How to check IDFC Credit Card status? Are you the one who applied for an IDFC First credit card and are wondering how to check the application status? For this, you can choose from several available options and track the status of your application. These options are as follows.

ONLINE:

- Visit the bank’s official website

- Through the bank’s mobile application

OFFLINE:

- Visit the branch

- Call the customer care team

Let us now look at both options in detail:

How to check the IDFC Credit Card status online

You can check your credit card application status online via your application number and registered mobile number. Banks monitor credit card applications in their own way, but the processes for all banks are almost the same. To check your credit card application status online, you simply need to follow the process stepwise:

Step 1). Go to your credit card issuer bank’s official website, in this case, visit ‘www.idfcfirstbank.com’

Step 2). Under the services section, look for the ‘Track your credit card application’ option OR directly start with step 3

Step 3). Go with ‘track your credit card application’ option

Step 4). A form will appear in front of you in which you have to carefully fill the required information such as RMN (Register Mobile No.) & DoB ( Date of Birth).

Step 5). Just after that, find the application number entry in the form, now you can proceed to next step

Step 6). Once your application is successfully submitted, you will get your credit card application status

The bank sends an SMS and an email regarding your current application status to your registered contact details (mobile number and e-mail)

NOTE- The online process of checking your IDFC FIRST BANK Credit Card application status are same through both options (bank’s mobile application & official website)

HOW to check the IDFC FIRST BANK Credit Card application status offline:

Check IDFC First Credit Card application status by visiting the branch

You can check the status of your IDFC First Bank credit card by going to the nearest bank branch. Once you reach the bank branch, you can now ask the executive for proper information on how to check your credit card application status.

The executive may ask you for some important details like application reference number, date of birth, mobile number, and other information. Using the details provided, they will give you an update on the status of your IDFC FIRST Bank credit card application.

IDFC Credit Card application status through Customer Care:

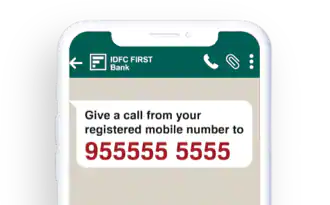

IDFC First Bank has a 24/7 credit card customer care number that you can call to check the status of your IDFC First Bank credit card. The number to contact for credit card-related queries is 1800 10 888. You can also connect on the 24/7 WhatsApp banking Numbers to connect: 95555 55555 and check the status of your credit card.

Different types of IDFC credit card application status and meaning of their related terms

Based on the evaluation stages, the status of your Office First Bank Credit Card could be as follows:

In Progress, On Hold, Approved, Dispatched, Rejected/Disapproved, No Record Found

You can understand all terms in detail through the following table

| Application Status | What would you understand |

| In Progress | If your application is still in progress stage then you will see ‘ In Progress’ status |

| On Hold | If for any reasons, the bank has kept your application on hold, you will receive ‘On-hold’ status. There could be many reasons for this. Such as incomplete documentation or details, bank requires more details from you, it is also possible that the concerned department will call you to get some information. Once the gaps are filled the credit card processing resumes |

| Approved | Once all the assessment and policy checks are completed on your IDFC First Bank Credit Card, the status will show as ‘Approved’ and you are likely to receive your credit card within 3 to 5 working days |

| Dispatched | Once your IDFC First Bank credit card application is approved, your status is changed to ‘Dispatched’. This status informs you that you should make yourself available at your mailing address as the card will be delivered to the applicant very soon |

| Rejected/Disapproved/ Denied | If you don’t meet the bank’s eligibility criteria or internal policy set by the bank, your credit card, the application may be ‘Rejected’ or ‘Denied’ or ‘Disapproved’. Normally, you should receive a message similar to an SMS informing you that your application has been rejected by the bank without giving any reason |

| No Record Found | If you have entered incorrect details then the system will display the message ‘No record found’. You will have to enter the correct details again to correct or rectify the status |

Applicants can follow the above-explained methods to check the approval status of the popular IDFC First Power and IDFC First Power Plus credit cards.

To get your application approved, you need to pay attention to some important points

These suggestions increase the chances of approval process being completed quickly:

- If you are not able to meet the required eligibility criteria, then you should avoid applying

- Submit all the required documents and paperwork along with the application form on time

- Fill your credit card application form provided by the bank correctly and completely

- Avoid making mistakes like wrong information, incomplete details, etc

- If your CIBIL score is high and your credit history is clean, then the chances of your credit card application getting approved will increase

Points to note

If your IDFC First Bank credit card has been rejected by the bank for the first time for some reason, then make sure to consider the following points while applying again:

- Before reapplying for the card, it is important to know the reason for the rejection of your credit card application. If it is due to minor issues like incomplete documents or spelling errors, then make a checklist before reapplying for a credit card

- However, in some cases, the application may get rejected due to your poor credit history. In such a case, you need to repay any outstanding debt immediately and also need to improve your CIBIL score before reapplying

FAQs

How can I check the status of my credit card application?

Here you have two options available, out of which you have to choose one. These are-

– ONLINE mode (Visit the bank’s official website or through the bank’s mobile application)

– OFFLINE mode (Visit the branch & Call the customer care team)

What are the important things to keep in mind when you reapply for an IDFC credit card after rejection?

Your credit card application may get rejected due to errors like improper documentation, incorrect or false information in your report, bad credit history, outstanding loans, etc. Hence, you should clear all this and reapply for the loan.

Does IDFC Bank offer the KCC facility?

Yes, IDFC Bank provides a Kisan Credit Card. You can get more information by visiting the official website ‘www.idfcfirstbank.com’

Can I check my IDFC FIRST Bank credit card application status without the application reference number?

Yes, you can easily check your IDFC FIRST Bank Credit Card application status without your application reference number. All you need to do is enter your correct date of birth and mobile number instead

How can I track my IDFC FIRST Bank card application status through the customer care centre?

To track your IDFC FIRST Bank Credit Card application status, call the bank’s official 24×7 customer care helpline at 1860 500 1111

– You can also call the 24/7 customer care number 1800 10 888 to check the status of your credit card

How long does it take to get an IDFC FIRST Bank Credit Card approved?

After approval by the Bank, you will receive your credit card within 3-5 working days at your mailing address.