-Free.” The interest earned is added to your total annual income and taxed according to your slab.

- If you are in the 0% tax bracket, you keep the full 7.5%.

- If you are in the 30% tax bracket, your post-tax return drops to roughly 5.25%.

Pro Tip: If you are a homemaker with no other source of income, this scheme is effectively tax-free for you because your total income will likely be below the taxable limit (₹12 Lakhs under the New Regime).

How to Open an MSSC Account (Step-by-Step)

You cannot open this account online (yet). It follows the traditional Post Office/Bank route.

- Visit the Branch: Go to your nearest Post Office or any authorised Public Sector Bank (SBI, Canara, PNB, etc.) or select Private Banks (HDFC, ICICI).

- Form I: Ask for the “Account Opening Form – Form I” for Mahila Samman Savings Certificate.

- KYC Documents: Carry your Aadhaar Card and PAN Card.

- Photos: 2 Passport size photographs.

- Deposit: Fill out the deposit slip. You can pay via Cash (upto limits) or Cheque.

- Certificate: You will receive a physical passbook or certificate stating your Date of Opening, Principal Amount, and Maturity Date.

Mahila Samman Savings Certificate Calculator: FAQs

Can I open more than one MSSC account?

Yes! You can open multiple accounts, but the total investment across all accounts cannot exceed ₹2 Lakhs. Also, there must be a 3-month gap between opening an existing account and a new one.

Is the interest rate of 7.5% guaranteed for the full 2 years?

Yes. Once you open the account, the rate is locked in for the entire tenure. Future changes in government interest rates will not affect your existing certificate.

Can NRIs (Non-Resident Indians) invest in the MSSC Scheme?

No. The scheme is strictly for Resident Indian women only.

Can I invest in the name of my 5-year-old daughter?

Yes. A natural or legal guardian can open the account on behalf of a minor girl child.

What happens if I don’t withdraw the money after 2 years?

If you do not close the account on maturity, the account may stop earning the special 7.5% interest and might revert to the standard Savings Account rate (usually 4%). It is highly recommended to close or renew it promptly upon maturity.

Is this scheme available in private banks?

Yes, the government has authorised major private sector banks like HDFC Bank, ICICI Bank, Axis Bank, and IDBI Bank to open MSSC accounts, in addition to Post Offices and PSU banks.

How does the Mahila Samman Savings Certificate calculator handle the 3-month gap rule?

Our MSSC calculator focuses on the returns of a single account or your total cumulative investment limit (₹2L). It assumes the investment amount entered is deposited on Day 1.

The FinMinutes Verdict

The Mahila Samman Savings Certificate is a welcome addition to the financial toolkit for Indian women. While it doesn’t offer the inflation-beating returns of the stock market, it offers something equally valuable: Peace of Mind.

For the conservative investor, the risk-averse saver, or the family looking to park short-term funds for a specific goal, MSSC is a winner. Use our Flexi MSSC Calculator above to plan your investment, simulate a withdrawal if you foresee expenses, and take control of your financial journey today.