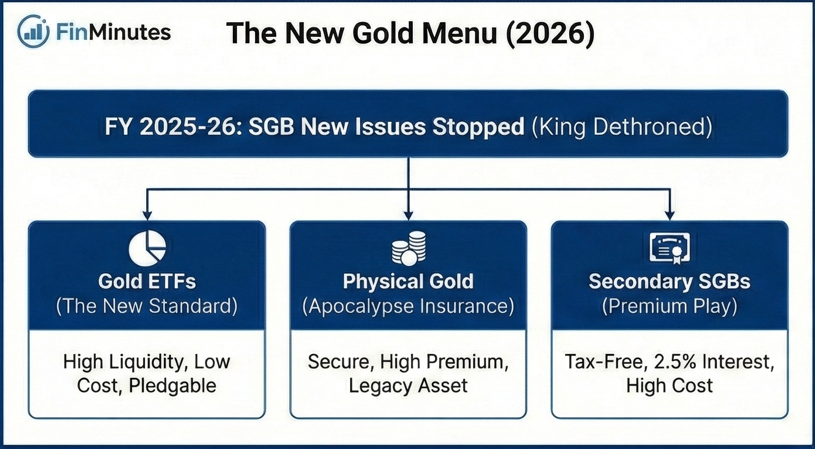

The Vehicles: How to Own Gold in 2026

The "King of Gold" (SGB) has been dethroned. The government has paused new issuances. Here is your new menu, ranked by efficiency.

🚨 IMPORTANT: The SGB Shift (FY 2025-26)

Status: New SGB Issuances are DISCONTINUED.

Why? The Government realized it was a losing trade. Paying 2.5% interest + 4x Capital Appreciation was unsustainable for the exchequer.

Implication: You can only buy existing SGBs on the secondary market (Stock Exchange). However, due to scarcity, they now trade at a Premium. The "Free Lunch" is over.

Gold ETFs (The New King)

- Best For: Traders & Wealth Builders.

- Liquidity: ⭐⭐⭐⭐⭐ (Instant on Exchange).

- Cost: ~0.5% Yearly (Expense Ratio).

- Safety: Regulated by SEBI. Gold sits in JP Morgan/Scotia Bank vaults.

- Verdict: The most efficient way to buy gold today.

Physical Bars/Coins

- Best For: "Apocalypse Insurance" (Doomsday).

- Liquidity: ⭐⭐⭐ (Dependent on Jewelers).

- Cost: High! 10-15% "Making Charges" + 3% GST on buy.

- Risk: Theft/Storage costs.

- Verdict: Essential for 10% of portfolio, but terrible for trading.

Digital Gold (Apps)

- Best For: Nobody. (Avoid).

- The Trap: You pay a 3% "Spread" + 3% GST instantly.

- The Math: You start your investment at -6% Loss immediately. Gold must rise 6% just for you to break even.

- Regulation: NOT regulated by SEBI. Platform risk is high.

- Verdict: Avoid at all costs. Use ETFs instead.

The ETF Handbook: Retail's Secret Weapon

What is an ETF? An Exchange Traded Fund (ETF) is like a basket. When you buy 1 unit of a Gold ETF, the fund manager (Nippon, SBI) takes your money and buys actual 99.5% pure physical gold bars. They store these bars in a secure vault. The price of your ETF unit moves exactly with the price of physical gold.

🏆 Top 3 Indian Gold ETFs (2026 Rankings)

Not all ETFs are equal. You need Liquidity (Volume) so you can sell when you want, and Low Costs (Expense Ratio) so fees don't eat your profit.

| Ticker | AUM (Cr) | Expense Ratio | Liquidity Score |

|---|---|---|---|

| GOLDBEES (Nippon) | ₹10,500+ | 0.79% | High (No Slippage) |

| SETFGOLD (SBI) | ₹4,200+ | 0.35% | Medium-High |

| HDFCMFGETF | ₹5,100+ | 0.59% | Medium-High |

*Pro Tip: Always use Limit Orders when buying ETFs. Market Orders can result in "Impact Cost" (buying at a higher price due to low liquidity).

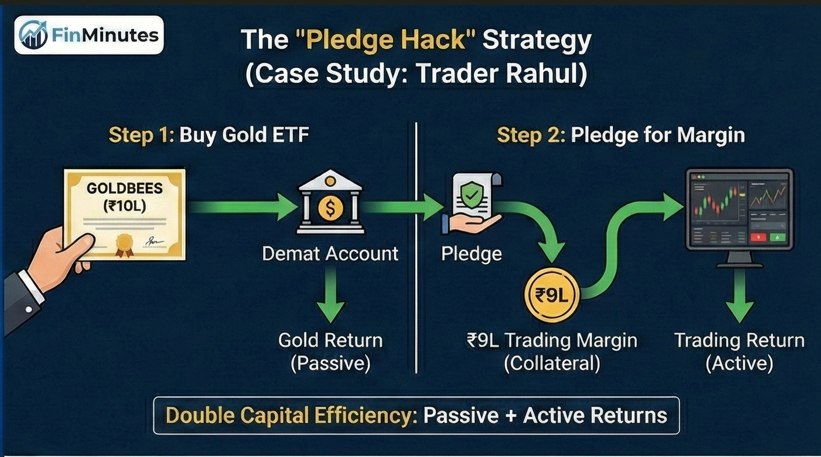

🧮 The "Pledge Hack": Double Dipping Your Capital

Most investors just hold Gold. Smart investors put their Gold to work. In India, you can Pledge your Gold ETFs with your broker to get margin for stock trading.

Case Study: Trader Rahul

Rahul has ₹10 Lakhs capital.

- Step 1: Rahul buys ₹10 Lakhs of GOLDBEES. He now owns Gold.

- Step 2: He "Pledges" these ETFs. The broker gives him a 90% haircut margin. He gets ₹9 Lakhs trading margin.

- Step 3: He uses this ₹9 Lakhs to sell Options (Low Risk Strategies) generating 15% yearly.

- The Result:

- Gold Return: +12% (Passive)

- Trading Return: +15% (Active)

- Total Return: +27% on the same capital.

*Note: There is a small cost (~₹50) to pledge/unpledge. This works best for Option Sellers/Intraday traders.

The Great Debate: Bulls vs. Bears

Before you invest, you must listen to the enemy. Here is the forensic audit of both arguments.

The Bulls (Target: ₹2.10L)

- Debasement: Global debt is $315 Trillion. Governments must print money to pay interest. More printed money = Higher Gold price.

- De-Dollarization: BRICS nations are buying gold to settle trade outside the US Dollar system to avoid sanctions.

- The "War Premium": Conflict in the Middle East and Europe creates a permanent bid for safety.

The Bears (Target: ₹1.00L)

- Peace Dividend: If the Ukraine/Israel wars end suddenly, the "Fear Trade" evaporates. Gold could drop 20% overnight.

- Tech Deflation: AI will lower the cost of goods and services. If inflation dies, Gold (the inflation hedge) dies with it.

- Strong Dollar: If the US economy booms due to AI, the Dollar strengthens, crushing Gold.

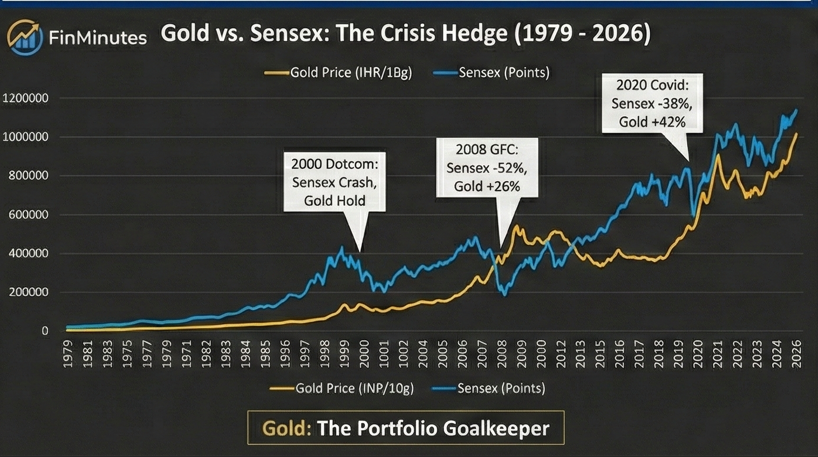

📈 Benchmark Test: Gold vs. Sensex (Crisis Correlation)

Why hold Gold if Sensex gives higher returns? Because they move differently.

| Period | Scenario | Sensex Return | Gold Return | Verdict |

|---|---|---|---|---|

| 2008 | Global Crash | -52% | +26% | Gold saved the portfolio. |

| 2020 | Covid Crash | -38% | +42% | Perfect inverse correlation. |

| 2023 | Bull Run | +20% | +15% | Rare tandem rally (Supercycle). |

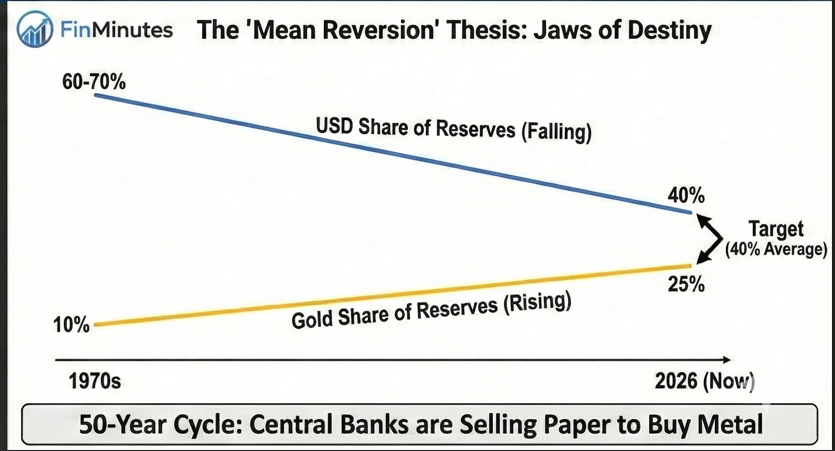

The "Mean Reversion" Thesis

Why are experts like Ajay Bagga predicting significantly higher prices? It comes down to one chart: Global Central Bank Reserves.

Source Data Logic: Bloomberg / WGC / Ajay Bagga Analysis

The Logic Explained

The History: In the 1970s and 80s, Global Central Banks held 60-70% of their total reserves in Gold. It was the standard.

The Shift: In the 1990s and 2000s, they sold gold to buy US Dollars (Treasuries), believing the Dollar was "Risk Free." Gold ownership dropped to just 10%.

The Reversion (Now): Today, Central Banks realize the Dollar can be weaponized (Sanctions). They are frantically selling Dollars to buy Gold. Currently, Gold is back to ~25% of reserves.

The Prediction: If history "Rhymes" and Central Banks simply revert to the mean (average) of 40%, they need to buy Trillions of dollars worth of Gold.

Conclusion: We are barely 1/3rd of the way through this buying cycle. The price must rise to accommodate this massive flow of sovereign capital.

The Final Strategy: Personalizing Your Allocation

One size does not fit all. Select your profile to see your recommended Gold Strategy.

🧒 The Young Aggressor (Age 20-35)

- Allocation: 5-10% of Portfolio.

- Goal: Wealth Creation via "The Pledge Hack."

- Strategy: Buy GoldBeES (ETF). Pledge it immediately to get margin. Use that margin to trade Stocks/F&O.

- Logic: You have time. You don't need dead assets. You need assets that work double-time.

👨💼 The Balanced Builder (Age 35-50)

- Allocation: 15-20% of Portfolio.

- Goal: Wealth Preservation & Education funding.

- Strategy: 50% in Secondary Market SGBs (Tax Free maturity matches child's college). 50% in ETFs for liquidity.

- Logic: You have liabilities. You need the stability of Gold to offset stock market crashes.

👴 The Golden Retiree (Age 50+)

- Allocation: 20-25% of Portfolio.

- Goal: Inflation Protection & Legacy.

- Strategy: Buy Physical Gold Bars/Coins.

- Logic: This is your "Sleep Well at Night" money. Physical gold has no counterparty risk. It is the ultimate legacy asset to pass down to grandchildren.

The Golden Rule of Rebalancing

If Gold shoots up and becomes 30% of your portfolio (due to a price spike), SELL 5% and buy undervalued Stocks.

This forces you to "Buy Low, Sell High" automatically without emotion.

The Gold ETF & Reserve Masterclass: Execution in the New Era (2026)

Current Status: The “Free Lunch” is over. For a decade, Indian investors enjoyed the greatest gold product in history, the Sovereign Gold Bond (SGB). It paid you interest and gave you tax-free returns. But in FY 2025-26, the government paused new issuances. The reason was simple math: paying 2.5% interest on an asset that quadrupled in value was bankrupting the exchequer.

Welcome to Module 4 of the FinMinutes Gold ETFs Masterclass, the final and most practical chapter of your journey. Now that you understand the Supercycle (Module 3), you need the vehicle to ride it; we are discussing Gold ETFs in this module.

In this module, we pivot from “Why” to “How.” We will dismantle the traps of Digital Gold, unlock the hidden “Pledge Hack” used by pro traders, and decode the single most important chart in global finance, the Mean Reversion of Reserves, which suggests we are barely 30% into this bull run.

The Vehicles: How to Own Gold in 2026

With Sovereign Gold Bonds (SGBs) gone from the primary market, investors are confused. Jewellers are pushing schemes, apps are pushing “Digital Gold,” and banks are selling coins. Most of these are wealth destroyers.

The “Trap” of Digital Gold

If you open GPay, PhonePe, or Paytm, you see a shiny button: “Buy Gold for ₹1.” Do not click it.

- The Math of Loss: Digital Gold is unregulated and expensive. When you buy ₹100 of digital gold, you pay 3% GST instantly. On top of that, the platform charges a Spread (difference between Buy and Sell price) of 3-6%.

- The Reality: You start your investment at a -6% to -9% loss on Day 1. Gold has to rally 9% just for you to break even. It is a “convenience fee” that destroys compounding.

- Verdict: Avoid. It is a product for spenders, not investors.

The “Legacy King”: Sovereign Gold Bonds (Secondary Market)

- Status: Discontinued for new issues.

- The Play: You can still buy old Sovereign Gold Bonds (SGBs) on the stock exchange (secondary market).

- The Catch: Because no new supply is coming, existing SGBs now trade at a Premium. You might pay ₹160,000 for ₹155,000 worth of gold. You must calculate if the remaining interest payments justify this premium.

The “New Standard”: Gold ETFs

- Structure: Exchange-traded funds (Gold ETFs) are mutual funds that trade like stocks. Each unit is backed by physical gold stored in high-security vaults (usually JP Morgan or Scotia Bank).

- Cost: Extremely low. Expense ratios are ~0.5% per year.

- Liquidity: Instant. You can sell ₹1 Crore worth of GoldBeES in 1 second during market hours.

- Verdict: For 90% of investors, Gold ETFs are the new default.

The Gold ETF Handbook: Retail’s Secret Weapon

Not all ETFs are created equal. You need to look at two metrics: Liquidity (Volume) and Impact Cost.

The “Big Three” Leaderboard (2026)

| Ticker | Fund House | Expense Ratio | Why it Wins |

| GOLDBEES | Nippon India | 0.79% | Liquidity King. The highest volume means you can buy/sell without moving the price. |

| SETFGOLD | SBI MF | 0.35% | Cost Leader. Lowest fees, backed by India’s largest bank. |

| HDFCMFGETF | HDFC MF | 0.59% | The Balance. Good mix of liquidity and reasonable costs. |

🧮 The “Pledge Hack”: Double Dipping Your Capital

This is the strategy that separates “Investors” from “Traders.” In India, gold sitting in your Demat account is a productive asset.

Case Study: Trader Rahul

- Scenario: Rahul has ₹10 Lakhs. He wants to buy Gold for the Supercycle, but he also wants to trade options for monthly income.

- The Old Way: He splits capital. ₹5 Lakhs in Gold, ₹5 Lakhs in Trading.

- The Pledge Way:

- Rahul buys ₹10 Lakhs of GOLDBEES. He now has full exposure to the Gold Supercycle.

- He logs into Zerodha/Upstox and “Pledges” these units.

- The broker applies a haircut (margin safety) of ~10-15%.

- Rahul receives ₹8.5 – ₹9 Lakhs in “Collateral Margin.”

- He uses this margin to sell safe Option Strategies (like Covered Calls or Iron Condors).

- The Result: Rahul earns 15% CAGR from Gold Appreciation (Passive) PLUS 20% CAGR from his trading (Active). His capital is working double shifts.

- Note: SEBI rules require 50% cash for overnight F&O positions, but for Intraday, 100% collateral often works.

The Great Debate on Gold Price: Bulls vs. Bears

To be a good investor, you must understand the counterargument. Why might Gold crash?

The Bear Case (Target: ₹1.00 Lakh)

- Peace Dividend: The current gold price includes a massive “War Premium.” If the Ukraine and Middle East conflicts end suddenly with treaties, that premium evaporates. The gold price could drop 15-20% in weeks.

- Tech Deflation: AI is lowering the cost of intelligence and production. If AI solves supply chain inefficiencies, inflation could drop to 0-1%. Gold thrives on inflation; it dies in deflation.

- King Dollar: If the US AI boom (Silicon Valley) drives massive productivity, capital will flow into the US Dollar, crushing all other currencies and commodities.

The Bull Case (Target: ₹2.10 Lakhs)

- The Debt Trap: The US government pays over $1 Trillion/year just in interest on its debt. They cannot raise interest rates to fight inflation without going bankrupt. They are forced to print money. This is “Fiscal Dominance.”

- Weaponization: After the US froze Russia’s reserves in 2022, trust was broken. Nations like China, Saudi Arabia, and Brazil are diversifying out of Dollars. They only have one place to go: Gold.

📈 Benchmark Test: Gold vs. Sensex Correlation

Why hold Gold if the Sensex gives 15% returns? Because the Sensex fails when you need it most.

- 2008 Crisis: Sensex crashed -52%. Gold price rose +26%.

- 2020 Covid: Sensex crashed -38%. Gold price rose +42%.

- The Lesson: Gold is not there to outperform the Sensex in a bull market. It is there to save you from bankruptcy in a bear market.

The “Mean Reversion” Thesis: The Jaws of Destiny

This section is the intellectual core of the module. It explains why the rally has years left to run.

The Data Point

Renowned market expert Ajay Bagga points to a single, critical metric: Gold as a Percentage of Global Central Bank Reserves.

- 1970s/80s: Central Banks held 60-70% of their total reserves in Gold. It was the primary asset.

- 2000s: They sold gold to buy US Treasuries (believing the Dollar was risk-free). Gold holdings dropped to a low of ~10%.

- 2026 (Now): They are panic-buying gold again. Holdings have risen to ~25%.

The Theory

This is a 50-Year Mean Reversion.

- The “Blue Line” (USD Share) is falling.

- The “Yellow Line” (Gold Share) is rising.

- For Central Banks to simply return to the historical average of 40%, they need to buy Trillions of Dollars worth of physical gold.

- The Conclusion: We are barely 1/3rd of the way through this accumulation cycle. The price must rise significantly to accommodate this massive sovereign demand. Retail investors are just front-running the Central Banks.

The Final Strategy: Personalising Your Allocation

“Buy Gold” is bad advice. “Buy X% of Gold based on your Age” is a strategy.

🧒 Profile 1: The Young Aggressor (Age 20-35)

- Allocation: 5-10% of Portfolio.

- Vehicle: Gold ETFs (Pledged).

- Strategy: You don’t need safety; you need growth. Buy ETFs and pledge them to trade F&O or buy stocks on margin. Use gold as a “battery” to power your aggressive trades.

👨💼 Profile 2: The Balanced Builder (Age 35-50)

- Allocation: 15-20% of Portfolio.

- Vehicle: 50% Secondary SGBs + 50% Gold ETFs.

- Strategy: You have liabilities (Home Loan, Kids’ Education). Buy Sovereign Gold Bond (SGBs) from the secondary market that mature when your child goes to college (Tax-Free redemption). Use ETFs for emergency liquidity.

👴 Profile 3: The Golden Retiree (Age 50+)

- Allocation: 20-25% of Portfolio.

- Vehicle: Physical Bars & Coins.

- Strategy: This is your “Sleep Well” money. You are protecting a lifetime of earnings from currency collapse or bank failures. Physical gold has no counterparty risk. It is the ultimate legacy asset to pass down.

The Golden Rule of Rebalancing

Never let gold become 50% of your portfolio. If a price spike makes Gold 30% of your net worth, SELL 5% and buy undervalued stocks. This forces you to “Sell High” (Gold) and “Buy Low” (Stocks) automatically, removing emotion from the equation.

Gold ETFs: Frequently Asked Questions (FAQs)

Since SGBs are stopped, will my existing SGBs stop paying interest?

No. The government is contractually obligated to pay 2.5% interest on all existing SGBs until their maturity. Your current holdings are safe. The “stop” only applies to new launches.

Is the “Pledge Hack” risky?

Yes, if the market crashes or your options bet goes wrong. If the value of your pledged Gold ETFs falls drastically, the broker may ask for more cash (Margin Call). However, since Gold is less volatile than stocks, it is considered “Cash Equivalent” collateral, making it much safer than pledging stocks.

Why not just buy Silver instead?

Why not just buy Silver instead?

Silver is “Gold on Steroids.” It moves 3x faster. But it is an industrial metal, not a central bank reserve asset. Central Banks buy Gold, not Silver. For stability, stick to Gold. For speculation, use Silver (covered in our upcoming Silver Masterclass).

What is the target price for this Supercycle?

Based on the “Mean Reversion” data, if the central bank’s gold reserves go back to 40%, Gold could realistically target ₹2.10 Lakhs per 10g by 2029-2030. However, expect 20% corrections along the way.

Can I buy Gold ETFs through SIP?

Yes. Most brokers allow “Stock SIPs.” You can set a monthly order to buy 1 unit of GOLDBEES or SETFGOLD. This averages out your buying price and removes the stress of timing the market.

Final Verdict

The FinMinutes Gold Masterclass has taken you from the basics of terminology to the advanced mechanics of Central Bank reserves. You now possess knowledge that 99% of retail investors lack.

You understand that Gold is not just a shiny metal; it is the only financial asset with no counterparty risk. In a world of $110 Trillion debt, that property is priceless.

Your Action Plan:

- Check your portfolio. Is Gold < 5%? You are under-hedged.

- Choose your vehicle (ETF for trading, Physical for safety).

- Set a “Rebalance Alert.”

- Sit back and let the “Jaws of Destiny” close.

Disclaimer: This is for educational purposes. Consult a SEBI-registered advisor before making investment decisions.