The Macro Engine: Why Gold Changed Forever

The "Net Stable Funding Ratio" (NSFR) Shift:

- Before 2023: Banks could short "Paper Gold" (Unallocated) cheaply to suppress prices.

- The Change: Regulators reclassified Allocated Physical Gold as a Tier 1 Asset (0% Risk). Unallocated Paper Gold became expensive to hold.

- The Impact: Bullion banks (JP Morgan, HSBC) were forced to stop shorting and start buying physical bars. This created a Structural Floor under the price.

| Old Correlation | New Reality (2026) |

|---|---|

| Real Rates UP = Gold DOWN | Rates UP = Gold UP |

| Driven by: Opportunity Cost | Driven by: Sanction Evasion |

Strategic Insight: Since the weaponization of the USD (Russia Sanctions), Central Banks care more about safety than yield. Do not short gold just because the Fed hikes rates.

📜 Real-World Case Study

The "Yen Carry Trade" Unwind (July 2024)

The Situation: For years, traders borrowed Japanese Yen at 0% interest to buy Gold. It was "free money."

The Event: The Bank of Japan unexpectedly raised rates.

The Personified Impact: Meet "Hedge Fund Harry." Harry had $1B in Gold, bought with borrowed Yen. When the Yen spiked 10% overnight, Harry got a Margin Call.

The Result: Harry had to sell his Gold to pay back the Yen. Gold crashed $100 in 2 hours despite no bad news for Gold itself.

Lesson: Sometimes Gold crashes not because it is weak, but because traders need cash to cover losses elsewhere.

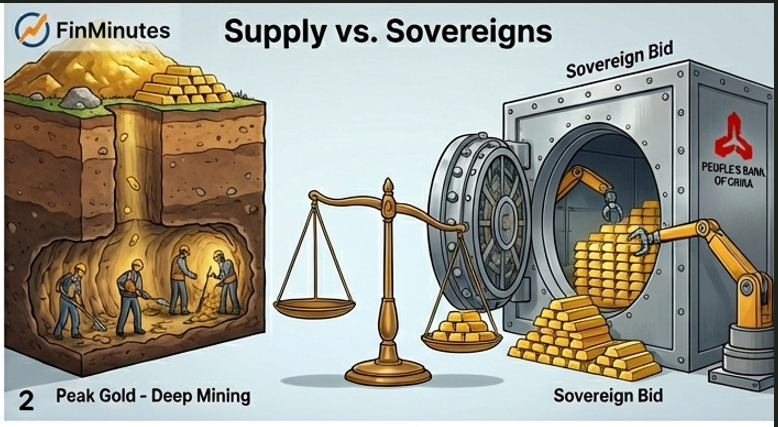

The 2026 Squeeze: Supply vs. Sovereigns

⛏️ "Peak Gold" is Here

The Data: Global mine production has plateaued at ~3,600 tonnes/year.

The Grade Problem: Miners in South Africa/Nevada are digging deeper for lower-grade ore.

The Floor: The All-In Sustaining Cost (AISC) has risen to ~$1,600/oz. Gold mathematically cannot crash below this level without bankrupting the industry.

🐳 The Sovereign Bid (The "China Put")

It is not jewelry demand driving price; it is Sovereign Wealth Funds.

- The Buyer: People's Bank of China (PBOC) has bought gold for 24+ straight months.

- The Strategy: "Buy the Dip." Whenever Gold falls 5%, Sovereigns step in to de-dollarize their reserves.

- Rule: Never trade against Central Banks. They have infinite liquidity.

🏭 The Industrial Breakdown (2026 Data)

Demand

Mix

- Jewelry (46%): Losing share. High prices = Lower Indian weddings demand.

- Investment (25%): ETFs & Bars. The fastest growing segment.

- Central Banks (20%): Historic highs. Strategic buying.

- Tech/Industry (9%): The "Hidden Gem" (See below).

🔮 Sector Prediction: The "Silicon Flip"

Subduing: Dentistry (-3% YoY). Ceramic alternatives are killing gold usage in teeth.

Leading: AI Hardware (+12% YoY). Gold is the only metal reliable enough for nanometer-scale connectors in NVIDIA/AMD AI chips. As AI data centers double, industrial gold demand will hit new records.

Institutional Trading Playbooks

Specific "If-Then" rules for the 2026 market environment.

Context: US Data releases at 6:00 PM / 7:00 PM IST.

The Algo Trap: HFTs trade the headline in 10ms, creating a massive fake wick.

The Strategy:

1. Do NOT trade minute 1.

2. Wait 15 mins.

3. If the initial spike is fully retraced, enter the Counter-Trend.

Context: Geopolitical escalations often happen on weekends.

The Pattern: Hedge Funds hate holding cash over the weekend. They buy Gold on Friday afternoon as insurance.

The Trade: Look for LONG setups on Fridays between 2:00 PM - 4:00 PM IST (European Close).

💀 The "Fake-Out" Tragedy

Personified: "Trader Joe's" CPI Disaster

Scenario: CPI comes in "Hot" (Inflation UP). Textbooks say Gold should Fly.

Minute 0 (6:00 PM): Gold spikes $20 in 10 seconds. Joe sees green candles and buys at the very top (FOMO).

Minute 2 (6:02 PM): Smart Money realizes higher inflation = Fed Hikes Rates = Bad for Gold. They dump massive sell orders.

Minute 5 (6:05 PM): Gold collapses $40. Joe is liquidated.

The Lesson: The initial move is often a "Stop Hunt" to trap breakout traders like Joe. Always wait for the M5 candle to close.

Advanced Sentiment: The Hidden Signals

🇨🇳 The Shanghai Premium (SGE vs. LBMA)

Concept: Gold trades at different prices in London and Shanghai.

| Premium | Meaning | Action |

|---|---|---|

| < $10 | Normal Demand | Neutral |

| > $40 | Voracious Asian Demand | Strong Buy (Arbitrage is active) |

📊 Commitment of Traders (COT)

Released: Every Friday.

- Commercials (Banks/Miners): Usually Net Short (Hedging). If they reduce shorts, they expect a rally.

- Managed Money (Funds): Trend followers. If they are at Record Longs, expect a liquidation crash (Contrarian Signal).

🚕 The "Taxi Driver" Indicator

The Contrarian Rule

"When your Taxi Driver (or Uber Driver) asks you how to buy Gold Options, SELL EVERYTHING."

Why? Retail mania usually marks the exact top.

Real Example (2011 Top): Cash-for-Gold kiosks appeared in every mall in America. Gold crashed 40% the next year.

Current Status (2026): Interest is high, but not "Mania" yet. We are in the "Disbelief" phase where people think it's too expensive, which is actually Bullish.

The Future: 2026-2030 Price Scenarios

Current Price (Jan 2026): ~$4,650/oz (₹1.57 Lakhs/10g)

🚀 Bull Case: $6,000+ (+29%)

(Approx ₹1.85 Lakhs/10g) | Probability: 30%

- Trigger: Rapid De-dollarization (BRICS Currency launch) + Fed Cuts Rates to 2%.

- Scenario: Gold becomes the literal global reserve asset.

⚓ Base Case: $4,800 (+3%)

(Approx ₹1.57 Lakhs/10g) | Probability: 50%

- Trigger: "Stagnation". Economy stabilizes. No new wars.

- Scenario: Gold digests the massive 2024-25 gains. Prices range between $4,200 and $5,000 for 2-3 years.

🐻 Bear Case: $3,500 (-25%)

(Approx ₹1.08 Lakhs/10g) | Probability: 20%

- Trigger: Global Peace Treaty (War Premium evaporates) or Asian Demand Destruction (Prices too high for jewelry).

- Scenario: A violent "Liquidity Shock" crash, followed by a slow recovery.

The 10-Year Roadmap (2036 Vision)

Where will we be in a decade?

🚀 The "Debt Jubilee" Case

The Driver: Global Sovereign Debt exceeds $200 Trillion. Central Banks are forced to "Reset" currencies against a Gold Standard to restore trust.

Winner Industry: Private Vaults & Security.

Probability: 25%

⚓ The "Slow Grind" Case

The Driver: Just tracking inflation. Gold does exactly what it's supposed to do: preserve purchasing power against a 3% annual inflation rate. No apocalypse, no utopia.

Winner Industry: Recycling (Urban Mining).

Probability: 55%

🐻 The "Tech Deflation" Case

The Driver: AI solves energy scarcity (Fusion?). The cost of mining crashes. Alternatively, asteroid mining becomes viable (Psyche Mission), flooding supply.

Loser Industry: Junior Miners (Bankruptcies).

Probability: 20%

7.X The Supercycle Report (Real Data Update)

Status: Early 2nd Half (The "Vertical Phase")

We are 7 years into the rally, but the 4x+ returns suggest we are accelerating, not ending.

📊 Confirmed History: The 4x Benchmark

The Timeline: The current Supercycle began in 2019 (Covid Start). In INR terms, the gains have been staggering, outpacing many global benchmarks.

| Bull Market | Duration | INR Price Move | Total Growth |

|---|---|---|---|

| 1970 - 1980 | ~10 Years | ₹184 -> ₹1,330 | 7.2x (620%) |

| 2001 - 2011 | ~10 Years | ₹4,300 -> ₹26,400 | 6.1x (513%) |

| Current (2019-2026) | ~7 Years | ₹35,220 -> ₹1,57,562+ | 4.5x (350%+) |

The Verdict: Previous supercycles delivered 6x to 7x returns over a decade. We are currently at 4.5x in Year 7.

Implied Target: If this cycle matches the 2000s (6x), Gold still has room to hit ₹2,10,000/10g by 2029.

The "Sentiment" Check

In 2011 (The Top), gold was on the cover of Time Magazine. Everyone owned it.

In 2026, despite record prices (₹1,57,000+), Western investors still hold < 2% of their portfolio in Gold. The "FOMO" crowd hasn't even arrived yet.

A Deep Dive into Institutional Macro-Trading

Current Gold Price: Gold has shattered the ₹1,57,000 per 10g ceiling. The old rules of investing are breaking down. Welcome to the new standard.

For decades, gold trading was simple: if the Dollar went up, the gold price went down. If interest rates rose, Gold crashed. But in 2026, we are witnessing a phenomenon that baffles traditional economists. The US Dollar is strong, interest rates are relatively high, yet Gold is trading at all-time highs. Why?

The answer lies not in simple charts, but in the complex machinery of the global financial system. In Module 2 of the FinMinutes Gold Trading Masterclass, we strip away the noise and hand you the “Macro Engine”, the institutional playbook for trading the modern Gold Supercycle.

This isn’t just about buying low and selling high; it’s about understanding why the game has changed and how to position yourself for the next decade. Below is a complete breakdown of the insights, strategies, and future roadmaps covered in this module.

The Macro Engine: Why Gold Price Movement Changed Forever

Most retail traders are using a playbook from 2010. They look at the Fed, they look at inflation, and they place their bets. And mostly, they lose. The market underwent a structural surgery in 2023, known as Basel III, which fundamentally altered how banks handle gold.

The Basel III Revolution (The “Paper” Cleanup)

For years, “Paper Gold” (futures contracts with no physical backing) ruled the market. Bullion banks could short-sell unlimited paper gold to suppress prices. But the Net Stable Funding Ratio (NSFR) regulation changed everything.

- The Shift: Regulators reclassified “Allocated Physical Gold” as a Tier 1 Asset, meaning it is now considered as safe as cash (0% risk). Conversely, “Unallocated Paper Gold” became expensive and risky for banks to hold.

- The Result: Banks like JP Morgan and HSBC were forced to stop their massive shorting games. They had to become net buyers of physical bars to meet regulatory requirements. This created a Structural Floor under the gold price. The days of random 20% crashes driven by paper manipulation are largely over.

The Great Decoupling

Perhaps the most shocking development of the 2024-2026 era is the death of the “Real Rates” correlation.

- Old World: When bonds paid 5% interest, investors dumped gold (which pays 0%).

- New Reality (2026): Bonds pay 5%, yet investors are buying gold.

- The Driver: Sanction Evasion. After the weaponisation of the US Dollar against Russia, global Central Banks realized that US Bonds are not “risk-free” if your assets can be frozen. Gold has moved from being an “investment” to being “insurance.” Banks prioritise safety over yield.

Case Study: The Yen Carry Trade Unwind. To understand macro volatility, look at July 2024. Traders had borrowed billions in Japanese Yen (at 0% interest) to buy Gold. It was a “free money” glitch. But when the Bank of Japan raised rates overnight, those traders faced a massive margin call. They didn’t sell gold because they wanted to; they sold it because they had to repay their Yen loans. The gold price crashed by $100 in two hours.

- The Lesson: Sometimes, price action isn’t about the asset itself. It’s about the liquidity of the people holding it.

Supply vs. Sovereigns: The 2026 Squeeze

If you are waiting for gold to crash back to ₹50,000, you are fighting mathematics. The fundamentals of supply and demand have shifted so drastically that the floor price has become permanently elevated.

“Peak Gold” is Real

We are digging up as much gold as we can, but the earth is stingy.

- Production Plateau: Global mine output is stuck at roughly 3,600 tonnes per year. We simply cannot find new, massive deposits.

- The AISC Floor: The All-In Sustaining Cost (the break-even price to mine an ounce of gold) has risen to ~$1,600/oz. If prices fall below this, miners shut down, supply vanishes, and prices spike back up. This acts as a hard safety net for investors.

The “China Put” (Sovereign Buying)

In the stock market, traders talk about the “Fed Put”, the idea that the Federal Reserve will save the market. In Gold, we have the “China Put.”

- The Strategy: The People’s Bank of China (PBOC), Reserve Bank of India and other sovereigns have been relentless buyers for 24+ months. They are not chasing price; they are accumulating reserves.

- The Impact: Whenever gold dips 5%, these Sovereign Wealth Funds step in with billions of dollars to “buy the dip.” This provides immense support and makes shorting gold extremely dangerous.

The “Silicon Flip”: A New Industrial Era

Historically, in the consumer world, gold demand was driven by Indian weddings and the Chinese New Year. That is changing. High prices are curbing jewellery demand (-3% YoY in sectors like dentistry). However, a new beast has awoken: AI Hardware.

- Why Gold? Gold is the most reliable conductor for nanometer-scale connectors in high-performance chips (like NVIDIA’s AI GPUs). It doesn’t corrode.

- The Forecast: As the world builds millions of AI data centres, industrial demand for gold in tech hardware is growing at +12% YoY. Gold is quietly becoming a critical technology metal.

Institutional Playbooks: How to Trade the Volatility

Theory is great, but how do you make money on a Tuesday afternoon? Module 2 provides specific “If-Then” algorithms used by institutional desks.

Playbook 1: The CPI “Knee-Jerk” Fade

US Inflation data (CPI) releases are the most volatile minutes in the market (usually 6:00 PM or 7:00 PM IST).

- The Trap: High-Frequency Trading (HFT) algorithms read the news headlines in milliseconds. If inflation is hot, they buy instant spikes. This creates a “Fake Wick.”

- The Tragedy of “Trader Joe”: Joe sees the green candle at 6:00:05 PM and buys massive leverage due to FOMO. By 6:02 PM, “Smart Money” realises that high inflation actually means the Fed will hike rates (bad for gold), and they dump the gold price. Joe gets liquidated.

- The Rule: Never trade the first minute. Wait 15 minutes. If the initial spike is fully retraced, enter the Counter-Trend.

Playbook 2: The Friday War Hedge

In our current geopolitical climate, bad news often breaks on weekends when markets are closed.

- The Psychology: Hedge fund managers are terrified of holding cash over the weekend while wars escalate. If a war breaks out on Saturday, the gold price will open +5% on Monday, and they will miss it.

- The Strategy: Institutions buy gold on Friday afternoons (2:00 PM – 4:00 PM IST) as a cheap insurance policy.

- The Trade: Look for Long setups on Friday during the European session. Ride the institutional wave of fear-buying.

Advanced Sentiment: The Hidden Signals

Charts tell you where the gold price was. Sentiment tells you where it is going.

The Shanghai Premium (Arbitrage)

Gold does not trade at one price. There is a price in London (LBMA) and a price in Shanghai (SGE).

- The Signal: Usually, they trade within a few dollars of each other. But if the Shanghai price is $40+ higher than London, it means China is desperate for physical metal.

- The Action: This is a “Strong Buy” signal. Arbitrageurs will buy in London to sell in China, pushing the global price up.

The “Taxi Driver” Indicator

This is the ultimate contrarian signal.

- The Rule: When people who have no background in finance, your Uber driver, your barber, your distant relative, start asking you how to buy Gold Options, SELL EVERYTHING.

- History Repeats: In 2011, “Cash for Gold” kiosks were everywhere just before the crash. In 2026, despite high prices, the general public is still in “disbelief.” They think it’s too expensive. Paradoxically, this is bullish. It means the “mania phase” hasn’t happened yet.

The Supercycle Status: Are We Too Late?

With the gold price at ₹1.57 Lakhs, the most common question is: “Have I missed the bus?” The answer, according to historical data, is a partial No. We are currently in the “7th Inning” of the Supercycle.

- 1970s Cycle: Gold rose 7.2x over 10 years.

- 2000s Cycle: Gold rose 6.1x over 10 years.

- Current Cycle (2019-2026): We are currently at roughly 4.5x returns.

If this cycle simply matches the average of the previous two, Gold has room to run toward ₹2,10,000 per 10g by 2029. We are entering the “Vertical Phase,” where gains accelerate, but volatility increases.

Gold price in 2036 (10y Vision)

What will be the gold price in 2036 from now? Module 2 outlines three distinct probability paths.

🚀 The Bull Case: ₹3.70 Lakhs/10g ($12,000/oz)

- Probability: 25%

- The Driver: The “Debt Jubilee.” Global sovereign debt exceeds $200 Trillion. It becomes mathematically impossible to pay back. Central Banks are forced to “reset” the financial system, re-pegging currencies to gold to restore trust. Gold becomes the literal global reserve asset again.

⚓ The Base Case: ₹2.10 Lakhs/10g ($6,800/oz)

- Probability: 55%

- The Driver: The “Slow Grind.” Gold does exactly what it is designed to do: preserve purchasing power. It tracks a 3-4% annual inflation rate plus a small premium for scarcity. No apocalypse, no utopia, just solid wealth preservation.

🐻 The Bear Case: ₹1.00 Lakh/10g ($3,200/oz)

- Probability: 20%

- The Driver: “Tech Deflation.” Artificial Intelligence solves the energy crisis (perhaps via Nuclear Fusion), causing mining costs to plummet. Or, space exploration (like the Psyche mission) makes asteroid mining viable, flooding the earth with supply.

Frequently Asked Questions (FAQs)

Should I buy Gold ETFs or Physical Gold given these macro factors?

For pure returns, Gold ETFs are superior because they are hassle-free. However, ETFs are “Paper Gold.” If your goal is apocalypse insurance (The Bull Case), you need physical metal in your hand. If your goal is wealth growth (The Base Case), stick to gold ETFs.

How does the US Election affect this roadmap?

Historically, Gold loves uncertainty. If an election leads to political instability or questions about the US debt ceiling, gold rises. However, if a candidate promises strong fiscal austerity (cutting spending), the Dollar might strengthen, creating temporary headwinds for gold.

Can Bitcoin replace Gold as the “Reserve Asset”?

Bitcoin is “Digital Gold,” but Central Banks move slowly. While retail investors love Bitcoin, the PBOC and other Central Banks are buying physical gold, not crypto, for their national reserves. For the next decade, Gold remains the primary Tier 1 banking asset, though Bitcoin acts as a high-beta correlation.

What is the biggest risk to the “Supercycle” theory?

Peace. A sudden, lasting global peace treaty would evaporate the “War Premium” currently priced into gold. Additionally, a massive collapse in Asian demand (due to prices being simply too high for Indian/Chinese consumers) could stall the rally.

Why did the Finminutes Gold trading masterclass 2 consider the Supercycle start date to 2019?

Many analysts look at the 2016 USD bottom. However, for Indian investors and in real terms, the structural breakout began with the onset of COVID-19 in 2019. This is when the money supply expansion went vertical, kicking off the 4.5x run we see in the gold price today.

Gold Trading: Conclusion

The FinMinutes Gold Trading Masterclass Module 2 is not just a lesson; it is a warning and an opportunity. The financial architecture of the world is changing. The “safety” of government bonds is being questioned, and Gold is reclaiming its throne.

Whether you are a scalper looking to trade the Friday War Hedge or a long-term investor eyeing the 2036 roadmap, understanding the Macro Engine is the only way to navigate the turbulent, profitable years ahead. Ready to trade the cycle? Access the full interactive tool on FinMinutes.com.