The IndusInd Pinnacle Credit Card is a complete package designed for customers for whom excellence is not a choice but a habit. Users will enjoy a wide range of travel, luxurious lifestyles, golf privileges, and exceptional experiences on this card. IndusInd Bank Pinnacle Credit Card is a premium card that comes with a joining fee of ₹15,000.

Pinnacle gives users 2.5% reward points on online e-commerce transactions, which can be redeemed for partner airlines. Not only this, but it also offers 1% reward points on offline spending. As a welcome benefit, the card offers a choice of gift vouchers from a range of brands. While booking movie tickets on BookMyShow, users can enjoy BOGO offers and get 3 complimentary tickets every month. Its travel benefits include complimentary airport lounge visits with a Priority Pass membership.

Key Highlights of IndusInd Pinnacle Credit Card

| Key Highlights | Joining fee | ₹ 15,000 + GST |

| Annual fee | Nil | |

| Best known for | Travel, Shopping | |

| Welcome benefit | Get premium welcome gifts in the form of vouchers for luxury hotels, branded merchandise, etc. | |

| Fuel surcharge waiver | 1% Fuel surcharge waiver on all fuel transaction | |

| Insurance cover | Get a complimentary personal air accident insurance cover of up to ₹25,00,000 | |

| Complimentary lounge access | Available with Priority Pass membership | |

| Card Network type | Master Card |

Features and Benefits of IndusInd Pinnacle Credit Card

| Benefits | Details |

|---|---|

| Welcome Benefits | On applying for an IndusInd Pinnacle credit card, the cardholders will be provided with various premium welcome gifts in the form of vouchers for luxury hotels, branded merchandise, etc. Oberoi Hotels: Feel the luxury and experience exotic holidays and have a memorable stay with family & friends at the stunning Oberoi Hotels Montblac: Experience craftsmanship from the most premium brand by choosing from the finest collection of watches, stationery, jewellery, leather goods, and eyewear The Postcard Hotels: Enjoy the combination of luxury & simplicity with the collection of intimate luxury hotels hidden in holiday destinations across India Vouchagram: Enjoy discount vouchers from various brands such as Amazon, Flipkart, Zee5, Apollo Pharmacy, Uber, Ola, and more Vouchagram Premium: Enjoy discount vouchers from various brands such as Pantaloons, Bata, Raymond, Hush Puppies, and more Luxe Gift Card: Get access to 30+ global luxury and premium brands with over 360+ stores across 30 cities in India |

| Reward Benefits | With the IndusInd Pinnacle Credit Card, consumers will earn rewards as given below: On e-commerce transactions: ₹ 100 spent = 2.5 reward points On E-com travel & airline transactions: ₹ 100 spent = 1.5 reward points On PoS, MoTo, IVR transactions & Standing instructions: ₹ 100 spent = 1 reward point |

| Insurance Benefits | The ‘Total Protect’ program offers cover up to an amount equal to your card’s credit limit, which is also available on add-on cards. Total Protect covers you for the following: Air Accident Cover: Get a complimentary personal air accident insurance cover of up to ₹ 25,00,000 Cover Against Counterfeit Fraud: The claim must be reported by the victim within 15 days from the date of issuance of the statement containing the disputed fraudulent transaction (The amount claimed by the cardholder may vary as per the actual loss of the covered card and the credit card limit) Unauthorized Transactions in Case of Loss/Theft of Card: Insurance cover is available for the first 48 hours after reporting the loss of the card |

| Travel Benefits | Travel Plus program: Enjoy exclusive waiver on lounge access charges outside India with Travel Plus program (max of 8 lounge access/year of value $27) Travel insurance: To avoid any unforeseen event, IndusInd Bank, in association with ICICI Lombard General Insurance Company Limited, offers the following insurance coverage to its cardholders: Insurance Cover– Sum Assured (Up To) Lost Baggage– ₹ 1,00,000 Delayed Baggage– ₹ 25,000 Loss of Passport– ₹ 50,000 Lost Ticket– ₹ 25,000 Missed Connection– ₹ 25,000 Priority Pass Membership: Get access to over 700 lounges worldwide as part of the Priority Pass program privileges (Effective March 13, 2025; enjoy 1 complimentary international lounge visit every calendar quarter outside India via Priority Pass membership) Note: Enjoy 2 complimentary visits to any international lounge outside India every calendar quarter |

| Movie Offers | The cardholder can enjoy the ‘BOGO’ offer on movie tickets via BookMyShow. The maximum discount for each ticket is capped at ₹ 200. Three complimentary tickets can be availed monthly |

| Golf Benefits | As an IndusInd Pinnacle Credit Card holder, enjoy complimentary golf games and lessons at some of the most beautiful golf courses and golf clubs across India Avail supplementary Hole-in-One Insurance policy of ₹ 20,000 |

| Fuel Surcharge Waiver | Enjoy a waiver of 1% on fuel surcharge for all transactions between ₹ 500 – ₹ 4,000 at any fuel station across the India |

| Concierge Services | Get 24×7 complimentary concierge service from a highly skilled professional team with IndusInd Pinnacle Credit Card, such as Hotel Reservations, Flight Bookings, Pre-Trip Assistance, Sports & Entertainment Bookings, Special Bookings, Flowers & Gifts, etc. Note- One can avail of the services by contacting the Concierge Desk number 1860 267 7777. |

| Auto Assist Benefit | Use the 24X7 call service to get assistance under the Auto Assist feature, where you will be provided with on-the-spot assistance. This assistance is available for the whole year. Which includes: Roadside Repair Service, Flat Tyre Service, Emergency Fuel Supply, Lost Keys, Emergency Towing Assistance, Battery Services, Accidental Management & Medical Assistance |

Reward Redemption Process of IndusInd Pinnacle Credit Card

IndusInd Bank Rewards Points can be redeemed against the following options available on IndusMoments.

Cash Credit- 1 RP = ₹0.75

KrisFlyer Miles- 2 RP = 1 KrisFlyer Mile

Fees & Charges

| Charges | Details |

|---|---|

| Joining Fee | ₹ 15000 |

| Annual Fee/Renewal Fee | Nil |

| Add-On Card Fee | Nil |

| Finance Charge | 3.83% monthly 46% yearly |

| Cash Advance Charges | 2.5% of cash advance subject to a minimum charge of ₹300 |

| Late Payment Fee | For Outstanding Balance- Charges Balance between Nil– Balance up to ₹ 100 ₹ 100– b/w ₹ 100 – ₹ 500 ₹ 350– b/w ₹ 501 – ₹ 1,000 ₹ 550– b/w ₹ 1,001 – ₹ 10,000 ₹ 800– b/w ₹ 10,001 – ₹ 25,000 ₹ 1,100– b/w ₹ 25,001 – ₹ 50,000 ₹ 1,300– Above ₹ 50,000 |

| Fuel Surcharge Waiver | waiver of 1% on fuel surcharge for all transactions between ₹ 500 – ₹ 4,000 at any fuel station across the India |

| Foreign Currency Mark-Up | 3.5% on foreign currency transactions |

| Reward Redemption Fee | ₹ 99 |

Eligibility criteria for IndusInd Pinnacle Credit Card

To fulfill eligibility criteria for IndusInd Pinnacle Credit Card, the applicant must have the following requirements:

| Criteria | |

|---|---|

| Age | 18-65 Years |

| Occupation | Salaried/Self-employed |

| Min. Income Required | For salaried individuals: ₹ 10 lakh per annum For self-employed: ₹ 12 lakh per annum |

| Nationality | Indian |

| Credit Score | A good CIBIL score with no history as a defaulter |

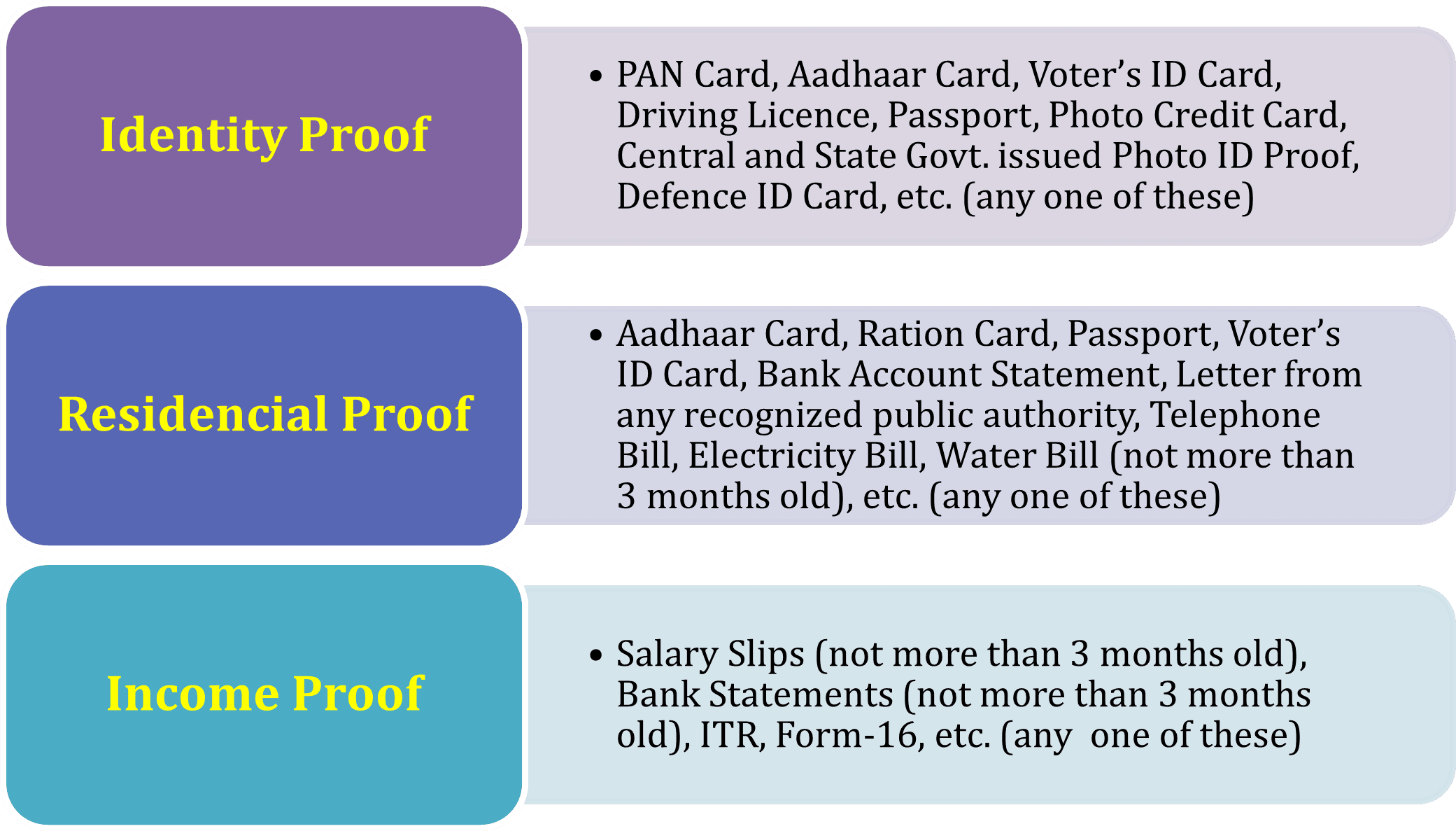

Documents Required for IndusInd Pinnacle Credit Card

Applicants will be required to submit proof of identity, address and income along with a duly filled application form for IndusInd Pinnacle Credit Card. Given below is the list of acceptable documents:

Customer Care Service

All IndusInd Pinnacle Credit Card holders can avail the service by calling 18602677777 for any problem or information related queries and other assistance related to the card.

How to Apply for Indusind Pinnacle Credit Card

Offline

Visit your nearest IndusInd bank branch. Fill the application form correctly & submit it along with the required documents. Following the submission, you can await processing and approval from the Bank.

Online

- First visit official website of the bank

- Select ‘Credit Card’ from the drop-down menu under ‘Apply Online.’

- Fill out all the required information.

- Select IndusInd Pinnacle Credit Card from the list of IndusInd Bank credit cards

- Complete all formalities & Proceed to Final Submissions

FAQs

What is the minimum income-based criteria to get the Pinnacle card?

The minimum income requirement of this card holder should be as follows:

– For salaried individuals: ₹ 10 lakh per annum

– For self-employed: ₹ 12 lakh per annum

Is insurance benefit available for add-on members on the Pinnacle Credit Card?

Yes, The ‘Total Protect’ program offers cover up to an amount equal to your card’s credit limit which is also available on add-on cards.

What is the structure of insurance coverage on the IndusInd Pinnacle Credit Card?

The insurance cover available on this card is as follows:

– Personal Air Accident Cover: Up to ₹ 25,00,000

– Lost Baggage: ₹ 1,00,000

– Delayed Baggage: ₹ 25,000

– Loss of Passport: ₹ 50,000

– Lost Ticket: ₹ 25,000

– Missed Connection: ₹ 25,000

Is golf facility available on this card?

Yes, as an IndusInd Pinnacle Credit Card holder, you can enjoy complimentary golf games & lessons at some of the most beautiful golf courses and golf clubs across India.

What is the interest rate charged on Pinnacle Credit Card?

The interest rate charged on this credit card is 3.83% monthly & 46% annually.

What is the use of Priority Pass membership?

Priority Pass membership is complimentary to all IndusInd Bank Pinnacle Credit Cardholders. No more than 2 complimentary lounge visits will be offered per calendar quarter for visits by the primary cardholder to any lounge outside India, subject to a usage fee of up to USD 35. The usage fee up to USD 35 will not be waived for visits by the primary cardholder to any lounge within India. The usage fee up to USD 35 will not be waived for visits by the cardholder’s guests to any lounge within or outside India.

Which categories are included under Concierge Services on this card?

Get 24×7 complimentary concierge service from a highly skilled professional team with IndusInd Bank Pinnacle Credit Card, such as Hotel Reservations, Flight Bookings, Pre-Trip Assistance, Sports & Entertainment Bookings, Special Bookings, Flowers & Gifts, etc. To avail of the services, please contact the Concierge Desk number 1860 267 7777.