The Hang Seng Index (HSI) and the Nikkei 225 are two of the most significant stock market indices in Asia. Representing the Hong Kong and Japanese stock markets, respectively, these indices offer valuable insights into the economic health and investment climate of these regions. This comprehensive analysis aims to provide an in-depth comparison of the Hang Seng and Nikkei indices, focusing on their performance, underlying factors, and future prospects for 2024.

AIA, Bank of China (Hong Kong), China Unicom, Sung Hung Kai properties are some of the largest companies listed on Hang Seng by market cap while for Nikkei 225 Toyota motor, Mitsubishi UFJ, Sony group, Keyence and Hitachi are some of the largest listed companies. Hang Seng index is a doorway to invest in Chinese stocks for foreign investors as they are barred from directly buying stocks from Chinese exchanges and Hang Seng is a key indices which foreign investors track closely.

Similarly Nikkei 225 is a key index comprising 225 prominent companies operating in Japan. These 2 indices combined fetch significant foreign investment among Asian indices. While Hang Seng’s performance depends a lot upon how Chinese economy is doing as major chunk of revenue for listed companies come from there only and given the trouble Chinese economy is facing the key question is, how will Hang Seng index will perform going ahead.

Economic and Geopolitical Background

Hong Kong’s economy, heavily dependent on trade and finance, has faced challenges in recent years due to political unrest and the global pandemic. Japan, with its advanced economy, has been dealing with aging demographics and a deflationary environment. Both economies are crucial players in the global market, influencing and being influenced by international economic trends.

Hang Seng index

The Hang Seng Index, established in 1969, is one of the oldest and most well-known indices in Asia. It tracks the performance of the 50 largest companies listed on the Hong Kong Stock Exchange, serving as a benchmark for the region’s economic health. Over the years, the HSI has evolved, incorporating companies from various sectors, including finance, real estate, utilities, and technology.

Key Sectors Represented in the Hang Seng index

- Finance: Dominated by major banks and insurance companies, reflecting Hong Kong’s status as a global financial hub.

- Technology: Includes leading tech giants like Tencent, emphasizing the region’s growing focus on innovation.

- Real Estate: Significant due to Hong Kong’s high property values and major developers.

Key Issues Influencing Hang Seng Index

Geopolitical tensions, especially between the U.S. and China, significantly impact the Hang Seng Index. Sanctions, trade wars, and political developments leads to increased volatility. Japan’s relationship with its neighbors, especially China and South Korea, also plays a role in market dynamics. Additionally, Japan’s alignment with Western policies often impacts its economic and trade policies.

Recently, Investor sentiment towards China has become more cautious. While some investors still see potential in China’s large consumer market and technological innovation, others are wary of the risks associated with regulatory changes and geopolitical tensions. Famous investors like Michael Burry bought Chinese stocks like Alibaba and JD.com but his investment failed to provide any significant returns in last 6 months.

Reason, China’s economy has experienced significant fluctuations in recent years. While it was once known for double-digit GDP growth, recent years have seen a slowdown. Post covid pandemic, China’s economy is falling continuously, recently China’s National Bureau of Statistics released country’s second-quarter GDP growth numbers which showed a growth of 4.7% year on year, missing expectations of a 5.1% growth, according to a Reuters poll.

This is not it, China’s economy is facing a structural downturn, once China’s key growth engine “real estate sector” is facing a big problem as its huge inventory is having no demand. China back in 2015, during capital outflow scare provided boost to infrastructure investment and came out of trouble by encouraging property market speculation, among other measures. That infra boost was primarily fueled by ‘debt’ and that is the root cause of real estate trouble.

When covid restrictions came in place it badly impacted the revenue of companies and government as well and many real estate companies started showing signs of troubles as they had no or very less cash to pay interest to banks, in return health of banks or other debtors deteriorated impacting overall economy. Due to huge unsold inventory, real estate prices crashed and it impacted households badly as they had a large part of savings in real estate.

Impact on households further crumbled the consumption as people started focusing more on savings instead of spending. As result China’s economic growth is falling, Even in the recently released data, Housing-related wealth in China rose only by 2.2% in 2023-24, down sharply from 13% average annual pace between 2016 and 2021.

Last week in a surprising move China’s central bank cut major short and long term interest rates and provided liquidity to banks at a very cheaper interest rate to boost the economy but experts see a very limited impact of this move as consumer confidence is still down and there is no viable solution in sight for its sinking real estate sector.

As result Hedge funds are selling Chinese stocks and their exposure in Chinese stocks is at 5-year low. Several notable hedge funds have reduced their exposure to Chinese stocks. For example, some have shifted their focus to other emerging markets or increased their investments in developed markets. These strategies reflect a broader trend of caution among hedge funds.

Performance Trends of the Hang Seng Index

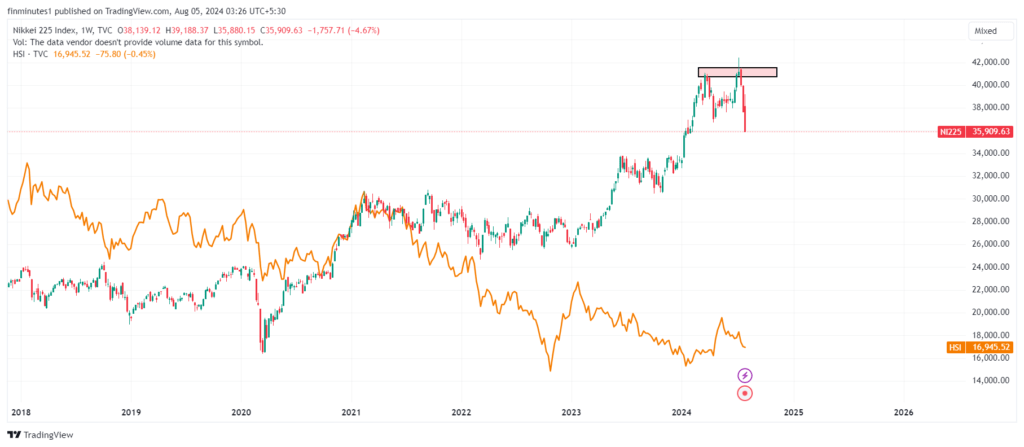

Hang Seng is down more than 50% from its peak in 2021 and underperformed other key global markets heavily. Chart of Hang Seng index suggests it will remain in a range of 16000-18000 until it breaks it either on upside or downside, Index recently started making higher highs and higher lows but failed to continue the formation. Our view is negative on the index as long as it is below 18000-18200 range.

Nikkei index

The Nikkei 225, or Nikkei, is Japan’s premier stock index, established in 1950. It includes 225 of the most liquid and influential stocks on the Tokyo Stock Exchange. The Nikkei has undergone significant changes, reflecting Japan’s post-war economic boom, subsequent challenges, and the country’s resilience in adapting to global economic shifts.

Key Sectors Represented in the Nikkei index

- Automotive: Japan is home to some of the world’s largest car manufacturers, which are key components of the Nikkei.

- Technology: Includes electronics and tech companies like Sony and Panasonic, highlighting Japan’s innovation in this sector.

- Pharmaceuticals: Reflects Japan’s advancements in healthcare and medical technology.

Key issues influencing Nikkei index

Japan’s mature economy which shows a modest growth but keeps attracting investors from around the world due to its technological advancements. Japan boasts a sophisticated infrastructure, advanced technology, and a skilled workforce but a rapidly aging population poses significant challenges to its labor force and social security system.

Japan’s GDP growth has been relatively modest in recent years. The country has faced challenges such as a declining birth rate, an aging population, and global economic fluctuations. While there have been periods of growth, sustained economic expansion has been elusive. Japan’s average GDP growth rate for last 10 years is just 0.8%.

Due to very low growth, the country was at 0 to 0.1% interest rate for many years but Japan’s central bank on Wednesday raised its benchmark interest rate to “around 0.25%”, the move was primarily aimed at taming falling currency as the country’s currency yen fell to a 38-year low against the U.S. dollar this week. Also Japanese authorities spent 5.53 trillion yen, or $36.8 billion, to shore up the yen in July, official data published Wednesday showed.

The yen rose sharply after the BOJ’s decision and was last seen trading at around 150 per dollar. It marks a stark contrast from the start of the month, when the Japanese currency fell to 161.96 per dollar for the first time since December 1986.

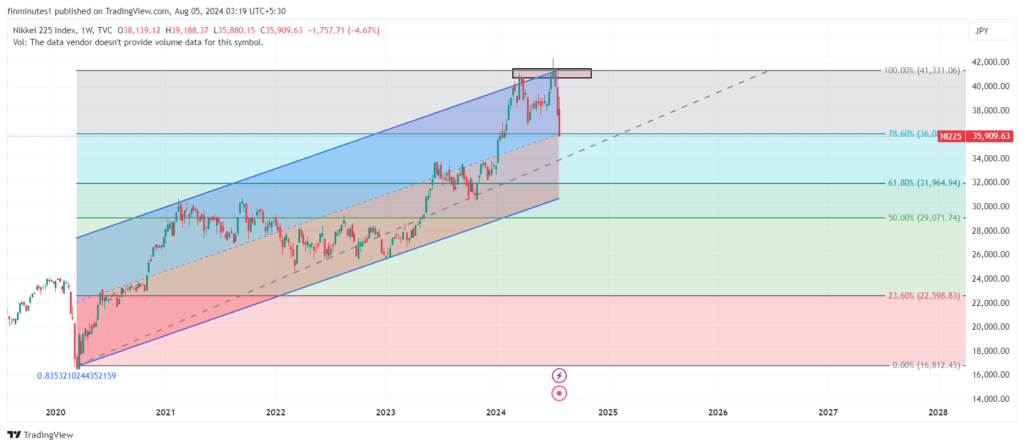

A look at Nikkei index performance

Nikkei index is up more than 2x from covid lows participating in a global stock rally but saw a sharp decline of more than 10% after the rate hike announcement. Nikkei index is trading at a crucial support but could fall to 31,950-32000 if the fall escalates. On the upside 40,860-41,500 will work as a strong resistance. In near term our view on Nikkei index is ‘cautious’.

Impact of recent rate hike is yet to be seen but investors are taking long term view, “We continue to believe improvement of domestic economy is a key catalyst for Japanese equities to move higher, and we remain constructive over the medium term,” said Kazunori Tatebe, a strategist at Goldman Sachs. “At the same time, Japanese equities cannot be isolated from global development, so we might also need to see relief of investors’ US recession concerns, and see moderation of yen strengthening – therefore we remain cautious in the near-term.”

What is the Hang Seng Index?

- The Hang Seng Index is a market capitalization-weighted index representing the largest companies listed on the Hong Kong Stock Exchange.

What is the Nikkei 225?

- The Nikkei 225 is a price-weighted index representing 225 leading companies on the Tokyo Stock Exchange.

How do geopolitical tensions affect these indices?

- Geopolitical tensions can create market volatility, impacting investor sentiment and stock prices in both indices.

What are the key sectors in the Hang Seng Index?

- Key sectors include finance, technology, and real estate.

Conclusion

In conclusion, both the Hang Seng Index and Nikkei 225 are crucial indicators of economic health and investor sentiment in Asia. The analysis highlights their differences and similarities, providing insights into their past performance, current trends, and future prospects. Investors should consider the unique factors influencing each index, including economic conditions, regulatory environments, and geopolitical risks. For those interested in gaining exposure to Asian markets, understanding these indices is essential for making informed investment decisions.

Nikkei index beat Hang Seng index in terms of returns by a wide margin and in long term our view remain more constructive on Japan but investors should keep watching both economies carefully to analyze how they are overcoming there respective problem.