Gold return vs Nifty 50, though this year belongs to Gold, as the yellow metal has mostly outperformed every other asset class by a big margin, but is this the case for this year, or has it been the case for a long time? Was your grandmother’s simple, hassle-free gold investment better than your fancy equity investments? Let’s find out with data. We will use the Nifty 50’s return vs Gold in different time frames for the comparison.

Why Compare Gold and the Nifty 50?

When it comes to building wealth over the years, Indian investors typically lean towards two popular options:

- Gold – A traditional, tangible asset often considered safe and stable in value.

- The Nifty 50 – A benchmark equity index symbolizing the top-performing companies listed on the National Stock Exchange (NSE) in India.

While gold relies on its historical, intrinsic value and global appeal, the Nifty 50 represents the evolving Indian economy and its dynamic business landscape. Comparing the two provides insights into which investment generates better returns and aligns with your financial goals.

Gold rally in 2025

Gold returned more than 25% in five months of 2025 alone, outperforming equities big time. At 1st January 2025, gold was at INR 76,500, and this month it made a high of 1,00,000 before retracing back to 94,500. But is this a one-off return or a case of gold outperforming other asset classes over the years? This year’s gold rally is primarily the result of central bank buying the yellow metal to hedge against the USD, and countries like China are buying it to shield themselves against volatile U.S. trade policies.

Gold Return vs Nifty 50

Gold return vs Nifty 50 is not something that remained head to head for a long time, but the recent rally in gold forced investors to rethink their view on gold, Usually, gold has been considered a safe haven asset, a hedge in tough times, but in last 1 year, gold has already returned more than 35% catching attention of many investors. Though Gold’s return is different as physical, digital, ETF, and Sovereign Gold Bond (SGBs), so will consider them too when comparing.

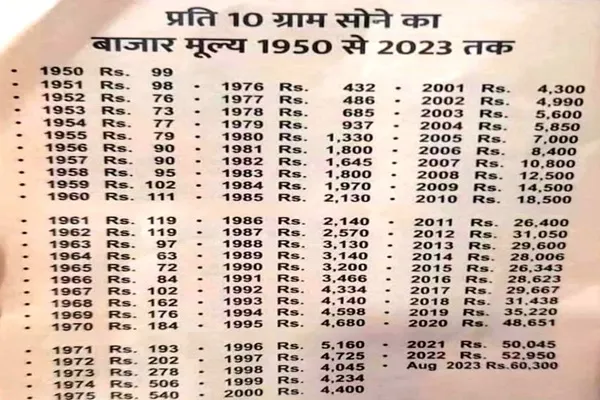

Gold Return in last 75 years

To get started, this is how Gold fared in the last 100 years (as most of the other investment instruments e.g., digital gold, ETF, SGBs, became popular after 2009-2010 or later, so here we are talking about physical gold’s journey in the last 75 years.

In 1950, the price of 10 gm of physical gold was at INR 100, and it touched INR 1,00,000 in April 2025, giving a 1000x return in 75 years. It means 10,000 (ten thousand) invested in gold 75 years ago would have grown to 1 crore of capital now (without tax adjustment).

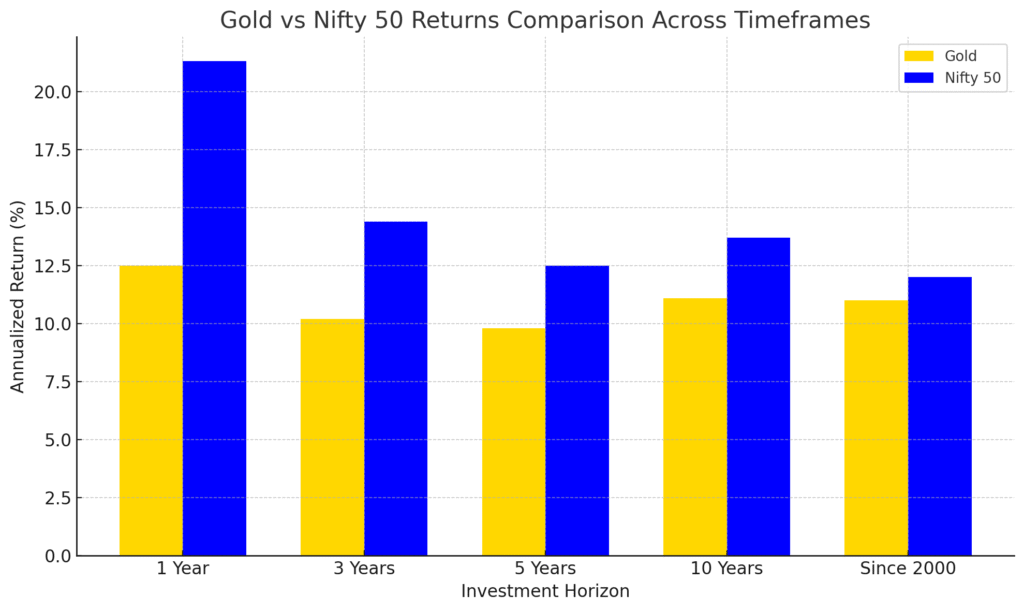

Since the Nifty 50’s inception in 1995 at a base price of 1,000, the index is up more than 26x, whereas Gold was at INR 4,680 in 1995 and has given close to 21.4x in this period, so Nifty’s return in this period is more than that of gold’s (considering the recent all time highs of both instruments). In terms of CAGR, the Nifty 50 has given a return of 11.89% since inception, whereas gold has given a return of 11% in the same period.

Key Data Points from Research and Market Analysis

| Time Horizon | Gold (CAGR) | Nifty 50 (CAGR) | Winner |

|---|---|---|---|

| 6 Months of 2024-25 | 20% | 0.13% | Gold |

| 1 Year (2023-24) | 31.6% | 21.3% | Gold |

| 3 Years | 10.2% | 14.4% | Nifty 50 |

| 5 Years | 9.8% | 12.5% | Nifty 50 |

| 10 Years | 11.1% | 13.7% | Nifty 50 |

| Since 2000 | 11.0% | 12.0% | Nifty 50 |

Note: CAGR = Compounded Annual Growth Rate

So, here Nifty 50 is a clear winner in the longer timeframe, but Gold wins in short-term volatility or crisis periods (2008, COVID-2020, or recent geopolitical, trade war). Nifty 50 outpaces gold in wealth creation over 5+ years.

📊 Long-Term Performance Metrics (1996–2024, Since the inception of Nifty 50)

| Asset | Start Value (1996) | Value in 2024 | CAGR (Annualized Return) | ₹1 Lakh Investment Grows To |

|---|---|---|---|---|

| Nifty 50 | 1,006 | ~26,200 | 12.4% | ₹19.7 Lakhs |

| Gold (INR/10g) | ₹5,160 | ₹80,000 | 10.2% | ₹12.4 Lakhs |

🧮 Calculated using:

CAGR = (EndingValue/StartingValue)(1/Years)−1(Ending Value / Starting Value)^(1 / Years) – 1(EndingValue/StartingValue)(1/Years)−1 × 100

Comparing the results decade wise

Considering the results decade-wise provides a valuable insight, This helps us decode whether there is a pattern by which investors can benefit.

📈 1. Performance Snapshot: CAGR Returns (2000–2024)

| Period | Gold CAGR (%) | Nifty 50 CAGR (%) |

|---|---|---|

| 2000–2010 | 15.2% | 13.45% (returns affected due to the global financial crisis) |

| 2010–2020 | 8.4% | 9.82% |

| 2020–2025 (till date) | 16.9% | 21.7% |

| Overall | 11.0% | 12.0% |

Decade-Wise Insights

🔶 2000–2010: Gold Takes the Lead

- The 2008 global financial crisis led to panic selling in equities. Investors fled to gold, pushing its price up significantly.

- Gold CAGR: 15.2% vs Nifty’s 13.0%

🔷 2010–2020: Nifty 50 Rises from the Ashes

- Despite multiple slowdowns, Indian equities stabilized and gained strength.

- Nifty 50’s earnings recovery and new-age sector growth helped it outperform gold.

🔷 2020–2025 (till date): Equity Boom, Gold Safe Haven

- First, COVID-19 pushed gold to ₹56,000 levels (Aug 2020) — a historic high at the time. Then, geopolitical tensions and trade wars pushed gold to 1,00,000, a new high.

- But Nifty 50 surged in 2021–2023 due to tech, BFSI, and midcap booms (post-COVID earnings boom). New high of 26,000 in Sept 2024, powered by rate cuts and macro ease. But, the equity is struggling since then due to lackluster earnings, trade wars, FII exodus, and geopolitical troubles.

So, Gold is a Crisis Hedge

Gold shines when uncertainty looms. Here’s how it reacted to global shocks:

- 2008 Crisis: Gold rose 28% while Nifty crashed 52%.

- COVID-19 (2020): Gold rose 24% Y-o-Y; Nifty corrected sharply but rebounded fast.

- Geopolitical conflicts (Russia-Ukraine, Middle East): Again, gold served as a volatility shield.

- Trade wars: Gold’s new high vs Nifty 50’s new 52-week low.

🔁 Gold is not for wealth creation alone — it is wealth preservation.

Gold Investment options vs Nifty 50

The return comparison of the Nifty 50, Gold as physical, digital, gold ETFs, and SGBs is presented above. Gold ETFs are becoming more and more popular in India, so should you consider that?