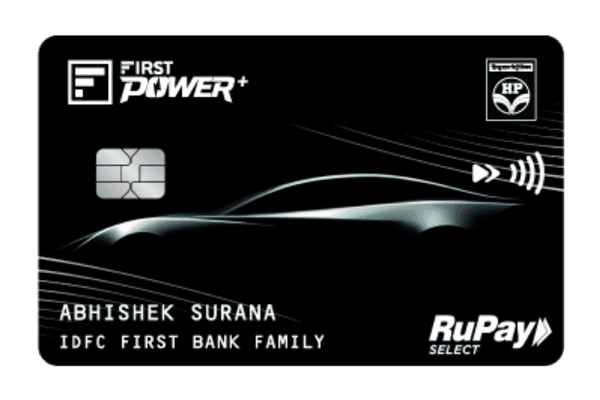

IDFC FIRST Power Plus Credit Card is a co-branded fuel credit card launched in partnership with Hindustan Petroleum Corporation Limited (HPCL). If riding, traveling, and exploring the world is your passion, the open road beckons, especially when First Power Plus fuels you. Enjoy unlimited benefits and perks with the IDFC First Power Plus Credit Card.

The card is designed with the premium lifestyle and amenities of the cardholders in mind. Elevate your lifestyle with welcome benefits worth ₹ 2,500, complimentary roadside assistance and insurance covers, flexible EMI options, low and dynamic interest rates starting at 9% per annum, 0% Interest on ATM Cash Withdrawals until the due date, and saving up to ₹ 18,500 annually with this credit card which is enough to buy user 175+ liters of fuel, 3X Rewards on retail transactions and much more.

Key Highlights of IDFC FIRST Power Plus Credit Card

| Key Highlights | Features | Details |

| Joining Fee | ₹ 499 | |

| Annual Fee | ₹ 499 (Annual Fee waived off on spends of ₹ 1,50,000 or more in a year) | |

| Best Suited For | Riding (travel) | |

| Welcome Benefits | Get welcome benefits worth ₹ 2,500 | |

| Fuel Surcharge Waiver | Fuel surcharge waiver of 1% | |

| Partnered With | Hindustan Petroleum Corporation Limited (HPCL) | |

| Rewards | Earn up to ₹10,000 Rewards by referring to your friends (₹ 2,000 rewards for each card set-up) and more | |

| ATM Cash Withdrawals Interest | 0% Interest on ATM Cash Withdrawals until due date |

Features and Benefits of IDFC FIRST Power Plus Credit Card

| Benefits | Details |

|---|---|

| Welcome Benefits | As soon as the customer pays the joining fee of just ₹ 499 for IDFC First Power Plus Credit Card, he will be given a welcome benefit of ₹ 2,500 as a cardholder |

| Reward Benefits | HPCL Fuel spends – 5% savings as Rewards on HPCL Fuel spend (30X Rewards = 5% savings) – Applicable Structure: 30 Reward points per ₹150 spent – Maximum Spends Capping: ₹ 12,000 per statement cycle (Maximum 2,400 Rewards = ₹ 600/month) – 1.5% savings per ₹100 as Happy coins on all fuel purchases through HP Pay App by HPCL Grocery & Utility – 5% savings as Rewards on Grocery & Utility expenses (30X Rewards = 5% savings) – Applicable Structure: 30 Reward points per ₹150 spent – Maximum Spends Capping: ₹ 2,000 per statement cycle (Maximum 400 Rewards = ₹ 100/month) IDFC FIRST FASTag recharge – 5% savings as Rewards on IDFC First FASTag recharge (30X Rewards = 5% savings) Applicable Structure: 30 Reward points per ₹150 recharge Maximum Spends Capping: ₹1,000 spends per statement cycle (Maximum 200 Rewards = ₹ 50/month) UPI Transactions – 3X Rewards on all retail spends via UPI channel excluding ATM cash withdrawals, non-HPCL fuel spends, Insurance premium payments, EMI transactions, utility spends, grocery spends and IDFC First FASTag recharges Applicable Structure: 3 Reward points per ₹ 150, There is no capping on these reward points. Other Retail Spends – 3X Rewards on retail transactions excluding ATM cash withdrawals, non-HPCL fuel spends, Insurance premium payments, EMI transactions, utility spends, grocery spends and IDFC FIRST FASTag recharges Applicable Structure: 3 Reward points per ₹150, There is no capping on these reward points Note- 1 Reward point = ₹ 0.25, 1X = 1 Reward per ₹ 150 |

| Cashback Benefits | ₹ 500 cashback on 1ST HPCL fuel transaction of ₹ 500 or above (benefits available within 30 days of card set-up & only cardholders who have paid the Joining Fee will be eligible for this offer) 5% cashback (up to ₹ 1,000) on the transaction value of 1st EMI conversion ₹ 1,000 discount on Zoomcar rentals Discount up to 50% on Domestic and International Rental Cars with Eco Rent A Car and Europcar |

| Roadside Assistance | Avail Emergency Roadside Assistance worth ₹ 1,399 with your credit card – in case of an unfortunate & unforeseen event like a breakdown or a road accident Avail 4 complimentary RSA services in a year Avail 24*7 Roadside Assistance (RSA) anywhere, anytime by calling the RSA partner, Global Assure on 1800 572 3860 (toll-free) |

| EMI Conversion | EMIfy your purchases & balances and enjoy the convenience of payments |

| Fuel Surcharge Waiver | 1% waiver up to ₹ 100 per statement cycle. This will be applicable on fuel transaction values from ₹ 200 to ₹ 5,000 |

| Referal Rewards | Earn up to ₹ 10,000 Rewards by referring your friends (₹ 2,000 rewards for each card set-up) |

| Insurance Benefits | Personal Accident Cover of ₹ 2,00,000 Lost Card Liability Cover of ₹ 25,000 |

| Powerful Features On Card | Rewards have no expiry date, Earn forever and Redeem anytime, anywhere with IDFC FIRST Power Plus Bank credit cards Low & Dynamic interest rate Interest-free ATM cash withdrawals for up to 45 days Annual fee waiver on spending ₹ 1,50,000 in a year Enjoy a convenient balance transfer facility |

| Airport Lounge Access | Complimentary Domestic Airport lounge access: Once Every Quarter on minimum spend of ₹ 20,000/month International Airport lounge access: Not available |

| Entertainment | 25% off on movie tickets up to ₹ 100, once every month |

| Add-On Card | Extend the Add-on card to your pillion rider & boost your savings without any extra charges |

| Cash Withdrawal | Interest-free ATM cash withdrawals for up to 45 days IDFC FIRST Bank offers the best credit card interest rates in India, whereby cardholders pay zero interest till the payment due date and a transaction fee of just ₹ 199/- |

| Low & Dynamic Interest Rate | Low & Dynamic Interest rates starting at 9% per annum |

Note- This credit card from IDFC First Bank requires minimum spending to qualify for complimentary airport lounge access. One needs to spend a minimum of Rs 20,000 in a calendar month to get complimentary airport lounge and spa visits in the next calendar month. For example, if you want to visit the lounge in March, then you should have spent a minimum of Rs 20,000 in February.

Savings at Every Turn with IDFC FIRST POWER PLUS

Users can save up to ₹ 18,500 annually with this credit card. Assuming monthly spends of ₹ 10,000 on Fuel, ₹ 1,000 on IDFC FASTag, ₹ 2000 on Utility & Grocery, ₹ 2000 on other spends (excluding Insurance, EMI, Cash withdrawal), ₹ 20,000 from other spends converted to EMI. See how its calculation works:

| Category | Annual Spends in (₹) | Savings (₹) |

|---|---|---|

| Fuel | 1,20,000 | 6,000 |

| HP Pay Savings | 1,800 | |

| Welcome Benefit- 1 (Fuel Cashback) | 1,800 | |

| IDFC FASTag Recharge | 12,000 | 600 |

| Grocery & Utility | 24,000 | 1,200 |

| Other Spends | 24,000 | 120 |

| Annual Fee Waiver | 499 | |

| Welcome Benefit-2 (EMI Cashback) | 20,000 | 1,000 |

| Complimentary Roadside Assistance | 1,399 | |

| Offer Discount – Zoomcar Rentals | 1000 | |

| Movie Discount | 1,200 | |

| Complimentary Domestic Airport Lounge Access | 3,600 | |

| Total | 2,00,000 | 20,218 |

| Fuel worth in litres @ ₹ 105 | 192.5 litres |

Reward Redemption Process for IDFC FIRST Power Plus Credit Card

1 Reward point = ₹ 0.25

The best advantage of this card is that the reward points can be redeemed as a statement credit. There are no restrictions on redemptions of the rewards in fuel or vouchers only. Statement credit is always better than other options.

The Bank charges ₹ 99 + GST for each reward point redemption. Redeeming reward points frequently can impact you negatively. It would be a wise decision to first accumulate points and then redeem them. There is another variant of this credit card known as the IDFC First Power credit card, and it is designed to provide rewards to bike riders who fill their tank from an HPCL fuel station.

Fees & Charges

| Charges | Details |

|---|---|

| Joining Fee | ₹ 499 |

| Annual Fee/Renewal Fee | ₹ 499 (waived off on crossing ₹ 1,50,000 spends in the previous anniversary year) |

| Add-On Card Fee | Nil |

| Interest Rate/Finance Charges on Purchases, Cash Advances and Outstanding Balances Due | Monthly rate – 0.75% – 3.65% Annual rate – 9% – 43.8% |

| Interest Rate/Finance Charges on Overdue Interest | Monthly rate – 3.99% Annual rate – 47.88% |

| Foreign Currency Mark-Up Fee | 3.50% of the transaction amount |

| Cash Advance Transaction Fee | ₹ 199 per transaction |

| Fuel Surcharge Waiver | 1% Fuel Surcharge Waiver on Fuel Transactions value between ₹ 200 and ₹ 5000 |

| OVL/Over-Limit Charges | 2.5% of the over-limit amount (Subject to a min. charge of ₹ 550) |

| Late Payment Fee | 15% of Total Amount Due ( subject to a min of ₹ 100 & a max of ₹ 1,300) |

| Interest-Free ATM Cash Withdrawal | For up to 45 days (cash withdrawal fee of only ₹199 per withdrawal) |

| Card Replacement Fee | ₹ 100 |

| Charge Slip Request | Nil |

| Cheque/Cash Processing Fee | Nil |

| Duplicate Statement Request | Nil |

| Return of Cheque /Auto-Debit SI/ Payment Return | 2% of Payment amount subject to a minimum of ₹ 500 |

| Reward Redemption Fee | ₹ 99 per redemption transaction |

| Outstation Cheque Processing Fee | Nil |

| EMI Fee | A one-time processing fee of 1% of the transaction amount or ₹ 99, whichever is higher, + GST |

| Balance Transfer Processing Fee | Processing fee on Balance transfer transaction will be communicated at the time of the transaction |

| Fee on Cash Payment at Branches | Nil |

Eligibility Criteria for FIRST Power Plus Credit Card

The following are the criteria required to apply for the IDFC FIRST Power+ Credit Card:

| Eligibility Criteria | Details |

| Age | 21 Year & above |

| Citizenship | Indian |

| Income | annual income should be ₹ 3 lakh & above |

| Cibil | Should have a healthy credit score |

| Others | Your credit usage ratio must be within an acceptable level |

Required Documents

To apply for an IDFC FIRST Power Plus Credit Card, you’ll need to provide the following documents:

- ID Proof: PAN Card, Passport, Voter’s ID, Aadhaar Card, Driving Licence

- Income Proof: A Salary Slip (not more than 3 months old), ITR

- Address Proof: Passport, Voter’s ID, Aadhaar Card, Utility Bill (Electricity, Water, Telephone)

How to Apply for IDFC FIRST Power Plus Credit Card

Follow the steps given below to apply online:

Step 1: Visit the official website of the IDFC FIRST Bank & explore its Power Plus Credit Card.

Step 2: After reading all the terms & conditions, click the “Apply Now” option on the screen to proceed.

Step 3: Enter all the relevant details requested on the application form.

Step 4: Apply.

Once the application has been submitted, the customer will receive an SMS with the reference number of the application. A bank representative will call him after the details have been verified. After the application process is complete, you can track the status of your IDFC First Bank Credit Card.

FAQs

Yes, UPI on Credit Card facility is available on FIRST Power+ Credit Cards. Cardholders just have to ensure that they have linked their IDFC FIRST Bank Power+ Credit Card to the UPI app being used by them. Now card users can scan any UPI-enabled QR code & pay using FIRST Power+ Credit Card.

Fuel is not cheaper with a Fuel Card. However, the spending done on fuel with a Fuel Card brings savings through accelerated Reward Points. With the FIRST Power+ Credit Card, one can earn 30X Reward Points on fuel spends done at HPCL outlets.

Yes, ₹ 500 cashback on 1st HPCL fuel transaction of ₹ 500 or above done within 30 days of card generation is applicable for FIRST Power+. The joining offer will only be applicable for cardholders who have paid the joining fee in full.

No, only payments to the merchant (P2M) will be allowed from the linked FIRST Power+ Credit Card.

The amount limit per card can be up to ₹ 1 lakh per day and ₹ 2 lakh for some special MCC codes; however, it will be subject to the available credit limit on the user’s card. One has to pay attention that the amount limit per day per card is ₹ 5,000 for the first 24 hours of linking the card on your preferred UPI app.

No, no charges will be levied on the user for making any transaction using the credit card linked to UPI.

Avail Emergency Roadside Assistance worth ₹ 1,399 with your credit card – in case of an unfortunate & unforeseen event like a breakdown or a road accident.

– Avail 4 complimentary RSA services in a year.

– Personal Accident Cover of ₹ 2,00,000.

One can enjoy annual savings of up to ₹ 18,500, equivalent to more than 175+ litres of fuel, using this credit card.

You will be eligible to apply only for the FIRST Power+ credit card if you already hold any of the IDFC FIRST Bank Credit Cards.

However, the credit limit is shared with all of your existing IDFC FIRST Bank Credit Cards, if any.

You can enjoy complimentary Domestic Airport lounge access: Once Every Quarter on a minimum spend of ₹ 20,000/month.

Categories – P2P (peer-to-peer), P2PM (peer-to-peer-merchant) digital account opening, lending platform, cash withdrawal at merchant, cash withdrawal at ATM, e-RUPI, IPO, Foreign Inward Remittances, Mutual Funds, and any other categories as restricted by National Payment Corporation Of India (NPCI).