Jewellery Audit Terminal™

Verify Purity • Multi-Item Bill Check • Reveal Hidden Costs

| Item | Net Wt | Gold Value |

|---|---|---|

| No items added yet. | ||

Live Gold Trend (Global Spot)

A Forensic Tool To Check Gold Bill for Hidden Costs

Don’t Just Pay. Audit. The FinMinutes Jewellery Audit Terminal™, the Only Tool in India That Separates the Asset (Gold) from the Expense (Making Charges & Stones).

Buying jewellery in India is an emotional experience. It’s about weddings, festivals, and family heirlooms. But for the jeweller, it is a business of margins.

Every day, thousands of Indians walk out of showrooms with a bill they don’t fully understand. They look at the “Grand Total” and haggle for a ₹500 discount, completely missing the fact that they might have overpaid by ₹15,000 on “Hidden Gold Making Charges” or “Stone Weight.”

The Problem: Most online “Gold Making Charges Calculators” are too simple. They add Price + Tax. They don’t tell you if the price itself is fair. The Solution: The FinMinutes Jewellery Audit Terminal™.

We didn’t build a calculator. We built a Forensic Auditor. It doesn’t just calculate 3% GST; it reverse-engineers your bill to find out exactly how much you paid for the gold vs the “Art.” It is far more than a Gold Making Charges Calculator.

Why “Calculating” is Not Enough (You Need to Audit)

When you buy a stock, you know the price. When you buy gold jewellery, the price is a mix of three things:

- The Asset (Pure Gold): The part that has resale value.

- The Expense (Gold Making Charges/VA): The labour cost (Wastage) that is gone forever.

- The Variable (Stones/Gems): The diamonds or zirconia that are often priced arbitrarily.

If you don’t separate these three, you are flying blind. A jeweller might offer you a “Discount on Gold Making Charges” but secretly inflate the “Gold Rate.” Or they might sell you an 18K chain but bill you at the 22K rate.

Our FinMinutes Jewellery Audit Terminal empowers you to spot these discrepancies in seconds.

Key Features That Make This Tool a Game-Changer

1. The “Multi-Item” Cart System

Real life isn’t about buying one ring. You buy a necklace, two bangles, and a pair of earrings.

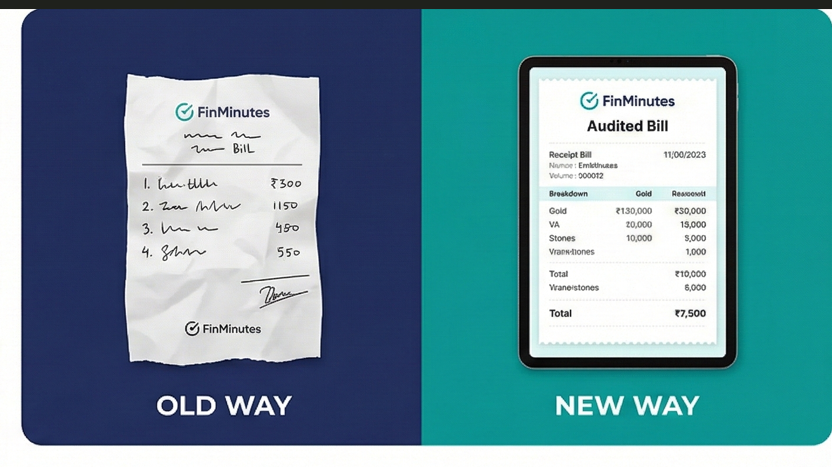

- The Old Way: Calculate each item separately on a calculator and scribble on paper.

- The FinMinutes Way: Add multiple items to your Audit Cart. Mix and match (e.g., a 22K Chain + an 18K Diamond Ring). The tool sums it all up into a single, professional bill view.

2. The “Stone Weight” Scrubber

This is the top scam in the industry.

- The Scam: You buy a ring weighing 5 grams (4.5g Gold + 0.5g Stone). The jeweller charges you for 5 grams of Gold. You effectively pay ₹7,500/gram for a cheap stone.

- The Fix: Our tool forces you to enter “Gross Weight” and “Stone Carats” separately. It automatically deducts the stone weight (1 Carat = 0.2g) and calculates the price only on the Net Gold Weight.

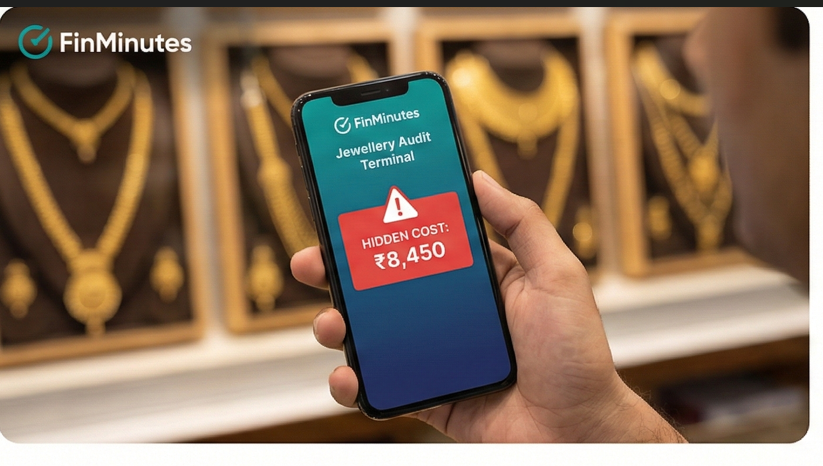

3. The “Reverse Audit” Mode

Have an old jewellery bill? Or a handwritten estimate from a shopkeeper? Switch to “Audit Mode.” Enter the Final Amount you paid. The tool works backwards to reveal the “Hidden Cost.”

- Verdict: It will stamp your bill with either “YOU SAVED” (Green) or “HIDDEN COST” (Red), showing you exactly how much extra profit the jeweller made off you.

How to Use the FinMinutes Jewellery Audit Terminal™

We designed this tool to work exactly like the software jewellers use, but simplified for you.

Mode 1: “Estimate New Bill” (Before You Buy)

Use this when you are in the shop, negotiating a purchase.

- Set the Benchmark Rate:

- Look at the “Board Rate” displayed in the shop (usually for 24K or 22K). Enter this in step 1. This is your “Truth Source.”

- Add Your Items:

- Name: E.g., “Bridal Necklace,” or shortname BN.

- Purity: Select the Karat (22K for gold, 18K for diamond jewellery, or whatever is mentioned on the jewellery that you are buying).

- Gross Weight: The weight shown on the weighing scale.

- Stone Weight: Check the tag! It will say something like “Stones: 0.45 Ct”. Enter “0.45” in the Stone Carat field. Watch the tool automatically deduct the gram weight.

- Enter Charges:

- Gold Making Charges % (VA): Ask the jeweller, “What is the VA on this?” (Usually it should be 8% to 18%).

- Stone Charge: Enter the fixed price quoted for the stones.

- Click “Add to List”: Repeat for all items.

- The Result: The tool generates an “Estimated Bill” showing what the Fair Price should be. If the jeweller’s quote is higher, ask them why.

Mode 2: “Audit Old Bill” (After You Buy)

Use this to check past jewellery purchases or verify a handwritten receipt.

- Switch Modes: Click the “Audit Old Bill” button.

- Add Items: Enter the item details from your bill into the cart as usual.

- Enter Final Amount: Scroll down to the “Total Bill Amount Paid” field. Enter the exact figure written at the bottom of your receipt.

- The Verdict: The tool compares the “Fair Math” vs. “What You Paid.”

- If there is a difference, it shows up as “Hidden Cost.” This is usually hidden markup on the gold rate or uncalculated stone deductions.

Understanding Gold Pricing: A Crash Course

To use this tool effectively, you need to understand the three pillars of a jewellery bill.

1. Purity (Karat vs. Fineness)

The biggest variable.

- 24K (99.9%): Pure gold. Too soft for jewellery. Used for coins/bars.

- 22K (91.6%): Standard for gold jewellery. Contains 91.6% gold, 8.4% copper/silver/zinc.

- 18K (75.0%): Standard for Diamond Jewellery. The alloy is harder to hold stones securely.

- 14K (58.5%): Common in the US/Europe, growing in India for modern office-wear jewellery.

The Trap: Buying 18K jewellery but paying 22K rates. Always select the correct Karat in the FinMinutes Jewellery Audit Terminal™ to see the real price of the gold content.

2. Making Charges (VA – Value Addition): How to calculate gold making charges?

Jewellers don’t call it “Labour Cost”; they call it Wastage or VA.

- Traditional theory says gold is “wasted” during melting/cutting.

- In reality, modern machine-made jewellery has near-zero wastage. VA is simply the Jeweller’s Profit Margin.

- Fair Range:

- Machine Chains: 8% – 12%

- Intricate Temple Jewellery: 15% – 25%

- Diamond Settings: 18% +

3. The Stone Weight Logic

Diamonds and gemstones are weighed in Carats, not Grams.

- The Math:

1 Carat = 0.20 Grams. - If a tag says “Gr. Wt: 10.00g” and “Stones: 2.00 Ct”:

- Stone Weight in Grams = 2.00 * 0.20 = 0.40g.

- Net Gold Weight = 10.00 – 0.40 = 9.60g.

- The Rule: You must ONLY pay for 9.60g of gold. If the bill charges for 10.00g, refuse to pay.

Who Is This FinMinutes Jewellery Audit Terminal™ For?

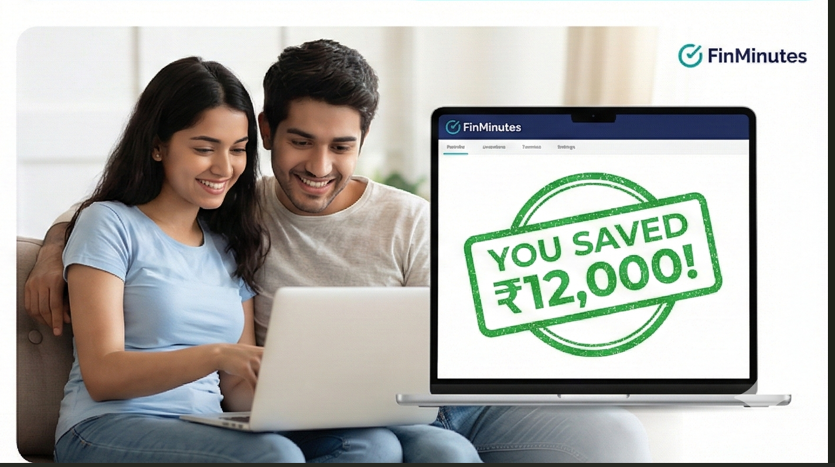

1. The Wedding Shopper

You are about to spend ₹5 Lakhs to ₹20 Lakhs. A 2% “calculation error” by the jeweller costs you ₹40,000. Use the Estimate Mode of our FinMinutes Jewellery Audit Terminal™ to plan your budget and the WhatsApp Share feature to send the estimate to your parents or partner for approval.

2. The “Exchange” Customer

You are exchanging old gold for new. This is where calculations get murky. Use the Terminal to audit the value of the new jewellery to ensure they aren’t inflating the price to offset the exchange value.

3. The Investment Buyer

You buy coins or biscuits. Use the tool to check if the premium charged over the raw gold rate is reasonable. For coins, Gold Making Charges should be very low (1-3%).

FinMinutes Jewellery Audit Terminal™: FAQs

Why is the “Shop Board Rate” different from the rate on Google/MCX?

The rate you see on Google (MCX) is for Pure Gold (24K) Bullion without GST, duties, or local delivery premiums. Jewellers use the IBJA Rate or their local association rate, which includes import duties and a small premium for physical inventory. Advice: Never argue using the Google rate. Always negotiate based on the Shop’s Board Rate vs. the Final Bill.

What is a “Hidden Cost” in the Audit result?

If the tool shows a “Hidden Cost,” it means the math doesn’t add up.

– Maybe they applied the 24K rate to a 22K item.

– Maybe they didn’t deduct the stone weight.

– Maybe they added a “Cash Handling Fee” or “Card Swipe Charge” (2%) hidden inside the total. Ask the jeweller to explain this gap.

Should I pay GST on the old gold exchange?

No. You only pay GST (3%) on the Net Value (Cost of New Item minus Value of Old Gold). However, many jewellers calculate GST on the full value of the new item. Use our tool to calculate the exact GST on the new item’s value to see the maximum tax liability.

How does the “Stone Weight” feature work?

The tool uses the universal standard: 1 Carat = 200 Milligrams (0.2g). When you enter “1.5 Carats” in the input, the tool internally subtracts 0.3g from the Gross Weight. This ensures you pay for Net Gold only.

Can I use this for Silver?

Currently, FinMinutes Jewellery Audit Terminal™ is calibrated for Gold Densities and Karatage. Silver calculations are simpler (usually just Weight * Rate + Making per Kg). We recommend using this specifically for Gold and Diamond jewellery, where the financial stakes are higher.

Is the “Save Receipt” valid in court?

The “FinMinutes Receipt” is a Consumer Awareness Tool, not a legal document. However, it serves as powerful evidence during a dispute with a jeweller. Showing them a generated breakdown often forces them to correct “calculation errors” immediately.

The Final Verdict

In the world of gold, ignorance is expensive. The jeweller has a calculator, a software system, and years of experience. Now, you have the FinMinutes Jewellery Audit Terminal™. Level the playing field. Audit every gram. Verify every rupee. Scroll Up and Audit Your Bill Now.