• The parent company of popular online travel agencies Ixigo, AbhiBus, and Confirm Ticket came out with its public issue on June 10, and the issue has received a decent response from the investors. IPO is subscribed 1.95 times on its first day 1 of subscription. The Rs 740-crore IPO attracted bids for 8,51,54,349 shares, much higher than the 4,37,69,494 shares available, as per data from the NSE.

• The retail individual investors’ segment was subscribed 6.17 times, while the non-institutional investors category saw a subscription rate of 2.78 times. The portion allocated for qualified institutional buyers (QIBs) received only 12% subscription (least among all category).

While there are other listed Peers available in same category, does Le travenues offer some solid differentiators to attract investors, let’s analyze.

Le Travenues Ixigo: A little about the company

Le travenues is a technology company focused on empowering Indian travelers to plan, book and manage their trips across rail, air, buses and hotels. They assist travelers in making smarter travel decisions by leveraging artificial intelligence, machine learning and data science led innovations on their OTA platforms, comprising websites and mobile applications. Company’s vision is to become the most customer-centric travel company, by offering the best customer experience to its users.

Company’s focus on travel utility and customer experience for travelers in the ‘next billion user’ market segment is driven by technology, cost-efficiency and culture innovation. Its OTA platforms allow travelers to book train, flight, bus tickets and hotels, while providing travel utility tools and services developed using in-house proprietary algorithms and crowd-sourced information, including train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions.

It also provides add on services such as alternate route or mode planning, flight status updates, automated web check-in, bus running status, pricing and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, AI-based travel itinerary planner and automated customer support services.

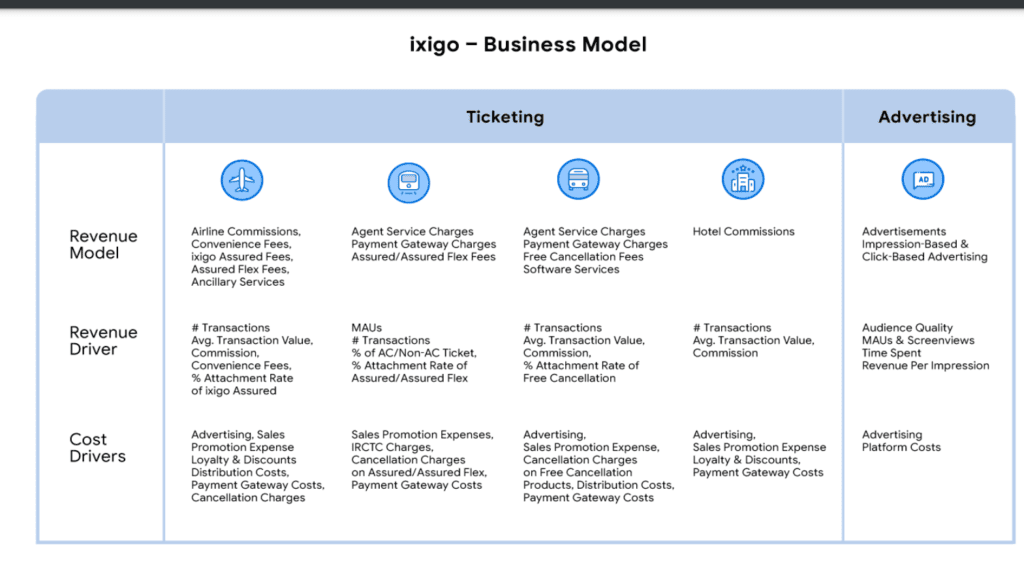

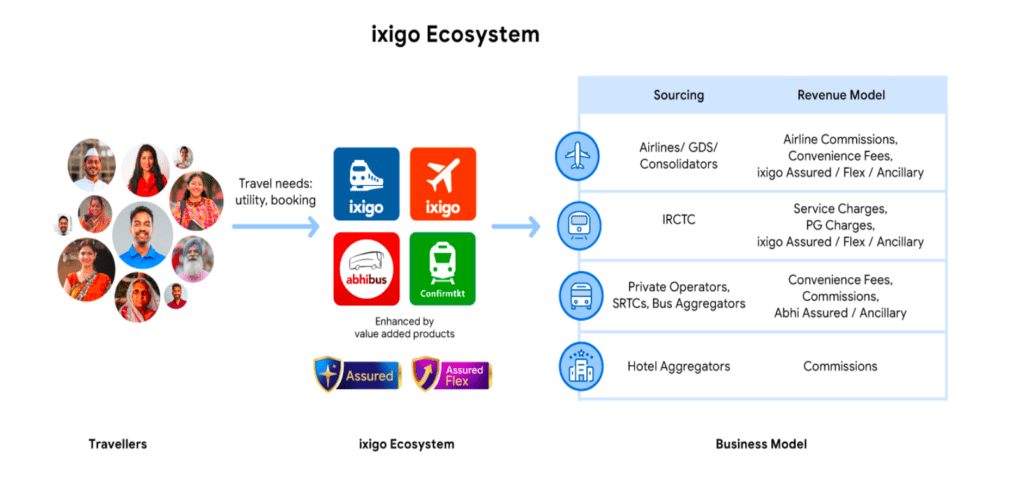

Ixigo’s business model and how it drives its revenue

Travel and OTA industry outlook

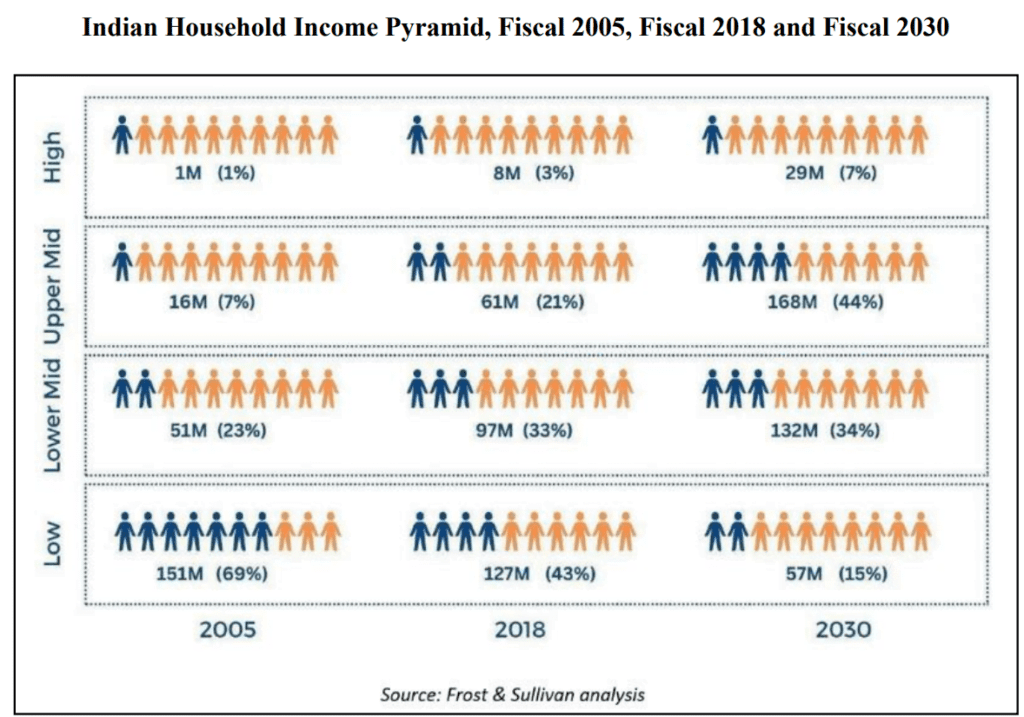

Overall economic growth of the country, rising numbers of HNIs, higher and lower middle class, rising per capita income and further penetration of internet, rise in number of smartphones, 5G, online payment and UPI etc giving birth to a new class of Next Billion Internet Users (“NBUs”), The NBUs are a highly anticipated consumer class that will determine the direction of consumption in many internet-based industries. It is an existing as well as anticipated market of “new to Internet” users that includes all non-Tier I market demand i.e., all travel demand originating from and/or concluding in Tier II, III and rural areas.

The nomenclature ‘next’ indicates the non-metro market as the ‘next’ frontier of demand, where a majority of incremental internet users & potential ecommerce transactions are likely to emanate. For the next 5 years, it is expected that 20% of NBUs will come from Tier I cities, and a substantial 50% to come from Tier II, Tier III, and significantly, the rest of 30% will come from rural India.

Indian Travel Industry Growth

The travel industry has been the beneficiary of direct government policies to increase both domestic and inbound travel to India. Government policy is also active in all segments of air, road, and rail to move the masses across the country in the most efficient manner. This is evidenced by the number of roads and airports built, which indicate that the policy may be skewed towards such development to provide more tangible and immediate returns on investment. While this is harder in railway creation given the already saturated nature of Indian railways, the marginal incremental benefit of increased investments is being harnessed through policy actions.

Govt schemes such as UDAN, Swadesh Darshan, Pilgrimage Rejuvenation and Spiritual Heritage Augmentation Drive (PRASAD Scheme), Foreign direct investment (FDI), where government allowed 100% of FDI to motivate investments in construction projects for hotels, resorts, city, and state infrastructure. Visa-on-Arrival and Visa-Free facilities, according to the Henley Passport Index, about 60 countries now offer Visa-on-Arrival and Visa-Free facilities to Indian passport holders as of March 2023.

According to the World Travel & Tourism Council (“WTTC”), Indian travel and tourism spending was ₹ 16.5 trillion in Fiscal 2023 with an equally high contribution to GDP at 9.7% of GDP as of Fiscal 2023, and this contribution is expected to grow strongly in the forecast period. This includes not just transportation and accommodation spending but also spending on culture, sports, recreational spending, on entertainment, retail trade and food and beverage amongst others by residents as well as visitor exports.

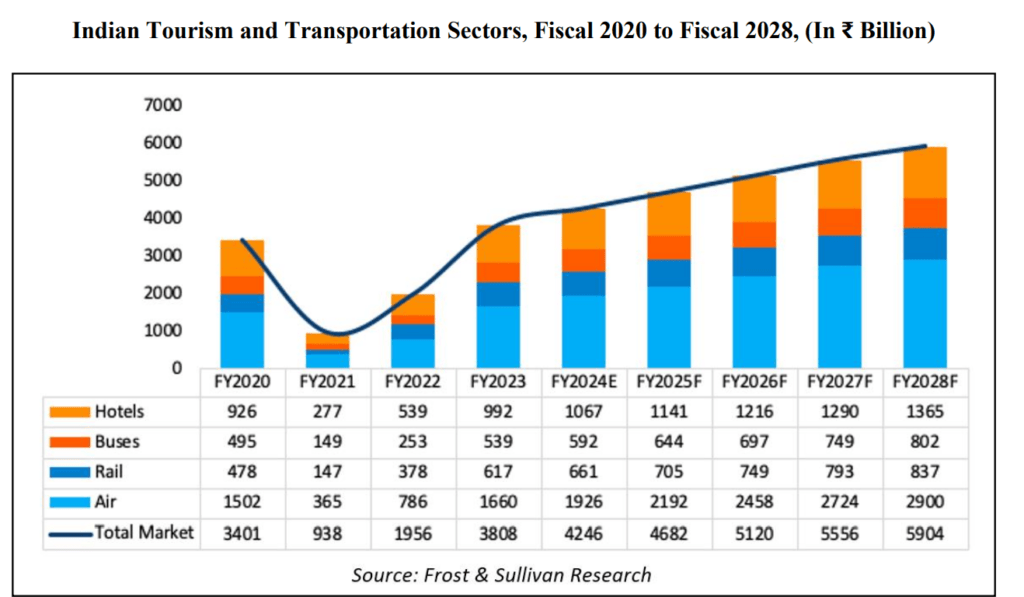

The Indian travel and tourism market for air, road, air and hotels accounts to around ₹ 3,808 billion and this is expected to grow to ₹ 5,904 billion in Fiscal 2028. The overall travel market is expected to grow at a CAGR of 9% powered by growth in domestic appetite for travel from young and middle India.

Ixigo’s OTA business and outlook

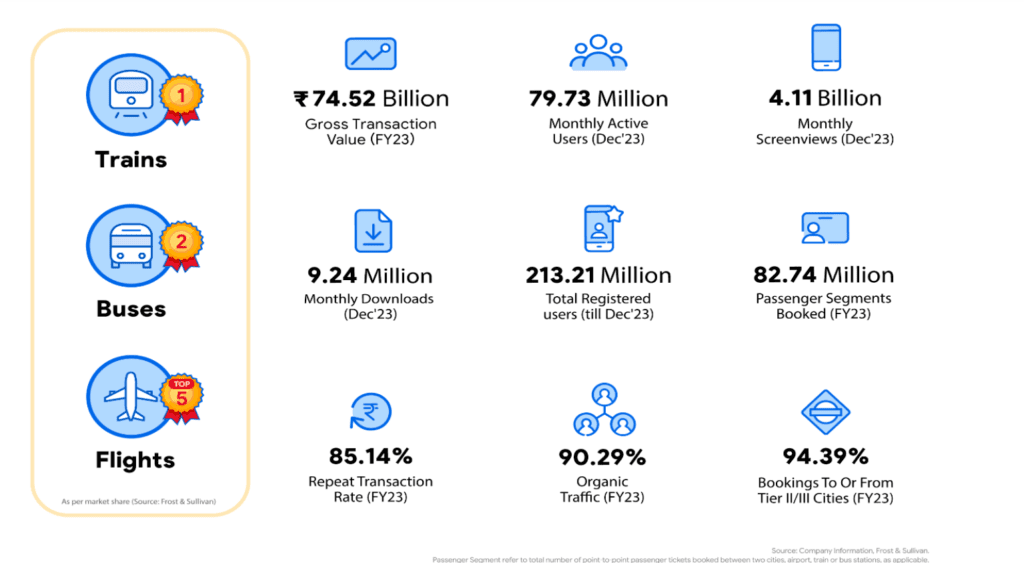

Le travenues- Ixigo is the the largest Indian train ticket distributor in the OTA rail market and it had the largest market share of around 51%, in terms of rail bookings, among OTAs, as of March 31, 2023 (market share in this segment rose to 52.4% in the first half of Fiscal 2024). Company’s bus-focused app, AbhiBus, was the second largest bus-ticketing OTA in India, with a 11.5% market share in online bus ticket bookings in Fiscal 2023 which increased further to 12.5% in the first half of Fiscal 2024.

Ixigo air had a market share in India of nearly 5.2% of the total airline OTA market by volume in the first half of Fiscal 2024 up from 3.3% in Fiscal 2023. Ixigo have the highest app usage among OTAs with 83 million Monthly Active Users cumulatively across our apps, as per data.ai in September 2023.

Ixigo Financials, strengths and growth strategy

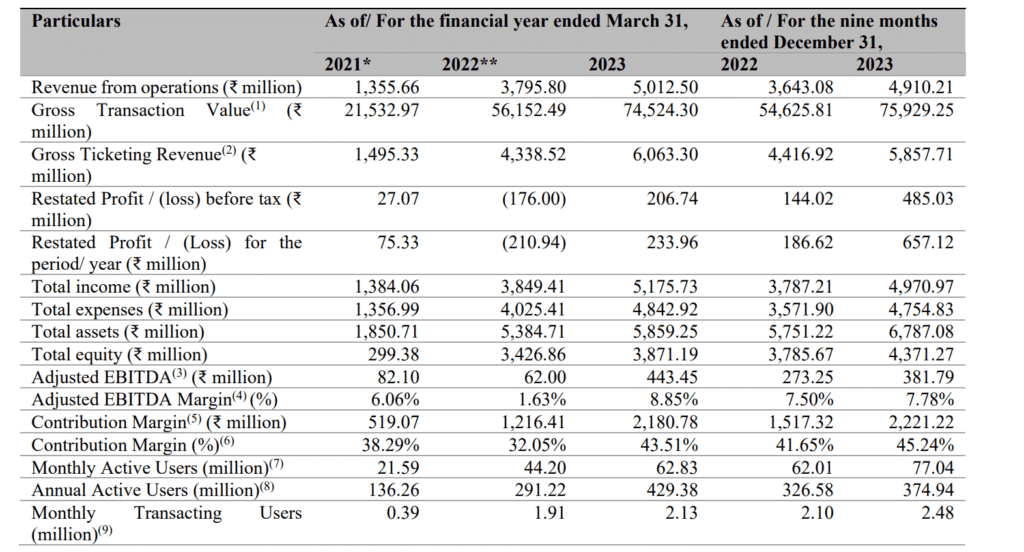

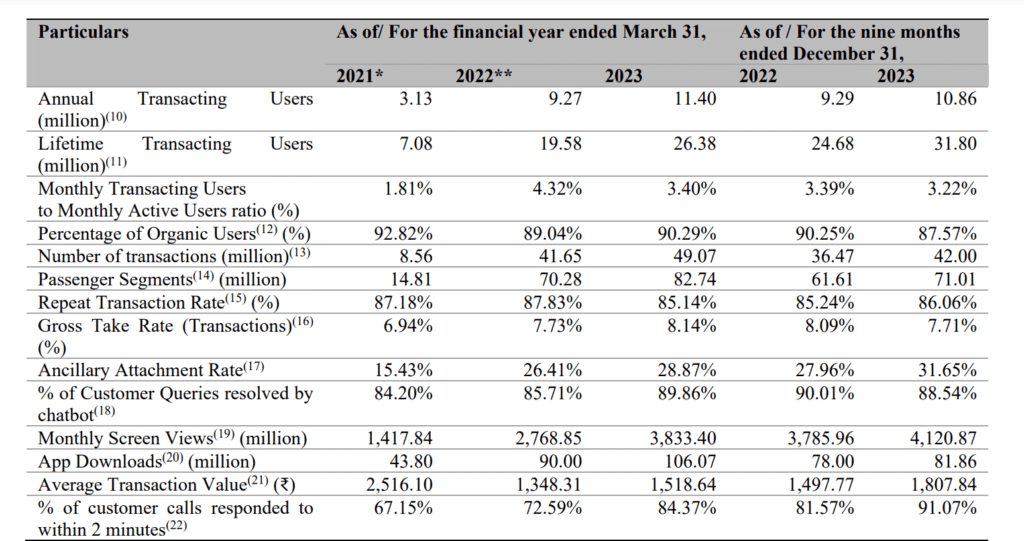

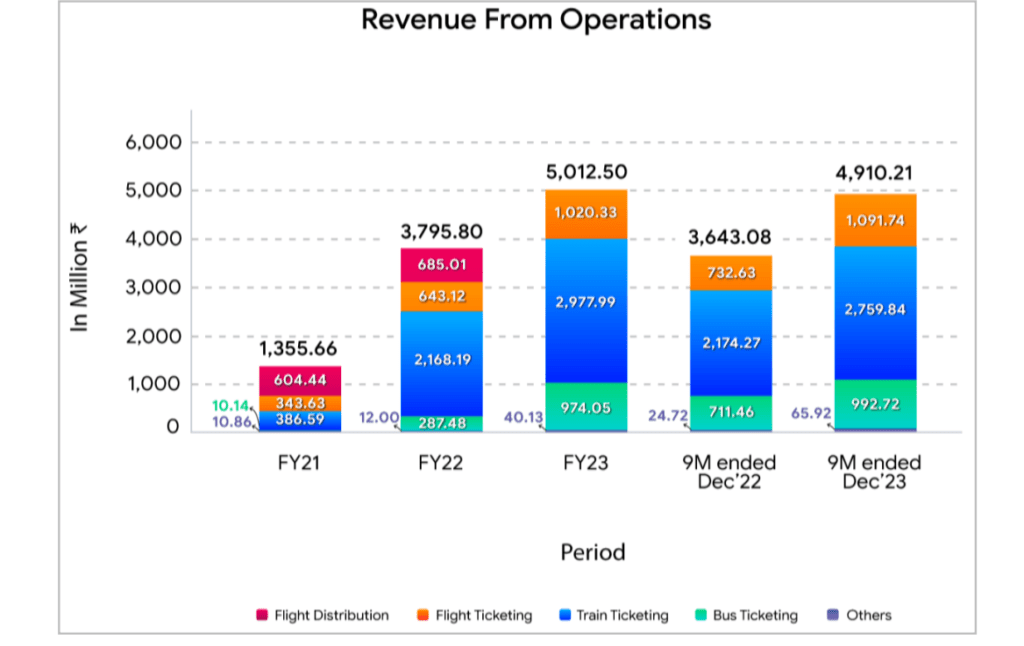

Company’s revenue from operations have grown at a CAGR of 92.29% between Fiscal 2021 and Fiscal 2023, and its revenue from operations were ₹ 1,35.66 cr, ₹ 3,79.58 cr and ₹ 5,01.25 cr in Fiscals 2021, 2022 and 2023, respectively, while revenue from operations were ₹ 3,64.3 cr and ₹ 4,91.0 cr in the nine months ended December 31, 2022 and December 31, 2023, respectively. Company’s restated profit before tax was ₹ 2.71cr in Fiscal 2021, while restated loss before tax was ₹ 17.6 cr in Fiscal 2022.

Ixigo again became profitable in 2023 as its restated profit before tax was ₹20.68 cr in Fiscal 2023. Its restated profit before tax was ₹ 14.4 cr and ₹ 48.5 cr in the nine months ended December 31, 2022 and December 31, 2023, respectively.

Apart from fast growing Financials, company also enjoys the support of a experienced and expert management team. Ixigo management’s domain experience, industry relationships, and experience in identifying, evaluating and leveraging organic and inorganic growth opportunities enables them to grow organically and through strategic acquisitions and partnerships that complement or expand its existing operations.

• Le travenues apps be it, Ixigo flight, Ixigo train, Confirm tkt, Abhibus all are very well crated and enjoy superior customer ratings and are well positioned to capture ‘next billion user’ market. Ixigo uses Artificial intelligence (“AI”) and technology driven operations to smoothen its operations.

• Company’s diversified nature of business operations are another key positive factor. Ixigo drives its revenue from segments such as train, bus, flights, hotels, VAPs etc and slow down in any of these can be compensated by others. Apart from this company benefits from providing all means of travel options under one brand driving synergy among them.

In next phase strategy to drive growth, Ixigo plans to deepen penetration and enhance its offerings for the ‘next billion user’ market segment. It also plans to increase monetization through cross-selling and up-selling, company intends to increase the scope of its Value-Added services and the breadth of embedded finance products beyond ixigo Assured and ixigo Assured Flex to new proprietary services relying on data-science that can offer enhanced flexibility and value added services across our train, flight, bus and hotel bookers.

Ixigo valuation and comparison with peers

At the upper price band of ₹93, the IPO is priced at a p/e of 160 times (significant premium to industry peers). There were one-time exceptional items of 29cr and deferred tax benefits of ₹17cr in the nine months of FY-2024, so the EPS numbers are not comparable. Even if the company does an EPS of ₹1.3 in FY-25, it will be priced at 70 p/e (expensive to peers). Its closest listed peer, Ease my trip, is priced at a p/e of 60x (FY24 earnings). There are no other major risks to the business apart from general macro risks, but ‘valuation’ and fluctuating Financials warrant caution.

Apart from premium valuation, Ixigo’s high-margin business, like hotel and flights, is just in the nascent stage, and it will be good to wait for some time to see how well they’re shaping up for the company. Ixigo’s business model is solid with immense growth potential, but my view is that better opportunities will be there post-listing. Investors with ‘very high’ risk appetite can bid for the issue in small lots, keeping the risk in mind. Ixigo’s Grey market premium (GMP) of 20-23% gain on debut should not be taken at face value to apply to the issue.