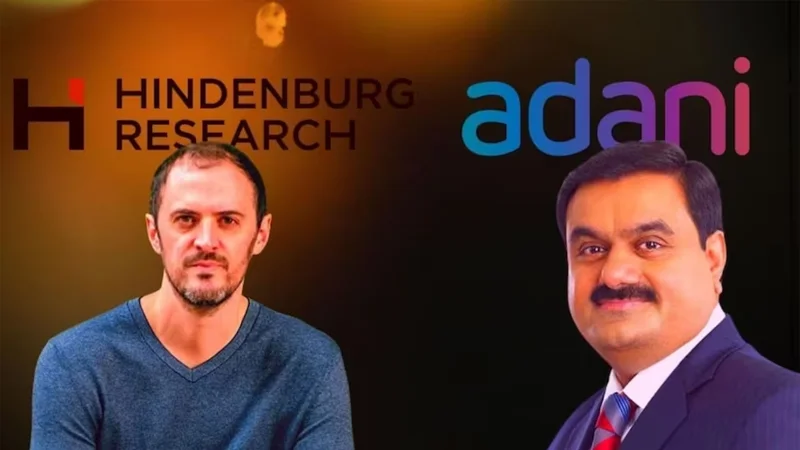

Hindenburg research, an “American short seller investor-activist firm” who claims to make its living out of publishing research reports through its handful of researchers and some forensic tools to surface accounting frauds happening in companies and shorting it before hand. In January last year it published a report alleging some frauds happening in Adani group for which Adani group duly responded and later got the judgement in its favor after SEBI, the Indian capital market watchdog submitted its report to top court.

Later SEBI issued a ‘show cause’ notice to Hindenburg asking some questions that seemed mandatory for a market watchdog to proceed with the investigation in the matter but instead of answering that Hindenburg research tried to give this matter a political shape, later on August 10 (yesterday) it released another report alleging SEBI chairman’s involvement in the case and alleged that she is manipulating the investigations to favor the Adani group.

Let us dive deeper into Hindenburg’s media trial on Adani group, Indian capital market regulator ‘SEBI’ and why we are calling it just a “childish whiny” of Hindenburg and a blatant try to do a character assassination of SEBI’s chairperson.

A little background on Adani Hindenburg research saga

- First, on Jan 25, 2023, Hindenburg Research released a report titled – ‘Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History’, which highlighted some points and alleged financial fraud and stock manipulation by the conglomerate. The report came a few days before Adani Enterprises the flagship company of the group was supposed to make a Rs. 20,000 crore follow-on public offer (FPO).

- The Adani group duly responded to the claims, stating they were “ completely baseless” allegations meant to bring down their share price and to stop the group from raising money through FPO.

- On February 24 within a month, the shares of Adani Enterprises fell by 59 per cent and shares of other group companies fell as much as 80% in response to the report being released. The report led to major losses for the company as it lost more than half of its market cap.

- In February 2023, the Supreme Court heard a PIL asking for a committee to be set up to investigate these claims. The Supreme Court asked SEBI on March 2, 2023, to probe the allegations made in the report and determine whether stock price manipulation and other financial irregularities had taken place.

- The top Court also decided set up a panel for the protection of Indian investors after the Adani group lost more than 100 million dollars off of their market valuation.

- On Jan 3, 2024, almost after a year the Supreme Court dismissed a plea seeking an independent probe by the CBI into the allegations against the Adani group and reaffirmed that it was the sole jurisdiction of the SEBI to look into matters of market regulation and stock price manipulation.

- In June 2024, SEBI said that Hindenburg Research had shared its findings on the Adani group with a New York-based hedge fund manager and allowed him to trade with this information. Though Hindenburg claimed that it made only a few millions from shorting Adani group stocks/bonds from the $153bn rout.

- On August 10, 2024, Hindenburg Research posted on X saying, “Something big soon India”.

August 10 report

In August 10 report, Hindenburg shifted its target to SEBI from Adani group and claimed that SEBI chairperson is involved in its alleged Adani scam and that’s why she is not letting SEBI to investigate the case freely from last 18 months. To make their point they have shared some screenshots of whistleblower document and some independent NGO groups like Adani watch.

To let readers know, “what offshore funds are” as this term is used multiple times in Hindenburg report, An offshore fund is an investment vehicle-based in an offshore location outside the jurisdiction of the home country, often used as a tax haven, though sounds fishy but it is a legal and effective way to invest in entities that are only available outside one’s home country.

Hindenburg alleges that Adani group used to amass money and siphon it through these offshore funds and also used this money to buy it’s own stocks to manipulate price, what is new in the August 10 report that it also alleges that SEBI chairperson Madhabi Buch and her husband Dhaval Buch are also part of it as they stake in these obscure offshore funds.

10 reasons why we are finding Hindenburg’s allegations hollow

- Madhabi Puri Buch the current SEBI chairperson is first non IAS SEBI chief so she had a complete private life prior to her appointment, She is an alumnus of prestigious IIM Ahmedabad and had served in banking and financial services sector for more than 20 years. Madhabi also served private equity firms as an employee and consultant, Hindenburg cited her current salary and maliciously quoted her current wealth relating to it whereas she and her husband both have worked in top positions in leading private companies fetching high salaries, so there wealth is from those salaries, bonuses and investments.

- The fund that Hindenburg alleges Madhabi and her husband to be part of was nowhere linked to Adani investments in any form and she redeemed her units prior to her appointment in SEBI, Hindenburg also maliciously quotes name of a person close to her family which has nothing to do with this or any case.

- Hindenburg alleges SEBI chairperson to not disclose many information related to two consulting companies and her husband’s appointment in Blackstone but this claim is also wrong, all the information were properly disclosed to SEBI, Indian as well Singaporean tax authorities.

- Hindenburg also alleges that she promoted REIT’s to benefit her husband as he was consulting in Blackstone and Blackstone had REIT’s in India, this claim is also childish and false, as SEBI chairperson she advocated for safe investment routes like mutual funds, REIT’s for investors just because they are less risky and provide good returns. REIT’s are new but getting popular in India as alternate way to invest in real estates due to being less risky and providing good returns.

- Blackstone is famous for launching REIT’s in many markets including India, linking to some appointment when the alleged person was not even associated with real estate projects is something that feels wrong and motivated but Hindenburg did the same with no shame.

- Hindenburg also alleges that SEBI did many amendments in REITs act to benefit one large multinational conglomerate (Blackstone in this case) but this claim is also factually wrong, SEBI releases multiple consultation papers and take opinions of investors, industry bodies, experts, intermediaries etc before taking any decision and the decision comes from SEBI board not from SEBI chairperson as alleged by Hindenburg.

- Hindenburg alleged that Madhabi and her husband invested their money in offshore funds through IIFL WM which is now 360ONE WM but 360ONE cleared that the fund which Hindenburg citing was launched in Oct 2013 and was fully regulated and had invested 90% of its aum in bonds (regulated so no chance of investing in offshore funds), it also clarifies that any investor including Buch’s had no say in its working and Buch’s invested money was less than 1.5% of total fund aum. Again a lie from Hindenburg.

- Hindenburg alleged that SEBI did not acted much on Adani investigation and stalled it to benefit the group and its chairperson but it is totally wrong, SEBI in its report submitted to top court claimed that it completed investigations in 22 cases out of 24, now SEBI informs that one more investigation is also complete taking the number to 23 and remaining one is about to be completed.

- If you read the Hindenburg’s reports, you will feel that they are just conducting media trials, most of their sources are media reports, biased NGO articles and other unverified sources, Hindenburg itself discloses that it does neither take representation of its published reports nor verifies the accuracy, completeness and timelines of these information.

- Hindenburg is a short seller who earns from shorting the listed assets of companies that it publishes reports against, do we need to say more. Even now reports suggest it shorted MSCI India ETF prior to publishing this report on August 10 and plans to make good profit even if their base case plays out.

A reality check on Hindenburg research

Hindenburg research the activist short seller firm that expects everyone to behave within laws except itself, when SEBI served show cause notice to it, instead of replying it chose to revert allegations on SEBI and its chairperson. Hindenburg works with least disclosures, never disclose information about its clients or its related parties and never cares about any law to benefit itself.

In Adani group’s case Hindenburg cited a website or to say a project named Adani watch numerous times, but Adani watch is a biased, nefarious project launched to malign the image of Adani group and finds fault in anything and everything that the group does. The project Adani watch is run by a foundation named Bob Brown Foundation, it is a hydra-headed entity, with several sister entities working in tandem. The Foundation has created an extensive network of busybodies across continents, primarily targeting only one corporate group -Adani.

Nate Anderson run Hindenburg also forgets to mention that it has already faced castigation in the US courts, as being a defamed and almost a banned agency in USA, Judges in several US courts alarmed public to pay head to its reports with caution as short seller’s intention is to only make money out of its positions. It also does not wish to present its views to Indian courts despite being requested as it knows that it owns no weigh to its claims, no activism here at all.

It also hides its relation with numerous anti-India lobbies that have vested interest in India and openly seeks regime change for their own benefit, Hindenburg also fails to disclose source of its funds that it uses in shorting and even hides the names of its clients too. When SEBI in its show cause notice asked about Hindenburg revealing the Adani report (first published in Jan 2023) to its clients including Kindon capital months before making it public it went mum.

Hindenburg uses political language in its media reports and directly targets ruling government, Hindenburg in its reply to SEBI’s show cause notice mentioned, “With a rise in the killing or jailing of journalists in India, and a plummeting of press freedom scores in the country, we anticipated that the apparatus of Indian government may concoct a case to attempt to scare us, or worse”, while the above claims are factually wrong but even if true what a short seller had to with all these until it intends to get political attention.

While Hindenburg tried to paint itself as a ‘saint’ working for public good and hardly made break even out of billions of dollars of rout in Adani group’s market cap and said had only one client with it in this project it failed to provide any evidence to support its claims, it used the words like, ‘this work of ours was dedicated to Indian investors welfarism and we are most proud of it’ and expected everyone to believe its words instead of evidences.

Where at one place it expects target entity to disclose everything, Hindenburg itself does not disclose anything to public of its actions, not even a pebble so we are very surprised of their double standard. While Hindenburg names various offshore funds and claims Adani group to siphon money through it, it never discloses its relationship with Bob brown foundation and other similar cabals named ‘globalists’, it should also disclose its source of funds altogether.

Conclusion

While Hindenburg research may claim to be a simple short seller firm but it is way more than that and particularly in the case of Adani group it has many other vested interests apart from making money short selling. People swearing by the report published by it must think that it makes money from spreading negativity about a entity and in the case of report published on Aug 10, reports claim they have already bought truck load of shorts of MSCI India ETF and plans to make good money out of it.

click here to read more about our global news coverage.