• Indegene IPO opened for subscription on Monday, May 6, 2024 and received decent response from investors. The issue is fully subscribed on the day 2 of opening due to enthusiasm from NII investors. On day 2, issue is subscribed 7.7x as NII investors applied for 18.44 times of total provided quota, Retail investors booked 3.94 times and QIB investors applied for 5 times of total given quota.

• The GMP (grey market premium) is +240. This indicates Indegene share price were trading at a premium of ₹240 in the grey market.

• The company on May 3, garnered over ₹548.77 crore from anchor investors at the upper price band of ₹452 per equity share. Wide variety of marquee investors, including Capital Group, one of the world’s largest investment management firms, Fidelity Investments, Loomis Sayles & Company, Jupiter Asset Management, Abu Dhabi Investment Authority, SBI Mutual Fund, ICICI Prudential Mutual Fund, Nippon India Mutual Fund, DSP Mutual Fund, Custody Bank of Japan, WhiteOak Capital Management, UTI Mutual Fund etc took part in the issue.

Indegene IPO Details

| IPO Date | May 6 to May 8, 2024 |

| Issue type | Book building issue |

| Face Value | ₹2 per share |

| Price Band | ₹430 to ₹452 per share |

| Lot Size | 33 Shares(1 lot = ₹14,916) |

| Total Issue Size | 40,746,891 shares (aggregating up to ₹1,841.76 Cr) |

| Fresh Issue | 16,814,159 shares (aggregating up to ₹760.00 Cr) |

| Offer for Sale | 23,932,732 shares of ₹2 (aggregating up to ₹1,081.76 Cr) |

| Listing date | Monday, May 13, 2024 |

A little about the company

Indegene provides digital-led commercialization services for the life sciences industry, including biopharmaceutical, emerging biotech and medical devices companies, that assist them with drug development and clinical trials, regulatory submissions, pharmacovigilance and complaints management, and the sales and marketing of their products. Company’s solutions enable life sciences companies to develop products, launch them in the market, and drive sales through their life cycle in a more effective,

efficient and modern manner.

Company claims to achieve this by combining its over two decades of healthcare domain expertise and fit-for purpose technology. Indegene’s portfolio of solutions cover all aspects of commercial, medical, regulatory and R&D operations of life sciences companies. In short, the company is a IT company that works for life science companies providing them everything from development to sales to management of related products.

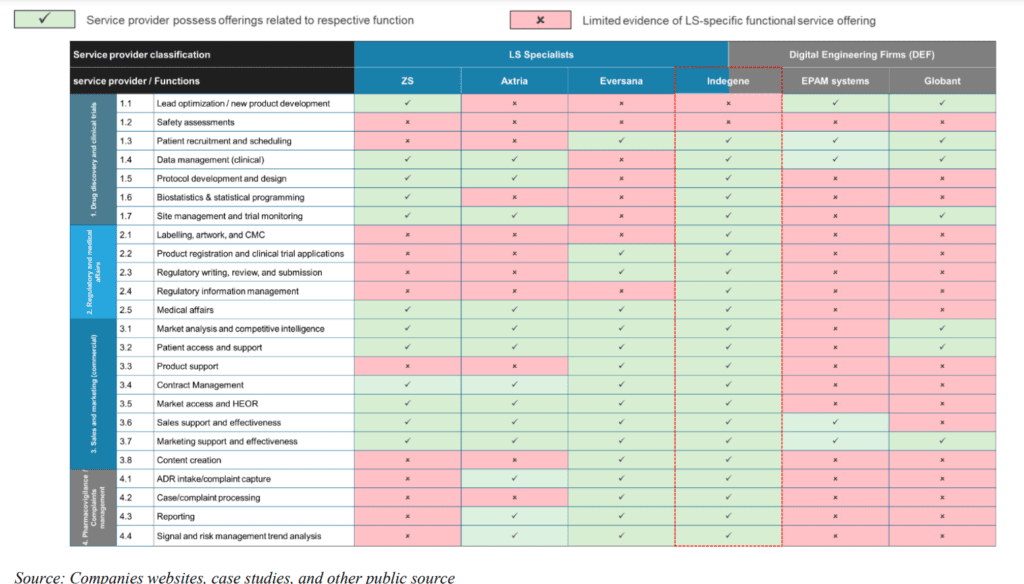

For life sciences companies it is a big headache to develop products, get regulatory approval, market them, sales management, keep customer satisfaction data and effectively manage it. All this requires a lot of expertise and extra investment so here comes the big opportunity for players like Indegene (In fact Indegene claims to be only company doing the range of jobs doing for life science industry, other players are available only in some segments), its a niche business with large addressable market size.

Global life science market, an overview

The life sciences industry comprises entities engaged in the research, development, and manufacturing and marketing of drugs and medical devices. The two main segments within this industry are the biopharmaceutical and medical devices segments:

- Biopharmaceutical. This segment comprises companies that discover, develop, manufacture, and sell drugs (chemical and biological-based) to cure, vaccinate, or alleviate symptoms of medical conditions or diseases.

- Medical devices. This segment comprises companies involved in the research, development, production, and sale of systems and devices of medical applications, i.e., to treat or diagnose diseases or medical conditions.

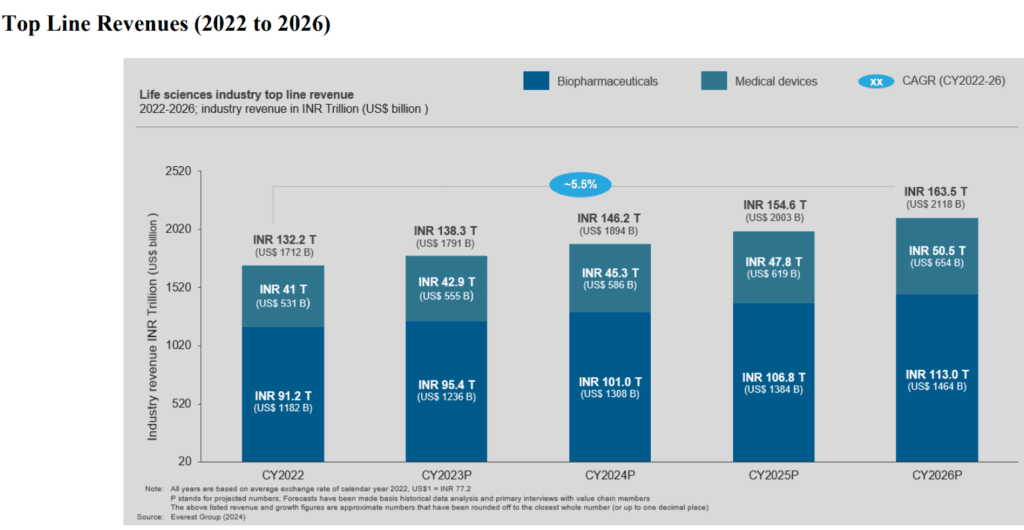

The combined sales of the biopharmaceutical and medical devices segments was estimated at ₹138.3 trillion (US$1.8 trillion) in 2023, with biopharmaceuticals constituting 69% or ₹95.4 trillion (US$1.2 trillion). By 2026, the combined sales of the biopharmaceutical and medical devices segments are expected to reach ₹163.5 trillion (US$2.1 trillion) with biopharmaceuticals constituting 69% or ₹113 trillion (US$1.4 trillion).

Outlook of niches where Indegene operates

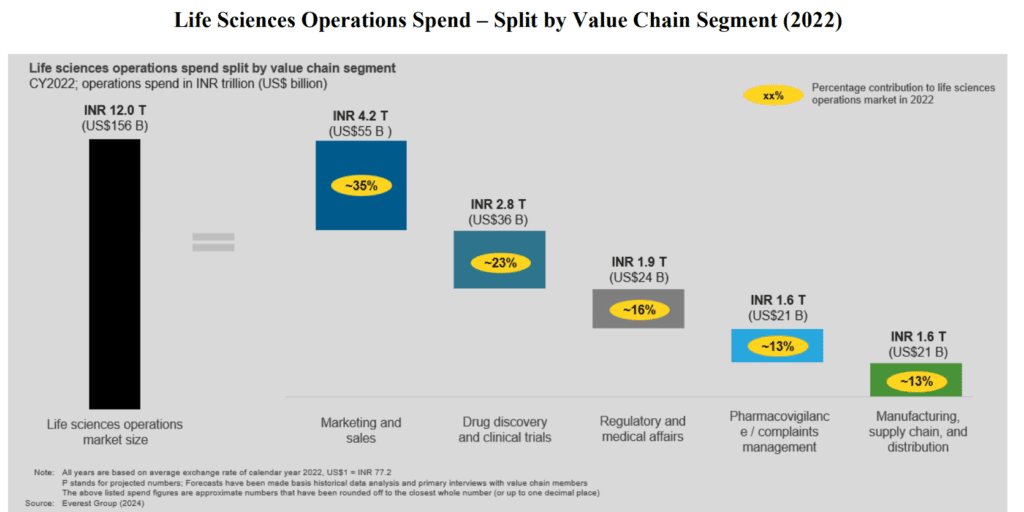

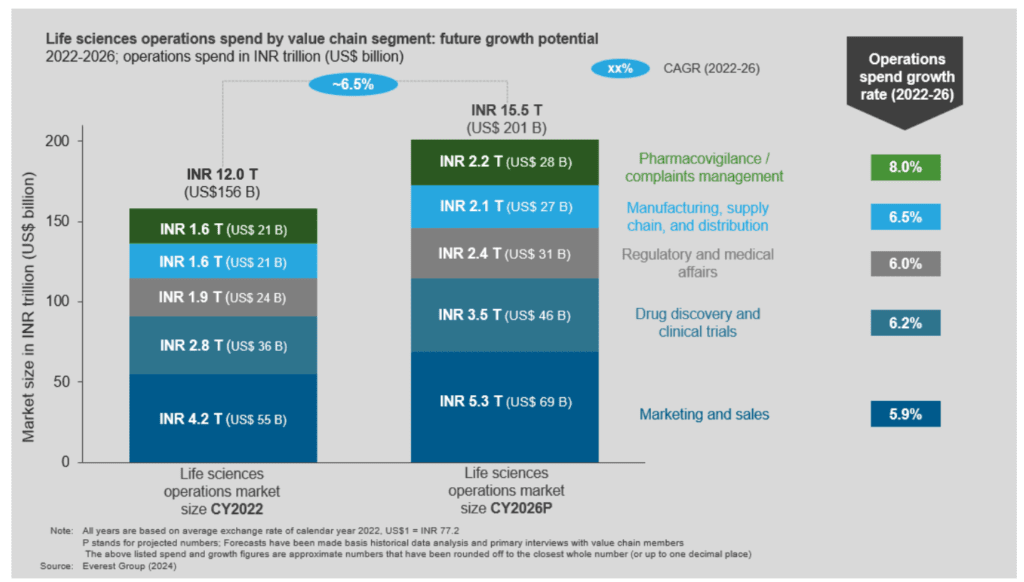

Life sciences operations spend has grown at a CAGR of approximately 6.7% from 2020 to 2022 and was estimated at approximately ₹12.0 trillion (US$156 billion) in 2022. The overall life sciences operations spend is expected to grow at a CAGR of approximately 6.5% to reach ₹15.5 trillion (US$201 billion) by 2026, driven by rise in aging population, increasing prevalence of chronic diseases and discovery of new diseases, among other factors.

Indegene: Strength and key strategies

Strengths

1• Only player in the industry providing a good range of services, there are a few other players but they only cater a specific segment of this market, unlike those Indegene caters almost all segments of the market.

2• Focused approach, company is catering right set of customers in right geography, by right geography what I mean is geography where growth in life science products is highest. The life science “outsourcing” market is still highly under penetrated so there is a huge opportunity to Indegene further consolidate its leadership position and gain more market share.

The segments that the company caters are expected to grow faster than overall life sciences average industry growth lead by pharmaceutical complaints management and followed by manufacturing, supply chain and distribution.

Most of the Life sciences spent are from North America and Europe (combined share 90%) and company is strategically focused in these regions almost of the revenue for company is coming from these 2 geographies.

The penetration of the outsourcing in life science industry is still on the lower side but the same is growing at a high CAGR, presenting Indegene with a mammoth opportunity in coming future.

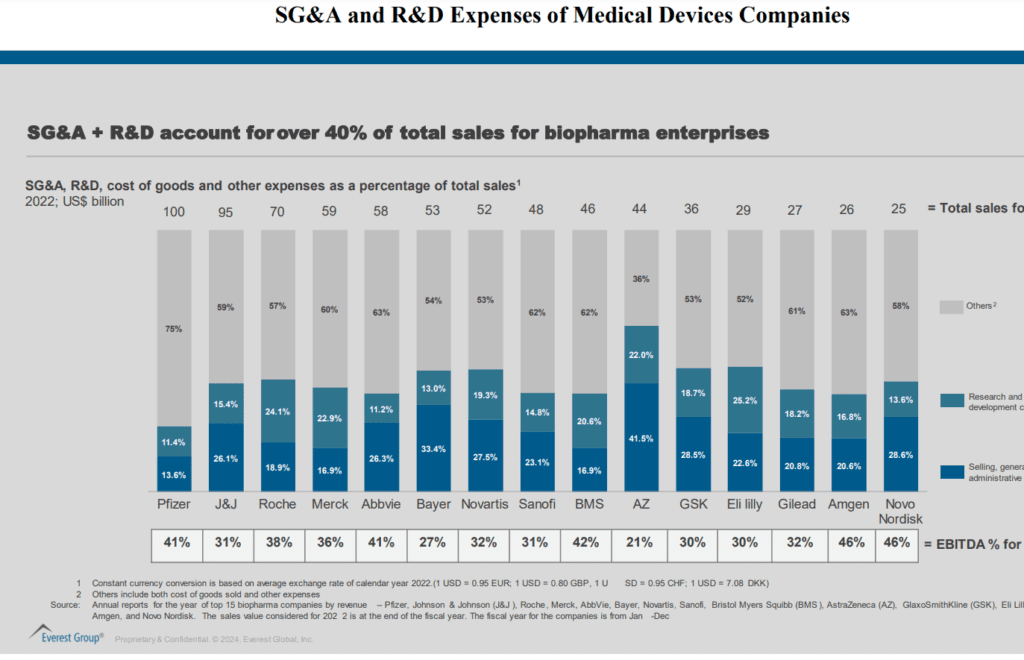

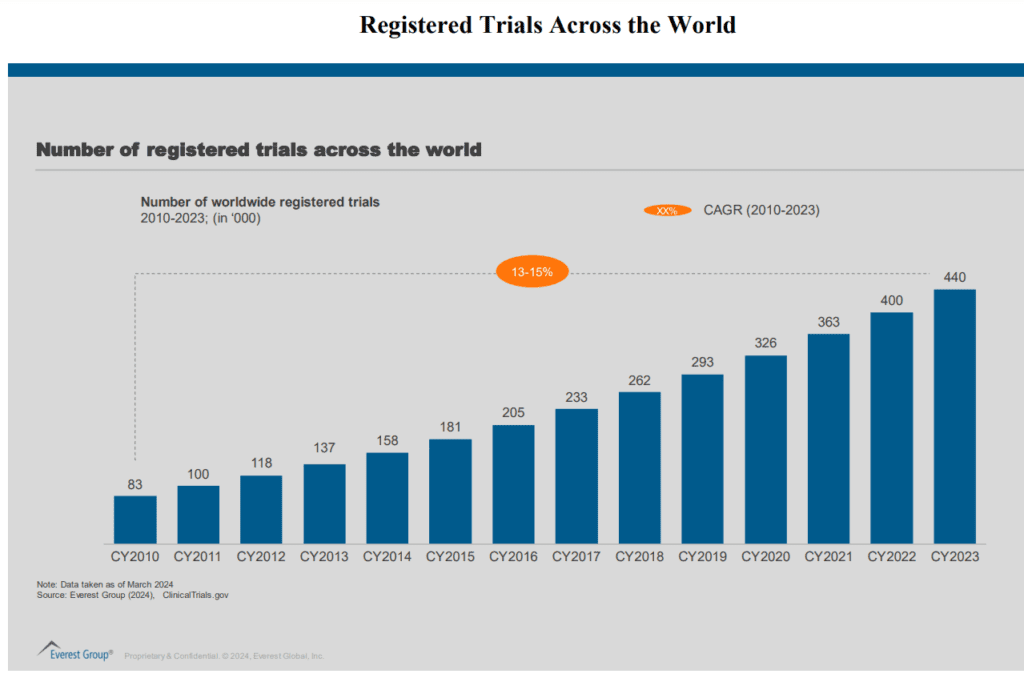

3• Strong growth in SG&A spends and in registered trials across the world. As the need of new life science products, medicines are rising due to emergence of new diseases and aging population, companies are spending more and more on R&D, new drug registration presenting companies like Indegene with a huge opportunity to cater these companies through outsourcing.

4• Domain expertise in healthcare, company understanding of the healthcare domain enables it to efficiently modernize and digitize the key functions involved in the life sciences commercialization process. This requires in-depth domain expertise of the journey of a drug from the research lab to the market to be able to organize and analyze scientific and clinical data, navigate the regulatory landscape and the ethical

guidelines within which the industry operates, and develop medical content for healthcare professionals, patients, and payers.

5• Robust digital capabilities and in-house developed technology portfolio, Over the years, Indegene have developed a suite of proprietary tools and platforms, including applications that automate and create AI-based efficiencies using AI, ML, NLP and advanced analytics capabilities that are core components of its solutions. These proprietary “NEXT”-branded tools and platforms assist in driving transformation across the commercialization lifecycle of biopharmaceutical products and medical devices.

Company aim to drive efficiency, effectiveness and quality in various aspects of the R&D and commercialization processes of life sciences companies. Co’s technology innovation is supported by a dedicated team of 650 individuals who work on data science, data engineering,

NLP, Natural Language Generation (“NLG”), Gen AI, machine vision, speech-to-text conversion and classification, and prediction model development.

6• Track record of establishing long-standing client relationships, Indegene have long-standing relationships with marquee biopharmaceutical companies including each of the 20 largest biopharmaceutical companies in the world by revenue for the Financial Year 2023. Due to the sticky

nature of company’s solutions, recurring revenues account for a high proportion of total revenues. Retention rates (i.e., revenues from existing customers as a percentage of revenues from such customers earned in the previous year) were 122.83%, 159.89%, and 129.90% for the Financial Years 2023, 2022 and 2021, respectively.

The above diagram illustrates the growth of Indegene’s revenues from the three largest clients (in Rupee millions) over the last six Financial Years.

Key risks

• Emergence of newer technologies like Gen or adaptive AI which can replace companies operations at lower cost is the biggest risk associated with any technology company including Indegene. Also, less or no competition may prompt other large tech companies to enter the market but that will take time as the trust that Indegene’s customers have over its expertise will provide it an edge.

• The company relies on sub-contractors and third-party service providers, who may not perform their obligations satisfactorily or in compliance with the law, and Indegene may have no recourse against such sub-contractors and service providers.

• The international operations expose Indegene to complex management, legal, tax, and economic risks, and exchange rate fluctuations, which could adversely affect business, financial condition, and results of operations.

• The business depends upon the ability to attract, develop, motivate, retain, and effectively utilize skilled professionals. The employee benefits expense constitutes the largest component of the total expenses, demonstrating how significantly they rely on the employees. In case of high attrition rates, the Company may incur greater recruitment charges towards agencies whom they use for identifying and recruiting personnel.

Financials and Valuation

There is good growth in company’s top and bottom-line over the years as Revenue grew at a CAGR of 54.5% between FY21-23 where EBITDA grew at 31.1% CAGR and PAT grew at 19.7% CAGR betweenFY21 andFY23. EBITDA margins have expanded to 19.1% in 9MFY24 as against 17.8% in 9MFY23.. Company’s operating margin of 17.2% and its net profit margin of 11.5% is impressive.

At the upper price band of ₹452 company is valued at 34x P/E (taking the FY24 EPS estimates), given the strong management of the company in terms of knowledge base and expertise and their growth track record, the company is well placed to capitalize on industry tailwinds. The company have impressive track record of acquisition and the company will use part of money raised through IPO proceeds for the same purpose with right opportunity is their.

Post issue the debt of the company will be negligible and it will provide company with opportunities to raise more funds on suitable terms. Overall it is an unique company with decent opportunity size and should be on investors radar, issue is already receiving strong response, so keeping the company in watchlist post listing can be a good idea given the limited number of allotments in IPO proceeds.

Read more about Indegene, click here

Read about our coverage on future outlook of REC, PFC. click here