Gold Price Prediction 2025: After outperforming other asset classes over the last few years, many are eager to know about gold’s performance in 2025. Analysts, experts, and global banks hold varying views on this timeless asset, with some bullish and others bearish.

Still, we at Finminutes Research will take a calibrated approach by taking factors into account that will influence the gold price in 2025 and, based on that, will make a calculated prediction on the precious metal’s next year price. Let’s begin

Gold performance in the last few years

When the world came to know about the COVID-19 pandemic in Dec 2019, the price of gold was at Rs. 38,000, but within a few months it reached 56,000 due to safe-haven buying. Since then gold price has outperformed most of the other asset classes due to various reasons like inflation, geopolitical uncertainties, supply chain disruptions, rise in demand due to its growing use in the manufacturing sector, and central bank buying.

| Year | Gold Price High (Rs) | Low (Rs) |

|---|---|---|

| 2020 | 56,000 | 39,000 |

| 2021 | 52,000 | 44,100 |

| 2022 | 55,500 | 47,200 |

| 2023 | 64,100 | 55,000 |

| 2024 (till date) | 79,400 | 61,200 |

After reaching a top in August 2020, Gold prices remained in a range for almost 3 years. Price twice touched the top, but it worked as strong resistance. In January 2022, geopolitical tensions started rising as Russia invaded Ukraine, and Gold prices again touched the pandemic top but failed to hold.

In February 2023, when Russia once again intensified the attack on Ukraine, and in the next few months, geopolitical stability further deteriorated due to the crisis in the Middle East ( tension between Israel and neighboring countries) started soaring. Gold prices gave a breakout and made a new high in 2024.

Gold price prediction 2025: Factors that will influence it

Demand

Demand is a major push for gold prices, as data suggests that 80% of global gold production is used by the jewelry industry, so the majority of gold produced (mined) goes to jewelry making. Also, the industrial demand for gold has been rising in the past few years.

In major manufacturing industries, with the rise of appliance penetration, gold in electronics is snowballing because it is the most reliable electricity conductor. Similarly, industries like medical science, aerospace, etc also use gold.

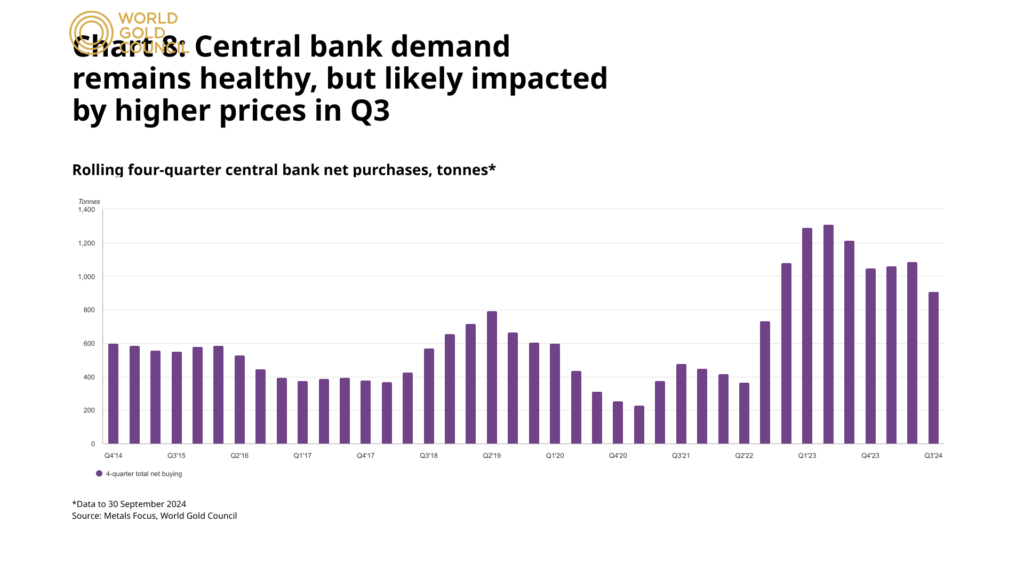

Central Banks are another major force controlling the demand for gold. In the last few years, central banks around the globe have been buying gold post-pandemic. Reasons can be anything from trade tensions between large economies (sanctions, tariffs, etc), to hedging against inflation and currency depreciation, geopolitical instability, record high interest rates in advanced economies, and uncertainties around economic growth.

For example, the Reserve Bank of India continued its 2024 buying streak, adding gold to its reserves every month during the quarter. It bought a total of 13 tons in Q3, marginally lower than the 18 tons it purchased in both Q1 and Q2.

Its gold reserves have now risen to 854t, 6% higher than at the end of 2023. Similarly, the People’s Bank of China (PBoC) also added a significant amount of gold in the last few years. From the graph below, it is visible that central banks are constantly raising gold in their gold reserves.

Demand forecast for Gold for 2025

The demand for yellow metal is expected to remain positive for 2025 too; the consumer side may remain mixed due to elevated prices, but industrial demand and that from central banks are also likely to stay strong. Industrial demand, especially from the technology and healthcare space, is projected to remain strong, with the boom in artificial intelligence.

YoY demand for gold to be used in technology grew 11% in the second quarter of 2024. Central banks are also likely to keep buying gold due to economic growth risks, trade wars, and dollar volatility.

With the Trump administration in power in the USA, common expectations are that the world will move into more stable geopolitics, which means an eased supply chain. Trump is also a big cheerer of cheaper oil; he wants to raise US oil production.

This should reduce inflation and his US first policy should strengthen USD (which is the case since he won the mandate) putting pressure on gold and driving prices lower but with Trump in power it is also expected that trade wars (tariffs and sanctions) will rise significantly so, central banks will keep buying gold to hedge against USD volatility supporting prices.

Interest rates (Inflation), dollar and Gold

The past few years have been nothing less than a riddle as the conventional definition of the relationship between gold, interest rate, and USD has been challenged. The book definition suggests that Gold, interest rates, and the USD have an inverse relationship.

Meaning, when Interest rates rise gold price falls as people shift to bonds in the hope of better returns. Similarly, when the USD rises, gold falls as the precious metal is a dollar-denominated asset, and when the dollar rises, it becomes expensive for other countries to buy gold, and due to a demand slump, gold prices fall.

In the last few years, this relationship definition has been challenged as the gold price, interest rates, and that of the USD are rising in tandem. It is surprising for some, but it is what it is. The reason can be anything from excess liquidity that is flowing in every asset class, geopolitical instability, inflation, etc, but this kind of in-tandem moment is expected to continue in 2025 too.

Inflation is easing globally, so central banks are cutting interest rates, USD is strengthening due to Trump’s expected America First policy, and Gold prices have been on the rise for the last few years due to higher inflation and gold being a preferred hedge against inflation are expected to remain elevated despite falling inflation due to the above-mentioned reasons so the inverse relationship between the USD index and gold may not play out well in 2025 too.

Geopolitical factors

Geopolitical factors have been a major driving force for gold prices for years. In 2020, when the pandemic began, gold prices soared in search of safe-haven buying, but later moderated with vaccines coming into the picture.

Then the Russia-Ukraine conflict began, gold prices again soared 6%, Middle East tensions added fuel to the fire, and gold rose to an all-time high (rising 9% within days), but with Trump in office, expectations are that the world will move to peace. But Trump’s unstable policies could reverse all that, keeping prices higher.

If there is progress in peace talks under the Trump administration, it could work as the biggest risk to gold upside in 2025, but to offset it, expectations are that trade wars, tariffs, and sanctions will become more common under Trump and this will keep investors attached to their gold holdings.

Geopolitical stability and trade talks will be key factors to watch out for investors this year, as this will provide cues about where the prices of this precious metal can go.

Money Supply

The system’s liquidity is expected to remain strong in 2025. When the Pandemic occurred in 2020, central banks around the globe cut interest rates and infused liquidity to support growth, but that fueled inflation. At a stage where inflation touched a decadal high level, forcing central banks to take measures such as raising rates, tightening the money supply (quantitative tightening), and taking other measures needed to tame it.

Now in 2024, inflation around the globe has come down significantly, so central banks are doing a rate cut. Rate cuts bring liquidity to the system as lower interest rates leave money in the hands of the consumer and increase their spending power.

Apart from that, a growth slowdown may warrant central banks to take other necessary measures to infuse liquidity in the economy (like the RBI took a CRR cut in today’s policy meeting to infuse approximately 1.16 lakh crore in the Indian economy). Money supply going up, coupled with a cut in interest rates, is positive for precious metals and may keep the prices up.

What does the chart say?

The gold price is up 30% in a year. Our thoughts are that returns will taper in 2025. For now, the price of gold is in a range, and fresh weakness will come only if it breaks below 73,200, then the prices could fall to 67500-68000, and if that range is broken too, then it could fall to the 63,000-63500 zone. On the upside, if 77800 is taken out, then prices can rise to 82800 and 84750. So in 2025, the range for the gold price will be between 63000 on the downside and 85000 on the upside.

Click here to read more about our personal finance coverage.

FAQs

Several factors are responsible for driving the price of gold, including:

– The value of USD (United States Dollar)

– Demand for gold, including jewellery, gold ETFs, and industry needs

– Gold demand and supply ( especially from Central banks and governments)

– Interest rates and other macroeconomic factors

– Geopolitical factors and their impact on the U.S economy

The gold price may remain in the 72,500 and 85,000 range if the central bank or government buy intensifies, and price breaks above 85,000, the price could further 15-20%.