ICICI Coral RuPay Credit Card is an entry-level credit card designed for beginners. It is a suitable option for those who like to have a low-maintenance credit card in their wallet while boosting their credit score. This credit card comes with a very low Joining and an Annual Fee of ₹ 500.

Coral is one of the four credit cards in the Gemstone Collection of ICICI Bank. With this card, cardholders can expect returns between 0.25 to 0.5% on their purchases. Benefits of ICICI Bank Coral Credit Card include complimentary access to railway and airport lounges per quarter and waiver of fuel surcharge. This card offers reward points across multiple categories, such as gadgets, lifestyle, travel, and more. The card also offers insurance coverage of ₹ 2 lakh, and discounts on BookMyShow & INOX.

Key Highlights of ICICI Coral RuPay Credit Card

| Key Highlights | Joining Fee | ₹500+ GST |

| Annual Fee/ Renewal Fee | ₹500+ GST | |

| Best Suited For | Travel | |

| Category | An entry level credit card | |

| Network | RuPay | |

| Milestone Benefits | Spend ₹ 2,00,000 on your card to earn 2000 Reward Points and thereafter spend over ₹ 1,00,000 in any anniversary year to earn 1000 RPs | |

| Fuel Surcharge Waiver | 1% Fuel Surcharge Waiver |

Features and Benefits of ICICI Coral RuPay Credit Card

| Benefits | Details |

|---|---|

| Rewards Benefits | Users can earn 2 reward points for every ₹200 spent, except fuel, Users can earn 1 reward point for every ₹100 spent on insurance and utilities |

| Milestone Benefits | Spend ₹ 2,00,000 on your card to earn 2000 Reward Points and thereafter spend over ₹ 1,00,000 in any anniversary year to be awarded 1000 Reward Points |

| Annual Fee Waiver | The annual fee on credit cards is waived if you spend more than ₹1,50,000 in the previous year |

| Complimentary Airport Lounge Access | Get 1 complimentary domestic airport lounge access on spending 75,000 in the preceding calendar quarter There is no complimentary international airport lounge access available on this card |

| Complimentary Railway Lounge Access | Get 1 complimentary access to select railway lounges in India each quarter |

| Insurance Benefits | The ICICI Coral RuPay Credit Card provides personal accident cover of up to ₹ 2 lakh |

| Movie Benefits | Enjoy 25% off, up to ₹100 on the purchase of a minimum of two movie tickets per transaction on BookMyShow (This offer can be availed twice in a month). The same offer is available on www.inoxmovies.com, the Inox app, or the Inox box office |

| Dining Benefits | Enjoy a 15% or more discount on your dining bill at 2,500+ premium restaurants including TGI Fridays, Café Coffee Day, Pizza Hut, Mainland China, Wango and more under ICICI Bank’s Culinary Treats program. |

| Fuel Surcharge Waiver | Enjoy a waiver of 1% on fuel surcharge every time you refuel at all HPCL pumps in India. The offer is valid on expenditure b/w ₹ 400 – ₹ 4,000 per transaction with max monthly reward capping of ₹ 250 |

| Security | The microchip embedded in this credit card ensures additional security of the card against counterfeiting & duplication This new chip card provides an additional layer of security in the form of a Personal Identification Number (PIN) You will have to enter your PIN on the terminal for transactions at merchant shops. While for online transactions, there is no need to share this PIN |

| Concierge Benefits | The Credit Card offers 24/7 concierge service which you can avail for concierge travel, medical, and emergency services. To avail of concierge service, please call 1800-26-70731 (toll-free for MTNL/BSNL lines) or 022-6787-2016 |

Reward Redemption Process

1 reward point is equivalent to ₹ 0.25 & can be redeemed against cash or gifts.

To redeem the earned points against cash, one can contact customer care at 080-4014-6444.

To redeem against cash, one can call 1860-258-5000.

Click here to know more about credit cards from ICICI Bank

Fees & Charges

| Types of Charges | Details |

|---|---|

| Joining Fee | ₹ 500 + GST |

| Annual Fee/Renewal Fee | ₹ 500 + GST |

| Finance Charges | 3.75% per month 45% per annum |

| Cash Advance Charges | 2.5% on advanced amount , subject to minimum of ₹500 |

| Late Payment Charges | For Outstanding Balance- Charges Balance between Nil– Balance up to ₹ 100 ₹ 100– b/w ₹ 100 – ₹ 500 ₹ 500– b/w ₹ 501 – ₹ 1,000 ₹ 600– b/w ₹ 1,001 – ₹ 5,000 ₹ 750– b/w ₹ 5,001 – ₹ 10,000 ₹ 900– b/w ₹ 10,001 – ₹ 25,000 ₹ 1,100– b/w ₹ 25,001 – ₹ 50,000 ₹ 1,300– Above ₹ 50,000 |

| Fuel Surcharge Waiver | Fuel surcharge waiver of 1% across all HPCL petrol stations in India. This offer valid for transaction b/w ₹ 400 – ₹ 4,000/- |

| Reward Redemption Fee | ₹ 99 |

| Foreign Currency Mark-Up Fee | 3.5% of the transaction amount |

| Over-limit Charges | 2.5% on over-limit amount , subject to minimum of ₹ 550 |

| Fee on Cash Payment at Branches | ₹ 100 per payment transaction |

| Credit Free Period | Credit free period of 48 days depends on your statement date |

| Dynamic Currency Conversion | 1% dynamic currency conversion fee will be applied on all the transactions conducted in Indian currency at international locations |

Eligibility criteria for Coral RuPay Credit Card

| Eligibility criteria | Details |

|---|---|

| Age | Min 21 years old Max 60 years for salaried individuals Max 65 years for self-employed individuals |

| Occupation | Salaried & self-employed individuals |

| Income | Monthly income ₹ 20,000 & above |

| Citizenship | Indian |

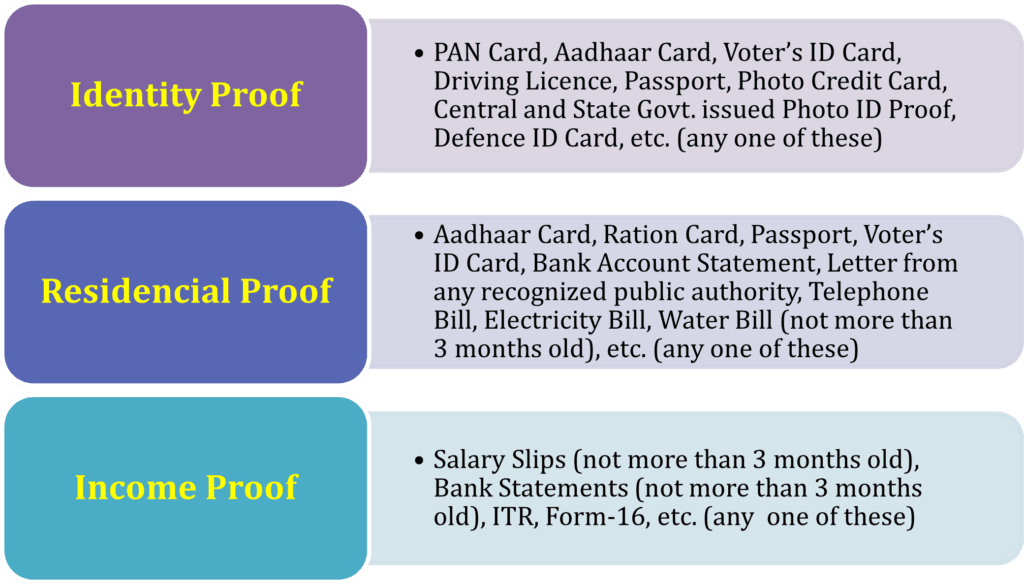

Required Documents

Applicants will be required to submit proof of identity, address and income for ICICI Coral Credit Card given below:

How To Apply For The ICICI Bank Coral Credit Card?

Offline

Visit your nearest ICICI bank branch. Fill the application form correctly & submit it along with the required documents. Following the submission, you can await processing and approval from the Bank.

Online

- First verify your eligibility for Coral RuPay Credit Card.

- Gather the required documents such as including identity, address and income details.

- Download the iMobile Pay app on your mobile.

- Log in using your credentials and fill in the required information.

You can also visit ICICI Bank Internet Banking website, log in and follow the steps carefully to apply.

Customer Support

Call 1800 1080

SMS Text “CORAL” to 5676766 to receive a call back

Email To [email protected]

FAQs

Does ICICI Coral Credit Card offer complimentary airport lounge access?

Yes, get 1 complimentary domestic airport lounge access on spend of ₹ 75,000 in the preceding calendar quarter but there is no complimentary international airport lounge access available on this card.

Is this card lifetime-free?

No, there is a joining fee of ₹500+ GST but the Annual fee on credit cards is waived if you spend more than ₹1,50,000 in the previous year.

What is the interest-free credit period on the ICICI Coral Rupay Credit Card?

There is credit free period of 48 days available on this card but it depends on your statement date.

What is the personal accident cover on ICICI Coral Rupay Credit Card?

The ICICI Coral RuPay Credit Card provides personal accident cover of up to ₹ 2 lakh.

How to link the ICICI Coral RuPay Credit Card to the iMobile Pay app?

You need to follow these steps properly:

– Open the app & navigate to ‘UPI Payments’, then select ‘Manage’ and ‘My Profile’

– From there, choose ‘Create New UPI ID’ and opt for ‘RuPay Credit Card’ as the payment method

– Select the UPI ID you wish to link and proceed to review the transaction details

Once you have verified the details, click on ‘Confirm’ to complete the transaction

How many reward points can you earn as milestone benefit?

Spend ₹2,00,000 on your card to earn 2000 Reward Points & thereafter spend over ₹ 1,00,000 in any anniversary year to be awarded 1000 Reward Points.

What are the age criteria to get a Coral RuPay Credit Card?

The minimum age should be 21 years old & the max age should be 60 years for salaried individuals & also max age should be 65 years for self-employed individuals.