4.1 The "Trend is King" Philosophy

Commodities behave differently from stocks. Stocks often revert to the mean (valuation). Commodities trend until the physical imbalance is fixed. A drought or a war does not end in a day; therefore, commodity trends can last for months.

Personified Example: Rajiv the Trend Follower

The Scenario: Rajiv sees Gold rallying for 3 weeks. It feels "too high." He wants to short it to catch a correction.

The Mistake: In commodities, "High" usually leads to "Higher." Physical demand from Central Banks creates a floor.

The Lesson: Rajiv ignores the 50-Day Moving Average. He shorts Gold at ₹72,000. The trend carries it to ₹75,000. He is wiped out. Rule: Never trade against the 50-DMA.

The Golden Crossover

The most reliable signal for a Commodity Super-Cycle is the Golden Cross: When the 50-Day Moving Average crosses above the 200-Day Moving Average.

4.2 Market Structure: Higher Highs

Before using complex indicators, look at the price structure.

• Bull Trend: Price makes Higher Highs (HH) and Higher Lows (HL).

• Bear Trend: Price makes Lower Highs (LH) and Lower Lows (LL).

Tip: If Gold is making Higher Highs on the Weekly chart, buying Puts on the 15-minute chart is financial suicide.

4.3 Strategy: The "9 EMA Pullback"

In strong commodity trends (like a War spike), price rarely touches the 50 DMA. It hugs the 9-Day Exponential Moving Average (EMA).

The Setup

1. Identify Trend: Price is clearly above the 9 EMA.

2. The Pullback: Wait for a red candle to touch or pierce the 9 EMA.

3. The Trigger: Buy when the next green candle breaks the High of the pullback candle.

4. Stop Loss: Below the Low of the pullback candle.

Success Rate: High in runaway trends (e.g., Crude Oil during supply shocks).

1. The RSI Trap: Why "Overbought" is a Buy Signal

In range-bound stocks, an RSI > 70 is a sell signal. In a trending commodity market, RSI > 70 means Momentum is Explosive.

The "Oscillator" Mistake

The Trap: Crude Oil rallies hard. RSI hits 75. Retail traders short it, expecting a pullback.

The Reality: RSI stays between 70 and 90 for weeks during a supply shock (e.g., War). Price doubles while RSI stays "Overbought."

The Fix: In commodities, use RSI > 60 as a zone to Buy Dips, not to sell tops.

2. ATR: The Volatility Stop Loss

Commodities are volatile. A standard ₹100 Stop Loss will get hit by random noise. You need a "Breathing Room" based on math.

The ATR Formula

ATR (Average True Range): Measures the average daily move of an asset.

Example: Natural Gas has an ATR of ₹15.

The Rule: Place your Stop Loss at least 1.5 x ATR away from your entry.

Entry: ₹250. Stop: ₹250 - (1.5 × 15) = ₹227.5.

This ensures you only exit if the trend actually breaks, not just on intraday noise.

3. Strategy: The "False Breakout" (Trap Trading)

Institutional Algos love to hunt liquidity at key levels. This strategy profits from retail traders getting trapped.

The Setup

1. The Level: Identify a major resistance (e.g., Silver at ₹80,000).

2. The Breakout: Price shoots up to ₹80,200. Retail traders jump in ("Breakout Buy!").

3. The Reversal: Within the same candle (or next), price slams back down below ₹80,000, leaving a long upper wick (Pinbar).

4. The Trade: SHORT immediately. The retail buyers at ₹80,200 are now trapped and will panic sell, fueling the drop.

1. Decoding the Institutional Footprint (OI)

Price can lie, but Open Interest (OI) cannot. OI tells you if new money is entering or leaving.

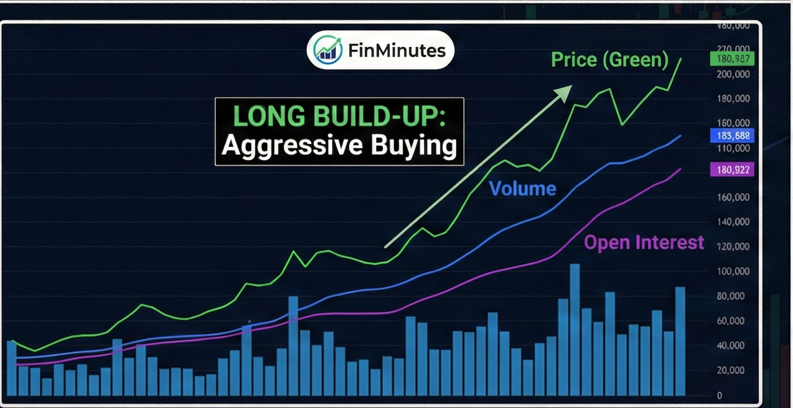

The Four Signals

1. Long Build-up (Bullish): Price $\uparrow$ + OI $\uparrow$ + Volume $\uparrow$.

Meaning: Aggressive buying. Institutions are entering longs.

2. Short Covering (Bullish): Price $\uparrow$ + OI $\downarrow$.

Meaning: Bears are trapped and exiting. This rally is fueled by fear, not greed. It might be short-lived.

3. Short Build-up (Bearish): Price $\downarrow$ + OI $\uparrow$.

Meaning: Aggressive selling. New shorts are being added.

4. Long Unwinding (Bearish): Price $\downarrow$ + OI $\downarrow$.

Meaning: Bulls are booking profits. The uptrend is losing steam.

2. Volume Profile: The "Fair Value"

Traditional volume bars appear at the bottom (Time). Volume Profile appears on the side (Price).

High Volume Node (HVN): A price level where massive trading occurred. This acts as a magnet. Price loves to return to HVN.

Low Volume Node (LVN): A zone where price moved fast. If price re-enters an LVN, it will likely zip through it again.

3. Advanced Strategy: The "Calendar Spread"

Commodities have seasonality. Instead of betting on direction (risky), bet on the difference between two months.

The "Roll Yield" Trade

Scenario: You expect a short-term squeeze in Natural Gas (Winter Storm).

The Trade: BUY Near Month (Nov) + SELL Far Month (Jan).

Logic: In a shortage, the spot price (Nov) rises much faster than the future price (Jan).

Benefit: Lower Margin (Spread Benefit) + Protection against a general market crash.

1. The "V-Bottom": A Commodity Special

Stocks usually form a "Base" (U-shape) before reversing. Commodities often reverse violently (V-shape).

Why? Geopolitics. If news breaks that "OPEC cut production," Oil can jump 5% in a minute, leaving no time for a base.

Narrative: Suresh the Scalper

The Situation: Crude Oil crashes $5 in a week. Suresh is waiting for a "Double Bottom" pattern to buy.

The Event: A drone strikes a pipeline in the Middle East.

The Move: Oil spikes vertically, erasing the entire week's drop in 2 hours.

The Lesson: Suresh missed the trade waiting for a "Stock Market Pattern." In commodities, fundamentals trigger V-Bottoms. You must react to news, not just patterns.

2. Top-Down Analysis: The Eagle Eye

Never enter a trade without checking the higher timeframe.

1. Monthly Chart: Defines the 10-Year Super Cycle. (Are we in a Bull Market?)

2. Daily Chart: Defines the current Trend. (Is it a dip or a crash?)

3. 15-Min Chart: Defines the Entry Trigger. (RSI Divergence / Breakout).

Rule: If the Monthly is Bullish, ignore Sell signals on the 15-min chart.

3. FAQs: Technical Analysis

Q: Which timeframe is best for MCX?

A: For Intraday: 15-Min. For Swing: 4-Hour. The 5-min chart is too noisy for commodities due to algo spikes.

Q: Does "Support & Resistance" work in commodities?

A: Yes, but "Round Numbers" (e.g., Gold 70,000) are often fake-out zones. Use Previous Week High/Low (PWH/PWL) as stronger levels.

4. REDLINES: How to NOT Blow Up

These are the specific mistakes that wipe out 90% of retail commodity traders. Memorize them.

☠️ The "Hero or Zero" Option Trade

The Mistake: Buying OTM Options on Expiry Day because they are cheap (₹5 premium).

The Reality: In commodities, liquidity dries up near expiry. Even if the price moves in your favor, the spread (Bid ₹2 / Ask ₹10) will kill you. You often cannot exit.

The Rule: NEVER trade options on the day of expiry. Close everything 2 days prior.

☠️ Averaging a Loser (Revenge Trading)

The Mistake: You bought Silver. It fell. You buy more to "lower your average." It falls more.

The Reality: Commodities can trend for 6 months without a pullback. Averaging down is adding fuel to a fire that is burning your house.

The Rule: Only average UP (add to winners), never average DOWN.

5. Extended FAQs

Q: What is "Wick Fishing"?

A: It's placing limit orders at key support levels hoping to catch the "wick" of a panic candle. Risky, but high reward if the V-shape reversal happens.

Q: Why did my Stop Loss execute at a worse price?

A: This is Slippage. If you use a "Stop Loss Market" order during a data release (like EIA inventory), the price jumps gaps. Always use "Stop Loss Limit" orders, but be aware they might not get filled in a crash.

Mastering Technical Analysis for Commodities

If Module 3: The Engine taught you why to buy (Fundamentals), Module 4 is about when to buy.

You might know that Gold is bullish because Central Banks are buying (Fundamental). But if you buy at the exact top of a candle, and the price corrects 3% the next day, your Stop Loss will be hit before the rally even begins. You were right on the direction, but wrong on the timing.

This is where Commodity Technical Analysis comes in.

However, a warning is necessary: Do not treat Crude Oil like the stock of Reliance Industries. Stock market technicals are often based on “Mean Reversion”, the idea that if a stock goes up too fast, it must come down to its fair valuation. Commodities are different. They are driven by physical imbalances. A drought doesn’t end because the chart is “Overbought.” A war doesn’t stop because the RSI hit 80.

In this Commodity Trading masterclass, we will rebuild your technical analysis toolkit specifically for the high-voltage world of MCX and NCDEX. We will learn to surf the massive trends, decode the institutional footprints using Open Interest, and avoid the “traps” that algos set for retail traders.

The Philosophy: Why “The Trend is King”

In the equity market, trends are often broken by earnings reports or management scandals. In commodities, trends are stubborn. When a Commodity Market Super Cycle begins, it is like a freight train; it takes miles to stop.

The Physics of Trends

Commodity Market trends are driven by the time it takes to fix a supply problem.

- Mining: If there is a shortage of Copper, it takes 10 years to build a new mine. Price must stay high for 10 years to incentivize that build.

- Farming: If El Niño destroys the Jeera crop, no amount of money can grow more Jeera until the next season. Price stays high for months.

This is why Trend Following strategies work exceptionally well in commodities.

The “Golden Crossover”

As demonstrated in the Beginner Tier of the commodity trading masterclass above, the most potent signal in Gold or Silver is the Golden Crossover.

- The Signal: When the 50-Day Moving Average (DMA) crosses above the 200-Day Moving Average.

- The Meaning: The short-term trend has synchronised with the long-term trend. This signal often marks the beginning of a multi-year Bull Run.

- The Rule: When the Golden Crossover is active, delete the Sell button. You only look for dips to buy. Shorting a Golden Cross market is the fastest way to blow up an account.

Adapting Indicators: The “RSI Trap”

One of the most common mistakes retail traders make is applying stock market logic to commodity oscillators.

The RSI Misconception

In range-bound stocks, an RSI (Relative Strength Index) above 70 is considered “Overbought,” signalling a reversal. Traders are taught to sell here.

In Commodities, RSI > 70 is a Rocket Fuel signal. When Crude Oil or Natural Gas supply is choked (e.g., during a geopolitical crisis), the RSI can enter the “Overbought” zone (70-90) and stay there for weeks.

- Stock Trader Logic: “RSI is 80, I must Short.” -> Wiped Out.

- Commodity Trader Logic: “RSI is 80, Momentum is extreme. I will buy every intraday dip on the 15-minute chart.” -> Profitable.

The Adjustment:

- Bull Market: Shift your RSI range. Oversold is 40, Overbought is 90. Buy near 40-50.

- Bear Market: Shift your RSI range. Overbought is 60, Oversold is 10. Sell near 50-60.

The Mathematics of Safety: ATR Stop Losses

Commodities are volatile. A generic stop loss (e.g., “I will risk ₹1,000”) is useless because it ignores the market’s personality.

- Gold moves differently than Natural Gas.

- Silver moves differently than Copper.

You need a dynamic tool: Average True Range (ATR). ATR measures the “noise” of the market. If Natural Gas moves ₹15 a day on average (ATR = 15), placing a stop loss ₹5 away is foolish. You will be stopped out by random noise, even if your direction was correct.

The Pro Formula: Stop Loss = Entry Price - (1.5 x ATR)

This places your exit point just outside the noise zone. It ensures that if your stop is hit, the trend has actually reversed, rather than just shaken you out.

Decoding the Footprints: Open Interest (OI) Analysis

Price charts show you history. Open Interest (OI) shows you commitment. In the Pro Tier simulation above, we visualized the four phases of OI. This is the closest thing to a “Truth Serum” in trading.

1. Long Build-up (The Bull)

- Signs: Price Rising + OI Rising + Volume Rising.

- Meaning: Strong hands are entering fresh Buy positions. They are confident.

- Action: Buy.

2. Short Covering (The Squeeze)

- Signs: Price Rising + OI Falling.

- Meaning: The price is going up, but not because of buyers. It’s going up because Short Sellers are panicking and exiting their positions.

- Action: Caution. This rally is fueled by fear, not conviction. It often crashes as soon as the short covering is done.

3. Short Build-up (The Bear)

- Signs: Price Falling + OI Rising.

- Meaning: Aggressive selling. Institutions are shorting every rally.

- Action: Sell.

4. Long Unwinding (The Exit)

- Signs: Price Falling + OI Falling.

- Meaning: Bulls are booking profits and leaving the market. The uptrend is dying.

- Action: Exit Longs.

MCX Trading Strategies: The Playbook

Now that we have the tools, let’s look at three specific MCX Trading Strategies designed for different market conditions.

Strategy A: The “9 EMA Pullback” (Momentum)

- Best For: Strong trending markets (e.g., Gold during a war).

- The Logic: In a runaway trend, price never retreats to the 50 EMA. It “surfs” the 9 EMA.

- The Setup:

- Confirm price is trending above the 9 EMA on the 1-Hour chart.

- Wait for price to touch the 9 EMA.

- Enter Long when a green candle breaks the high of the touch-candle.

- Ride the wave until a candle closes below the 9 EMA.

Strategy B: The “False Breakout” Trap (Reversal)

- Best For: Range-bound markets or major resistance levels.

- The Logic: Algos hunt for liquidity (Stop Losses) just above key resistance levels.

- The Setup:

- Mark a major resistance (e.g., Silver ₹80,000).

- Watch price break above it (e.g., to ₹80,200). Do not buy.

- If price immediately reverses and closes back below ₹80,000 (forming a Pinbar candle), enter Short.

- You are now trading against the trapped breakout buyers who must sell to save themselves.

Strategy C: The Calendar Spread (Low Risk)

- Best For: Risk-averse traders and Seasonal plays.

- The Logic: Instead of betting on price direction, bet on the spread between two months.

- The Setup:

- Scenario: You expect a supply shortage in Winter.

- Trade: Buy Nov Futures + Sell Jan Futures.

- Why: In a shortage, the near-month price rises much faster than the far-month price.

- Safety: If the whole market crashes, your Sell position protects your Buy position. Margin requirements are also lower for spread trades.

The Redlines: Capital Protection

In the Real World section, we discussed “Redlines.” These are the non-negotiable rules of survival.

- No Hero-Zero Trades: Options on expiry day are not “lottery tickets”; they are traps. The gamma risk is so high that a small move against you can wipe out 100% of the premium in seconds.

- No Averaging Down: In stocks, you can average down on a “quality company.” In commodities, if you are wrong, you are wrong. A futures contract has an expiry date. Averaging down on a losing future is the fastest way to bankruptcy.

- The “News” Rule: Never hold a massive position into a major binary event (like a Fed Meeting or OPEC decision) unless you are hedged. The gap-up or gap-down can jump over your Stop Loss.

FAQs: Technical Analysis in Commodities

Which timeframe is best for intraday MCX trading?

Avoid the 1-minute and 5-minute charts; they are full of algorithmic “noise” and stop-hunting spikes. The 15-Minute timeframe is the “Goldilocks” zone; it offers enough detail for entry but smoothes out the random noise. For trend analysis, always use the 4-Hour or Daily chart.

Does Volume Profile work on Indian exchanges?

Yes, Volume Profile is highly effective on MCX because commodity trading is concentrated at specific price levels (High Volume Nodes). Price tends to spend a lot of time at these nodes (Fair Value) and moves very quickly through the gaps (Low Volume Nodes).

Can I use Ichimoku Cloud for commodities?

Absolutely. The Ichimoku Cloud is excellent for identifying the “Trend” and “Support” in one glance. A simple rule for Gold: If the price is above the Cloud, only look for Buy setups. If below, only look for sell setups.

How do I identify a “Trend Reversal”?

Look for a “Market Structure Shift” (MSS).

– Uptrend: Higher Highs + Higher Lows.

– Reversal Signal: Price fails to make a Higher High, and then breaks the previous Higher Low.

Once the Low is broken, the structure has shifted from Bullish to Bearish. Do not anticipate a reversal just because “it went up too much.” Wait for the structure to break.

Conclusion: The Complete Trader

Congratulations. By finishing Module 4, you have built a complete trading system.

- Fundamentals (Module 3) give you the “Bias” (Bullish or Bearish).

- Technicals (Module 4) give you the “Entry” and “Exit” points.

- Mechanics (Module 2) keep you safe from Margin Calls and Devolvement.

You are now ready to step into the live market, not as a gambler hoping for luck, but as a navigator equipped with a map, a compass, and an engine.

Next Steps:

- Practice: Open your trading terminal and try to identify the “Golden Cross” on the Gold Daily Chart.

- Observe: Look at the Crude Oil chart and apply the RSI > 70 rule. Did price reverse immediately, or did it keep trending?

- Simulate: Before risking real capital, paper trade the “9 EMA Pullback” strategy for one week to get a feel for the rhythm.