Use FinMinutes’ Lumpsum plus SIP calculator to calculate mutual fund returns for SIP or Lumpsum investments, compare both, and even understand the real (inflation-adjusted) value of your future corpus.

Lumpsum + SIP Calculator

Switch between SIP and Lumpsum mode to calculate future wealth, inflation-adjusted value, CAGR, and more with full transparency and charts.

Investment Inputs

Formula Behind the Calculator

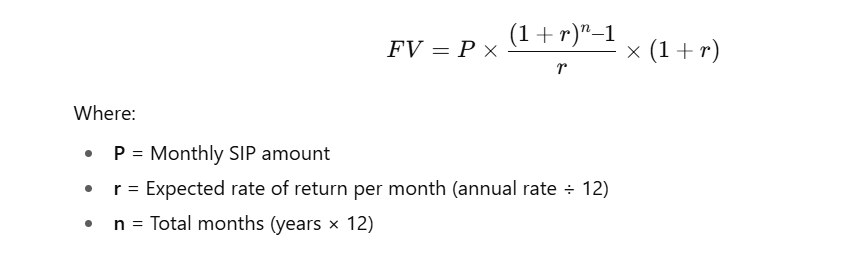

SIP Future Value: FV = P × [( (1 + r)^n – 1 ) / r ] × (1 + r)

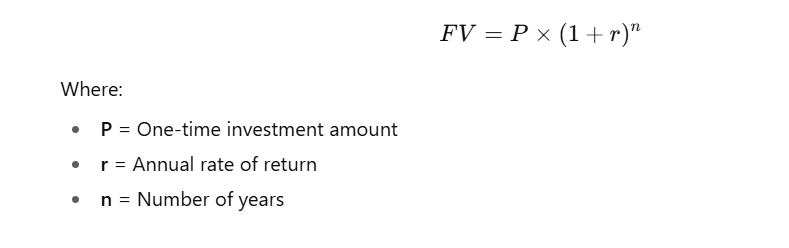

Lumpsum Future Value: FV = P × (1 + r)^n

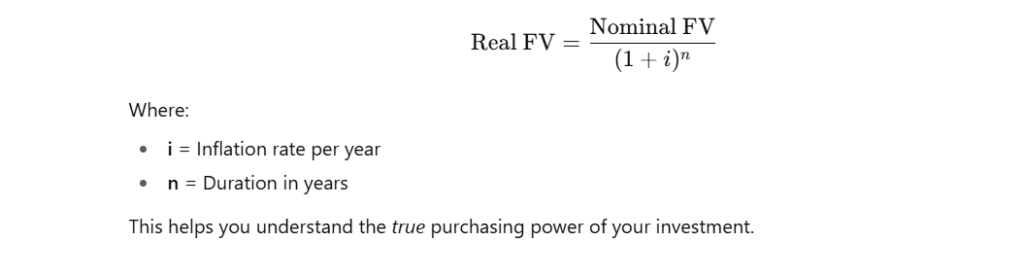

Inflation Adjusted (Real) FV: Real FV = Nominal FV ÷ (1 + Inflation)^Years

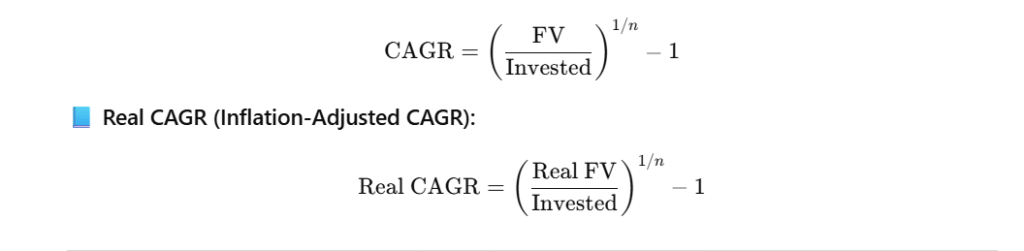

CAGR: CAGR = [(FV ÷ Invested)^(1 ÷ Years)] – 1

Real CAGR: CAGR (Real) = [(Real FV ÷ Invested)^(1 ÷ Years)] – 1

When it comes to mutual fund investing, most investors find themselves torn between SIP (Systematic Investment Plan) and lump sum investments. Both serve different financial goals, but what if you could compare or even combine them to plan smarter?

That’s exactly what our Lumpsum + SIP Calculator does. This smart tool helps you calculate mutual fund returns for SIP or Lump-sum investments, compare both, and even understand the real (inflation-adjusted) value of your future corpus.

What Is a Lumpsum plus SIP Calculator?

A Lumpsum plus SIP Calculator is a hybrid mutual fund return calculator that lets you estimate how much wealth your investments can grow into, whether you are investing a fixed amount monthly (SIP) or a one-time lump sum amount.

Unlike basic calculators, the FinMinutes Lumpsum plus SIP Calculator goes a step further by including:

- Inflation-adjusted values

- Real CAGR (after inflation)

- Step-up SIP option

- Visual charts to compare invested vs corpus value

- Comprehensive tooltips and formulas for complete clarity

This makes it ideal for both new and seasoned investors looking for a realistic understanding of future returns.

How to Use the Calculator

Our Lumpsum plus SIP calculator features a clean, mobile-friendly design that makes it easy to use. Here is how it works:

Step 1: Choose Investment Type

At the top, select between:

- SIP Mode– for monthly recurring investments

- Lumpsum Mode– for a one-time investment

The form changes automatically based on your selection.

Step 2: Enter Your Investment Details

For SIP Mode:

- Monthly SIP (₹) – your fixed monthly investment.

- Duration (Years) – how long you plan to invest.

- Expected Return (p.a.%) – choose from Conservative (8%), Moderate (12%), Aggressive (16%), or enter your custom return expectation rate.

- Annual Step-Up (%) – optional; increase your SIP every year as your income grows.

- Initial Lumpsum (optional) – one-time starting boost to your SIP.

- Inflation (p.a. %) – select typical inflation rate or customize.

For Lumpsum Mode:

- Investment Amount (₹)

- Duration (Years)

- Expected Return (p.a. %)

- Inflation (p.a. %)

Step 3: Get Instant Results

Click Calculate, and within seconds you will see:

- Total Invested Amount

- Nominal Future Value (without inflation)

- Real Value (after inflation adjustment)

- Gain (Profit earned)

- CAGR (Compounded Annual Growth Rate)

- Real CAGR (Inflation-adjusted CAGR)

The tool also shows:

- A donut chart comparing invested vs gain

- A line chart comparing invested, nominal FV, and real FV over time

Example: SIP vs Lumpsum Comparison

Let’s understand this with an example.

Example 1: SIP Investment

- Monthly SIP = ₹10,000

- Tenure = 15 years

- Expected Return = 12% p.a.

- Step-Up = 10% yearly

- Inflation = 6%

👉 Total Investment: ₹34.8 lakh

👉 Nominal Corpus: ₹61.2 lakh

👉 Real Value (after inflation): ₹28.5 lakh

👉 CAGR: 12%

👉 Real CAGR: 5.7%

Your SIP investment grows significantly, but after adjusting for inflation, the real purchasing power is what truly matters.

Example 2: Lumpsum Investment

- One-time investment = ₹5 lakh

- Tenure = 15 years

- Expected Return = 12%

- Inflation = 6%

👉 Corpus Value: ₹27.3 lakh

👉 Real Value: ₹12.7 lakh

👉 CAGR: 12%

👉 Real CAGR: 5.7%

A lump sum grows faster initially, but SIPs allow gradual, disciplined investing, helping you average market volatility.

Formula Behind the Calculator

The FinMinutes Lumpsum plus SIP Calculator follows standard mutual fund growth and inflation adjustment formulas used globally by financial analysts.

SIP Future Value Formula:

Lumpsum Future Value Formula:

Inflation-Adjusted (Real) Value:

CAGR (Compounded Annual Growth Rate):

Why Use FinMinutes’ Lumpsum plus SIP Calculator?

1. Dual Functionality

Unlike most calculators that focus on only SIP or Lumpsum, this tool gives you both — in one clean interface.

2. Inflation Adjustment

See real future values, not just nominal numbers. This helps set practical goals.

3. Step-Up Option

Model your income growth by increasing SIPs every year — just like real life.

4. Visual Charts

Get a clear, interactive view of how your investment grows over time.

5. Tooltip Guidance

Each field includes simple explanations to make investing concepts beginner-friendly.

6. Formula Transparency

Every formula used is shown and explained for full trust and SEO clarity.

| Feature | Benefit |

|---|---|

| Dual Mode (SIP + Lumpsum) | Versatility in one tool |

| Inflation Adjustment | Shows true wealth |

| Step-Up SIP Option | Models salary growth |

| Real CAGR | Realistic performance measure |

| Charts & Visuals | Easy to interpret |

| Formula Transparency | Builds user trust & SEO advantage |

FAQs

What is a Lumpsum plus SIP calculator?

It is a mutual fund calculator that allows you to estimate returns for either SIP or one-time Lumpsum investments, and even compare both modes in one place.

Can I use both SIP and lump sum together?

Yes, in SIP mode, you can optionally add an initial lumpsum investment. This simulates real-life cases where investors invest a large amount initially and continue with monthly SIPs.

How is inflation considered in this calculator?

The calculator adjusts your corpus using your chosen inflation rate. This helps you see the real purchasing power of your future returns.

What is the difference between Nominal and Real CAGR?

Nominal CAGR shows total compounded growth. Real CAGR removes inflation to show actual wealth growth. For example, if your investment CAGR is 12% and inflation is 6%, your real CAGR is around 5.7%.

Is the Step-Up feature important?

Yes. It reflects how most people invest, gradually increasing SIPs as their salary rises. Step-up SIPs can dramatically increase long-term wealth creation.

How accurate are the results?

All calculations use the standard compound interest formula and real-world logic. However, actual mutual fund returns may vary depending on market performance.

Can FinMinutes’ Lumpsum plus SIP calculator help me plan financial goals?

Absolutely. You can use it to plan:

– Retirement corpus

– Education fund

– Home purchase

– Wealth creation targets

By adjusting inflation and return assumptions, you get realistic goal estimates.

Conclusion

The FinMinutes Lumpsum plus SIP Calculator is not just another return calculator; it is a complete investment planning tool. It empowers you to plan realistically by showing both nominal and inflation-adjusted returns, step-up projections, and real CAGR.

Whether you are a first-time investor planning your SIP journey or a seasoned investor comparing Lumpsum vs SIP strategies, this calculator helps you take informed, confident decisions. Start using it today, and make your mutual fund investing smarter, not harder.