• IPO of JNK India was open for subscription from April 23 to April 25, the 649cr issue had received good response from investors as the issue was subscribed 28x, in which QIB quota was booked 75x, Retail quota was booked 23x and NII quota was booked 4x.

• Heating equipment maker JNK India had raised ₹194.8cr from institutional investors on April 22, marquee institutional investors like Goldman Sachs, Allianz Global Investors Fund, Natixis International Funds, Kotak Mutual Fund, HDFC Mutual Fund, Nippon Life India, Mirae, DSP Mutual Fund, Edelweiss Trusteeship, LIC Mutual Fund, Bajaj Allianz Life Insurance Company and Aditya Birla Sun Life Insurance Company had invested in the company via anchor book. The pedigree of such anchor investors increase confidence in the company.

• The issue was a mix of fresh issuance of equity shares worth ₹300cr, and an offer-for-sale (OFS) of 84.21 lakh equity shares by the existing shareholders, for which the price band was kept at ₹395-415 per share.

• The company said it will spend ₹262.69 crore out of the net fresh issue proceeds on its working capital requirements, and the remaining on general corporate purposes. Lets take a deep dive on company’s business, Financials and other key details and on why it can fill the gap in your portfolio for energy ancillary company and an idle bet for India’s growing energy needs.

JNK India, a little about the company

JNK India is one of the leading Heating Equipment companies in India in terms of new order booking between Fiscal 2021 to Fiscal 2023 and have capabilities in thermal designing, engineering, manufacturing, supplying, installing and commissioning process fired heaters, reformers and cracking furnaces. The company is one of the well-recognized process fired heater companies in India, having a market share of approximately 27% in the Indian Heating Equipment market, in terms of new order booking in Fiscal 2023.

A process fired heater is a type of industrial heater used to heat fluids or gases directly by burning a fuel source such as natural gas or propane. Reformers are devices used to convert hydrocarbons, such as natural gas or naphtha, into synthesis gas or syngas, which is a mixture of hydrogen and carbon monoxide. Further, cracking furnaces are used to break down large hydrocarbon molecules into smaller ones, which can then be used to produce a variety of products, including fuels, chemicals, and plastics.

The process of breaking down hydrocarbons is known as cracking, and it typically involves heating the hydrocarbon feedstock in the presence of a catalyst. The process fired heaters, reformers and cracking furnaces (together, the “Heating Equipment”) are required in process industries such as oil and gas refineries, petrochemicals, fertilizers, hydrogen and methanol plants etc.

JNK India’s business model involves collaboration with Customers right from the initial consultation, specification and design stage to the final installation of the Heating Equipment. In terms of customers NNK India Some of domestic Customers include Indian Oil Corporation Limited, Tata Projects Limited, Rashtriya Chemicals & Fertilizers Limited and Numaligarh Refinery Limited.

JNK India’s unique operations, entry barrier and competitions

Heating equipment such as process fired heaters and reformers are used in a typical refinery and are also an effective and efficient heating solution for a wide range of industrial applications, but proper design, installation, and operation are critical to ensure safe and reliable performance. Around 10 – 20 process fired heaters are used in any typical refinery. Of all the process fired heaters, four applications such as the crude distillation unit (“CDU”), vacuum distillation unit (“VDU”), delayed coker unit and catalytic reforming units are the most critical and the capex for these heaters is also high when compared with the other heater application areas in the refinery.

Apart from refineries various Heating Equipment such as process fired heaters, reformers and cracking furnaces are used in a petrochemical plant as well. Reformers and cracking furnaces are the most critical equipment in a petrochemical plant. Process fired heaters and reformers are also used primarily in the ammonia plant of an integrated urea plant. Reformers are the most critical equipment in an ammonia plant. Reformers are used in ammonia production, which is later converted into urea.

With emission control norms getting stricter, JNK India have diversified into flares and incinerators

systems as well. Flare systems are important safety devices used in refinery and petrochemical facilities to burn excess hydrocarbon gases which cannot be removed or recycled. Flare system is a gas combustion device used in industrial plants such as petroleum refineries, chemical plants, natural gas processing plants, at oil or gas production sites with oil wells, gas wells, offshore oil and gas rigs, and landfills. Flare systems provide for the safe disposal of gaseous wastes.

JNK India is also working on building capabilities in renewable sector with green hydrogen. They are building capabilities in renewable sector with onsite hydrogen production, hydrogen fuel stations and solar photovoltaic –EPC (“Solar PV-EPC”) which forms part of green hydrogen value chain.

JNK India Financials and other key details

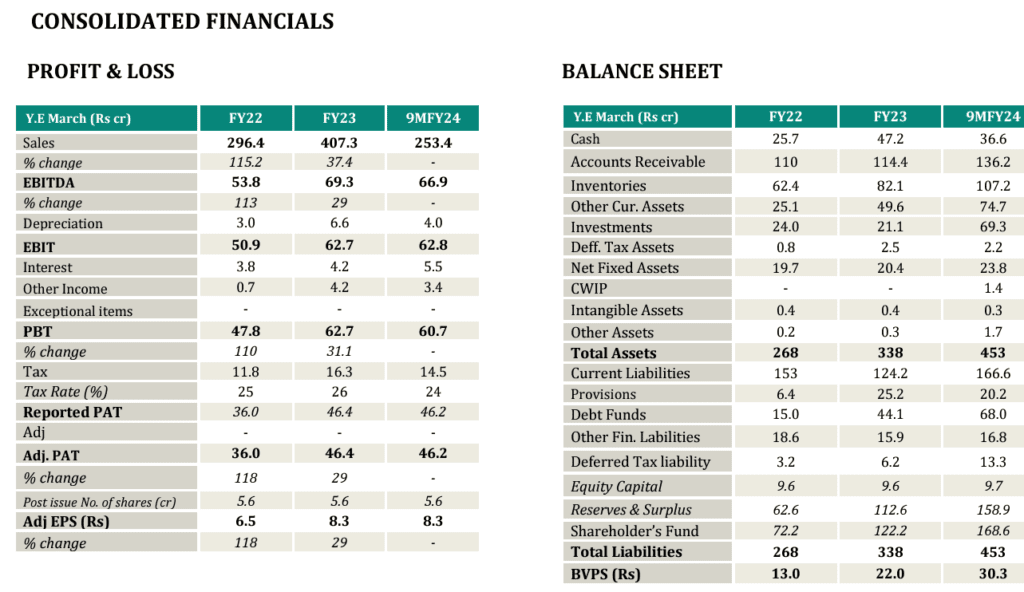

For the fiscals 2021 to 2023, JNK India’s revenue from operations, EBITDA and profit after tax had grown at a CAGR of 71.97%, 68.09% and 67.75%, respectively, demonstrating growth in our financial performance in recent years

JNK India’s positioning is strong to capture industry tailwinds through demonstrated capabilities over time. Growing demand for transportation fuels and petrochemical feedstock are the primary growth enablers of the Indian refinery industry. There are 18 refinery projects expected to be commissioned by Fiscal 2031 with a cumulative capacity of 124.0 MMTPA. Further, with the progressive GDP growth, the petrochemical products demand is expected to grow significantly over medium to long-term. Driven by increased domestic consumption and global demand.

So, there are 15 petrochemical projects expected to be commissioned by Fiscal 2031 with a cumulative capacity of 23.0 MMTPA. Similarly, given that urea is the major fertilizer used in India and accounts for about 60% of the total fertilizer consumption in India. Local production of urea is not able to meet the domestic demand and about 30% of the demand is met through imports. There are about four urea projects expected to be commissioned by Fiscal 2026 to meet the growing demand.

In overseas market where JNK India operates, there are 52 refinery projects that are likely to be commissioned between calendar year 2025 and calendar year 2030, with an installed capacity of these projects being 510.9 MMTPA and an estimated capital expenditure of USD $ 186 billion. Further, considering a two-year lag between equipment ordering and project commissioning, these projects will generate demand for Heating Equipment between calendar year 2023 and calendar year 2028.

The Heating Equipment account for 3.3% of the total capital expenditure of a refinery project, hence, demand for Heating Equipment from the refineries in between calendar year 2023 and calendar year 2028

would be ₹490,450 million which is approximately ₹81,750 million on annualized basis. This potential is based on the projects announced till date and may go up if more projects are announced in the coming years.

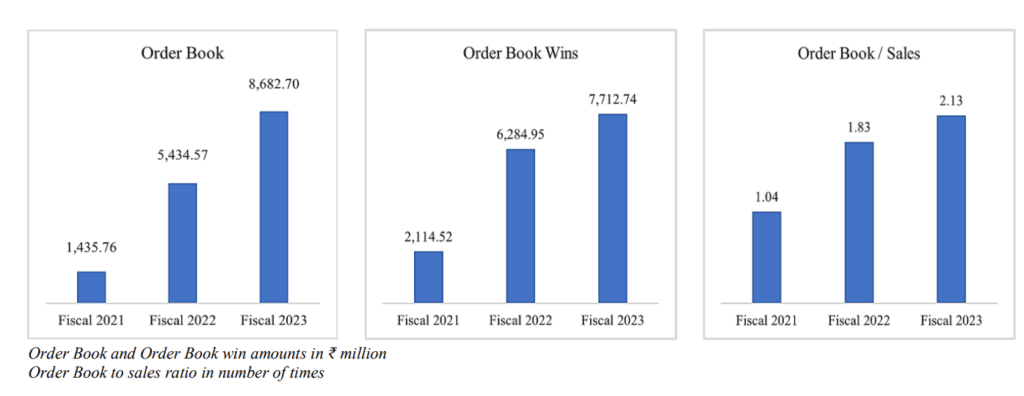

In terms of companies order book significant boost came post 2022 as the sizing was the the issue earlier and now this issue stands resolved and company is betting on larger orders. Our take is company will have ₹800-1,000cr of order per year from domestic market for next 5 years and approx ₹800-900cr oder from international market, for a company earning ₹350-400cr annually it will be a significant boost.

JNK India IPO: Valuation and peer comparisons

| Company | Mcap(cr) | EBITDA(%) | ROE(%) | Mcap/Sales (x) | P/E(x) | EV/EBITDA(x) | P/BV(x) | CMP |

| JNK India | 3,559 | 17 | 38 | 5.7 | 56 | 34 | 19 | 638 |

| THERMAX | 56,841 | 3.2 | 1.8 | 4 | 110 | 32 | 3.3 | 4,731 |

| BHEL India | 1,06,121 | 7.5 | 12.2 | 7.1 | 199 | 42.1 | 14.8 | 304 |

It can be concluded from above table that JNK India is fetching far superior margin compared to Peers due to its asset light model. JNK India manufacture its product in a way that it requires less cost and they are known to complete the project in a very efficient way. Still the stock is cheapest among Peers and available at 56x P/E(FY-24-E). With the kind of revenue visibility JNK India is a lucrative play to have. India’s energy needs are growing significantly, with JNK venturing into green energy equipment, the orderbook is poised to grow.

Apart from Financials, JNK India is blessed with top quality management with minimum litigation and plethora of experience, their association with JNK heater (top global player in heating equipment market) will help them capitalize on global order. Company is planning to strengthen its footprint in newer geographies like Europe and South Africa and given the experience it has there is no doubt that will succeed in its newer ventures.

know more about the JNK India, click here

Read more of our stock research coverages, click here