• CPI data for the April month released earlier in the day shows first signs of cooling inflation in months keeping the rate cuts hope in 2024 alive. The Labor Department’s Bureau of Labor Statistics reported a 0.3% uptick in CPI from march, that was slightly below the Dow Jones estimate for 0.4%.

• On a 12-month basis, however, the CPI increased 3.4%, in line with the expectations, though Core inflation was at 3.6%, the lowest reading ex-food and energy since 2021 and this was enough to trigger a relief rally in the markets.

• Dow is up for 11th day in a row, it climbed 349.89 points, or 0.88% today ending at 39,908, The broad market index S&P500 gained 1.17%, breaking above 5,300 for the first time, to end at 5,308.15. The tech-heavy Nasdaq Composite rose 1.40%, to close at 16,742.39.

Throwing some light on April CPI data

Headline is CPI eased in April, a relief for consumers as well as inflation doves who were betting on easing inflation and rate cuts and were participating in one of the best rallies that wall street have in years. But On a 12-month basis, the CPI increased 3.4%, in line with expectations and it is still at a level that would suggest a cut in interest rates is imminent. Fed’s desired level of inflation is below 2% but market is happy with the progress in key data this month. CPI, labor market and adjusted WPI were better than market expectations and enough to keep markets afloat.

Table: Percent changes in CPI for All Urban Consumers (CPI-U): U.S. city average

Excluding food and energy, the key core inflation reading came in at 0.3% monthly and 3.6% on an annual basis, both as forecast. The core 12-month inflation reading was the lowest since April 2021 while the monthly increase was the smallest since December suggested data. The Commerce Department reported that retail sales were flat on the month, compared with the estimate for a 0.4% increase. That figure is adjusted for seasonality but not inflation, suggesting consumers did not keep up with the pace of price increases.

From above table, inflation is primarily driven by shelter and energy prices, shelter prices rose 0.4% for the month and 5.5% for the year and it is still a big worry for FED. Both the levels are uncomfortably high for the Fed trying to drive overall inflation back below 2%. The energy index rose 1.1% for a month and was up 2.6% on an annual basis. Food was flat and up 2.2%, respectively. Used and new vehicle prices, which had contributed to the early rise in inflation during the worst of the Covid pandemic, both declined, falling 1.4% and 0.4%, respectively.

From the above table it can be seen that how inflation rose between April 2021 and peaked in April 2022 and falling since but the troubling part is, it is loitering around 3.2-3.5% and not falling below it. For FED to cut the rates at least it should show continuous downward movement for few months and fall below 3%, unless these conditions are met it is highly unlikely that Fed will shift its approach on rate policy.

2 Rate cuts in 2024 hopes market

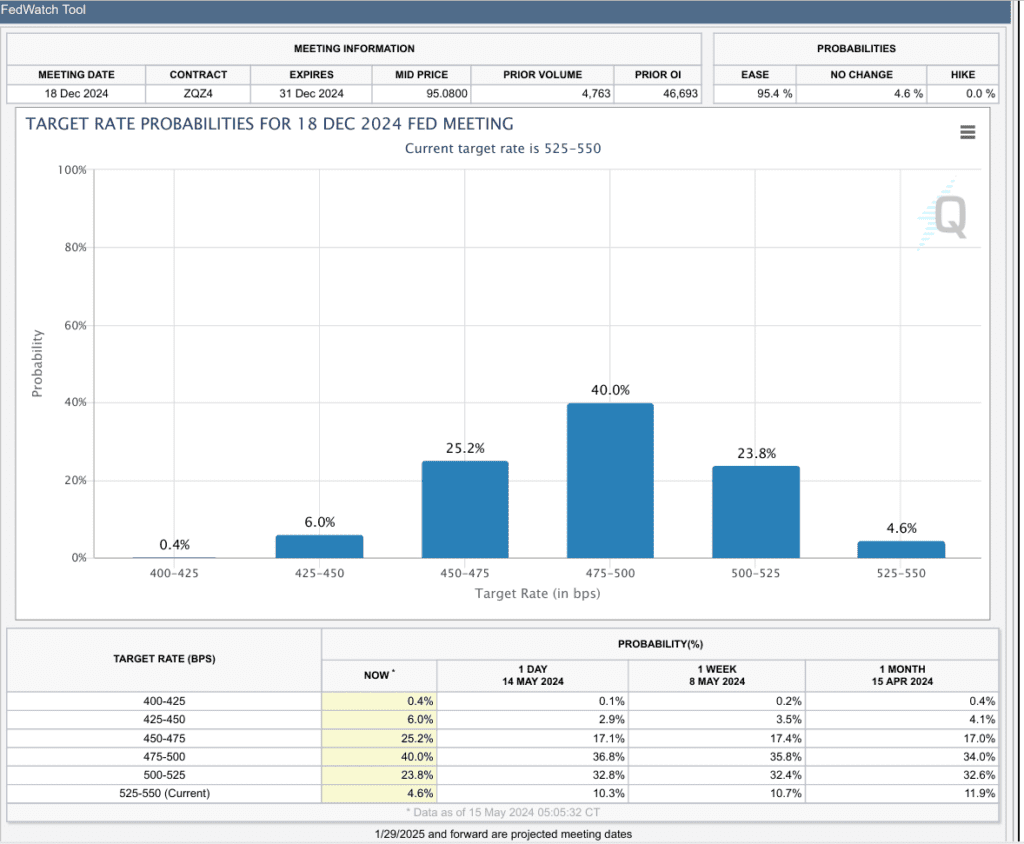

Given the progress made in the war against inflation and the way consumer confidence is falling with a slowing labor market, the market expects Fed to cut rates twice in 2024, once in September and again in December. So, overall market is factoring 2 quarter point rate cuts in 2024, if this happens policy rates will be sitting at 475-500bps at the end of the year.

“We think it’s September at the earliest that they’re going to cut,” said North, the Allianz economist. “Their mind seems to be that, ‘we’re not in any hurry to cut rates. Inflation is not near 2%, the economy is OK, we’re not going anything for months.’”

Data from CME FED watch tool

Though at the start of the year, expectations were widespread that the Fed’s 11 straight rate increases in the past two years would not only curb inflation but also cause economic stress, leading the market to bet on as many as six cuts this year. Instead, progress toward lower inflation has slowed, growth metrics have remained robust, and investors continue to shovel money into risky assets like stocks and corporate bonds at a pace that suggests the economy doesn’t yet require lower rates.

Following the inflation data today US 10y treasury yield fell 0.012 points to 4.344% and US Dollar index (DXY) fell 0.73 points or 0.69% to 104.28, it is its lowest level in more than a month. Oil both WTI and Brent rose slightly but in a weekly loosing streak. Other key commodities were trading rangebound.

Read more about our global news coverage, click here