5.1 Decoding the Jargon: What are you buying?

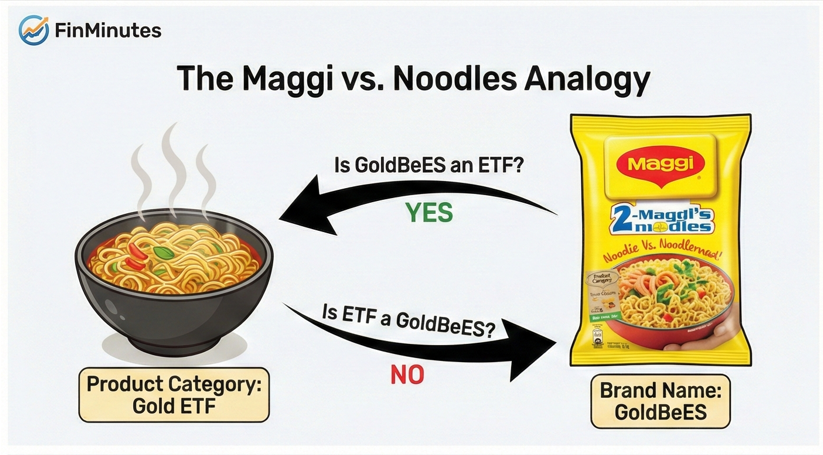

The most common question in India is: "Should I buy Gold ETF or GoldBeES?" asking this is like asking "Should I buy a Car or a Maruti?".

The Category: Gold ETF (Exchange Traded Fund). This is the product, like "Noodles". It represents 99.5% pure physical gold held in a vault.

The Brand: GoldBeES. This is just a brand name owned by Nippon India Mutual Fund. Just like "Maggi" is a brand of noodles.

The Confusion Matrix:

- Is GoldBeES a Gold ETF? YES.

- Is SBI Gold ETF a GoldBeES? NO. (It's a rival brand).

- Should I care? MAYBE. GoldBeES has the highest volume (liquidity), which makes it easier to sell in large quantities.

⚠️ The "Fund of Fund" Trap

Scenario: You go to your bank and ask to buy Gold. They sell you a "Gold Fund of Fund (FoF)".

The Problem: FoFs invest in ETFs. You pay double fees (Expense Ratio of FoF + Expense Ratio of Underlying ETF).

The Rule: Always buy Gold ETFs directly on the stock exchange (Demat). Never buy FoFs unless you don't have a Demat account.

5.2 The Great Battle: Physical vs. Paper

Physical gold is for emotions. Paper gold (ETF) is for wealth. Here is the math.

| Feature | Physical Gold (Jeweler) | Gold ETF (Demat) |

|---|---|---|

| Buy Price | Spot + 15% (Making Charges) | Spot + 0.5% (Expense) |

| Sell Price | Spot - 5% (Melting Loss) | Spot Market Price |

| Purity | Variable (22K/24K) | Guaranteed 99.5% |

| Storage | Risk of Theft (Bank Locker Costs) | Free (Digital Vault) |

| ROI (1 Year) | If Gold up 10%, you are -5% (due to charges) | If Gold up 10%, you are +9.5% |

Who should buy what? (Real Case Studies)

👰 Case A: "The Bride's Father"

Goal: Daughter's wedding in 2 years. Needs jewelry.

Verdict: Buy Physical. Even though making charges are high, he needs the physical ornament. An ETF cannot be worn. Buying bars now to convert to jewelry later saves on gold price hikes.

📈 Case B: "The Wealth Builder"

Goal: Wants to hedge portfolio against stock market crash.

Verdict: Buy ETF. He never wants to see the gold. He wants the profit from the gold. Paying 15% making charges would destroy his returns. ETF is the only logical choice.

5.3 The "Zero-to-Hero" Buying Guide

Never bought a stock before? Follow this exact sequence on Zerodha, Groww, or Upstox.

Type "GOLDBEES" or "SETFGOLD" in the search bar. Ensure it says "NSE" or "BSE".

> SETFGOLD [NSE] ₹62.10

Check the iNAV (Intraday Net Asset Value) on the fund's website. Ensure the market price is close to the NAV.

Select "Limit Order". Never use "Market Order."

- Qty: 100

- Price: ₹63.45 (Match the sellers)

- Product: CNC (Delivery)

💡 Pro Tip: The "SIP" Hack & Settlement

The T+1 Rule: If you buy on Monday, the Gold units will hit your Demat account on Tuesday evening. You can only sell them on Wednesday. Do not panic if you don't see them instantly.

Why SIP works (Real Example):

Investor A buys ₹1 Lakh lump sum at ₹65. Price drops to ₹60. He is in loss.

Investor B buys ₹10,000 every month. He buys at ₹65, ₹62, ₹60, ₹58...

Result: Investor B accumulates more units when price is low. His average cost is ₹61. When price returns to ₹65, Investor B is in profit, while Investor A is just breaking even.

5.4 The Selection Checklist: Due Diligence

There are 15+ Gold ETFs in India. Small differences in numbers create huge differences in wealth.

-

1. Liquidity (The King): Can you sell 10,000 units without crashing the price?

Look for: Daily Volume > 1 Lakh units. (Winner: Nippon/SBI). -

2. Expense Ratio (The Silent Killer): This is the fee the fund manager takes.

Look for: < 0.60%. (Winner: SBI/ICICI). -

3. Tracking Error (The Accuracy): Does it follow gold prices perfectly?

Look for: Lower is better. Ideally < 0.05%. -

4. Cash Component: Some funds hold 5% cash. In a bull run, this "Cash Drag" lowers returns.

Look for: >98% invested in Gold Bullion.

📉 The "Compound Cost" Effect (10 Years)

Why does 0.5% vs 1.0% matter? See the difference on a ₹10 Lakh Investment over 20 years.

Insight: A 0.5% higher fee can eat up 10-15% of your total final corpus due to lost compounding. Always pick the lowest expense ratio.

5.5 The Hall of Fame: India's Top Gold ETFs (2026)

Based on AUM, Liquidity, and Expense Ratios. Data updated for FY 2025-26.

| Rank | ETF Name | AUM (Cr) | Expense Ratio | 1Y Return | Why it Wins? |

|---|---|---|---|---|---|

| 🥇 1 | Nippon India ETF Gold BeES | ₹22,575+ | 0.79% | +66.5% | Liquidity King. Highest volume by far. Best for traders. |

| 🥈 2 | SBI Gold ETF (SETFGOLD) | ₹14,000+ | 0.64% | +65.8% | Trust. Backed by SBI. High retail trust and good volume. |

| 🥉 3 | HDFC Gold ETF | ₹11,379+ | 0.59% | +66.2% | Balanced. Good mix of lower cost and high AUM. |

| 4 | ICICI Prudential Gold ETF | ₹8,207+ | 0.50% | +66.0% | Cost Leader. Very low expense ratio. Great for long-term holding. |

| 5 | Kotak Gold ETF | ₹6,862+ | 0.55% | +65.9% | Accuracy. Lowest tracking error historically. |

📜 Taxation Rules (FY 2025-26)

Buying is easy. Selling involves taxes. Know the rules.

| Holding Period | Tax Rule | Rate |

|---|---|---|

| Short Term (< 12 Months) | STCG | Added to Income (Slab Rate) |

| Long Term (> 12 Months) | LTCG (New Rule) | 12.5% Flat |

Note: The "Indexation Benefit" (adjusting for inflation) was removed in the 2024 Budget. You now pay a flat 12.5% on profits if held for more than a year.

The Gold ETF Buyer’s Guide

Current Status: The rules of the game have changed. For years, the Sovereign Gold Bond (SGB) was the undisputed king of gold investments in India. But with the government pausing new issuances in FY 2025-26, the “free lunch” of 2.5% guaranteed interest is over.

Investors are now scrambling. How to buy Gold ETF? Should you buy physical bars? Gold ETF vs Physical Gold? Are “Digital Gold” apps safe? What exactly is a “GoldBeES”? Gold ETF vs Gold Bees, etc.

Welcome to Module 5 of the FinMinutes Gold Masterclass. This is your execution manual. We are moving away from macroeconomics and into the mechanics of wealth. In this module, we will strip away the confusing jargon, dismantle the “traps” set by marketing agents, and give you a push-button guide to buying gold efficiently, cheaply, and safely.

Whether you are saving for your daughter’s wedding in 2030 or hedging a ₹50 Lakh stock portfolio, this guide has a strategy for you.

Decoding the Jargon: What Are You Actually Buying?

If you type “Gold” into your broker’s search bar, you get 50 different results. It’s overwhelming. The most common question we get is: “Is GoldBeES better than a Gold ETF?” or Gold ETF vs Gold Bees? Let’s kill this confusion once and for all with the “Maggi vs. Noodles” Analogy.

The Product vs. The Brand

- Gold ETF (The Product): Think of this as “Noodles.” It is a category of investment. An Exchange Traded Fund (ETF) is a mutual fund that trades on the stock exchange like a share. It holds 99.5% pure physical gold in a vault.

- GoldBeES (The Brand): Think of this as “Maggi.” It is simply a brand name owned by Nippon India Mutual Fund. Because it was the first gold ETF in India (launched in 2007), the name became synonymous with the category.

The Verdict:

- Is GoldBeES a Gold ETF? Yes.

- Is SBI Gold ETF a GoldBeES? No (It’s a rival brand, like “Yippee Noodles”).

- Does it matter? Yes, but only for Liquidity. Because “GoldBeES” is a famous brand, it has the highest trading volume. This means you can sell ₹1 Crore worth of units in seconds without moving the price. Smaller, unknown ETFs might have “slippage” (you lose money trying to sell because there are no buyers).

The “Fund of Funds” Trap

When you walk into a bank, the relationship manager might try to sell you a “Gold Fund of Fund” (FoF). Say No.

- How it works: You give money to the Gold fund of fund (FoF) -> The FoF buys the ETF -> The ETF buys Gold.

- The Problem: You pay fees twice. You pay the expense ratio of the FoF plus the expense ratio of the underlying ETF.

- The Rule: Always buy the ETF directly through your Demat account. Cut out the middleman.

The Great Battle: Physical Gold vs Gold ETF

For 5,000 years, Indians have believed that “if you can’t hold it, you don’t own it.” In 2026, that belief is an expensive mistake for investors. Let’s look at the math of Physical Gold (Jewellery/Bars) vs. Paper (Gold ETFs).

| Feature | Physical Gold (Jeweler) | Gold ETF (Demat) |

| Buying Price | Spot Price + 15% (Making Charges) | Spot Price + 0.5% (Expense Ratio) |

| Selling Price | Spot Price – 5% (Melting Loss/Cut) | Spot Market Price (Zero Deduction) |

| Theft Risk | High (Requires Bank Locker) | Zero (Digital Vault) |

| Purity | 22K (91.6%) or variable | Guaranteed 99.5% (24K) |

| ROI (Year 1) | If gold rises 10%, you are -5% (Loss) | If gold rises 10%, you are +9.5% (Profit) |

The Reality Check: When you buy jewellery, you are paying for art, not investing in an asset. You start your investment with a 15-20% loss immediately due to making charges and GST. Gold has to rise 20% just for you to break even. With an ETF, you break even almost instantly.

Who Should Buy What? (Persona Case Studies)

Case A: “The Bride’s Father”

- Scenario: Mr Sharma needs 500g of gold for his daughter’s wedding in 2 years.

- Verdict: Buy Physical. Even though the costs are high, his end goal is consumption (ornaments). ETFs cannot be worn. Buying physical bars now to convert into jewellery later protects him from price hikes.

Case B: “The Wealth Builder”

- Scenario: Rahul wants to hedge his stock portfolio. He never wants to see the gold; he just wants the profit.

- Verdict: Buy Gold ETF. Paying 15% making charges would destroy his returns. He needs instant liquidity to rebalance his portfolio. ETF is the only logical choice.

The “Zero-to-Hero” Buying Guide

Buying an ETF is as easy as ordering a pizza, but new investors often make expensive errors. Here is the exact step-by-step workflow for platforms like Zerodha, Groww, or Upstox.

Step 1: The Search

Don’t just search “Gold.” You will get confusing results (Futures, Options, Sovereign Bonds).

- Type exactly:

GOLDBEESorSETFGOLD. - Check: Ensure the symbol says “NSE” or “BSE” and “EQ” (Equity/ETF).

Step 2: The “NAV” Check

Before you buy, check the iNAV (Intraday Net Asset Value). This is the “fair price” of the gold held by the fund.

- Why? Sometimes, if market demand is crazy, the ETF price might trade higher than the actual gold price (Premium).

- Rule: Only buy if the Market Price is close to the NAV. You can find the iNAV on the fund house’s website or tickers.

Step 3: The Order Type (Crucial)

- Mistake: Using a “Market Order.” If liquidity is low, you might end up buying at a much higher price than you see on the screen.

- Solution: Always use a “Limit Order.”

- Example: If the current price is ₹63.45, place a Limit Order at ₹63.45. This guarantees you don’t pay a penny more.

Step 4: The Settlement (The “Panic” Moment)

You bought the gold, but your dashboard shows “T1 Holdings.”

- The T+1 Rule: Indian markets operate on a T+1 settlement cycle. If you buy on Monday, the units will officially hit your Demat account on Tuesday evening.

- Constraint: You cannot sell these units on Tuesday. You must wait until Wednesday (T+2) to sell safely without risk of auction.

💡 Pro Tip: The “SIP Hack”

You don’t need to time the market.

- Strategy: Set up a “Stock SIP” in your broker app.

- Action: Order 10 units of GOLDBEES to be bought automatically on the 5th of every month.

- The Math: By buying fixed amounts monthly, you buy more units when the price is low and fewer units when the price is high. This lowers your average cost over time (Rupee Cost Averaging) and removes the stress of watching charts.

The Selection Checklist: Due Diligence

There are over 15 Gold ETFs in India. How do you pick the winner? It comes down to four boring but critical metrics.

1. Liquidity (The King)

Can you sell when you need to?

- The Test: Look at the Daily Average Volume.

- Target: You want an ETF that trades at least 1 Lakh units per day.

- Winners: Nippon (GoldBeES), SBI (SETFGOLD), HDFC.

- Losers: Small ETFs with low volume can have a “Bid-Ask Spread” of ₹1 or more, meaning you lose money instantly upon entering/exiting.

2. Expense Ratio (The Silent Killer)

This is the annual fee the fund manager deducts from your gold.

- The Impact: A 0.5% difference sounds small. But over 20 years on a ₹10 Lakh investment, a 1.0% fee vs a 0.5% fee will cost you ₹1.5 Lakhs in lost compounding.

- Target: Look for < 0.60%.

- Winners: SBI, ICICI, Kotak usually offer the lowest rates.

3. Tracking Error (Accuracy)

Does the ETF actually follow the price of gold?

- Sometimes, gold goes up 1%, but a bad ETF only goes up 0.90%. This “leakage” is called Tracking Error.

- Target: The lower, the better. Ideally < 0.05%.

4. Cash Component

Some ETFs hold 95% gold and 5% cash to handle redemptions.

- The Problem: In a raging bull market, that 5% cash earns nothing (Cash Drag). You want an ETF that is >98% invested in actual bullion.

The Hall of Fame: Top ETFs for 2026

Based on the criteria above, here is the curated list of India’s top instruments.

1. Nippon India ETF Gold BeES

- Rank: #1

- Superpower: Liquidity. It is the “State Bank of India” of ETFs. Everyone trades it. The spread is usually 1 paisa (the lowest possible).

- Best For: Active traders and short-term holders.

- Rank: #2

- Superpower: Trust & Cost. Backed by India’s largest bank, it often has a lower expense ratio than Nippon.

- Best For: Long-term investors who want safety and low fees.

3. ICICI Prudential Gold ETF

- Rank: #3

- Superpower: Efficiency. Historically keeps expense ratios extremely competitive to gain market share.

- Best For: Cost-conscious investors.

Taxation: The New Rules (FY 2025-26)

In the July 2024 budget, the government simplified capital gains tax, which impacts Gold ETFs significantly.

The Old Rule (Pre-2024)

Gold ETFs were taxed at your Slab Rate. If you were in the 30% tax bracket, you paid 30% tax on gold profits, regardless of how long you held it. It was brutal.

The New Rule (Current)

- Short Term (< 12 Months): Added to your income and taxed at your Slab Rate.

- Long Term (> 12 Months): Flat 12.5% Tax.

- The Benefit: This is a massive win for high-income earners. Instead of paying 30%, you now pay only 12.5% if you hold for just one year and one day.

- Note: The “Indexation Benefit” (adjusting buy price for inflation) has been removed, but the lower rate usually compensates for it.

How to buy Gold ETF: FAQs

Why is Digital Gold (Apps like GPay/PhonePe) bad?

Digital Gold is unregulated. When you buy ₹100 of digital gold, ~3% is cut for GST, and ~3% is cut as a “Spread” by the platform. You effectively start your investment with ₹94. You need the gold price to rise 6% just to recover your principal. In an ETF, the cost is ~0.5%. The math simply doesn’t work for Digital Gold unless you plan to convert it to jewellery later.

Since SGBs are stopped, is the Secondary Market SGB a good buy?

It depends on the “Yield to Maturity” (YTM). Because no new SGBs are coming, existing ones trade at a premium. If you pay ₹78,000 for ₹75,000 worth of gold, you might lose more in the premium than you earn in interest. Calculate the YTM carefully. For most, ETFs are now simpler.

How to buy Gold ETF? And, is my gold safe in an ETF? What if the bank collapses?

The buying process is explained in great detail above. SEBI strictly regulates gold ETFs. The Mutual Fund house does not keep the physical gold; it is kept with an independent Custodian (usually a global bank like JP Morgan or Scotia Bank). Even if the Mutual Fund company goes bankrupt, the gold belongs to the unit holders (you) and cannot be touched by creditors.

Can I convert my ETF units into physical gold?

Technically, yes. Practically, no. Most AMCs require you to hold 1 kg of gold (approx ₹1.5 crore) to request physical delivery. For retail investors, it is better to sell the ETF units for cash and buy jewellery from a shop.

Should I buy Gold Mining Stocks instead of ETFs?

Mining stocks are “leveraged” plays. If gold goes up 10%, miners might go up 20% (because their profits explode). However, they carry operational risks (strikes, mine collapses, government taxes). Gold ETFs are pure price exposure; Miners are business exposure. Stick to ETFs for safety.

Final Verdict: The Winning Strategy

For the modern Indian investor in 2026, the strategy is clear:

- Ignore Digital Gold apps.

- Use Physical Gold only for consumption (weddings/gifts).

- Make Gold ETFs your primary vehicle for wealth generation.

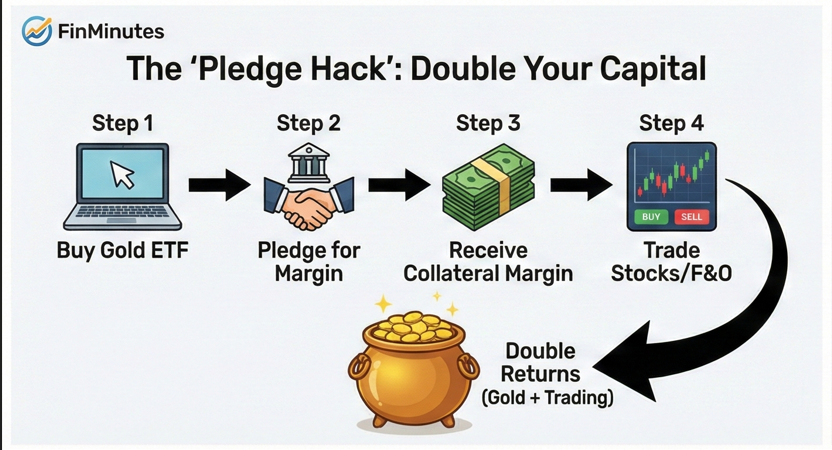

- Use the “Pledge Hack” if you are an active trader to squeeze double returns from your capital.

The Supercycle is here. You know (Modules 1-3), and now you have the vehicle (Modules 4 & 5). The only thing left to do is execute.

[Start Your Journey: Check Top Gold ETF Rates Live]