HCL share price reacted positively after the company declared an inline set of Q3 results: HCL Tech’s revenue from operations rose 5 percent to Rs 29,890 crore in Q3 FY25 as against Rs 28,446 crore in Q3FY24.

Net profit at Rs 4,591cr rose 5% for the quarter that ended December 31, 2024. The company’s board declared an interim dividend of Rs 18 per equity share of Rs 2 face value, which includes a special dividend of Rs 6 per share to celebrate 25 years of HCL Tech’s public listing.

Read to know the complete details of HCL Tech’s Q3 earnings, and will the market like it?

About the company

The global technology company, home to more than 220,000 people across 60 countries, delivers industry-leading capabilities centered around digital, engineering, cloud, and AI, powered by a broad portfolio of technology services and products.

HCL Tech works with clients across all major verticals, providing industry solutions for Financial Services, Manufacturing, Life Sciences, Healthcare, Technology and Services, Telecom and Media, Retail and CPG, and Public Services. Consolidated revenues of the company as of 12 months ending December 2024 totaled $13.8B.

HCL Tech Q3 results

Revenue

- INR Revenue of ₹29,890 Crores, up 3.6% QoQ & up 5.1% YoY

- Constant Currency (CC) Revenue up 3.8% QoQ & up 4.1% YoY

- USD Revenue of $3,533M, up 2.5% QoQ & up 3.5% YoY

- HCLTech Services CC Revenue up 2.2% QoQ & up 4.9% YoY

- Digital Revenue up 6.3% YoY CC; contributes 38.5% of Services

- HCL Software Revenue down 2.1% YoY in CC terms

- HCL’s Software ARR at $1.02B, down 0.6% YoY CC

Profitability

- EBIT at ₹5,821 Crores ( EBIT Margin at 19.5%, EBIT Margin up 93 bps QoQ), up 8.6% QoQ and up 3.7% YoY

- NI at ₹4,591 Crores (15.4% of revenue), up 8.4% QoQ & up 5.5% YoY

- ROIC (on LTM basis) – Company at 36.6%, up 385 bps YoY;

Services at 44.7%, up 455 bps YoY - OCF at $2,851M and FCF at $2,716M (on LTM basis)

- FCF/NI at 134% (on LTM basis)

Key highlights

- The IT major raised its revenue growth guidance in constant currency (CC) terms in the lower end by 100 basis points. Company Revenue growth is expected to be between 4.5% – 5.0% YoY in CC.

- Services Revenue growth expected to be between 4.5% – 5.0% YoY in CC.

- The company retained its EBIT margin guidance and expect it to remain between 18.0% – 19.0%

- Total People Count at 220,755; Net addition of 2,134 employees. The company added 2,014 freshers this quarter

- LTM Attrition at 13.2%, (up from 12.8% in Q3 of last year)

- New deal bookings were healthy during the quarter at $2.1B with wins across services and software.

- Balance sheet strengthened, co have highest ever cash balance of ₹27,707 Crores.

- Management commentary is positive, Mgmt sees growing demand in services and software offerings powered by AI-led propositions. Like its peer TCS, HCL Tech is also seeing improvement in discretionary demand as they are anticipating an uptick in client spending to for IT services to grow in medium term.

For more corporate updates and Q3 numbers, visit BSE India’s corporate announcement page.

Segment-wise performance

- IT and Business Services revenue growth is positive in both QoQ and YoY terms; similarly, Engineering and R&D Services also saw positive revenue growth.

- By vertical, Financial Services saw a degrowth of 1.4%, and Lifesciences & Healthcare saw a degrowth of 1.1%. Public Services, including Energy & Utilities, Travel – Transport – Logistics, and Government, saw a decline of 4.6% YoY.

- Verticals like Manufacturing, Technology and Services, Telecommunications, Media, Publishing & Entertainment, Retail & CPG saw a healthy growth of up to 33.1%.

- Geography-wise, all reasons saw good growth, Americas 6.2% Europe 2.6% and the rest of the world at 2.9% YoY.

HCL share price outlook

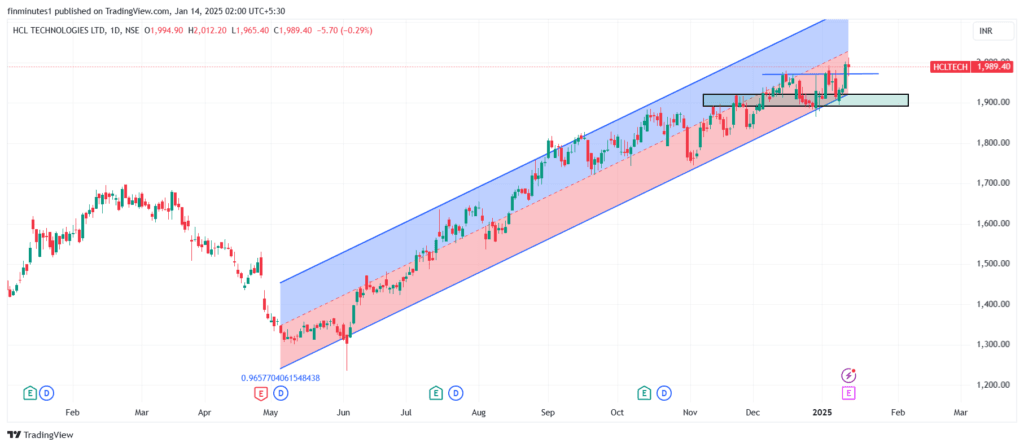

Technically, the stock of HCL Tech is firm, giving a breakout with good volume, making a higher top and a higher bottom. On a daily chart, the stock will have immediate support in the 1965-1975 range and resistance in the 2035 – 2050 range. If broken, the stock could rally to 2150. On the downside, the stock has very strong support in the 1885 – 1920 zone; if, in any circumstance, that breaks (on a closing basis), the current breakout will lapse.

On a weekly chart, the stock of HCL Tech is a trading guide in itself. First stock made a double top (shown by arrows), making that zone a strong resistance, then a fall, consolidation, a rounding bottom formation, and a breakout. Then the old resistance worked as new support, rally, again a breakout, and again rally, and now a new breakout a few days back, which has a high chance to turn into a new rally.

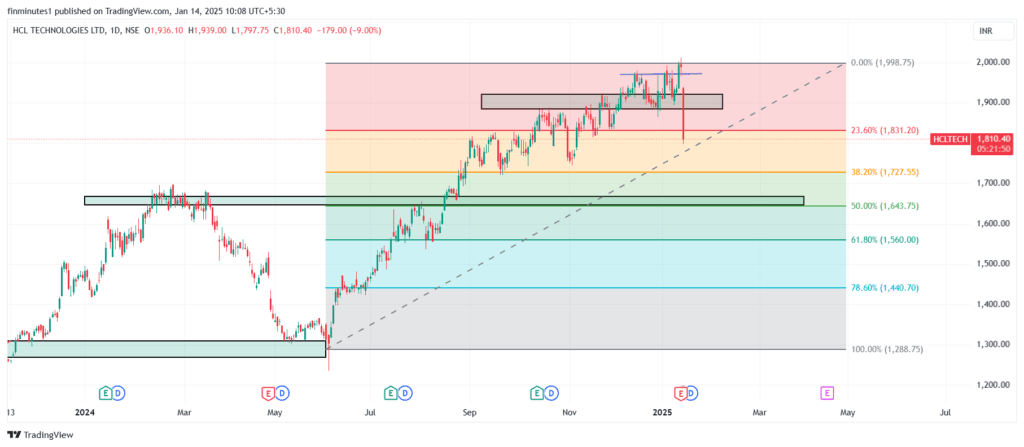

The stock of HCL Tech in today’s opening session fell more than 9% to 1800. The overreaction was due to a marginal miss in revenue growth and capped guidance for Q4. Brokerage firm CLSA has retained a ‘Hold’ call on HCL Tech with a target price of 1882.

Jefferies also has a ‘Hold’ call on the stock with a price target of 2060. Brokerage firm Motilal Oswal Fin Services retained its ‘Buy’ call on the stock with a target price of 2400, but pointed out the weak Q4 guidance.

If the stock closes below 1885, it opens the door for the stock to fall to the range of 1720 – 1730, which is also the 38.20% retracement of the current rally on Fibo retracement. Post that, the next support can be in the 1620-1640 range (50% retracement).

Conclusion

The result of HCL Tech though mixed, but largely in line with street expectations. There is a positive surprise in terms of bottom-line margins and deal wins ( seasonally weak quarter, but the deal wins are spread across the industry).

Investors were anticipating a muted Q3 from IT companies, all eyes were on management commentary, and for HCL Tech nothing negative in it. Management pointed out indications of discretionary spending coming back.

Indian IT companies have been facing challenging conditions for the last few quarters. There was pressure on margins as companies were prioritizing orders by cutting discretionary expenses. There may be a few more quarters until the pricing negotiations turn in favor of IT cos, but deal wins are signaling that clients are going ahead with projects.

For HCL Tech, growth from all geographies is a positive sign. Investors should keep track of macros in key geographies like the Americas and Europe, as they will be the driving force for the share price of Indian IT companies, including HCL Tech.