Hyundai Motor India IPO will open for subscription on October 15, 2024, and close on October 17, 2024. The grey market premium (GMP) fell 90% from its recent highs. The IPO GMP made a high of Rs.370 on Oct 4th but fell to just Rs. 30 on 14th October. If GMP is to be considered the market is expecting a tepid listing for India’s largest IPO to date. Hyundai Motor India IPO is looking to raise 27,780cr from the issue.

Key details of Hyundai Motor India IPO

| Date of Opening | 15th October 2024 |

| Date of Closing | 17th October 2024 |

| Price Band (Rs) | 1,865 – 1,960 |

| Fresh Issue (Rs. cr) | None |

| Issue Size (Rs cr) | 27,870 |

| Face Value (Rs) | 10 |

| Post Issue Market Cap (Rs cr) | 1,51,539 – 1,59,258 |

| Bid Lot | 7 shares and in multiple thereof (13,720 for 1 lot) |

| QIB shares | 50% |

| NII shares | 15% |

| Retail shares | 35% |

About the company

Hyundai Motor India Limited (HMIL), is a part of South Korea-based reputed Hyundai Motors group (the third largest auto original equipment manufacturer in the world based on passenger vehicle sales in CY2023). HMIL is the second largest auto OEM in the Indian passenger vehicles market since Fiscal 2009 (in terms of domestic sales volumes) according to the CRISIL Report. The Co has a track record of manufacturing and selling four-wheeler passenger vehicles that are reliable, safe, feature-rich, innovative and backed by the latest technology.

An overview of Passenger vehicle Industry

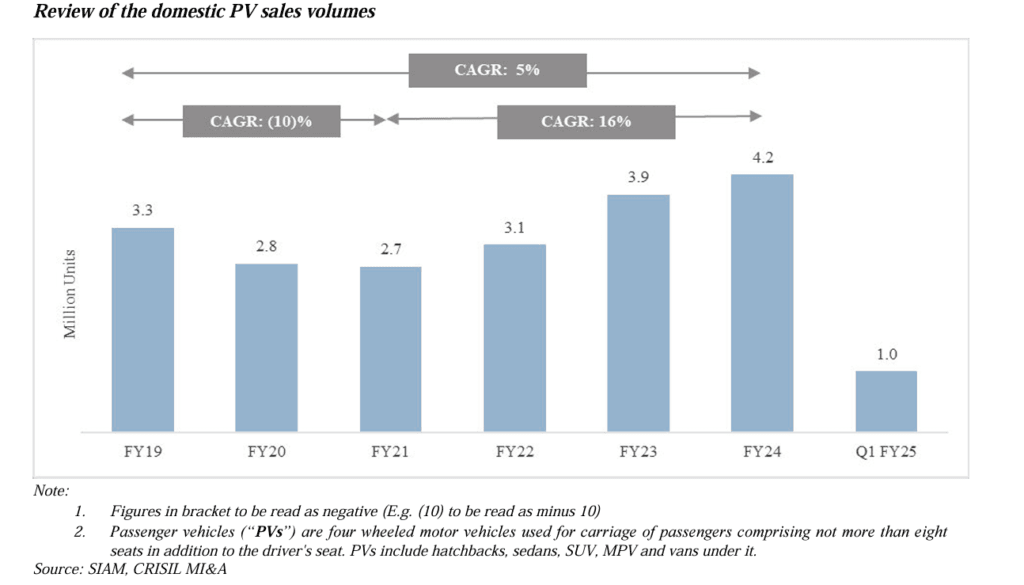

Between Fiscals 2019 and 2024, India’s domestic PV sales volume rose at 5% CAGR. This growth was despite the sales contraction (at 10% CAGR) witnessed during Fiscals 2019 to 2021 (covid 19). From the low base of Fiscal 2021, PV sales bounced back and grew at a healthy pace (16%) to reach a historic high of 4.2 million vehicles in Fiscal 2024.

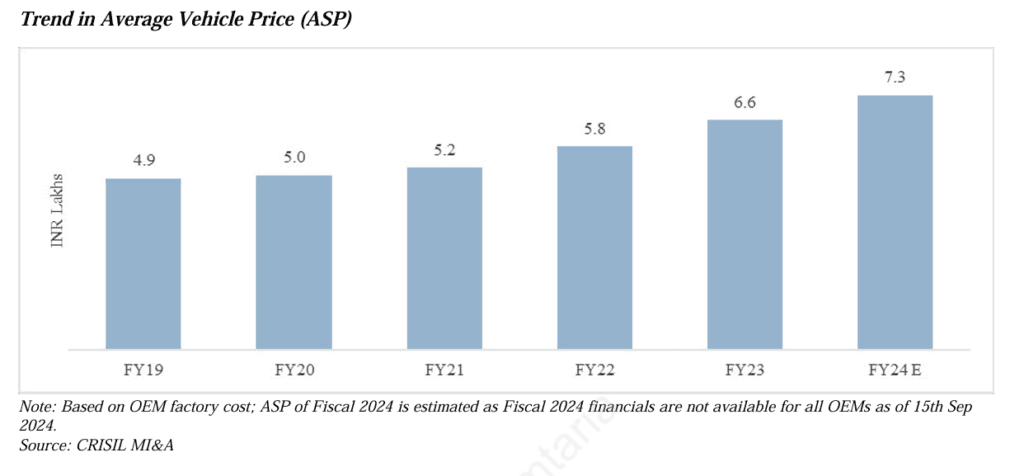

From 2,70,000 units in 2021 to a record 4,20,000 units in 2024, the growth of the PV industry in India is formidable. Apart from that Indian PV industry has witnessed a trend of premiumization playing out here. Now due to the younger age of buyers they are no longer choosing economical fuel-efficient models but instead going for more space and features. Now, The average selling price (“ASP”) between Fiscal 2019 and 2024 increased at a CAGR of 7-9% because of the premiumization trend as well as a sharp rise in vehicle prices.

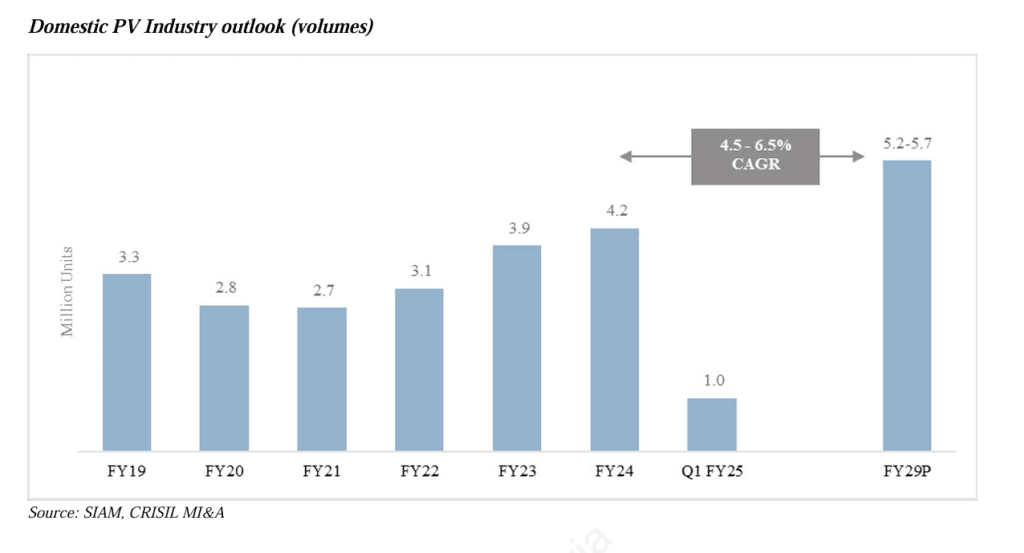

India’s PV industry is expected to grow at a 4.5-6.5% CAGR between 2024-2029.

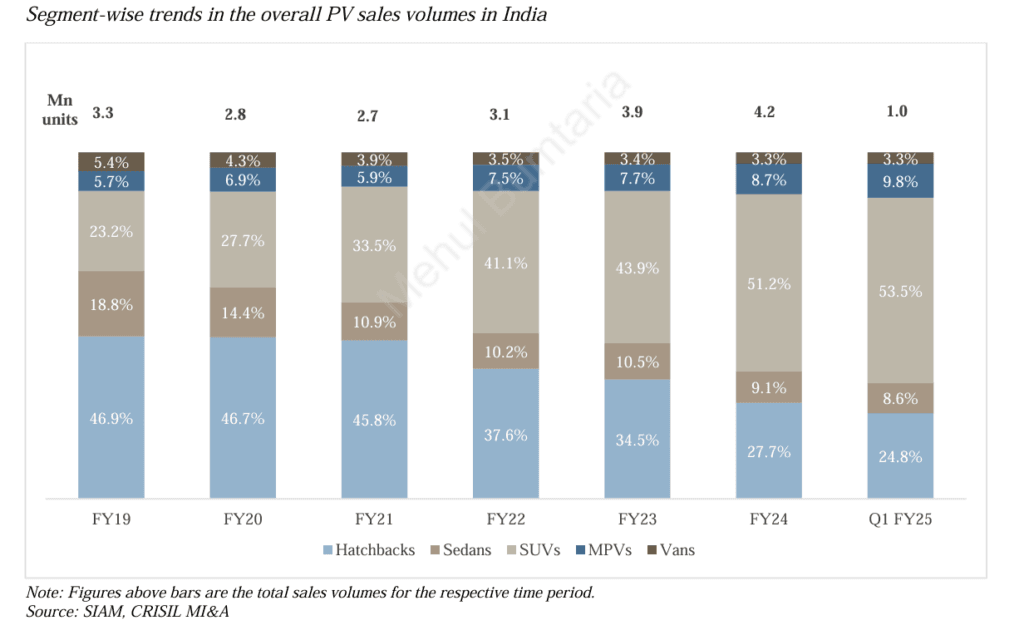

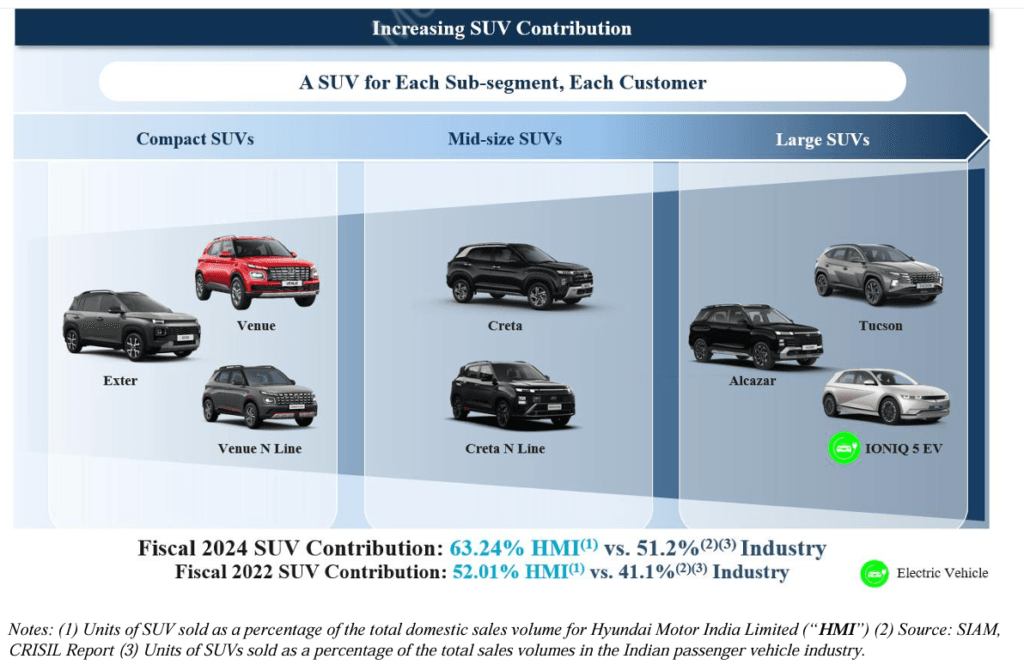

Also, there has been a major shift in customer preference with the launch of compact and mid-size SUVs. An increase in spending from the upper middle class after the pandemic led to more purchases of SUVs supported by a higher number of model launches in the SUV category (which have higher profit margins) and an increase in affordability with the launch of compact SUVs led to cannibalization of hatchbacks and compact sedans.

From the above graph, It is easily visible that the highest percentage of vehicles sold in the country are SUVs, from just 23.2% of total vehicles sold to 53.5% of the same, SUVs have come a long way. Their overall penetration is expected to cross 60% within a few years. Hatchbacks and Sedans are the biggest losers here. SUV’s have grown at a CAGR of 22.9% between 2019 and 2024 while Sedans and Hatchbacks have seen a decline of approx 10% in the same period.

Hyundai Motor India Business

Hyundai Motor India Limited with its large product offering is well placed to reap the benefits of PV industry growth. Not just in terms of domestic sales, they’re among the top players in exports as well. Hyundai Motor India Limited is a market leader in the Mid-size SUV segment, With its flagship model Creta, Hyundai Motor India commanded a leading 68% share of the subsegment during Fiscal 2019.

Intermittent upgrades to Creta helped Hyundai Motor India maintain a notable share in the next 4 years as well and had a market share of 31% in Fiscal 2024. Hyundai, through its only mid-size SUV offering Creta, extended its share in the mid-size SUV segment to approximately 38% in Q1 of Fiscal 2025.

With its industry-beating growth of 9-10% SUVs will make 60% of the total PV market in the next few years and those OEMs with large SUV are expected to maintain the leadership in the industry and Hyundai India with its large SUV offerings is well placed to be one.

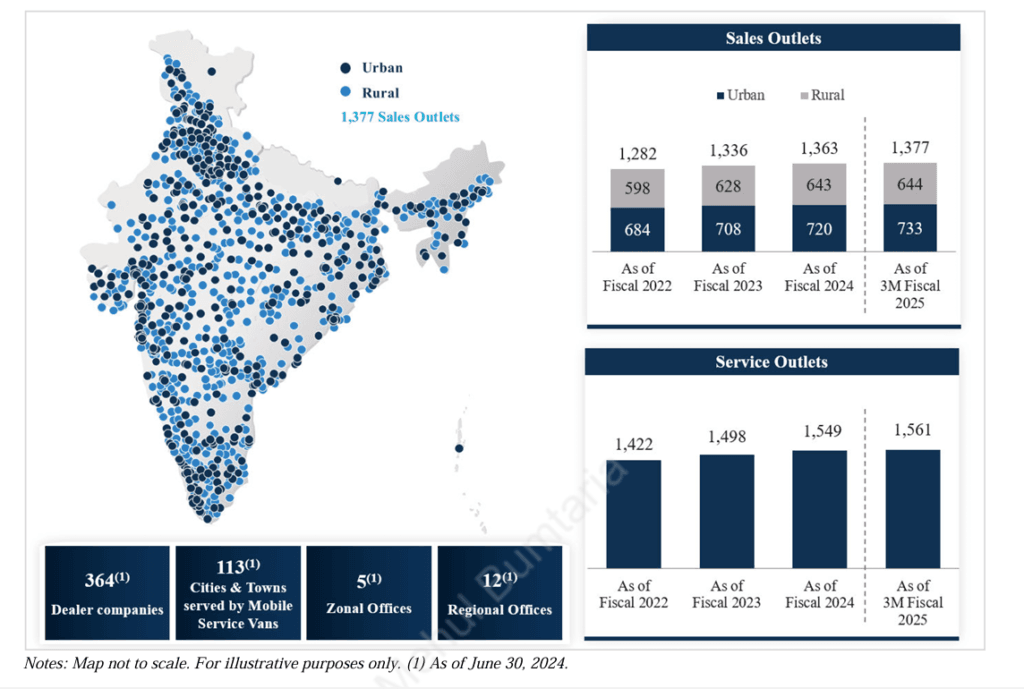

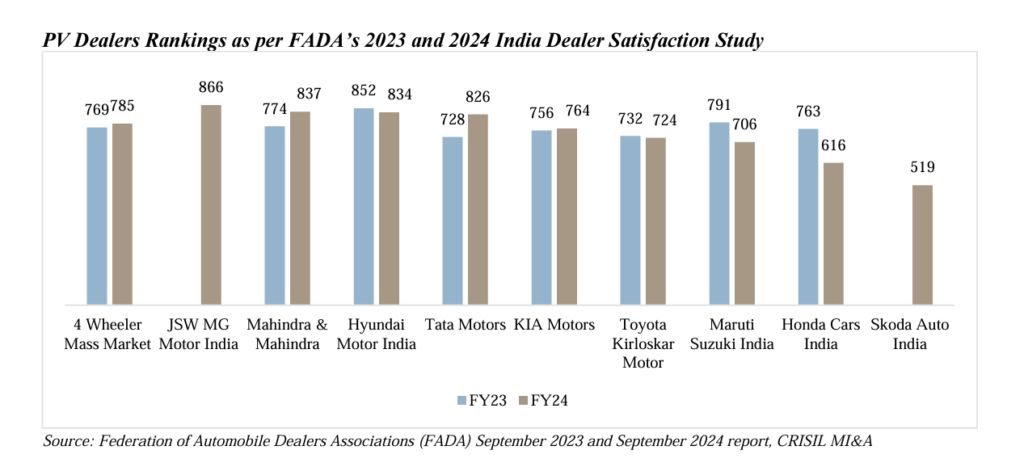

Apart from that Hyundai India has a superior after-sales service offering compared to its peers. It also have one of the highest dealer satisfaction rating among peers.

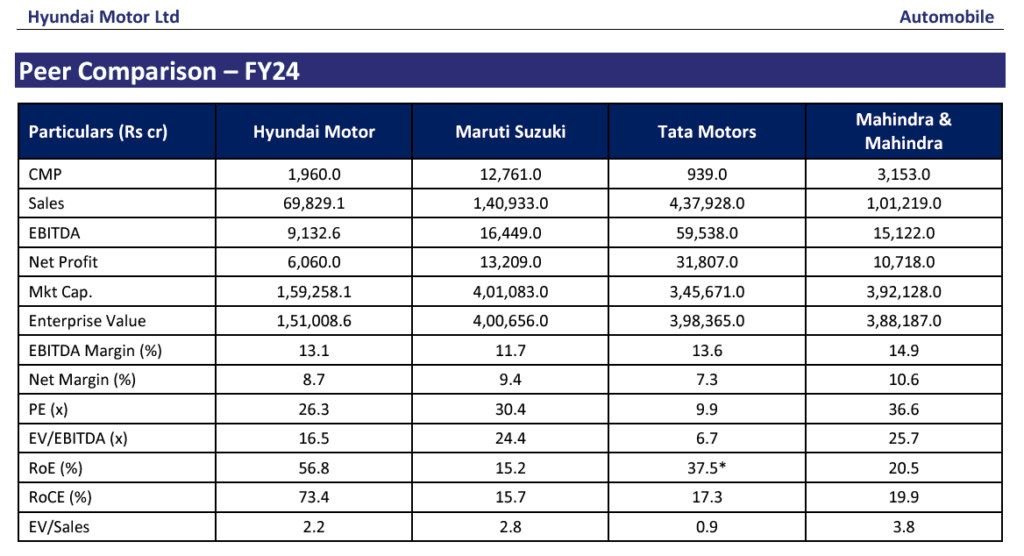

Financials and peer comparison

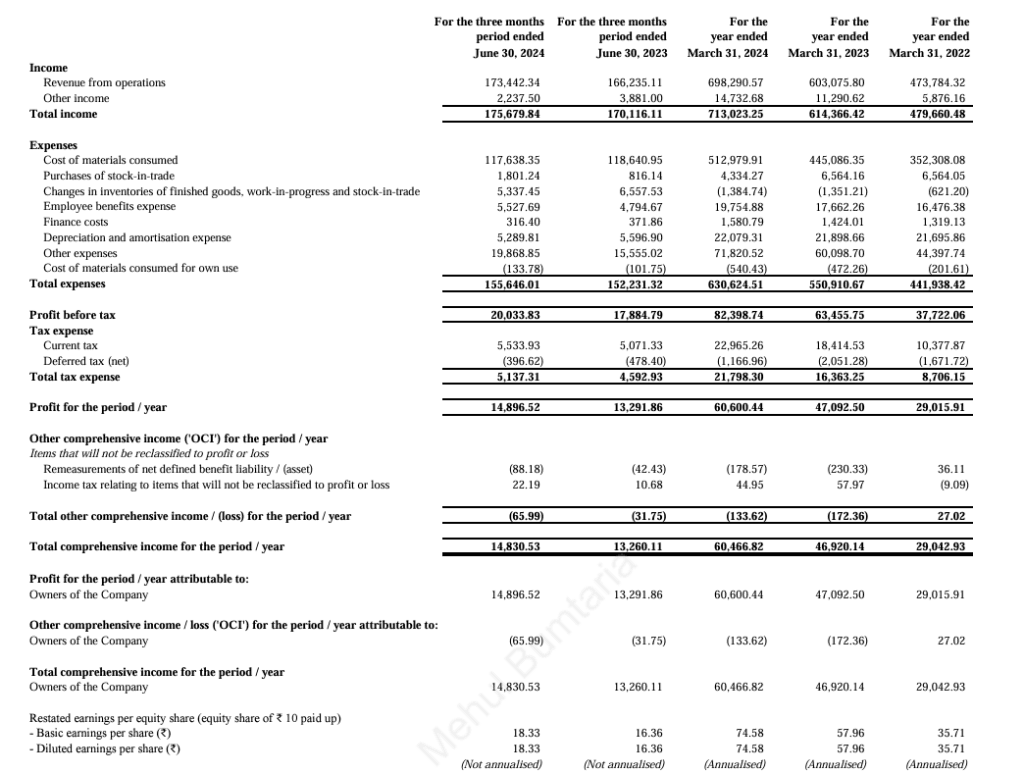

HMIL has seen a healthy 15% growth in the top line and 28.6% growth in the bottom line.

Strengths

- HMIL has a diverse portfolio of passenger vehicles across powertrains and major passenger vehicle segments. Co’s current portfolio of passenger vehicles caters to a diverse customer base, such that they are able to offer “something for everyone”.

- Currently, HMIL’s portfolio includes 13 passenger vehicle models (including N Line models which are the passenger vehicle models that feature sporty performance features) across all major passenger vehicle segments by body type;

- Hyundai Motor India ltd is famous for identifying emerging market trends promptly and introducing innovative passenger vehicles and technologies to meet customer needs in India. They identify emerging market trends, latent customer needs, and aspirations based on their and HMC’s global network, in-depth market and product research

- HMIL has a pan-India sales and distribution and after-sale services network offered by its dealers. As of June 30, 2024, it had 1,377 sales outlets across 1,036 cities and towns in India and 1,561 service centers across India across 957 cities and towns in India, which has grown from 1,167 sales outlets across 873 cities and towns in India and 1,307 service centers across 814 cities and towns in India as of March 31, 2021

- HMIL has digitized customers and dealers’ interactions with each other and with them. Through the “myHyundai” app and website, customers can interact with the company at every stage of the passenger vehicle purchase journey and access after-sale services

- Hyundai Motor India has flexible and automated manufacturing capabilities. The Chennai Manufacturing Plant was amongst the few large single-location passenger vehicle manufacturing plants in India in terms of production capacity as of June 2024, according to the CRISIL Report. HMIL’s passenger vehicles are based on five different platforms (four for ICE passenger vehicles and one for EVs)

- HMIL has an experienced management team with a track record of delivering profitable growth and superior returns.

Weakness

Apart from general weaknesses e.g. slowdown in the economy, spending, sharp uptick in crude price, Rise in interest rates etc the only major weakness or cause of worry for HMIL can be a change in royalty terms (which is unlikely given HMIL’s long-standing relationships with Hyundai motors limited).

Valuation and View on the issue

Taking FY24 EPS into account HMIL is offering its shares at a P/E of 26.3 at upper price band, which is reasonably priced. My expectations are HMIL will do an EPS of 90-94 in FY25 so it is priced at 21.3x FY25 earnings. While its main competitor Maruti Suzuki is will do an EPS of 520-550(*E) in FY25, so it is trading at a p/e of 23-23.5 FY25 earnings, which is in similar lines of HMILs valuations.

My view is that HMIL will not offer much of the listing gains, but we should embrace the listing of HMIL with open arms. A company that is earning huge revenue from India should be there, listed for common folks to be a part of its growth journey. For me, HMIL will remain a long-term story, given the growth of India’s PV sector and HMIL’s strengthening position, and the listing of many loss-making companies at absurd valuations. Listing of HMIL is a welcome step; those with a long-term view in mind should bid for the IPO.

Click here to track the live GMP of Hyundai Motor India IPO