The Eternal share price started the day with losses after the company reported a significant dip in its bottom line in Q4 FY2025. But, after Q4 numbers, Zomato’s (now Eternal) stock price soon reversed course and closed near day high, up 0.76%. Today, the Eternal share price is up 3.08%, trading at 234.

While the company’s topline growth remains impressive, a significant dip in the bottom line and end profit is concerning. Should a falling EBITDA be a red line for investors? Or, an impressive topline growth and being the only company in the segment that is profitable will glue investors, let’s find out.

A look at Eternal’s Q4 FY25

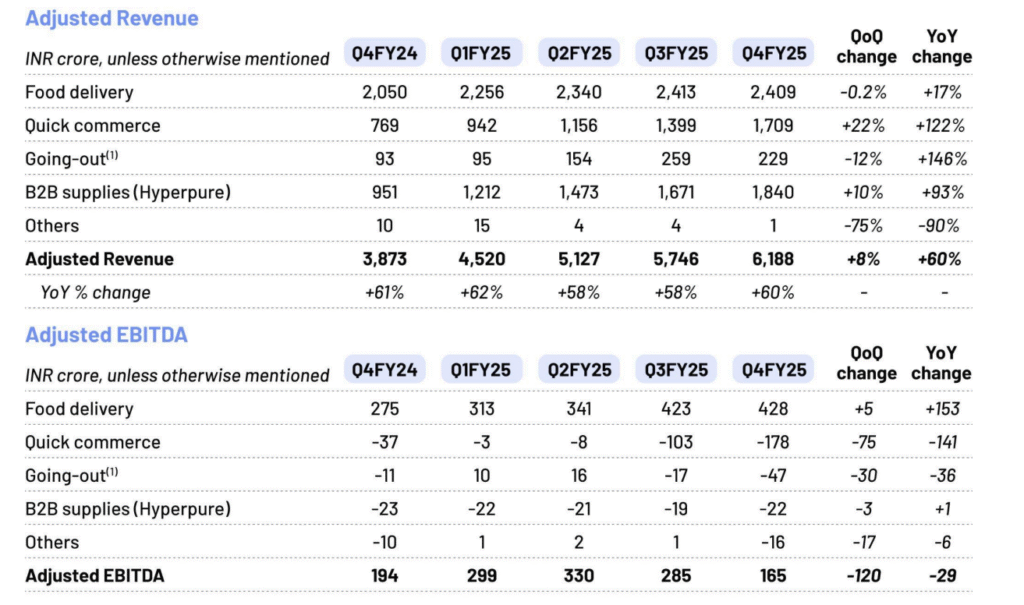

- The company’s adjusted revenue was at 6,188 crore, a growth of 60% YoY.

- Eternal reported a significant decline in adjusted EBITDA at 165 crore, down 29% YoY and 120% QoQ.

- The company’s reported PAT was at 39 crore, down more than 70% YoY.

- Segment-wise, Eternal reported the revenue of INR 1,840 crore, up 93% YoY in B2B supplies (Hyperpure)

- The food delivery segment of the business reported 2409 crore of revenue, up 17% YoY.

- The Quick Commerce segment saw the fastest jump of 122% in revenue to INR 1,709 crore.

- The going-out segment reported revenue of INR 229 crore, up 146% (also includes the revenue from the recently acquired ticketing business from Paytm)

- NOV (net order value, which is equal to gross order value – discounts) of our B2C businesses (business to consumer) grew 53% YoY (5% QoQ) to INR 17,440 crore in Q4FY25. On a like-for-like basis (excluding the impact of the acquisition of Paytm’s entertainment ticketing business), NOV growth was 48% YoY (5% QoQ). Our B2B business, Hyperpure’s revenue grew 93% YoY (10% QoQ).

Key Takeaways from Q4

While the company has delivered 60 %+ topline growth, the adjusted EBITDA saw a significant dip. Management cited the accelerated investments in expanding the quick commerce store network as the reason behind this dip.

Eternal added 294 net new stores in Q4FY25, the company’s highest-ever net store addition in a single quarter. As a result, ~40% of the overall network of 1,301 stores is underutilized, having opened in the last two quarters alone (216 in Q3FY25 and 294 in Q4FY25). It also added 1 million sq ft of new warehousing space to support the store expansion.

Also, the company increased investment in marketing to accelerate the pace of new customer acquisition. As an outcome, average monthly transacting customers increased to 13.7 million in Q4FY25 (up from 10.6 million in Q3FY25).

Due to these ongoing efforts, the management expects losses to go up in the upcoming quarters, especially in the B2C quick commerce (Blinkit) segment. Due to rising competition in food delivery and quick commerce from already existing and new entrant players, the management does not want to take chances on market share, so the near-term focus will be on gaining market share instead of profitability.

For Eternal, the food delivery business is facing a significant slowdown. The management pointed out few reason for the same-

- The sluggish demand environment (especially on discretionary spends)

- Shortage (temporary) of delivery partners due to high demand of delivery partners in quick

commerce given the rapid expansion of the industry in the last few months - Competition from quick delivery of packaged food from quick commerce leading to drop in demand

for food delivery from restaurants

Also, the company delisted as many as 19,000 restaurants for violating policy or quality measurements. It is clear that competition in the food delivery business has always been high, and the intensity of it has not changed in the last quarter. The company’s market share has been stable for the last few months, and it is aggressively taking measures to gain market share in upcoming quarters.

What to make out of it

Eternal is operating in many avenues, e.g., food delivery (Zomato), quick commerce (Blinkit), B2B supplies (Hyperpure), and going out (including ticketing and entertainment business acquired by Paytm). The company was already running programs like 10-minute food delivery services like Zomato Quick and Everyday, but they have failed to provide the desired results, so, company decided to discontinue them.

The primary challenge for the company is to maintain growth without compromising profitability. The company barely became profitable, but its primary business, e.g., food delivery and quick commerce, is struggling to maintain even a lower adjusted EBITDA margin due to very high competition, so, becomes a trade-off between margin and growth. There is not much brand loyalty in the picture, the brand that provides better service and discounts, consumer stick to that.

So, here, aggressive expansion, e.g., on delivery partners, restaurant partners, dark stores, and better inventory management, comes into the picture, and this can be better executed by being in a better cash position, which Eternal is. So, it is ahead of competitors, but here is the catch: how long can the company keep pushing on aggressive growth, compromising profits?

The company’s earlier plan of improving margins with advancing growth is not playing out, as margins in all of the segments except food delivery are falling, and in the food delivery segment, growth is slowing down. So, it should be a major worry for shareholders, and they should ask questions like, How long can the company keep going ahead with aggressive expansion?

Competitors will also keep pushing for aggressive expansion, and being a disruption-prone sector, for example, assume the company opens 3,000 dark stores, has excellent inventory management in place, delivers orders fastest to consumers, and gains maximum market share, and, based on that, it shifts focus to improving margins, to do so it raises platform, delivery fees etc, but will the consumer stick to the company and pay higher price or will the already desperate competitors will be able to lure them with aggressive offers?

So, that will be a rat race with no clear winners. One more possibility is that a new or existing player could further disrupt the industry by negating the relevance of dark stores to manage inventory. It will remain crucial for the company to find the X factor that is not visible till now. For the shareholders, the question should be how much further price appreciation they could expect if the stock price is already at a steep valuation of p/e 112x.

Even in terms of sales to market cap at 11x (FY25 sales figure), Eternal’s shares are trading at a steep valuation, which seems unsustainable given that the company’s profitability will take a hit due to aggressive expansion of dark stores to maintain the edge over competitors in the quick commerce space.

The company, in its recent conference call, informed investors that its top priorities in near term are-

- Improving customer experience with more consistent delivery and fulfilment experience

- Increase the breadth of product categories that customers can reliably buy from Blinkit

- Increase our footprint, both in terms of stores and our nationwide supply chain, to reach more customers efficiently

The management informed investors, “We will aggressively look to grow our market share, especially in the face of heightened competition, and will not let any short-term profitability goals come in the way of that.”

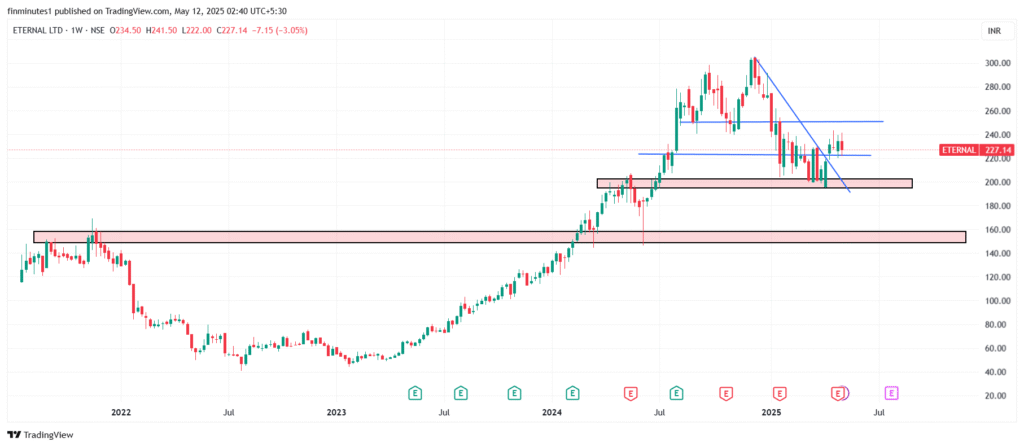

Eternal share price: technical setup

The stock of Eternal is down more than 18% YTD, and is technically weak as it is trading below most of the important trading averages. Recently, the stock crossed above the 50 DMA, which is currently at 221.6, but the stock will only turn bullish once it crosses the 250 level, which is also the immediate resistance for the stock.

If the stock fails to sustain above the 50 DMA, it can slide further to the 195-205 zone, below which 150-158 is a very significant support for the stock. On the upside, if the 250-255 level is taken out, it can easily reach the 300 mark. (Not a trading advice, analysis is backed by data, and investors should carry out research or take advice from registered advisors before taking any buy or sell call)

Conclusion

Investors should approach Eternal’s stock with caution, as the valuation is already steep, and in such a challenging time, where geopolitical risks and trade wars are looming, staying with an attractive valuation and low beta stock could be a better option. Even if investors are chasing high-growth stocks, it is advised to make sure that the growth is in both the top and bottom line.

Also, remaining vigilant of returns of various instruments like Gold, Nifty 50 can benefit investors.